If you’ve ever wanted to trade gold without buying physical bars or coins, Gold CFDs (Contracts for Difference) might be exactly what you’re looking for. They’re flexible, beginner-friendly, and let you make a profit whether gold prices rise or fall.

In this guide, you’ll discover what Gold CFDs are, how they work, the best times to trade, the costs to watch out for, and a step-by-step walkthrough using Mitrade. Now, let’s get into the details.

What Is a Gold CFD?

A Gold CFD (Contract for Difference) is a trading instrument that lets you speculate on the price of gold without owning any physical precious metal. That means you can trade gold like everyone else, but you don’t need a bullion stash to trade Gold CFDs.

It’s simply like entering an agreement with your broker to exchange the difference in gold’s price between the moment you open the trade and when you close it.

If gold moves in your favour, you profit, but if it moves against you, that’s a loss. However, you don’t need to bother about raising funds to buy real gold; you can trade in both directions, and you may even get leverage to trade bigger, depending on the broker you choose.

The best part is that all your Gold CFD trades happen online, so you only need your phone, a broker account, and the internet.

Why Do So Many Traders Choose Gold CFDs?

From trading communities online to even your crypto friends around, you’ve probably seen how popular gold is among traders. Here’s why many of them choose Gold CFDs:

They’re simple to get into: No serious entry barrier because you only need a phone or a laptop.

No minimum amount of physical gold needed: Unlike trading real gold, you can trade with small amounts by investing in tiny contract sizes.

You can hedge your portfolio: If you already trade currencies or stocks, you are exposed to high risks. Gold CFDs can act as a hedge against high volatility.

It’s one of the most liquid markets: You can buy and sell the CFD in seconds because of its deep liquidity.

And the biggest reason for many traders is the possibility of profiting whether gold prices rise or fall. This isn’t the situation when trading physical gold.

The Cost of Gold CFD

When speaking of what a Gold CFD costs, it goes beyond the quantity of the derivative you are purchasing. It also includes what you pay, even if you don’t realise it. That’s because CFDs may feel simple on the surface, but unknown costs can eat into your capital or profits.

Before opening your first trade, here are the costs to consider:

The Spread or Trading Fee

The spread is the difference between the buy and sell prices of digital assets, such as CFDs, on an online brokerage. You pay it automatically whenever you open a trade because it’s already added to the overall cost of completing the transaction.

Think of it as the toll fee you pay to the brokerage (a gate) that lets you enter the market to find financial instruments.

For example, if the buy price of an asset is $2300.50 and the sell price is $2300.20, the spread is 0.30, meaning you start your trade slightly at a loss, so the trade must move in your favour for you to profit.

This is why it’s good to choose a brokerage like Mitrade with tight spreads and zero commission fees to get the best value for your trades.

Overnight Fees

Unlike the cryptocurrency market, which runs 24/7, you can only trade CFDs 24/5. That means the trading window is open for five days a week, but if you hold your position past market closing times on these weekdays, your broker may charge you an overnight financing fee.

For example, Mitrade charges overnight funding when traders hold positions beyond 22:00 GMT (winter). If you’re planning to day trade gold, you can avoid such extra costs by closing your positions before the end of the trading day. If you're a swing trader, you’ll need to factor this cost into your plans.

Margin Requirements

Margin is the amount of money you must deposit to open a leveraged position. This kind of position lets you increase your lot with extra funds, similar to a loan from your broker, and you pay a margin (interest on the loan).

For every leverage trade, there’s a margin to consider. High leverage attracts a small margin requirement, while low leverage comes with a bigger margin requirement.

Broker Fees

Most CFD brokers don’t charge direct commissions for Gold CFDs, but spreads, swaps, and other fees still apply. These include:

Inactivity fee

Currency conversion

Deposit or withdrawal fees

Always check your broker’s cost page before trading to be sure you have the accurate fee details.

What Is the Best Time to Trade Gold CFDs?

Gold doesn’t move the same way as some digital assets do all day. Some hours are quiet, while others are full of activities. That means timing your trading activities with gold’s most active periods is crucial.

The London–New York Overlap

When London and New York trade at the same time, that’s your cue to trade gold. This is typically around 1:00 PM to 5:00 PM GMT (or 8 AM to 12 PM EST). Over 37% of the daily volume is traded during this prime period, making the asset extremely volatile because big whales are active, volumes are high, and spreads are tighter.

These factors make it perfect for traders who like to capitalise on its price movement. If you only trade gold for a few hours per day, this is often the best window to enter the market.

The First Hours of the US Session

Gold loves reacting to US-related news, which typically trends during the early U.S. session and is accompanied by intense volatility. These reports include:

Inflation data

Interest rate announcements, like cuts from the Federal Reserve

Employment reports

President Trump’s speeches

Some traders still buy and sell Gold CFDs during the “Dead Hours,” when the markets are rather quiet. These include the late Asian session and mid-day market lulls. However, these are statistically not the best times to trade, as the market feels slow.

