Nasdaq 100 Forecast:Is Nasdaq 100 Still a Buy Heading Into 2026?

The Nasdaq-100 has spent most of the past two years trading like a referendum on artificial intelligence. If you were “in AI,” you were in the money.

And if you weren’t?

Well… You were increasingly irrelevant.

That kind of market regime can last longer than most investors expect, but it rarely lasts forever.

In 2026, a plausible shift is already forming: the market may stop rewarding companies merely for having AI and start rewarding the companies that can prove they are actually making money from AI.

In other words, the conversation is likely going to shift from AI excitement to AI ROI.

Less hype, more results.

Investors are increasingly going to ask what measurable return a company is earning on its AI spending. The question is especially important because AI investment is no longer a rounding error. In fact, one estimate shows that artificial intelligence captured nearly half of all global funding in 2025!

The biggest Nasdaq-100 companies are investing tens of billions of dollars in data centers, chips, and infrastructure. These large spending efforts are now showing up in capital expenditures, depreciation, and eventually, pricing pressure.

Meanwhile, the sources of competitive advantage are changing. Companies that use AI to improve their distribution and workflows may gain a real advantage, not just those with the most advanced models.

This phase, focused on return on investment, could have a big impact on how the Nasdaq-100 performs and leads in 2026. It might:

Re-rank winners inside the index (monetizers over storytellers).

Set higher standards for valuation multiples when AI companies do not have clear evidence of profits.

Support a wider market if more companies can demonstrate real earnings growth from AI.

Reduce concentration risk when returns start to spread beyond just the largest companies.

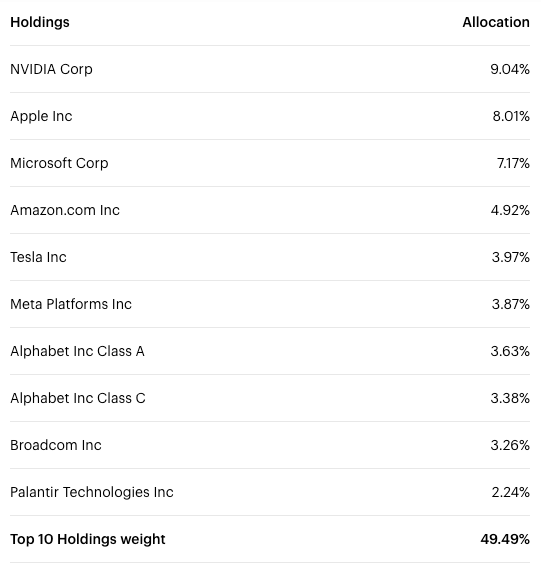

That last point matters because concentration is a defining feature of Nasdaq-100 exposure today. Invesco’s QQQ (the most widely used Nasdaq-100 ETF proxy) shows the index remains heavily weighted toward mega-cap leaders. The top 10 names represent around 50% of the entire holdings.

(source: invesco)

Concentration can help when strong leaders are in place. But it becomes risky if leadership weakens, valuations get too high, or earnings fall short.

What should we focus on when forecasting the Nasdaq 100 for 2026?

It shouldn’t be about picking a single number or making a tidy prediction.

A helpful forecast offers a framework. It looks at what could push the market up or down, and which parts of the index might change as the AI trend develops.

Here is that framework, based on the idea that 2026 could be when the market really expects results from artificial intelligence investments.

No more talking, it’s time to show and prove.

The Nasdaq-100 in 2026: From AI exposure to AI earnings power

The Nasdaq 100 is a modified market-cap weighted index, meaning the biggest companies still dominate, but there are rules and processes designed to prevent extreme overconcentration. Nasdaq uses a “modified market capitalization weighting scheme,” and limits a company’s weight to a maximum of 24%.

These rules are important because the growth of AI has pushed the index toward a small group of very large companies. Nasdaq has shown it will step in if this concentration gets too high.

For example, in July 2023, it carried out a special rebalance to address this issue and has said it may do so again if needed.

As we look toward 2026, the Nasdaq-100 will likely continue to rely on a handful of major companies. Still, investors may start choosing these companies for different reasons as AI moves from showing its capabilities to being used in real business applications.

This change usually happens in several stages:

Infrastructure stage: Companies invest heavily, face chip shortages, build more data centers, and train AI models.

Workflow stage: AI tools start being used in businesses, more companies adopt them, and productivity goes up.

Monetization stage: Companies gain more control over pricing, paid options become more common, ad performance gets better, and profit margins grow.

Competitive stage: Companies become less unique, and those that succeed are the ones with strong distribution, good integration, and solid financials.

