Financial Markets 2026: Volatility Catalysts in Gold, Silver, Oil, and Blue-Chip Stocks—A CFD Trader's Outlook

Stepping into 2026 Financial Markets

The financial world is perpetually in motion, but the landscape for 2026 seems to be shaping up to be particularly dynamic. For CFD traders navigating global markets, this heightened volatility could present a distinctive set of challenges and opportunities.

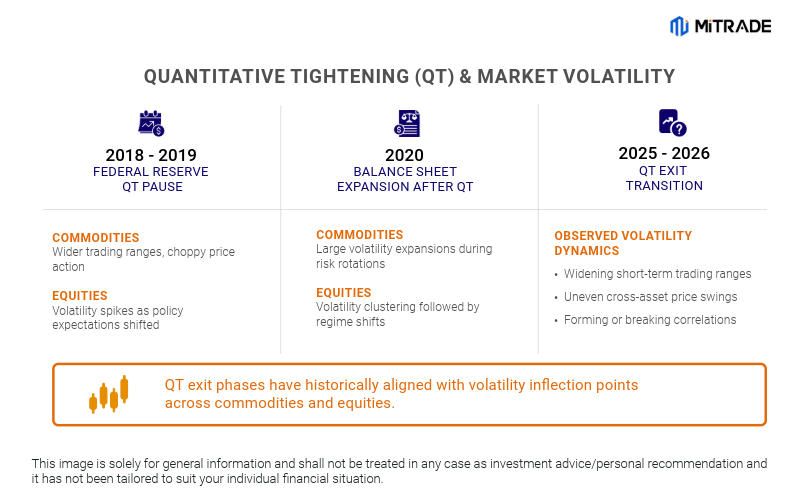

As markets move through a complex interplay of macroeconomic shifts, geopolitical developments, and evolving global conditions,2026 is increasingly framed as a potential transition period in monetary policy, which may mark the end of quantitative tightening across major economies. Past balance sheet transitions discussed in Federal Open Market Committee (FOMC) communications have coincided with shifts in volatility patterns across commodities and equities, as liquidity conditions stabilised and risk pricing adjusted.

Against this backdrop, understanding the specific volatility catalysts in gold, silver, oil, and blue-chip stocks becomes central. This outlook focuses on how markets have been repricing uncertainty rather than forecasting outcomes.

Unpredictable Macroeconomics: Market Volatility Is Becoming the New Norm

Central banks may face uncertainty heading into 2026. The U.S. Federal Reserve has communicated that future adjustments to interest rates, including potential cuts, remain contingent on economic development, with labour-market conditions playing a central role in policy considerations, while recent inflation data published by the U.S. Bureau of Labor Statistics show price pressures cooling but remaining close to the Federal Reserve’s 2% target. At the same time, labour-market data continue to point to resilience, reinforcing a cautious policy stance reflected in recent FOMC statements and press conferences.

Market expectations and policy actions remain misaligned. According to the CME FedWatch Tool, futures markets are pricing in possible rate cuts over the coming policy cycle based on Fed funds futures pricing. Policymakers, however, continue to emphasize a data-dependent approach, moving more slowly than markets anticipate. This gap can contribute to periods of volatility, as each FOMC decision prompts reassessment of whether expectations have moved ahead of policy reality.

As recession risks are debated, two competing narratives dominate market positioning. One assumes continued disinflation, allowing interest rates to fall without significant economic damage and supporting growth-sensitive assets. The opposing view highlights tariffs, wage pressures, and supply-side constraints as factors that could slow disinflation and keep policy restrictive for longer. Monthly inflation releases reported by the Bureau of Labor Statistics frequently shift sentiment between these narratives, producing sharp repricing.

Trade policy adds another layer of uncertainty to the macroeconomic outlook. Tariff developments may influence supply chains and earnings expectations, particularly for large technology and semiconductor firms such as Nvidia, TSMC, Broadcom, and Intel, as reflected in company disclosures and sector commentary. Periods of escalating trade tensions have historically amplified recession concerns, while easing tensions have supported stabilisation narratives.

