Why Solana traders need to watch for selling pressure on SOL

- Crypto wallet associated with bankrupt FTX exchange and Alameda trading firm has redeemed 177,693 SOL from staking.

- The wallet address holds another 7.057 million SOL tokens worth $943 million.

- Solana holders need to watch for selling pressure on SOL in case more tokens are transferred to a centralized exchange.

- SOL trades at $134.80 at the time of writing.

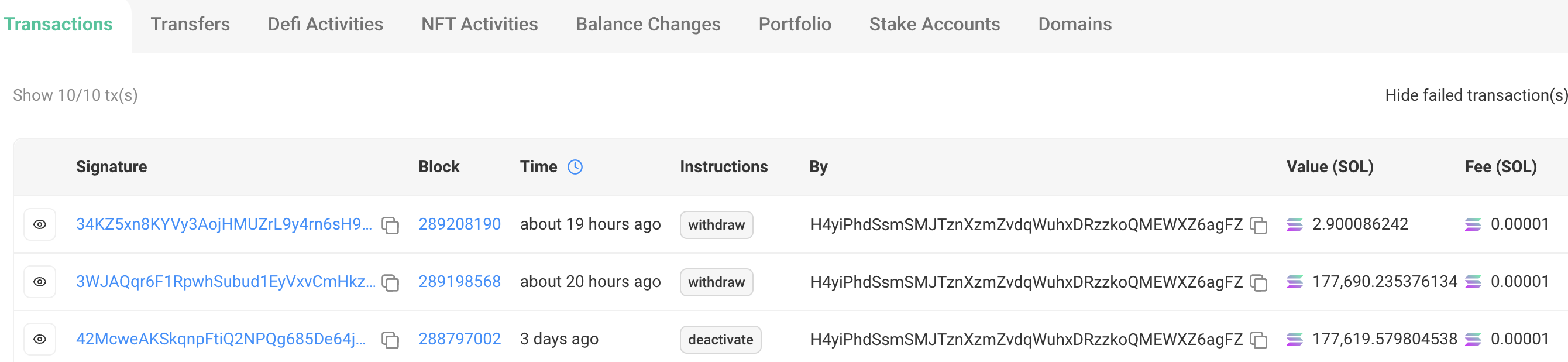

A crypto wallet identified as being related to the bankrupt FTX exchange’s address redeemed over $23 million from Solana staking on Thursday, according to data from Solscan. Solana traders need to watch the address to see whether the SOL tokens are transferred to a centralized exchange as this could increase the selling pressure for the coin, which trades at around $135 at the time of writing.

Solana could face mounting selling pressure

FTX exchange bankruptcy began in November 2022. The exchange ran out of customer funds alongside sister firm Alameda trading. A crypto wallet associated with FTX/Alameda redeemed 177,693 SOL tokens worth $23.75 million from Solana Proof-of-Stake staking on Wednesday, per Solscan data. Once the tokens are unstaked, they can be moved to a centralized exchange or an Over-The-Counter (OTC) desk for sale.

Wallet associated with FTX unstakes SOL

If the unstaked tokens are transferred to centralized exchanges, it would contribute to a rise in exchange reserves of SOL and likely impact prices negatively.

The wallet associated with the exchange holds another 7.057 million staked SOL tokens worth $943 million. Colin Wu, Asian journalist and crypto expert, notes that most of the SOL tokens held by FTX may have been sold through OTC trading.

