Ethereum may break out of consolidation as suspected Justin Sun wallet enters buying spree

- Ethereum could see a brief rally after posting a similar price movement that resulted in a previous high.

- Two wallets suspected to be owned by Justin Sun have been buying Ethereum heavily.

- Ethereum ETP outflows in April hit $85 million.

Ethereum's (ETH) recent price movement hints at a potential rally despite ETH ETPs recording outflows. The recent price improvement follows the fourth Bitcoin halving and a suspected Justin Sun wallet purchasing large numbers of ETH.

Read more: Ethereum resumes consolidation after brief dip, buyback yield exceeds that of major S&P 500 companies

Daily digest market movers: potential Justin Sun buying spree, ETP outflows

Ethereum began the week on a positive note following Bitcoin's successful halving. Here are today's market movers for the number one altcoin:

- Ethereum's price consolidation continues to attract whales as a recent whale address - suspected to be Justin Sun's - has purchased 127,388 ETH worth $405.19 million since April 8, according to Lookonchain.

Since March 31, the address has deposited $787 million USDT to Binance via the Tron blockchain. On the same day, an unknown individual created a wallet on Ethereum and withdrew $96 million worth of stablecoins from Binance.

The wallet began purchasing ETH from Binance and decentralized exchanges (DEX), buying a total of 127,388 ETH. The transaction behavior of this wallet is similar to another suspected Justin Sun wallet that bought 168,369 ETH at $2,894 from Binance and DEXs between February 12 and February 24, according to Lookonchain.Did #JustinSun buy 127,388 $ETH($405.19M) since Apr 8?

— Lookonchain (@lookonchain) April 22, 2024

The wallet suspected of being #JustinSun has deposited 787M $USDT to #Binance on #Tron since Mar 31.

Also on Mar 31, a mysterious wallet was created on #Ethereum and withdrew $96.8M stablecoins from #Binance.

Is this a… pic.twitter.com/OcEovodUrc - While whales are scooping up ETH, ETH ETP investors are selling, as the largest altcoin saw $34 million in outflows the past week, according to CoinShares. This brings its total outflows in April to $85 million. In comparison, Bitcoin had $333 million in inflows, probably fueled by its fourth halving.

Also read: Ethereum shows firm support at key level as its correlation with US indices increase

- On Sunday, President of ETF Store Neil Geraci commented on a potential spot ETH ETF approval in May. He stated that while the general consensus is that the Securities & Exchange Commission (SEC) will disapprove it in May, the regulator may be trying to avoid the fiasco that surrounded the spot Bitcoin ETF approval in January.

He further said that the SEC's only two options are to either approve the spot ETH ETFs or face a lawsuit. When pressed on potential issuers that may bring the lawsuit, he stated:Have to assume Grayscale, but some other enterprising ETF issuer w/ deep enough pockets could view this as a basic marketing expense…

— Nate Geraci (@NateGeraci) April 21, 2024

Basically brand themself as “pro-crypto” & willing to go to bat for innovation.

Technical analysis: ETH may see a brief rally, halving may not trigger bull run

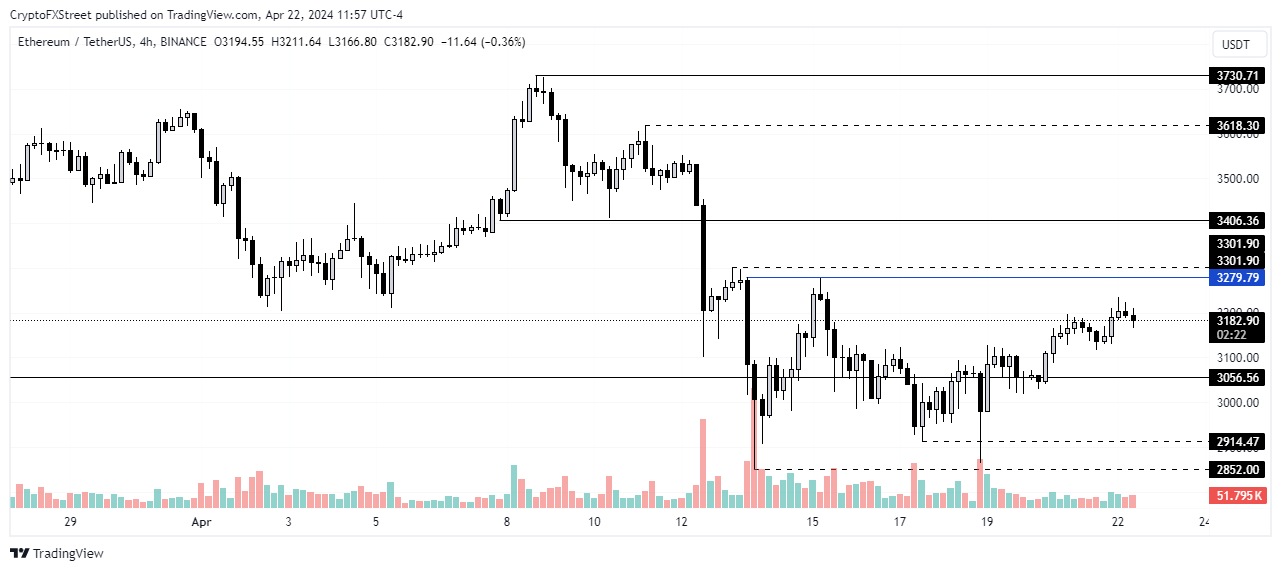

Ethereum is showing signs of a potential upswing on Monday after a successful fourth Bitcoin halving on Friday. While ETH is still consolidating, it has posted similar movements to its April 5 to April 8 price pattern.

ETH/USDT 4-hour chart

ETH recorded a three-week high of $3,730 on April 8, following the move. As a result, ETH may see a brief rally, if it breaks the $3,279 resistance of April 15, especially if it rejects a downturn to move past the $3,300 key level. This thesis would be invalidated if ETH trades below the $2,914 support of April 17.

Read more: Ethereum declines as crypto market crash increases bearish sentiment

While much of the general consensus is that ETH would see an increase in the long term following a potential Bitcoin post-halving rally, market dynamics may be different this time.

This is mainly because key analysis from Glassnode and Coinbase suggests that this time, the reduction in Bitcoin issuance rate from the halving may not be strong enough to trigger a crypto market rally. However, a potential spot ETH ETF approval could ignite a rally.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.