Geopolitical Developments and Regional Instability: What Traders Are Monitoring

The Venezuelan Oil Supply Wildcard

Barely a month into 2026, Venezuela’s political situation has become a renewed focus for oil markets. Political disruption has interrupted oil shipments and raised questions about how quickly the nation’s crude oil can return to global trade flows. Venezuela holds the world’s largest proven crude oil reserves, with an estimated 303 billion barrels — roughly 17 % of global reserves. Despite this vast resource base, actual production has remained constrained.

An important detail for understanding the market impact is the type of oil Venezuela produces. Most Venezuelan crude is classified as heavy and sour, meaning higher density and sulfur content. This classification aligns with crude-quality data published by the U.S. Energy Information Administration. Only complex refineries—particularly along the U.S. Gulf Coast—are equipped to process such grades efficiently.

This distinction explains why Venezuelan supply disruptions affect more than oil producers alone. When heavy sour crude becomes harder to source, refineries capable of processing may experience changes in margins as alternative supplies are limited, and pricing dynamics shift. As a result, market reactions are often visible not only in crude benchmarks such as Brent and WTI, but also in refining and downstream energy equities.

Trump's Greenland Ambitions and Supply Chain Stability

Beyond Venezuela’s oil dynamics, Arctic geopolitics function as a sentiment-sensitive factor rather than a direct supply driver. Greenland holds potential deposits of critical minerals used in advanced technologies, including semiconductors, as outlined in geological assessments referenced by U.S. and European strategic resource agencies. There are currently no large-scale commercial production and no immediate impact on physical supply.

From a trading perspective, Arctic-related developments have historically been treated as headline risk. Periods of heightened geopolitical discussion around Arctic access, foreign-investment rules, or strategic cooperation have coincided with temporary volatility and sector rotation within technology and semiconductor equities, rather than sustained fundamental repricing.

In this context, Arctic geopolitics are best understood as a volatility and sentiment input, reflecting reassessments of longer-term supply-chain concentration rather than expectations of near-term operational change.

Iran's Internal Tensions Spark Traders' Gold and Oil Repricing

Running parallel to these energy and supply-chain concerns, Iran presents a different repricing dynamic. Internal unrest combined with external diplomatic engagement creates conflicting market signals. Periods of heightened tension have coincided with sharp repricing across oil and safe-haven assets, while equity markets have responded to shifting risk perceptions.

Safe-haven behaviour in gold during geopolitical stress has been documented by the World Gold Council, while oil markets have historically reflected escalation risk through volatility rather than stable trends.

Contract For Differences (CFDs) in Volatile Climates

Periods like 2026 highlight a core market reality: Volatility is one of the primary expressions of uncertainty in market prices. Repricing that once unfolded over weeks now often occurs within hours of economic data releases, policy statements, or geopolitical developments.

Contract for Difference (CFD) is an over-the-counter derivative agreement between a trader and a broker to exchange the difference in an asset’s price between the time the contract is opened and closed. CFDs are used to gain exposure to underlying assets such as commodities, indices, and equities within a single trading framework, allowing traders to respond to market price movements that arise from uncertainty. These contracts mirror underlying price movements without conferring ownership and operate under margin requirements and financing considerations, as outlined in broker disclosures and regulatory guidance.

Why CFDs Remain Relevant in Sustained Volatility

When volatility becomes structural rather than episodic, market participation evolves. Attention shifts away from forecasting precise outcomes and toward observing how markets absorb and react to new information. CFDs enable traders to quickly respond to market moves, whether driven by macroeconomic data or shifts in sentiment. Blue chip stocks, in particular, tend to behave less like company-specific instruments and more like macro-sensitive assets, often moving in response to interest rates, liquidity conditions, and shifts in risk sentiment.

