SUI and ENA top this week’s cliff token unlock events

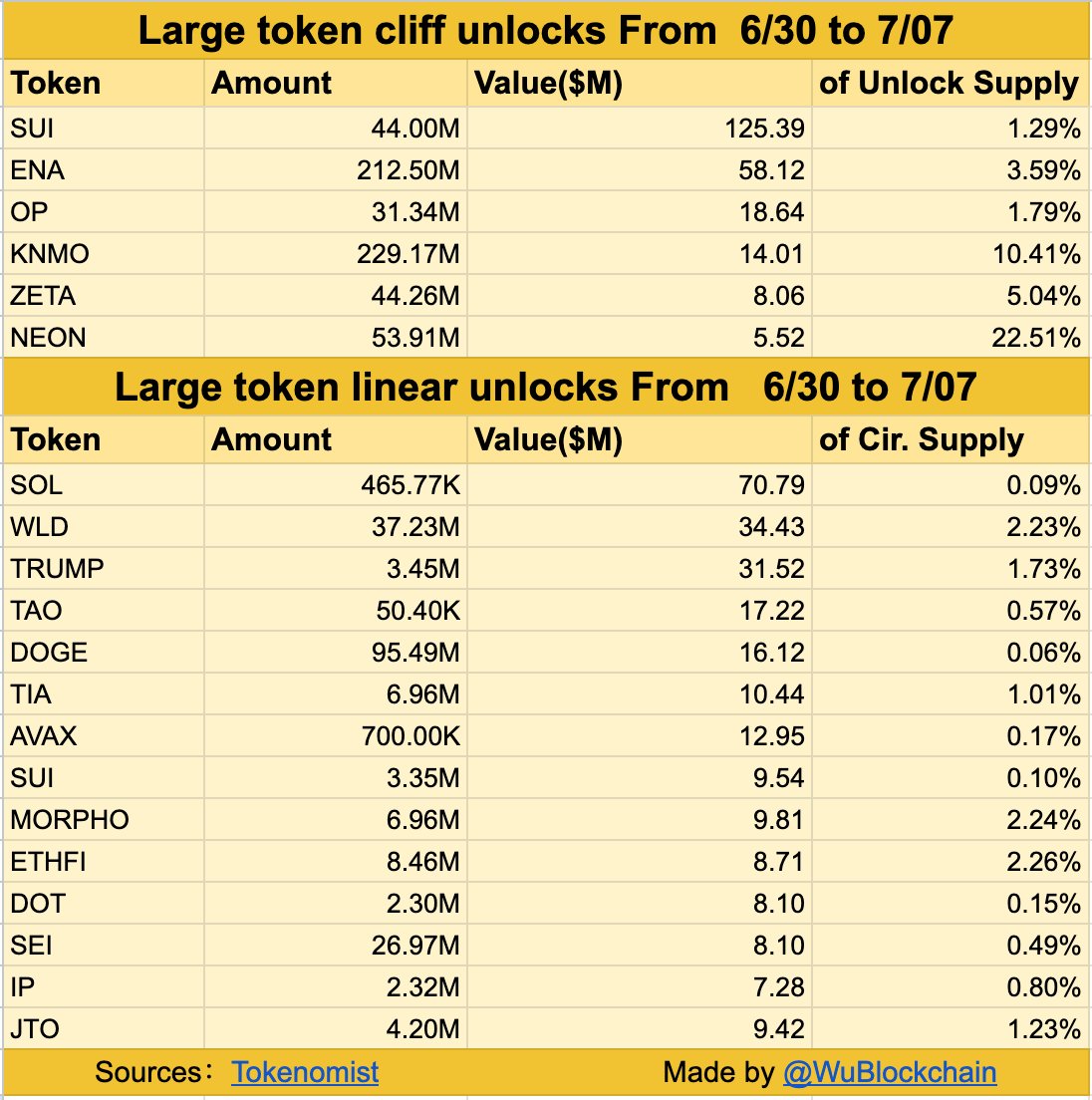

Token unlock events totaling over $484 million are scheduled for the period of June 30 to July 7.