2026 could be where phases 2 and 3 start to dominate the conversation for investors, especially because the bill for phase 1 is now enormous. Analysts and strategists are already flagging that continued equity gains into 2026 will depend not just on AI optimism, but on earnings delivery and proof that the spending is worthwhile.

In this setting, AI ROI connects the company’s story to its stock price.

Share trading with Mitrade 0 commission, low spreads. Enjoy limit and stop loss for every trade!

Get Started

How will markets judge AI ROI in 2026?

Many people see AI ROI as just one number, but public markets will want to see several types of evidence, especially in financial statements.

Revenue ROI: AI that helps companies create new sources of revenue

Some examples are:

Paid AI assistants and copilots

Increased cloud usage driven by AI workloads

Ad products that boost conversion rates and improve pricing

Enterprise software upgrades where AI is the main source of added value

Margin ROI: AI that improves operating leverage

AI can help increase margins when it:

Automates customer support and internal workflows.

Reduces software development time and boosts engineering speed.

Improves demand forecasting and makes supply chains more efficient.

Lowers fraud losses and increases underwriting accuracy.

Capital ROI: AI that earns back the data-center bill

The most difficult ROI to measure is also the one investors care about most: returns on invested capital after factoring in capital expenses. If depreciation rises and competition increases, the key question is whether these investments create lasting cash flow or simply help companies keep up.

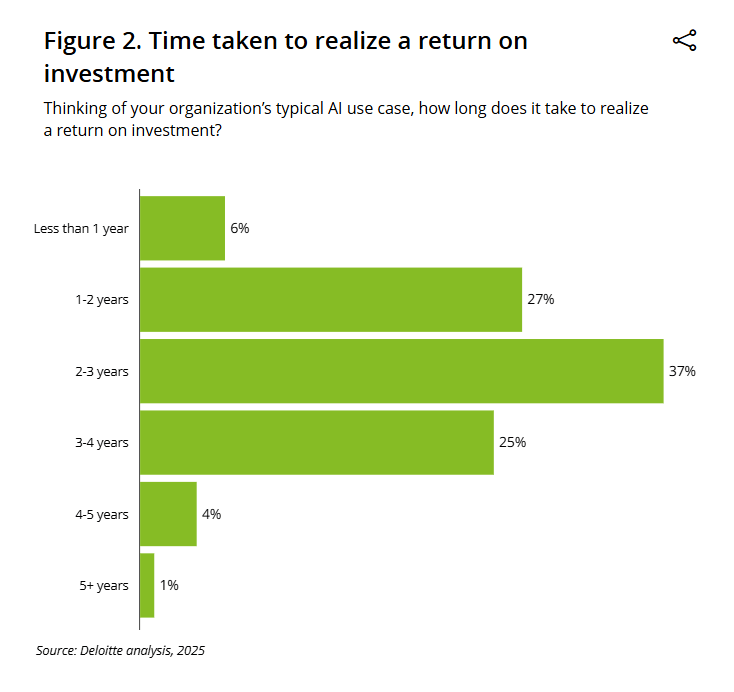

By 2026, investors may become more selective. Surveys show that while many organizations are adopting AI, measurable ROI is still inconsistent. Deloitte points out a gap between growing AI investment and “elusive returns,” and says leaders should focus on use cases and practices that deliver real value.

McKinsey also notes that moving from pilot projects to large-scale results is still a major challenge.

This gap will shape the market in 2026.

The takeaway? Companies that can clearly show ROI may be rewarded more, while those stuck in pilot projects and demos may see their valuations drop.

Where the Nasdaq-100 may show the clearest AI ROI in 2026

A useful way to forecast 2026 is to focus less on who has AI and more on who has monetization mechanisms already working.

