Ethereum may be gathering momentum for potential rally, Vitalik Buterin introduces EIP-7702

- Ethereum's new proposal would address concerns raised in the previous EIP-3074.

- Ethereum Foundation transfers 1,000 ETH worth $3 million to a multisig wallet.

- Ethereum's recent price action suggests it may be gathering momentum for a bullish run.

Ethereum (ETH) price action on Wednesday shows it could be gathering momentum for a rally as the number one altcoin's co-founder, Vitalik Buterin, and co-authors have published Ethereum Improvement Proposal (EIP) 7702 as an alternative to EIP-3074. The Ethereum Foundation also appears to be dumping ETH tokens again with a recent transfer.

Read more: Ethereum resume sideways move as Grayscale files to withdraw Ethereum futures ETF application with the SEC

Daily digest market movers: EIP-7702, Ethereum Foundation ETH dump

Ethereum is set to see interesting updates on its blockchain following recent developments. Here are key market movers for the top altcoin:

Following several concerns raised about EIP-3074, which was considered for inclusion in the upcoming Pectra upgrade, Ethereum co-founder Vitalik Buterin and co-authors Sam Wilson, Ansgar Dietrichs and Matt Garnett proposed EIP-7702 as an alternative.

3074 = upgrade for normal "EOA" wallets to give some smart wallet functionality

— hayden.eth (@haydenzadams) May 7, 2024

4337 = standard for smart contract wallets

3074 was slated for inclusion, v likely worried the long term implications of

1) compatibility btwn 3074 and 4337 wallets

2) 3074 breaking in a future…

EIP-7702 introduces a new transaction type that would allow externally owned accounts (EOAs) to temporarily act as smart contracts during a transaction. Like EIP-3074, the new proposal would enable better ways to abstract gas fees, batch transactions, and improve the user experience. However, it goes further by improving compatibility with the ERC-4337 standard for smart contract wallets — an issue with EIP-3074 — and being more future-proof.

Some crypto community members have speculated that EIP-7702 would replace EIP-3074 in the upcoming Ethereum Pectra upgrade. One X user commented, "I think it would probably make more sense to include in Pectra than 3074."

Fireblocks' VP of Technology Arik Galansky also commented on the proposal saying, "It's a long while since Ethereum introduced changes that are user-oriented rather than scaling-oriented and this one is right on point." He further stated that EIP-7702 is a "compromise between a few suggestions that were competitive rather than complimentary" and may make it to the next Ethereum upgrade.

A few weeks ago, EIP-3074 sent the AA world into shambles.

— Ivo e/acc (@Ivshti) May 7, 2024

Initially it looked like it's synergetic with ERC-4337, since they do different things. One enables EOA migration, another enables decentralized mempools.

However, the nitty gritty details looked suboptimal: it's hard…

Also read: Ethereum traders show uncertainty, SEC delays decision on Invesco's ETH ETF application

Meanwhile, the Ethereum Foundation appeared to be dumping ETH again on Wednesday following a transfer of 1,000 ETH worth $3 million to middle multisig address 0xbc9, according to data from Spot On Chain.

This transfer is the latest action in a larger trend where the Ethereum Foundation has sold 1,766 ETH for 4.81 million DAI stablecoin at ~$2,725 since the beginning of 2024. The ETH sales, done in small batches through the same middle multisig address 0xbc9, often coincide with brief Ethereum price declines, noted Spot On Chain.

ETH technical analysis: Ethereum could be gathering momentum for a bullish run

The market remained quiet on Wednesday as Ethereum continued trading around the $3,000 mark. Despite the calm market, ETH derivatives volume in May has risen higher — close to 60% — than that of Bitcoin, according to QCP.

Read more: Ethereum could see a brief rally despite Michael Saylor's jab at ETH ETFs

The reason for the increase may be the market pricing in volatility over the Securities & Exchange Commission's (SEC) upcoming decision on Van Ecks' spot ETH ETF application on May 23, noted QCP. This also explains why the market is slightly tilted toward a downward movement as many expect the SEC to deny spot ETH ETF applications.

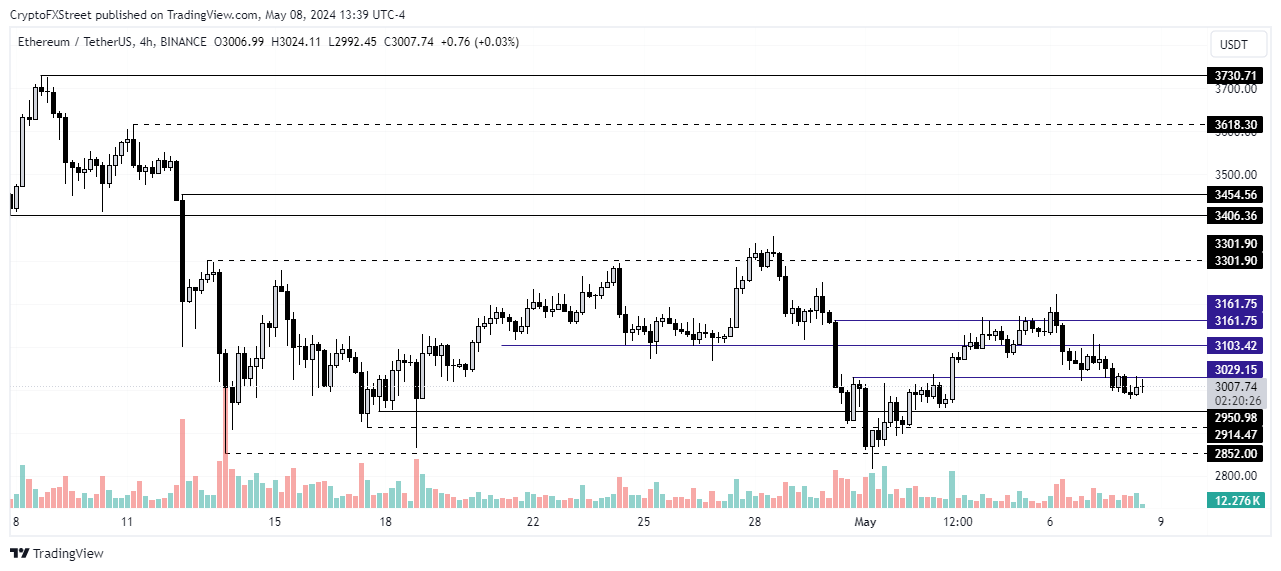

While current price action indicates ETH may continue a horizontal movement in upcoming weeks, historical data suggests the largest altcoin could be gathering momentum for a bullish run. Considering ETH has remained in the $2,852 to $3,300 range for nearly a month, it could attempt a sustained breakout above the upper level of the range if it sees a slight bullish trigger.

ETH/USDT 4-hour chart

Onchain data also shows most whales have been accumulating ETH around this range in anticipation of a price rally. A bearish event could see it break below the lower level of the range briefly, presenting a buying opportunity.

Ethereum is trading at $3,013 on Wednesday, May 8, down 0.7% on the day.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.