SUI and Ethena lead large cliff unlock categories, while Solana heads linear unlock schedules across multiple cryptocurrency projects during the upcoming week.

SUI leads large token cliff unlocks

According to Tokenomist data, SUI tops the cliff unlock schedule with 44.00 million tokens valued at $125.39 million, accounting for 1.29% of the unlock supply during the June 30 to July 7 period. This marks the largest single token unlock event by value among major cliff releases scheduled for the week.

Ethena follows as the second-largest cliff unlock with 212.50 million ENA tokens worth $58.12 million, comprising 3.59% of the unlock supply. The ENA unlock affects a larger percentage of circulating supply compared to SUI despite lower dollar value.

Optimism ranks third with 31.34 million OP tokens valued at $18.64 million, representing 1.79% of the unlock supply. KNMO schedules 229.17 million tokens worth $14.01 million for cliff release, affecting 10.41% of the unlock supply during the period.

ZETA follows with 44.26 million tokens valued at $8.06 million, comprising 5.04% of the unlock supply. NEON completes the major cliff unlocks with 53.91 million tokens worth $5.52 million, representing 22.51% of the unlock supply.

These cliff unlocks involve large one-time token releases exceeding $5 million in value, creating potential selling pressure on respective token markets. The combined cliff unlock value reaches approximately $229 million across these six major projects.

SOL heads linear unlocks

Solana leads the linear unlock category with 465.77K SOL tokens valued at $70.79 million, accounting for 0.09% of the circulating supply. The SOL unlock operates on a daily release mechanism rather than a single large unlock event.

Worldcoin follows with 37.23 million WLD tokens worth $34.43 million, comprising 2.23% of the circulating supply. TRUMP schedules 3.45 million tokens valued at $31.52 million for linear release, affecting 1.73% of the supply during the period.

Bittensor includes 50.40K TAO tokens worth $17.22 million in daily unlocks, representing 0.57% of the circulating supply. Dogecoin linear unlocks involve 95.49 million DOGE tokens valued at $16.12 million, comprising 0.06% of the supply.

Additional linear unlocks include Celestia with 6.96 million TIA tokens worth $10.44 million representing 1.01% of supply, Avalanche releasing 700.00K AVAX tokens valued at $12.95 million, and SUI unlocking 3.35 million tokens worth $9.54 million.

MORPHO schedules 6.96 million tokens valued at $9.81 million, while ETHFI releases 8.46 million tokens worth $8.71 million. Polkadot unlocks 2.30 million DOT tokens valued at $8.10 million, SEI releases 26.97 million tokens worth $8.10 million, IP unlocks 2.32 million tokens valued at $7.28 million, and Jupiter schedules 4.20 million JTO tokens worth $9.42 million through daily linear mechanisms.

Less popular unlocks face varying market pressures

Several cryptocurrency projects with lower market visibility prepare for unlock events during the June 30 to July 7 period. According to CoinMarketCap data, Shockwaves leads this category with 1.65 million NEUROS tokens scheduled for unlock, valued at $3,348.38 and comprising 1.65% of total locked supply.

Hooked Protocol follows with 8.33 million HOOK tokens worth $774,989.46, representing 1.67% of total locked tokens. The token’s current unlock progress shows 52.33% completion.

AC Milan Fan Token schedules 205,263 ACM tokens valued at $158,090.43 for unlock, representing 1.03% of total locked supply. The unlock progress stands at 55.87%. DeBox maintains 17.71% unlock progress with 19.68 million BOX tokens worth $189,666.58 scheduled for release. MAXX AI shows 39.61% unlock progress, scheduling 19.71 million MXM tokens valued at $20,032.86.

Your crypto news deserves attention - KEY Difference Wire puts you on 250+ top sites