Microsoft: AI revenue scaling inside an enterprise distribution machine

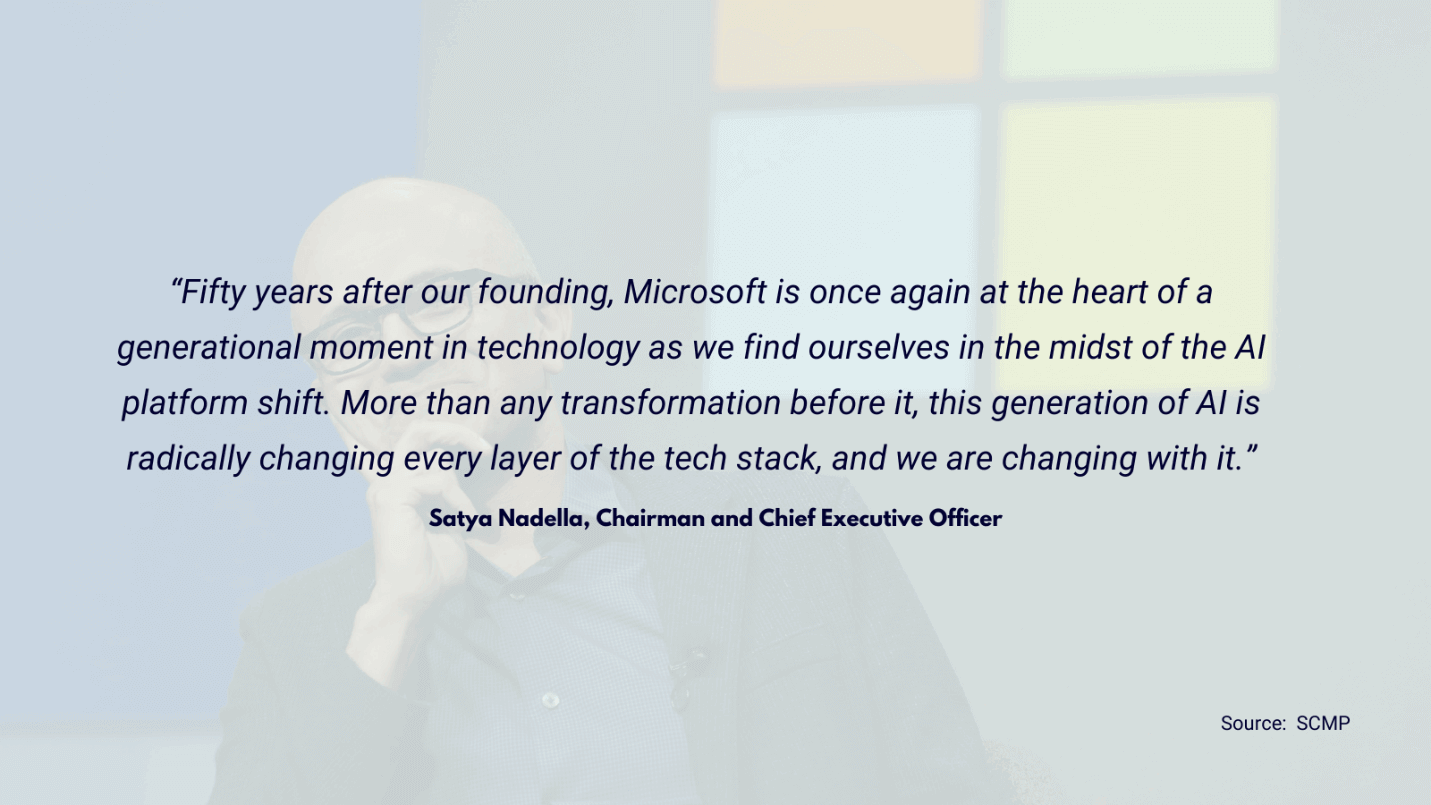

Microsoft has been explicit about AI monetization. In a FY2025 Q2 earnings press release, Satya Nadella said Microsoft’s “AI business has surpassed an annual revenue run rate of $13 billion,” up 175% year over year at the time.

And in its 2025 annual report, Microsoft reported that Azure surpassed $75 billion in annual revenue for the first time.

Why this matters for 2026: Microsoft’s AI ROI isn’t just “people like Copilot.” It’s visible in the company’s cloud growth and its ability to monetize AI across many surfaces.

By 2026, the conversation may move from asking if Copilot will be successful to focusing on how much it can boost margins, drive renewals, and keep customers loyal. If Microsoft keeps turning AI demand into steady revenue and controls capital spending, it could stay a key player in the Nasdaq-100, especially since the market values companies with strong cash flow.

NVIDIA: The real question isn’t ROI, but how long the growth will last

NVIDIA stands out in the AI industry because it provides the essential tools for growth. Unlike many other AI stories, NVIDIA has already shown strong returns through its revenue and profits. According to Reuters, NVIDIA’s data-center segment sales reached $51.2 billion in the quarter ending October 26, 2025, surpassing expectations.

Looking ahead to 2026, NVIDIA is less concerned with whether AI is real and more focused on other key questions:

How long will demand continue to exceed supply?

Will customers start to optimize their spending and slow down expansion?

Could the overall financing cycle for AI computing become unstable?

Will competition from custom chips and other alternatives, especially from China, put pressure on prices?

