XRP eyes comeback above $0.60 as pro-crypto attorney criticizes SEC for small investors’ losses

- XRP holds steady above support at $0.5800 on Tuesday, gears up for a recovery above $0.6000.

- Pro-Ripple Attorney John Deaton strongly criticized the SEC in recent interview.

- XRP gains slightly on the day, the altcoin trades at $0.5860.

Ripple (XRP) holds steady above $0.5800, an important support level for the asset on Tuesday. The altcoin gears up for recovery likely in response to positive developments in the project. XRP trades at $0.5860 at the time of writing.

Daily digest market movers: Pro-Ripple attorney slams US financial regulator for small investors’ losses

- Attorney John Deaton was amici curiae, meaning friend of the court in the SEC vs. Ripple lawsuit, making his statements key to XRP holders and the community of traders.

- Deaton said in a YouTube interview with the Good Morning Crypto podcast that the US Securities & Exchange Commission (SEC)’s handling of cryptocurrency regulation in the Ripple lawsuit led to nearly $15 billion in losses for small crypto investors.

- Ripple’s Chief Legal Officer (CLO) Stuart Alderoty recently announced the end of the SEC lawsuit. The regulator recently apologized for the confusion caused by the use of the term “crypto asset securities.”

- The term was used in the SEC lawsuit against Ripple, and Coinbase as well, and Alderoty believes that it misled judges into considering cryptocurrencies as securities, while the term has “no legal basis.”

Technical analysis: XRP could rally to $0.6602, break past $0.6000 resistance

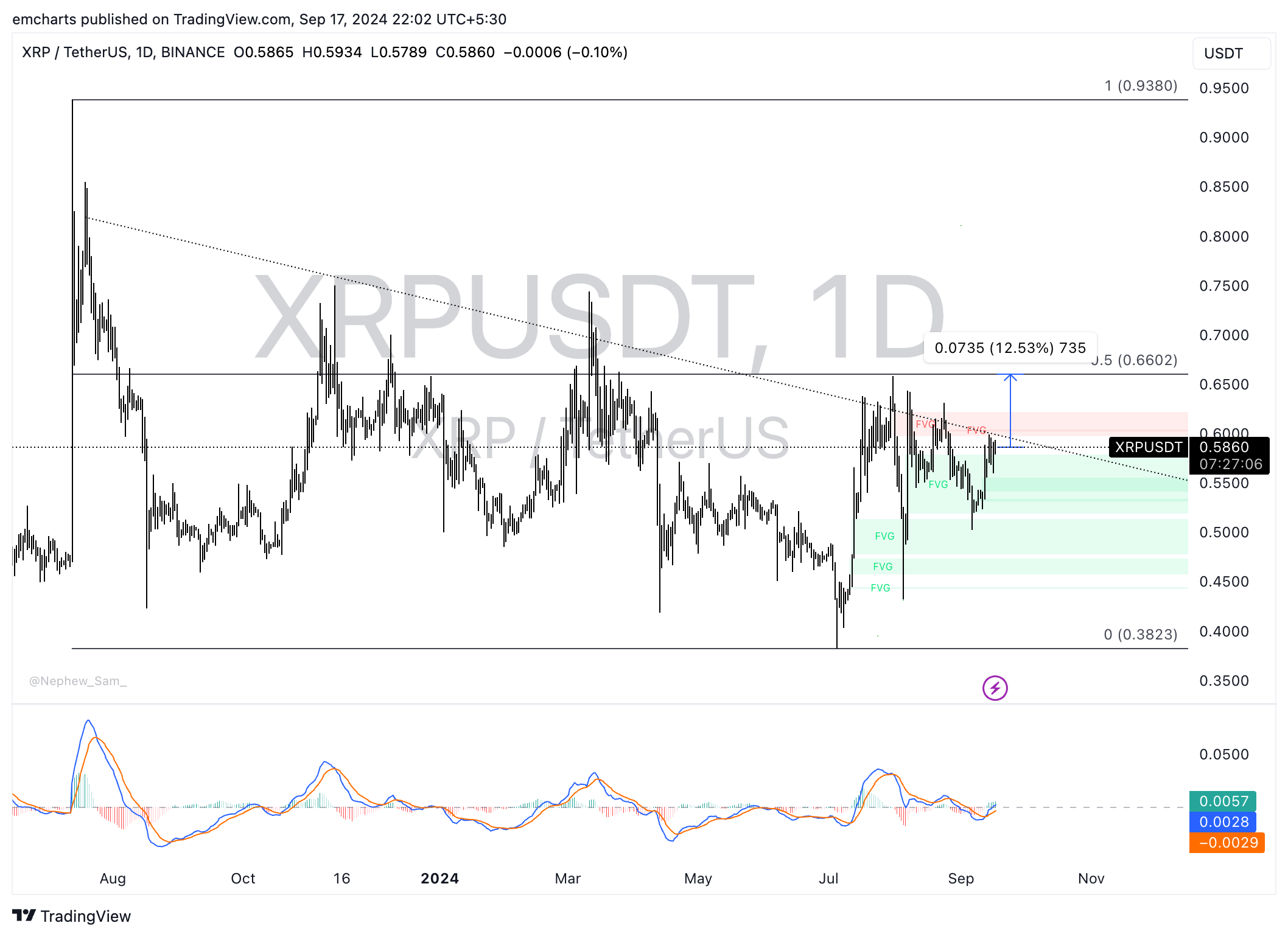

XRP has been in a downward trend since its July 2023 top of $0.9380, over 12 months ago. The asset hit its 2024 low of $0.3823 on July 5, since then XRP recovered, back above $0.5800.

XRP looks primed to make a comeback to $0.6602, the 50% Fibonacci retracement level of the decline from the July 2023 top of $0.9380 to the July 2024 low of $0.3823. XRP could rally 12.5% to hit its target.

XRP/USDT daily chart

The altcoin could find support in the Fair Value Gap (FVG) between $0.5413 and $0.5556 if there is a correction in XRP price.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.