Best Strategies When BTC Price Drops: From Hedging to Accumulating

Bitcoin fell three straight months through late 2025, dropping from $125,000 in October to $87,000 by year-end. That's a ~30% pullback.

History shows crypto cycles often bring sharp corrections after peaks—think 50-80% drops in past bears. While many analysts remain bullish long-term, a 2026 drawdown to $65,000 or lower isn't off the table if inflation lingers, rates stay elevated, or risk-off sentiment hits.

For intermediate crypto holders who've ridden the bull, preparation beats panic. In this article, let’s explore the top strategies for BTC price drops that professional traders use to protect their portfolios and even benefit from the market down swings. So, let’s dive right in.

Key BTC Price Support Levels to Monitor

Technical and on-chain levels often act as magnets in corrections. Watch these closely:

$88,000–$89,000: Near-term psychological and Fibonacci retracement support from recent highs—often a first line of defence.

$85,000–$86,000: Stronger historical volume zone; breaks here could accelerate selling.

$65,000–$70,000: Major on-chain support (realised price for many holders) and potential bear market confirmation if breached sustainably.

$50,000–$57,000: Deeper correction targets seen in some cycle analyses—aligning with prior bear lows.

Best Strategies When Bitcoin Price Drops

1 - Hedge Your Bitcoin Spot Position With Inverse ETFs

2 - Short Bitcoin via Futures and Perpetuals

3 - Buy at Key BTC Price Support Levels (Using institutional flow data)

4 - Tax-Loss Harvest to Offset Gains

5 - Use Put Options for Downside Protection

1: Hedging Spot Bitcoin Holdings with Inverse ETFs

Hedging strategy means you protect your Bitcoin holdings by buying inverse products that rise when Bitcoin falls. Think of it like insurance for your portfolio.

The simplest way to hedge Bitcoin in 2026 is through inverse ETFs like ProShares Short Bitcoin Strategy ETF (BITI). When Bitcoin drops 20%, BITI typically rises 20% to 25%. Your losses on Bitcoin get offset by gains on the hedge.