CFD trading allows positions to be opened and maintained across a range of time horizons, from intraday exposure to multi-day or multi-week positioning. Positions may be opened and closed within the same trading day to reflect immediate price movements or maintained over extended periods in response to evolving market conditions and broader market developments. Traders should note that overnight financing fees accrue for positions held beyond the trading day, which can substantially increase costs over longer holding periods.

The selected timeframe can materially influence how CFD positions are managed, including the level of monitoring required, the frequency of decision-making, and the extent of exposure to market movements, volatility, and associated costs over time. Understanding how different time horizons affect price behavior, trading costs, and overall risk exposure is an important consideration when engaging in CFD trading. Regardless of the timeframe adopted, CFD trading involves a high level of risk, and losses can be significant due to market volatility, leverage, and related costs.

CFD Market Maturity, Regulation, and Access

The modern CFD market operates within increasingly defined regulatory frameworks. Mitrade is regulated by authorities such as ASIC, CySEC, FSCA, CIMA, and the FSC, which function under disclosure and conduct standards that shape how market access is delivered.

Mitrade provides access to over 900 global instruments from a single platform. Features such as commission-free pricing models and tight spreads illustrate structural aspects of the platform rather than investment performance. CFDs on Mitrade enable exposure to market price movements within a regulated framework, and users should be aware of associated risks, including leverage and associated costs.

2026 Top Themes CFD Traders Are Eyeing

Given the backdrop of renewed policy uncertainty, geopolitical tensions, and heightened market sensitivity to central bank independence, we explore which themes are driving traders’ attention in 2026.

Gold: The Safe Haven When Everything Else Breaks

Gold has been trading as a fear gauge since the year before, with gold price movements reflecting institutional anxiety over Fed stability.Spot gold surged to an all-time high past $4,600 per ounce with a 2% intraday jump after federal prosecutors opened a criminal inquiry into Fed Chair Jerome Powell. The increase reflected the market’s reaction, as investors sought exposure to gold amid heightened uncertainty regarding policy development, making gold bullion and gold bars attractive to traders looking to buy gold as a safe haven against policy uncertainty.

The spot price of gold serves as the benchmark for both physical and derivative trading, including CFDs, determining the underlying market value used for settlement and pricing. In periods of heightened volatility, closely related instruments such as spot gold (XAUUSD) and gold futures have tended to move in tandem, as markets reassessed policy-related developments.

Concurrent geopolitical events have also helped sustain elevated volatility. News of tariff threats affecting major trading partners was linked with renewed safe-haven flows into precious metals. These compounded factors kept models on repricing alert, with traders monitoring how macro developments feed into gold’s narrative.

Silver: The Industrial Metal Riding The AI Wave

Silver price has been climbing as industrial demand outpaces mining supply. The world faces its fifth consecutive year of supply deficits, driven by AI's impact on critical minerals consumption. Goldman Sachs projects data center power demand will surge 165% by 2030, reflecting the scale of AI-driven infrastructure build-out.

Instruments like XAGUSD (spot silver) and SI futures tend to reprice instantly when hyperscale capex announcements arrive. Beyond data centers, solar installations consume critical minerals, and EVs consume 67-79% more silver per unit, compared to conventional cars, creating layers of industrial demand that keep the market active . Silver’s price behavior can diverge from gold due to its significant industrial demand. Traders monitor NVIDIA and semiconductor repricing to gauge how sector-specific industrial demand affects its price. Risk-on sentiment that lifts tech equities can support industrial metals demand, including silver, while risk-off reversals may weaken them, reflecting their sensitivity to growth expectations and industrial demand.