Alphabet: AI ROI through cloud acceleration and distribution

Alphabet’s case for AI returns now depends more on Google Cloud and business customers. Recent investor updates showed strong cloud results, with revenue up 34% to $15.2 billion in Q3 2025, helped by an “enterprise AI optimized stack.”

In a note from CEO Sundar Pichai, he highlighted AI as a main growth driver and mentioned a growing cloud backlog.

Alphabet is also investing in the infrastructure needed for AI, such as expanding energy resources and data center capacity.

By 2026, Alphabet’s AI success may depend less on how its models rank and more on whether its cloud and ad products show clear gains from using AI.

Amazon: AI ROI through cloud reacceleration and operating income durability

Amazon’s AI ROI shows up most clearly in AWS growth and profitability. In its Q3 2025 results, Amazon reported AWS segment sales increased 20% year-over-year to $33.0 billion.

Industry data shows that spending on cloud infrastructure is rising, partly because more companies are moving AI projects into full use. A report citing Omdia says global cloud spending hit $102.6 billion in Q3 2025, with strong growth for AWS, Azure, and Google Cloud.

Looking to 2026, Amazon may be evaluated on its ability to:

Maintain strong AWS growth while making big investments.

Protect its profit margins from price competition.

Prove that its AI services are bringing in new business instead of just replacing current workloads.

If AWS continues to generate strong cash flow as AI demand rises, Amazon could be a clear winner in AI returns, spending heavily on infrastructure while also making the most of it.

Meta: AI ROI is already visible in ad performance, not just chatbots

Meta’s story around AI is often misunderstood. Many investors focus on its consumer AI assistants and overlook its most important AI system: the advertising platform.

Meta has made it clear that it aims to automate more of its advertising with AI by the end of 2026.

The company’s earnings updates also highlight the adoption and performance gains from its Advantage+ suite. On the Q3 2025 earnings call, Meta mentioned that more advertisers are using generative AI features in Advantage+ tools.

Analysts and industry reports now often describe Meta’s ad AI as a major source of revenue, with some noting large ongoing earnings linked to its AI-powered ad systems.

If investors focus more on AI returns, Meta could be a standout winner because its returns are already real and not just based on future hopes:

Improved ad targeting.

Better creative optimization.

Higher conversion rates.

The ability to automate at scale.

The downside is that Meta expects much higher costs for AI infrastructure and talent, which could affect short-term investor sentiment even if long-term returns stay strong.

AI ROI goes beyond just revenue

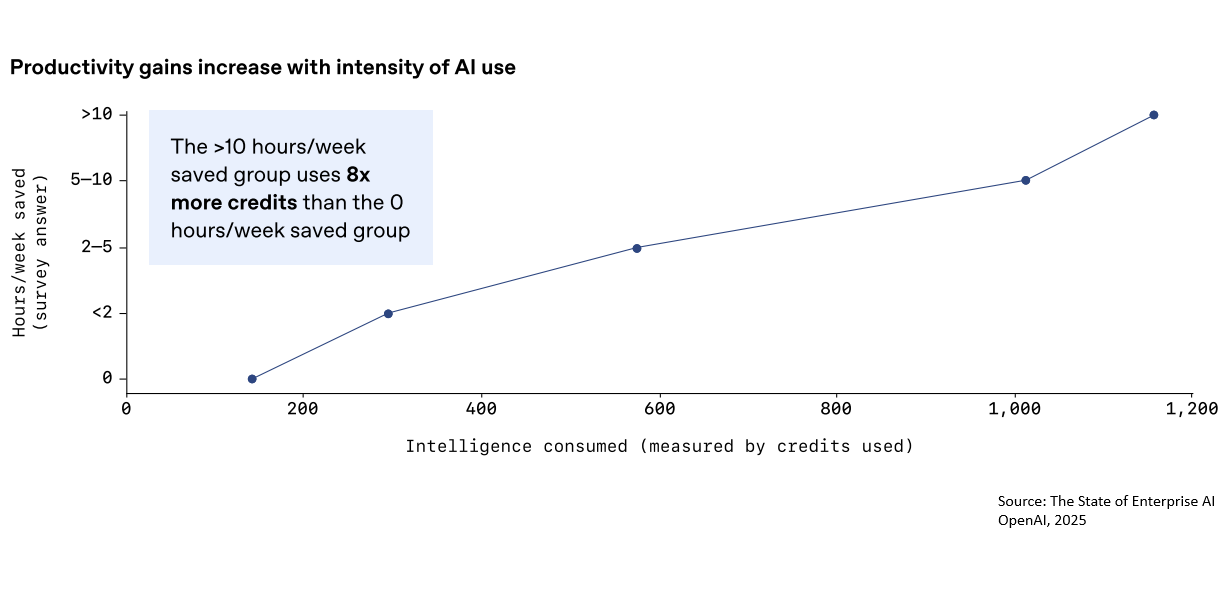

AI ROI does not always appear right away as a new source of revenue. Often, the first benefits are time saved and faster work cycles. When these gains are spread across thousands of employees, they can lead to higher earnings.

