散戶投資者的英雄Roaring Kitty再次迴歸——GameStop(GME)已經停止

基思·吉爾(Keith Gill),在網上更爲人熟知的名字是“咆哮的小貓”,再次迴歸社交媒體。三個月的沉默之後,他在 X(以前的 Twitter)上發佈了一張matic圖片。

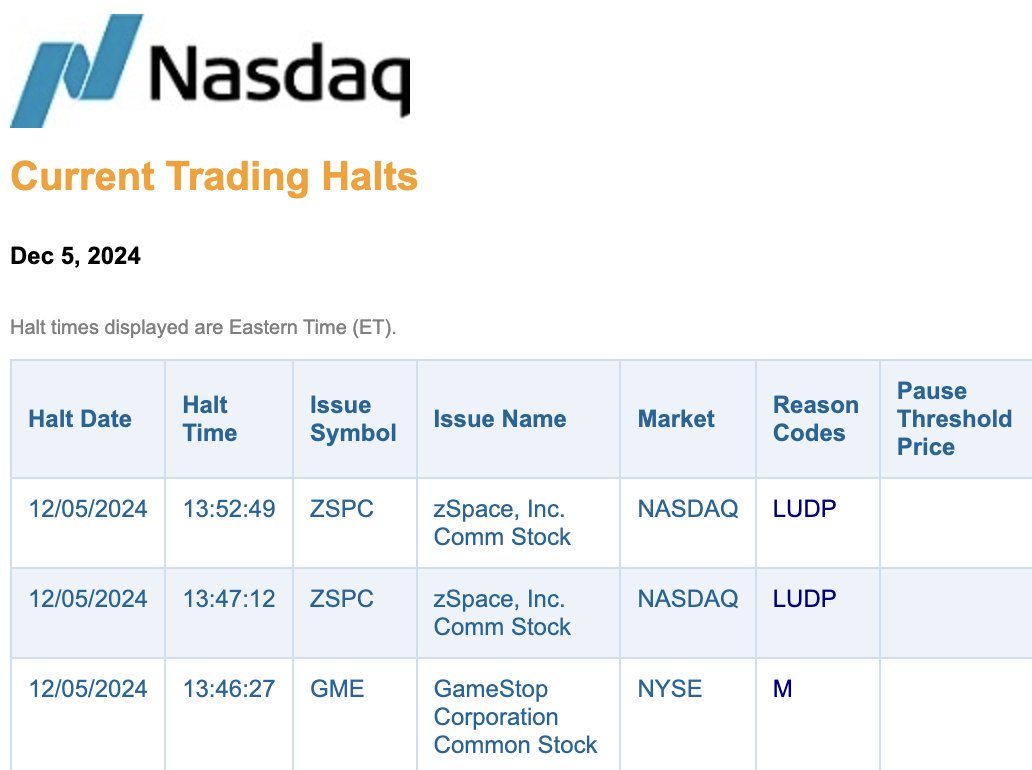

幾小時內,吉爾迅速成名的代名詞 GameStop (GME) 股價飆升 8%,並因劇烈波動而引發停牌。一如既往,散戶投資者、迷因股票愛好者和加密貨幣圈子都在剖析這篇文章,尋找神祕視覺背後的意義。

該 圖像的風格類似於《時代》雜誌的封面,具有空白的電腦屏幕和暫停的視頻。視頻的進度條顯示“01:09 / 04:20”。許多人認爲這可能是在不久的將來 YouTube 直播的暗示。

pic.twitter.com/tXViICmVFG

—咆哮的小貓 (@TheRoaringKitty) 2024 年 12 月 5 日

Kitty’s legendary legacy

Keith Gill became a household name in January 2021, leading the charge in the GameStop short squeeze that rattled Wall Street to its core. Posting under the moniker Roaring Kitty on YouTube and Reddit, Gill detailed his investment thesis on GME, encouraging retail traders to buy into the heavily shorted stock.

His early investment of $53,000 in GameStop shares ballooned into an astonishing $48 million during the height of the squeeze. GameStop’s stock soared over 1,000% at its peak, leaving hedge funds like Melvin Capital reeling with billions in losses.

Kitty’s passion for the stock made him a symbol of retail investor power and a thorn in Wall Street’s side. His influence outlasted the initial frenzy, maintaining momentum for meme stocks even after stepping away from the spotlight in 2021.

Earlier this year, he returned briefly in May and June, driving up GameStop’s stock price and confirming his continued stake in the company. At that time, he revealed holdings of 9 million shares valued at $262 million, cementing his ongoing commitment to the movement.

Trading halts are nothing new for GME where Keith is involved. Earlier this year, during a livestream where he showcased his massive holdings, the stock experienced similar fluctuations, with trading paused multiple times.

Investors are now eyeing GameStop’s upcoming earnings report, set for December 10, with analysts forecasting a $0.03 loss per share. The company has beaten estimates in recent quarters.

Kitty’s return coincides with Bitcoin’s historic breakthrough, crossing $100,000 for the first time ever. The crypto community, which shares strong ties with the meme stock movement, is riding super high right now.

Both phenomena represent the power of decentralized movements and retail investors taking control. With global stocks also rallying, the timing of Gill’s post feels like a deliberate alignment with the broader bullish sentiment. 2024 really has been one for the books!

From Zero to Web3 Pro: Your 90-Day Career Launch Plan