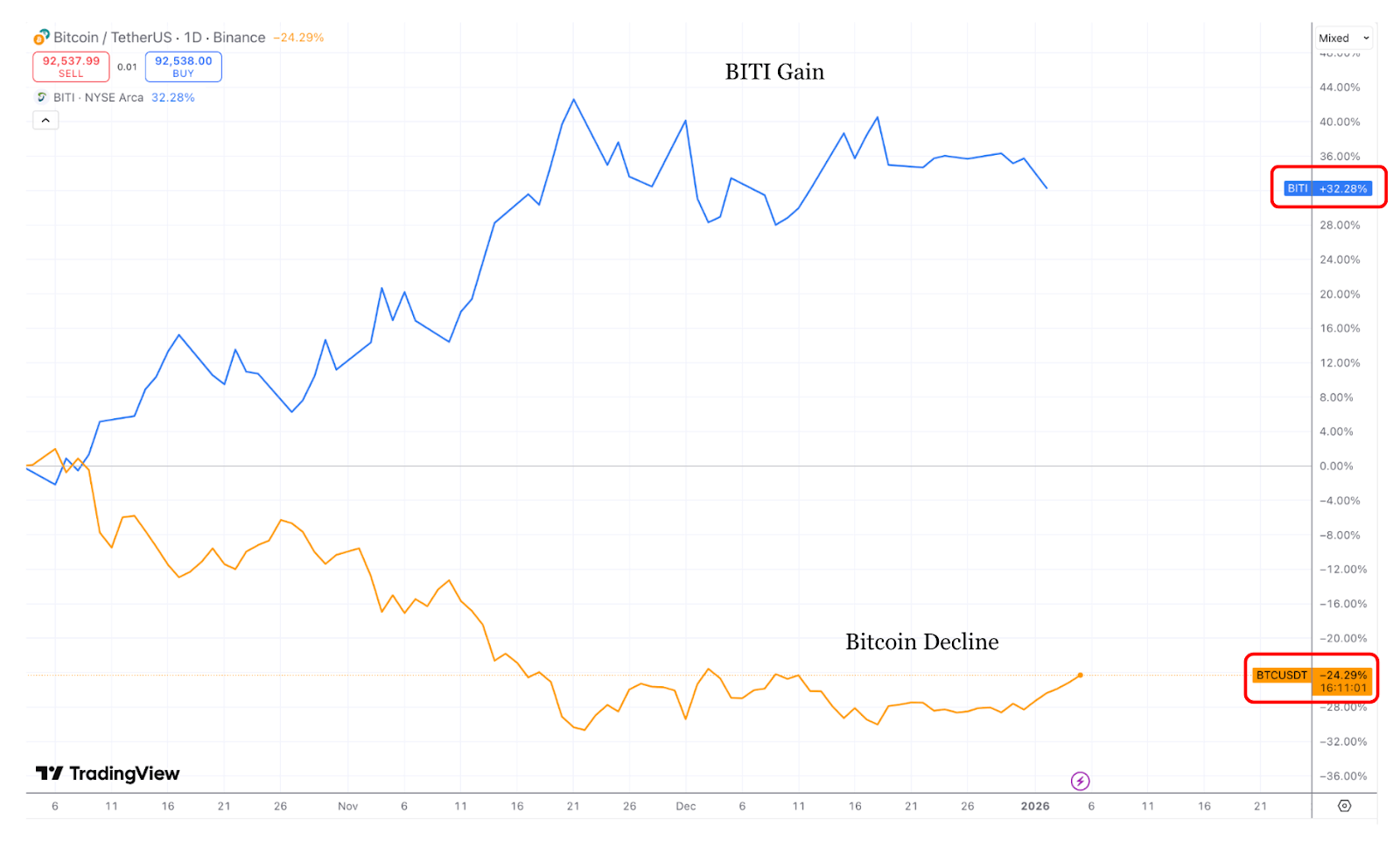

This chart shows exactly how hedging works. During Bitcoin's 24.29% decline from late 2025, BITI gained 32.28%.

Here's the key concept: You don't hedge 100% of your Bitcoin position. That would be shorting, not hedging. Most traders hedge 10% to 30% of their holdings, just enough to cushion losses, not so much that you miss gains when Bitcoin rallies.

Think of it like insuring your house for fire damage. You don't insure it for 300% of its value. You insure it for what you might lose.

Let’s see a real example with a 20% hedge. You hold $10,000 in Bitcoin. You hedge with $2,000 in BITI (20% of your position).

During the decline:

Your Bitcoin: -$2,429 (24.29% loss on $10,000)

Your BITI: +$646 (32.28% gain on your $2,000)

Net loss: $1,783 instead of $2,429

You reduced your loss by 27% with just a 20% hedge.

How It Works

You can buy BITI through any standard brokerage account and there is no crypto exchange needed. This asset class trades on NYSE Arca just like a stock. You can buy it at 9:30 AM EST and sell it at 4 PM EST during market hours.

The ETF uses Bitcoin futures to create the inverse exposure. When Bitcoin futures fall, the ETF rises. The correlation isn't perfect due to the futures price being typically greater than the spot, and also because of daily rebalancing, but it ideally captures 90% to 110% of Bitcoin's inverse move.

The Real Costs

BITI charges a 0.95% annual expense ratio. On a $10,000 position held for three months, that's roughly $24 in fees. You also pay standard stock trading commissions if your broker charges them.

The bigger cost is opportunity cost. If Bitcoin rallies 30% and you're 20% hedged, you only capture 24% of that gain. Your hedge loses money while your Bitcoin position gains. You're paying for protection you didn't need.

Here's a quick example on a $10,000 Bitcoin position with a 20% hedge ($2,000 in BITI)

Scenario 1: If Bitcoin drops 25%

Bitcoin position: -$2,500

BITI position: +$600 (assuming 30% inverse gain)

Net loss: -$1,900

Unhedged loss would be: -$2,500

You saved $600

Scenario 2: Bitcoin rallies 25%

Bitcoin position: +$2,500

BITI position: -$600 (BITI falls when Bitcoin rises)

Net gain: +$1,900

Unhedged gain would be: +$2,500

You gave up $600 in profits

Who Should Use This

This works if you hold Bitcoin long-term but expect short-term turbulence. Maybe you bought at $60,000 and Bitcoin is now at $95,000. You don't want to sell and trigger taxes, but you're nervous about a pullback.