How to Start Trading Gold CFDs?

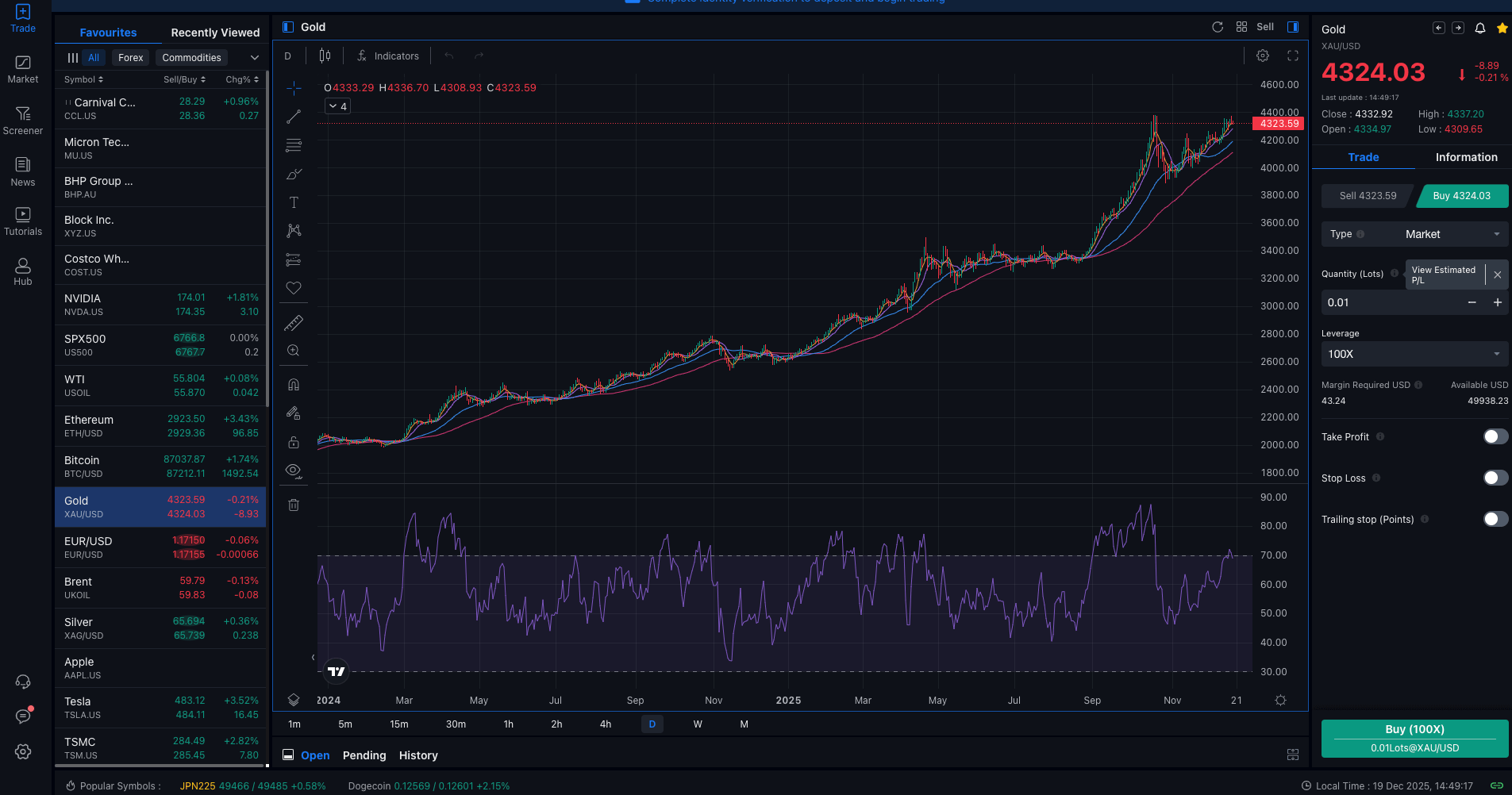

One of the best places to trade gold is on Mitrade. The broker charges no commissions and offers tight spreads. You can also enjoy low minimums as low as 0.01 lots. Get trading on Mitrade using the following steps:

Step 1: Create a Mitrade Account

Visit the Mitrade site or download the mobile app and click “Trade Now.” Provide your email address or choose the alternative sign-up options like using your Google, Facebook, or Apple account.

Afterwards, create a new password and verify your email to complete the registration process.