For example, OpenAI’s enterprise report says users save 40 to 60 minutes daily, and it includes case studies showing links to revenue growth, better customer experience, and quicker product cycles.

Concentration risk: why it matters, and how it could ease in 2026

As already mentioned, the Nasdaq-100 is top-heavy. That top-heaviness creates a simple reality:

If a few mega-caps stall, the index can underperform even if many constituents do fine.

Why breadth could improve in 2026

If 2026 becomes the year of AI ROI, market breadth can widen in two main ways:

Second-order AI beneficiaries start showing earnings leverage.

Not every winner will be a chip designer. Many winners will be software platforms, cybersecurity firms, workflow automation companies, and vertical SaaS names that use AI to raise margins or improve retention.The market re-prices AI capex differently across companies.

Some firms will show that high capex leads to high-margin recurring revenue. Others may show that high capex simply maintains parity. That separation can diversify leadership.

A realistic expectation

Even if breadth improves, the Nasdaq-100 won’t suddenly become a collection of equal-weighted stocks. The largest companies will still be the biggest. Reducing concentration risk does not mean the top companies have to get smaller. It just means more companies need to make a real impact.

In 2026, a healthier Nasdaq-100 could have the largest companies growing at a steady pace, while a wider range of companies see even stronger gains.

Put another way, the index would rely less on a handful of stocks for total return.

Big-picture factors: interest rates, company earnings, and careful valuation

Any prediction for the Nasdaq-100 in 2026 that only looks at AI overlooks a bigger issue: interest rates and the earnings cycle.

The Nasdaq-100 is naturally focused on long-term growth, with much of its value tied to future cash flows. This makes it sensitive to:

Changes in inflation.

Shifts in interest rates.

How the bond market views real yields.

If investors expect more interest rate cuts, the Nasdaq-100 could benefit from higher valuations and easier financial conditions. But if inflation picks up again or yields go up, the index could lose value quickly.

Possible outcomes for the Nasdaq-100 in 2026

Forecasting is not about guessing the exact result. It is about outlining the most likely scenarios.

Scenario A: AI ROI bull case (breadth widens)

What happens:

Companies are shifting from just testing AI to using it in many areas of their business.

AI tools are helping companies increase their profits and work more efficiently.

Cloud services continue to expand, and new advertising tools are helping companies raise their sales.

A wider range of companies, not only the biggest ones, are seeing their earnings go up.

Market result:

The Nasdaq-100 shows strong gains.

A wider range of companies are now driving returns.

Concentration risk goes down as more stocks help boost performance.

Scenario B: A reality check for ROI, with only some winners and a more volatile index

What happens:

Companies keep adopting AI, but not all are making money from it equally.

Some companies are seeing strong returns, but others are dealing with higher costs and not much gain.

The difference between high and low company valuations is getting bigger.

Market result:

The Nasdaq-100 keeps rising, but there are more ups and downs along the way.

Choosing the right stocks matters more than before.

The largest companies could start to lag, while some mid-sized and large firms perform better.

Scenario C: Capex hangover (downside risk)

What happens:

Spending on AI infrastructure slows, or supply becomes excessive.

Increased competition drives down prices for cloud services and AI models.

Some top companies have their earnings forecasts reduced.

High interest rates continue, putting pressure on stocks that depend on future growth.

Market result:

The Nasdaq-100 may experience losses or minimal gains.

Concentration becomes a headwind.

Companies with steady growth and strong cash flow outperform those focused on riskier AI ventures.

The Nasdaq-100’s next leg is less about who can say “AI” and more about who can prove return on investment tied to AI.

If that proof broadens across more stocks, through earnings growth, margin leverage, and measurable productivity gains, market breadth could widen, and concentration risk could ease.

However, if the proof remains narrow, the Nasdaq-100 may still rise, but with greater volatility and more dispersion beneath the surface.

Risk-Free Demo Account Trade Stock CFDs at Mitrade. 0 commission, low spreads. Enjoy limit and stop loss for every trade!

Risk-Free Demo Account Trade Stock CFDs at Mitrade. 0 commission, low spreads. Enjoy limit and stop loss for every trade!* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.