During times like this, a 10% to 30% hedge gives you downside protection without exiting your position entirely. It's also useful if you need your Bitcoin capital in 3 to 6 months and can't afford a 30% drawdown right before you need the money.

The Tradeoff

As mentioned, you're paying 0.95% annually plus opportunity cost to reduce volatility. If Bitcoin trades sideways for six months, your hedge costs you $475 in fees on a $100,000 position with no benefit. If Bitcoin crashes 40%, that same hedge saves you $8,000 to $12,000.

It's insurance. You pay the premium whether you need it or not.

2 Short Bitcoin via Futures and Perpetuals

Shorting Bitcoin means you profit when the price falls. Unlike hedging, you're not protecting an existing position, you're actively betting on BTC’s decline.

The two main ways to short Bitcoin in 2026 are futures contracts and perpetual swaps. Futures have expiration dates. Perpetuals never expire and use funding rates to keep prices aligned with spot. Both let you borrow Bitcoin, sell it, then buy it back cheaper when the price drops.

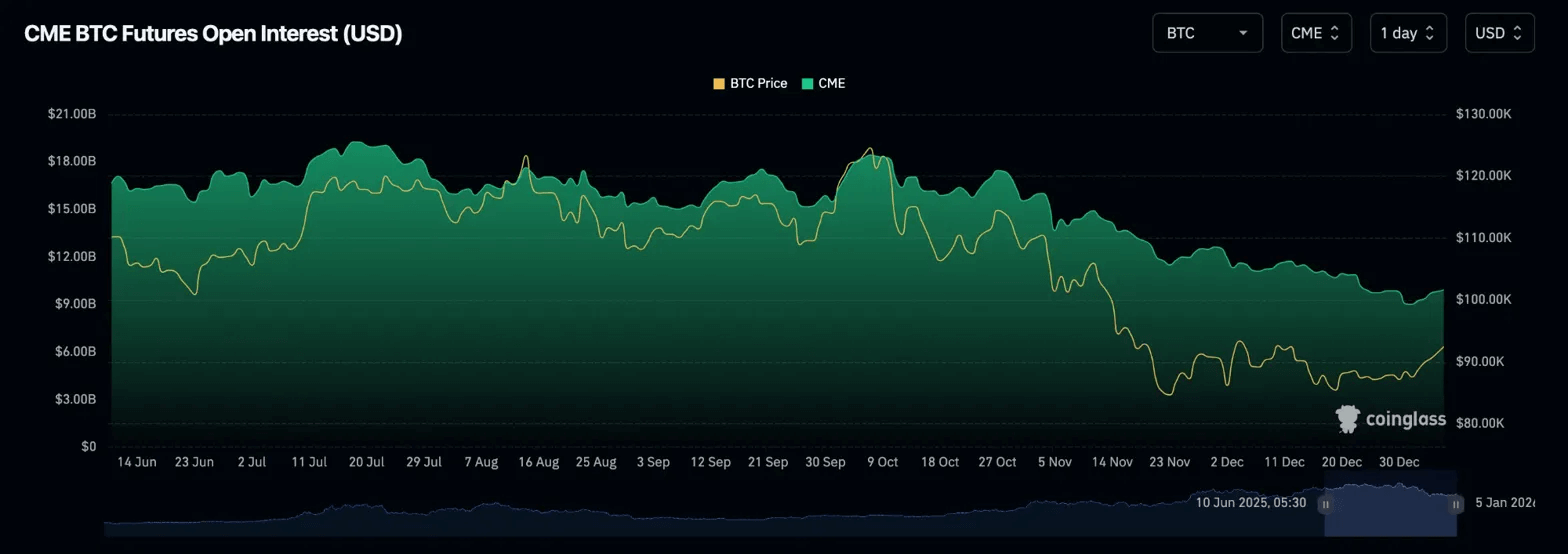

The chart below shows CME Bitcoin futures open interest staying elevated around $12-15 billion even as Bitcoin declined from $120,000 to $91,000 in late 2025.

High open interest during price declines indicates institutional hedging activity or short positions being established to profit from further downside. This is proof the strategy works at scale. When institutions see weakness, they short.