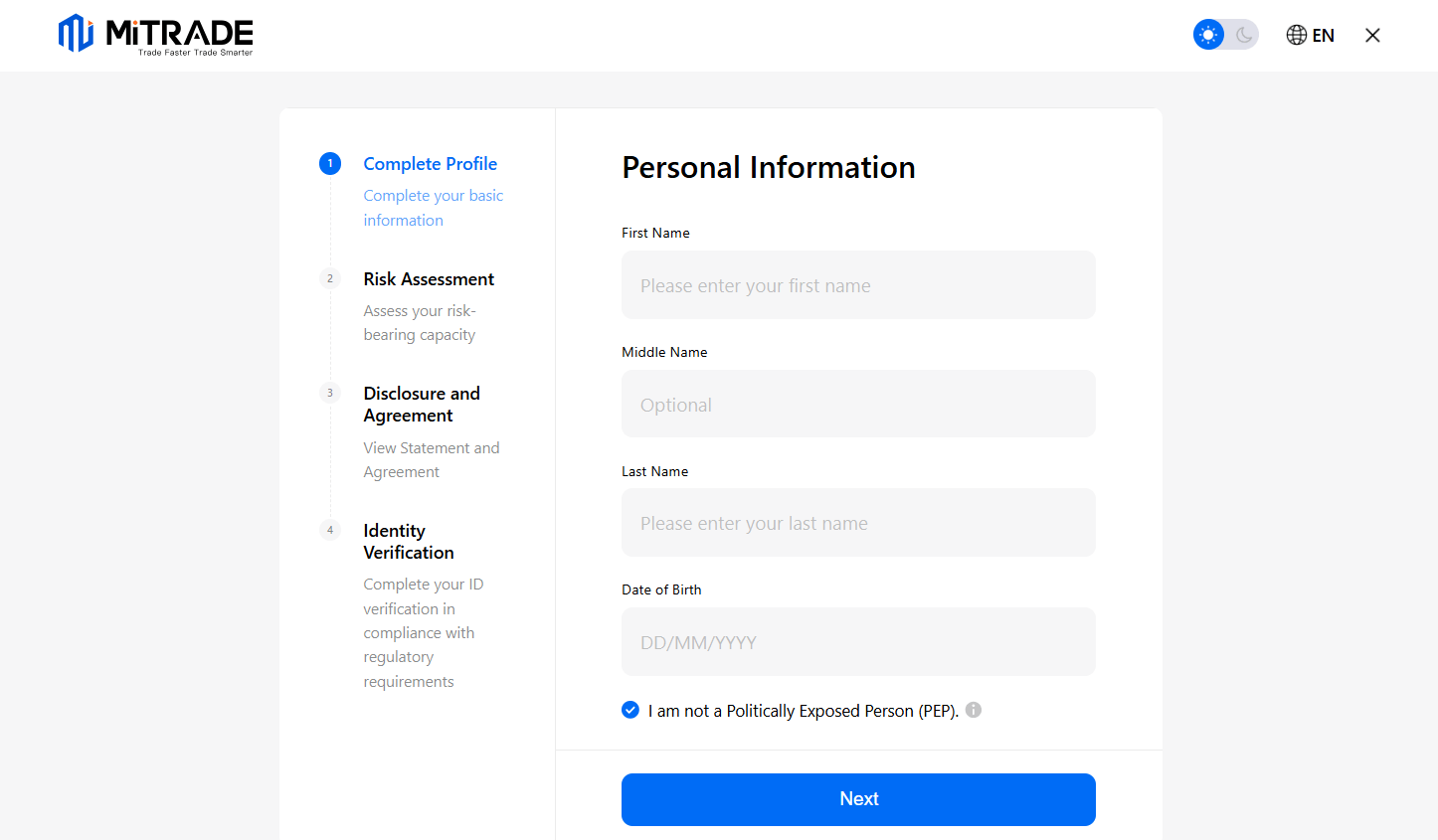

Step 2: Complete Identity Verification

Next up is the broker’s KYC process. Enter the required information, including your country of residence and ID issuing country.

Complete the verification by providing other details, including your full name, date of birth, risk assessment questions, and submit your proof of identity.

Tip: While your ID is under review, you can check out the demo trading option on Mitrae to get familiar with the platform and build a trading plan.

Step 3: Deposit Funds

After ID verification is completed, deposit funds using your preferred payment method. Options include credit/debit cards, bank transfers, e-wallets, Apple Pay, and Google Pay. The minimum deposit ranges from $20 to $50, depending on your country of residence.

Step 4: Trade Gold CFD

Once you have your trading strategy intact and are ready to dive in, switch to live trading mode and open your first CFD trade.

Once your trade is live, ensure you employ risk management measures like constant market monitoring, using stop-loss, and keeping your position sizes reasonable.

Final Thoughts: Is Gold CFD Trading Right for You?

Australia’s gold exports have soared by double digits. However, not every Aussie can buy and sell physical gold. For many traders, trading gold CFDs gives them exposure to the global derivative markets, where they can potentially profit from their activities.

With tools like leverage, margin trading, and the ability to go long or short, CFDs can deliver opportunities for profit in both rising and falling markets. Brokers like Mitrade make this accessible through a beginner-friendly platform, low minimum deposit, and a zero-commission fee structure.

However, trading CFDs is risky and requires a solid plan and skill. Ensure you have the best risk management strategies in place to minimise losses and make the most of your experience when you start trading Gold CFDs on Mitrade.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.