EUR/USD remains subdued around 1.0900 ahead of ECB’s Lagarde speech

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

EUR/USD continues to decline ahead of ECB President Christine Lagarde’s speech at the European Parliament in Brussels.

The US Dollar struggled as US yields weakened, following Fed’s reaffirmation of its outlook for two rate cuts in 2025.

Germany’s proposed economic plan, aimed at stimulating growth and boosting defense spending, could contribute to rising inflation and broader economic expansion.

EUR/USD loses ground for the second successive day, trading around 1.0900 during Asian hours on Thursday. However, the pair strengthened as the US Dollar (USD) remained under pressure, weighed down by declining yields after the Federal Reserve (Fed) reaffirmed its outlook for two rate cuts later this year. However, uncertainty surrounding US President Donald Trump’s tariff policies adds a layer of caution.

Meanwhile, US Treasury bonds gained traction following the Fed’s decision to slow the pace of quantitative tightening, citing concerns over reduced liquidity and potential risks tied to government debt limits.

The US Dollar Index (DXY), which tracks the USD against six major currencies, is hovering near 103.40, while US Treasury yields continue to decline. The 2-year yield stands at 3.97%, and the 10-year yield at 4.24%.

On Wednesday, as expected, the Federal Reserve held the federal funds rate steady at 4.25%–4.5% during its March meeting. Fed Chair Jerome Powell noted, “Labor market conditions are solid, and inflation has moved closer to our 2% longer-run goal, though it remains somewhat elevated.”

In Europe, German leaders approved a debt restructuring plan proposed by likely Chancellor Friedrich Merz on Tuesday. The plan aims to stimulate economic growth and increase defense spending. Market participants anticipate that a shift away from Germany’s long-standing fiscal conservatism could drive inflation and economic expansion, prompting the European Central Bank (ECB) to reassess its current monetary policy.

Traders will likely observe ECB President Christine Lagarde on Thursday, who is scheduled to deliver an introductory statement on Economic and Monetary Affairs (ECON) at the European Parliament in Brussels, Belgium.

Euro PRICE Today

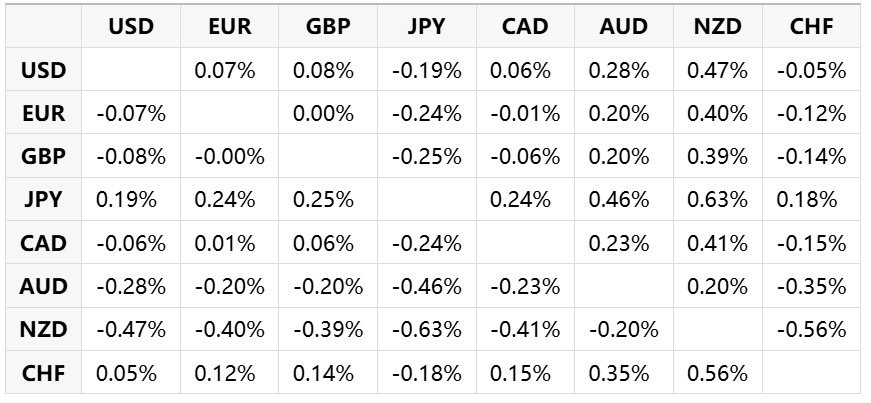

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the Japanese Yen.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.