How It Works

You open a short position on a crypto exchange for regulated Bitcoin futures. You put up margin, typically 20% to 50% of your position size with 2x to 5x leverage.

If Bitcoin drops from $95,000 to $85,000, you make $10,000 per BTC shorted. If it rallies to $105,000, you lose $10,000 per BTC.

On perpetuals, you pay or receive funding rates every 8 hours. In bear markets, shorts often pay 0.01% to 0.05% per day. CME futures don't have funding rates but trade at a premium or discount to spot.

The Real Costs

To short $10,000 worth of Bitcoin with 5x leverage, you need $2,000 in margin. Trading fees run 0.02% to 0.08% per trade ($2 to $8 on entry, same on exit). Funding costs in a bear market average $1 to $5 per day on a $10,000 position.

Quick example: Short $10,000 BTC at $95,000 with 5x leverage ($2,000 margin)

Bitcoin drops to $85,000 (10.5% decline):

Position profit: +$1,050

Costs (30 days): -$61

Net gain: +$989 (49% return on margin)

Bitcoin rallies to $105,000 (10.5% gain):

You get liquidated

Total loss: -$2,000 (entire margin gone)

Who Should Use This

Active traders who monitor positions daily. You need a specific strategy like resistance levels gauging, distribution patterns, etc. Enter the short, target 5% to 15% down, and exit. This isn't set-and-forget. Bitcoin can rally fast, wiping out your margin before you react.

The Tradeoff

Leverage amplifies gains. A 10% Bitcoin decline generates 50% returns on your margin. But liquidation risk is real. Bitcoin rallying 10% against a 10x short erases your entire position. Also, the funding rates compound over time. Six months of paying 0.03% daily costs 5.4% of your position just to hold the trade.

If you can't check positions daily, don't short.

3: Identifying Support Levels Using Institutional Flow Data

BTC price support levels are price zones where large buyers consistently step in. When Bitcoin hits these levels, institutional money flows in and the price bounces. So by applying this strategy, you're buying where the big money buys.

The difference between guessing and knowing is data. In 2026, on-chain analytics platforms track institutional wallet movements, exchange inflows/outflows, and whale accumulation patterns. This tells you where support actually exists.