Oil, Brent, and WTI: The Tug-Of-War Between Disruption And Oversupply

Oil prices are trapped between two conflicting narratives: geopolitical disruption risk and structural oversupply fundamentals. Iran produces roughly 3% of global oil supply, yet recent tensions have added $3-4 per barrel in geopolitical premium. This dynamic has contributed to observable volatility in instruments like BRENT(global benchmark),WTI(crude oil price), and USOIL, repricing in response to disruption-related headlines before subsequently reflecting broader oversupply conditions. The Venezuelan political transition promised 30-50 million barrels to U.S. markets, further reinforcing oversupply headwinds that pressure the fundamental ceiling. Global inventories are rising, and oversupply remains the main driver capping gains.

Trump’s tariff threats continue to reshape global supply chain dynamics. Tariff uncertainty adds a second-order volatility layer to geopolitically driven repricing, reinforcing binary outcomes between disruption premiums and demand-driven oversupply. This keeps commodities in near-constant repricing cycles, with energy equities such as XLE tracking headline risk and transmitting volatility across correlated instruments.

Blue Chip Stocks: The Macro Game Disguised As Equities

Blue chip stocks are now largerly macro plays dressed in equity tickers. Stock futures repriced rapidly as markets shifted expectations around the pace of rate cuts in 2026, with the S&P 500 pushing to a record high close in early January, led by semiconductor stocks. This repricing happened across NASDAQ, DAX, and ASX simultaneously—reflecting unified macro repricing on Federal Reserve rate-cut expectations. Instruments such as NVIDIA, Microsoft, Amazon, and Alphabet moved in tandem with Intel, Broadcom, Super Micro Computer, and Arista Networks, decoupling price action from individual company announcements.

AI investment narratives continue to drive directional bias within specific sectors—NVIDIA tends to respond to data-center build-out announcements, while Chevron and Exxon Mobil remain more sensitive to shifts in energy demand expectations. Mainstream media coverage of Federal Reserve communications and geopolitical headlines feeds continuously into equity pricing. Treasury yields, particularly the U.S. 10-year, have moved inversely to equity repricing during policy-driven volatility, reinforcing the importance of cross-asset relationships in macro-led market moves.

Closing Perspective: What 2026 Means for Traders and Market Participants

The real story of 2026 isn't the volatility—it's how traders navigate it. Outcomes are increasingly driven by evolving narratives—policy credibility, geopolitical recalibration, and shifting growth expectations—rather than by stable or predictable trajectories. In such an environment, certainty fades while adaptation becomes the dominant market force.

What separates traders who remain engaged from those who withdraw is rarely access, speed, or strategy. Greater differentiation appears in self-awareness. An honest understanding of personal risk tolerance, emotional limits, and decision-making behaviour under pressure shapes how individuals interact with volatile conditions. Clarity around whether rapid repositioning feels manageable or destabilising influences participation more than any market forecast.

This self-knowledge informs exposure, engagement, and restraint. Decisions around allocation, pacing, and when to step back often reflect personal education rather than technical insight. In that sense, risk education and risk mitigation extend beyond external tools and into self-assessment.

In volatile market environments, it is important to approach trading with a focus on learning and understanding, rather than trying to predict future price movements. Financial markets respond to events and participant behavior, which can provide insights into how prices react, but past patterns do not guarantee future outcomes. Managing risk effectively requires awareness of personal limits and careful consideration of exposure, rather than reliance on forecasts or market movements.

Explore CFD Trading in a Risk-Free Demo Environment

Some individuals choose to explore CFD trading through demo environments offered by regulated providers. Mitrade offers a demo account that enables users to simulate CFD trading using virtual funds rather than real capital.

While demo trading does not involve real money and cannot fully replicate live-market conditions, it may help users familiarize themselves with platform functionality, pricing mechanics, and behavior of different underlying assets from which CFDs derive their value, such as indices, equities, commodities, and currency pairs. Mitrade’s demo account provides a virtual balance of 50,000 EUR, allowing users to observe how markets and platform tools respond under different conditions without financial exposure.

Those interested in learning more about CFD trading can find further information on Mitrade’s platform and services at Mitrade’s website, including details on CFDs across foreign exchange, commodities, shares, indices, ETFs, and cryptocurrencies.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.