Solana price at risk of decline

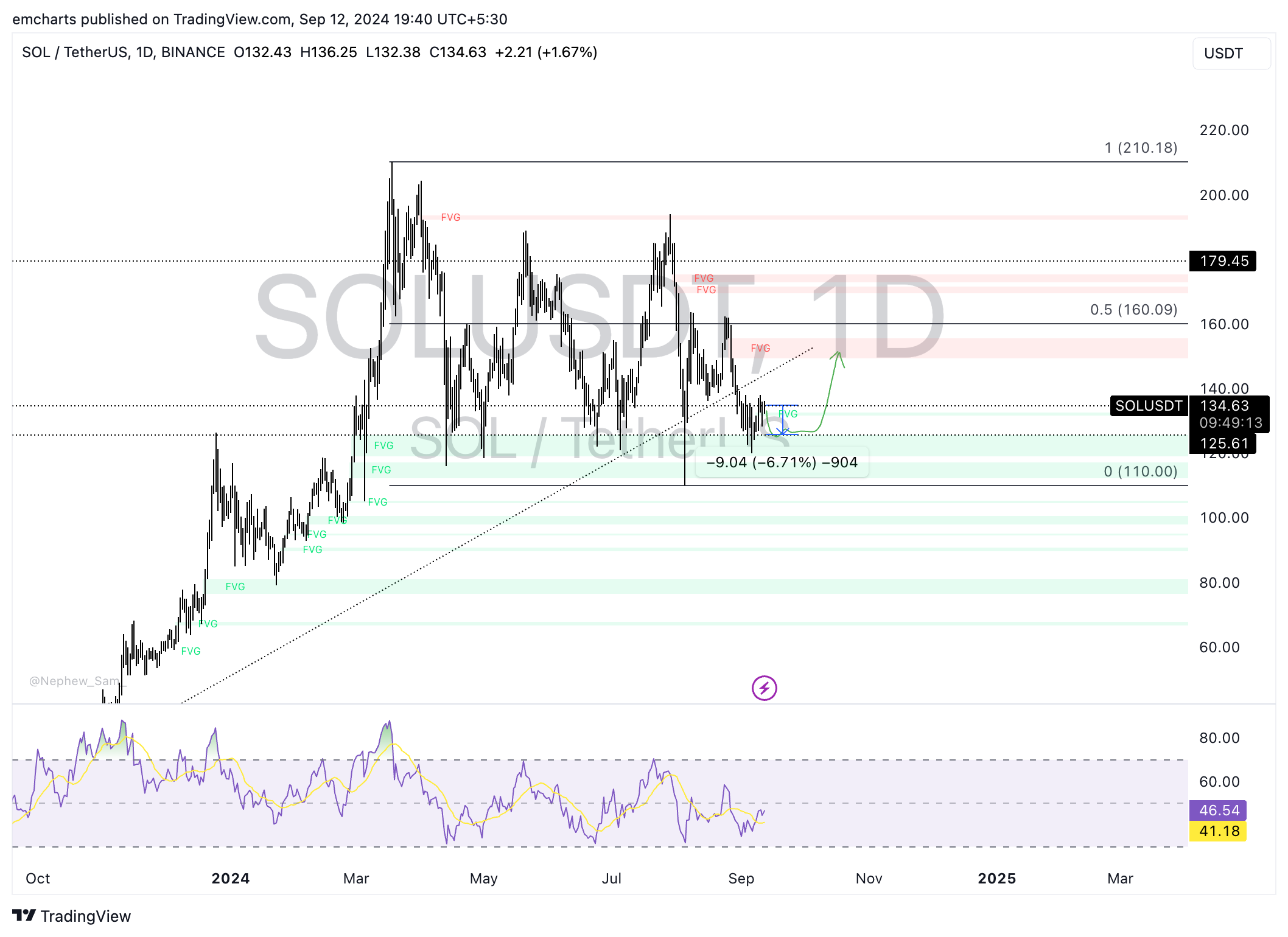

Solana is in a multi-month upward trend that started in October 2023, although it has traded broadly sideways in the last few months. SOL climbed to a top of $210.18 on March 18. Since then, the token corrected to $134.63. Solana has been trading rangebound since March, between $210.18 and $110.

If selling pressure increases, SOL could sweep liquidity at $125.61, a key support and the March 1 low. This would mark a 6.71% decline in the altcoin’s price.

SOL/USDT daily chart

A daily candlestick close above the September 10 high of $138 could invalidate the bearish thesis. In this case, SOL could target the $160 psychologically important price level.