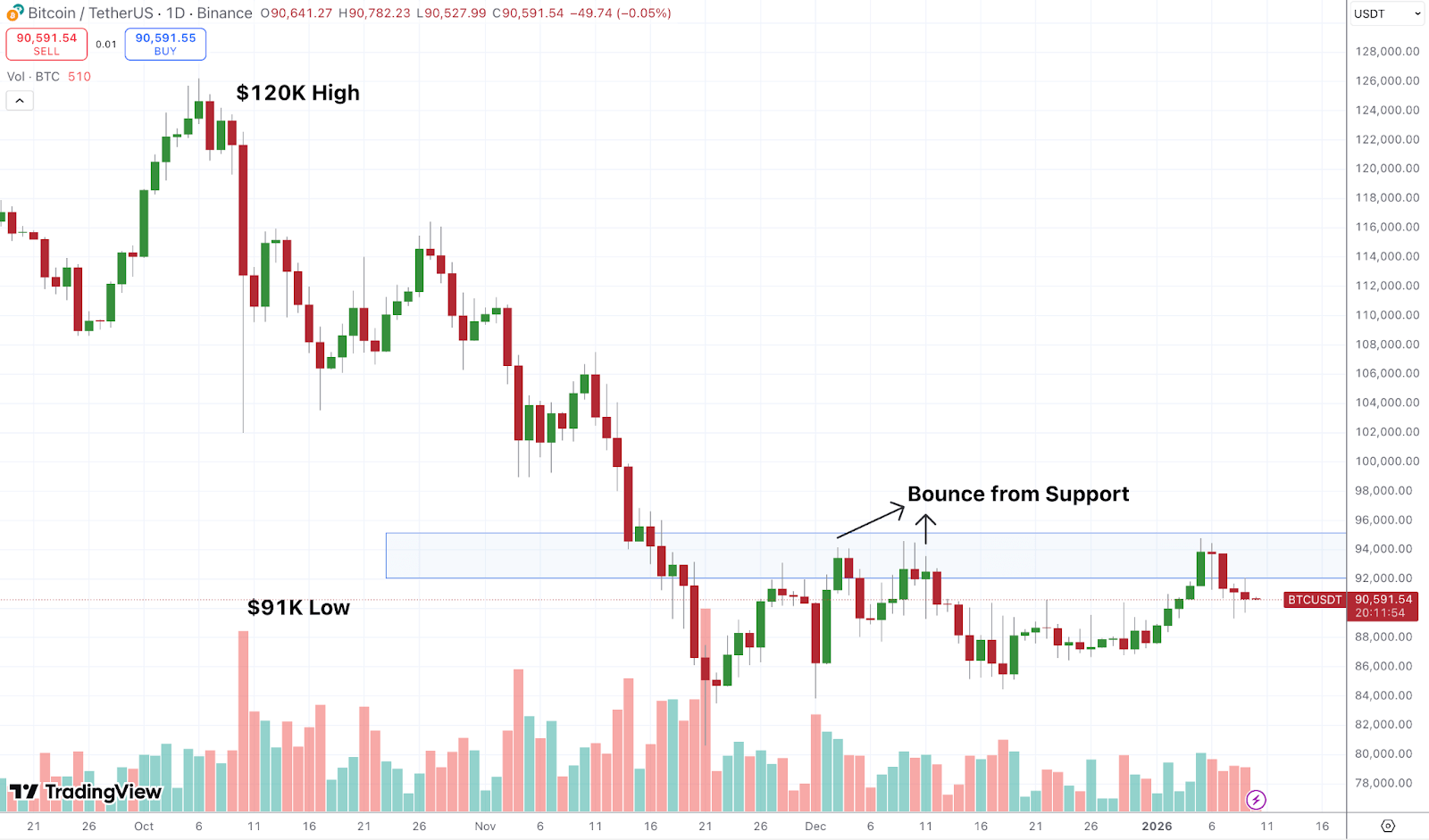

In the below chart, you can see Bitcoin finding institutional support at $92,000-$96,000 during the late 2025 decline. Price tested this zone multiple times, bouncing each time as large buyers stepped in. Volume spikes confirm buying pressure at these levels.

How It Works

You use platforms like Glassnode or CryptoQuant to identify institutional buying zones. These tools track Bitcoin moving from exchanges to cold storage (accumulation), whale wallet activity, and realized price levels where most Bitcoin last changed hands.

When Bitcoin approaches a level where whales historically accumulated, you buy. When it breaks below that level, you exit or wait for the next support zone.

The Real Costs

Analytics subscriptions: Glassnode starts at $29/month for basic metrics. CryptoQuant runs $39 to $99/month.

Trading costs: Standard exchange fees (0.1% to 0.5% per trade). On a $10,000 buy, that's $10 to $50.

Opportunity cost: Bitcoin might bounce 3% to 5% from support, but it could also break lower. If you buy at $92,000 expecting support and it drops to $85,000, you're down 7.6% while you wait for the next level.

Quick example: Buy $10,000 BTC at $92,000 support with CryptoQuant data ($39/month)

If Bitcoin bounces to $97,000 (5.4% gain):

Position profit: +$540

Costs: -$49 (fees + subscription)

Net gain: +$491 (4.9% return)

If Bitcoin breaks support, drops to $85,000 (7.6% decline):

Position loss: -$760

Costs: -$49

Net loss: -$809 (8% loss)

Who Should Use This

Long-term holders who want to improve their entry points. You're not trying to time the exact bottom. You're buying where institutions show up with real capital.

This works for dollar-cost averaging with better precision. Instead of buying every Monday regardless of price, you buy when Bitcoin hits data-confirmed support levels.

The Tradeoff

Support levels aren't guaranteed. Institutional buying at $92,000 doesn't mean Bitcoin can't drop to $85,000. It just means odds favor a bounce.

You pay $39 to $199 monthly for the data advantage. Over a year, that's $468 to $2,388. If it helps you avoid one bad entry or catch one better dip, it pays for itself.

The key is discipline. Buy the support, set your stop loss below it, and don't chase if you miss the entry.

Mitrade offers Bitcoin CFD trading with flexible position sizing if you want to implement support-level buying strategies with precise entry and exit points.

4: Tax Loss Harvesting to Offset Gains

Tax-loss harvesting means you sell Bitcoin at a loss during declines to offset taxable gains elsewhere in your portfolio. You lock in the loss for tax purposes, then rebuy Bitcoin immediately.

The real advantage is that, unlike stocks, crypto has no wash-sale rule in the U.S. You can sell Bitcoin, claim the loss, and buy it back 60 seconds later at the same price. The IRS allows this for cryptocurrency.

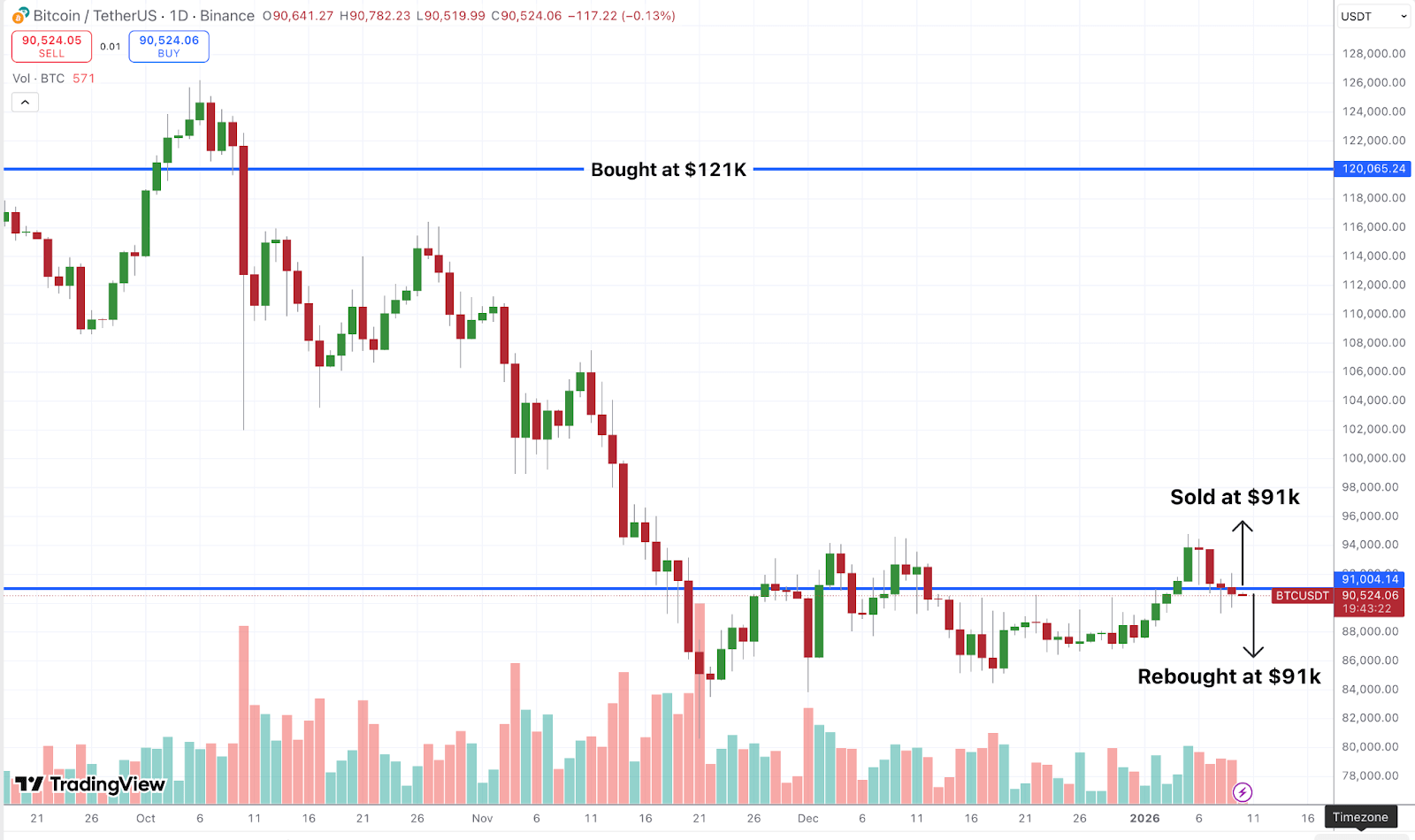

In the below chart, you bought Bitcoin at $121,000 in October. When it dropped to $91,000 in Jan, you sold to harvest an $30,000 loss for tax purposes, then immediately rebought at $91,000 to maintain your position.

How It Works

You execute this during market declines to capture the tax benefit for that financial year. Any Bitcoin position below your purchase price qualifies.

The process takes minutes. Log into your exchange, sell your Bitcoin at market price, then immediately place a buy order for the same amount. Use limit orders to control the price as market orders can cost you 0.2% to 0.5% in spread.

The loss becomes real the moment you sell. You can't just write down "I lost $18,000" without selling. The IRS requires an actual transaction. But unlike stocks where you'd wait 30 days to rebuy (wash-sale rule), crypto lets you rebuy instantly without losing the tax benefit.

You can harvest losses multiple times per year if Bitcoin has multiple legs down. Sell at $92,000, rebuy at $92,000, harvest the loss. If it drops again to $80,000, sell and rebuy again for another deduction.

The Real Costs

Trading fees: Two trades (sell + rebuy). At 0.5% per trade on Coinbase, that's $920 in fees on a $92,000 position. At 0.1% on Binance or Kraken, it's $184.

Tax benefit: If you're in the 32% federal bracket and harvest an $18,000 loss, you save $5,760 in taxes. Even after $920 in fees, you net $4,840.

Spread cost: If you market-order both trades, you might lose 0.1% to 0.3% to spread and slippage. On $92,000, that's $92 to $276.

Who Should Use This

Anyone who sold Bitcoin or other assets at a profit in 2026. If you sold Bitcoin at $126,000 earlier in the year and made $50,000, you owe $10,000 to $18,500 in capital gains tax. Harvesting a $20,000 loss in December cuts that tax bill by $4,000 to $7,400.

This also works for high-income earners with stock portfolios. You harvest crypto losses to offset stock gains, real estate profits, or business income.

The Tradeoff

You're paying fees to generate a tax deduction. If you have no gains to offset, this strategy does nothing for you in the current year. The loss carries forward, but you paid fees for a benefit you can't use now.

Also, when you rebuy at $92,000, your new cost basis is $92,000 instead of $110,000. If Bitcoin later goes to $150,000 and you sell, your taxable gain is $58,000 instead of $40,000. You didn't eliminate the tax, you just deferred it.

Other Ways to Profit When Bitcoin Goes Down

Beyond these core strategies, professionals use a few other tactics during Bitcoin bear market conditions.

Dealing with Put options is a great strategy but can be a bit complex for beginners. You pay a 2% to 5% premium for the right to sell Bitcoin at a set price, to protect it against crashes.

For example, a $400 premium on a $10,000 position protects you if Bitcoin drops from $95,000 to $70,000, with the put gaining $2,000 to offset losses.

Rotating to stablecoins like USDC lets you earn 4% to 5% yield while sitting out declines. If you rotate $10,000 at $100,000 and Bitcoin drops to $80,000 over six months, your $10,250 (with yield) buys 0.128 BTC instead of your original 0.10 BTC. That’s a 28% larger stack.

Finally, shorting altcoins amplifies returns since they typically fall 2x to 3x harder than Bitcoin. When BTC drops 15%, Ethereum might drop 25%, turning a $5,000 short with 3x leverage into $3,750 profit (75% return) versus $2,250 on a Bitcoin short.

Bitcoin Bear Market Strategies: Quick Comparison

Bottom Line

2026 could bring volatility; some see new highs above $150k, others a multi-quarter bear. The smart way for you is to prepare a plan now: define risk tolerance, set alerts, and allocate dry powder. Corrections are inevitable in crypto, surviving and thriving through them separates winners from the crowd. You now have proven strategies for navigating downturns. The choice depends on your position size, tax situation, and how actively you want to manage risk.

What's your bear market playbook? For active traders looking to implement hedging or shorting strategies across multiple asset classes, Mitrade offers flexible position sizing and tools for both directional and protective plays.

Turn Volatility into Opportunity

Turn Volatility into Opportunitywith crypto CFDs at Mitrade. 0 commission, low spreads. Enjoy limit and stop loss for every trade!

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.