Crypto Today: Bitcoin, Ethereum crumble under selling pressure, XRP hovers around $0.55

- Bitcoin slips under $57,000 following $287.8 million in outflows from BTC ETFs on September 3.

- Ethereum erases 1.20% of its value on the day, dips to $2,395 on Wednesday.

- XRP loses key support and corrects to $0.5326, new monthly low in September.

Bitcoin, Ethereum, XRP updates

- Bitcoin trades at $56,607 at the time of writing. Bitcoin Spot ETFs noted $287.8 million in outflows amidst broad market sell-off. Shares of NVIDIA erased 9.5% of their value on Tuesday and noted the largest single-day decline in market value for a single stock. Trader sentiment has changed, and market participants have turned risk-averse about emerging technologies, per a Reuter’s report.

- Ethereum trades at $2,395 on Wednesday. The altcoin erased 1.20% of its value on the day.

- XRP slipped to a new monthly low of $0.5326 as capital leaves the crypto market.

Chart of the day

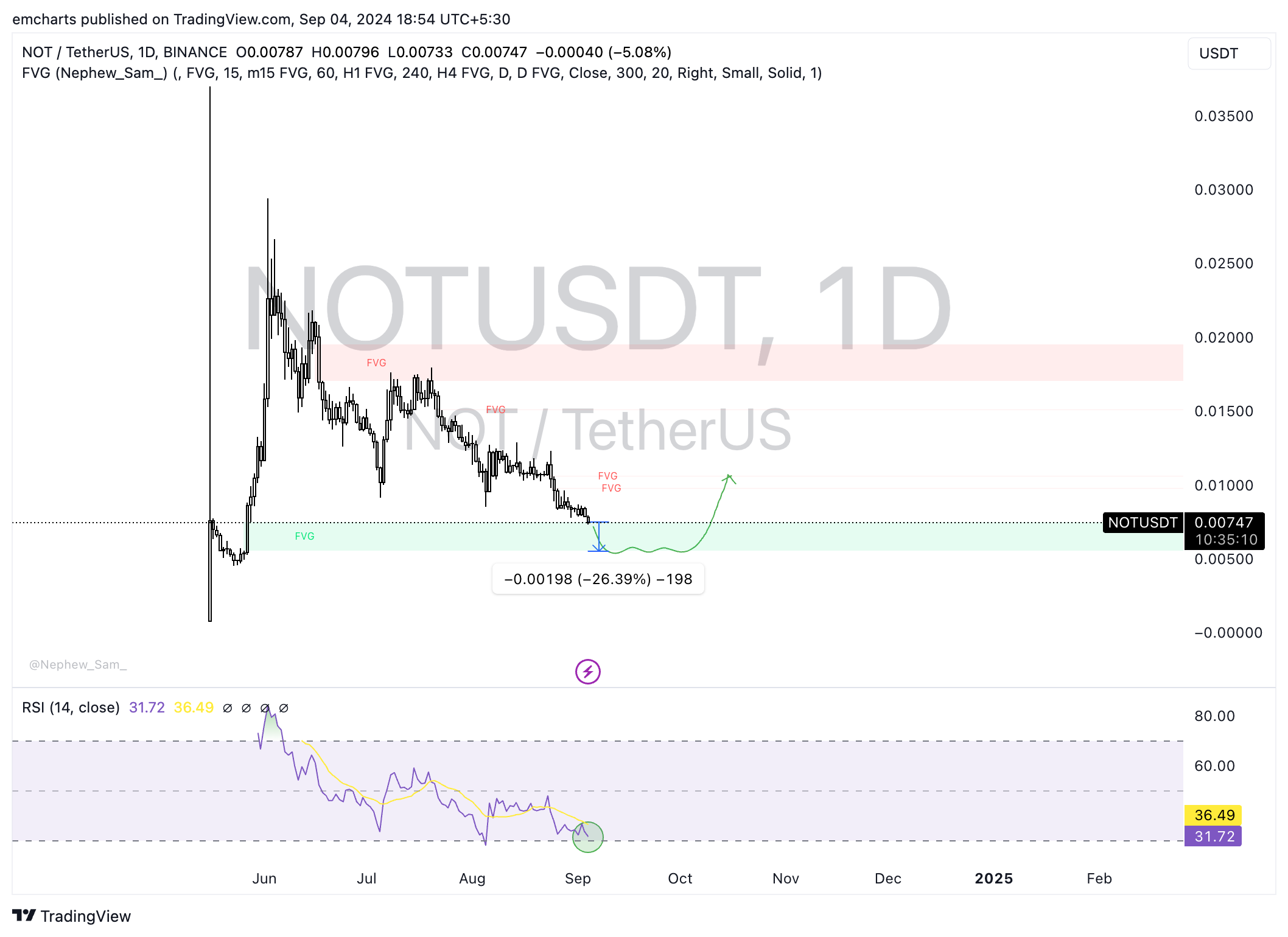

NOT/USDT daily chart

Notcoin (NOT) erased 5% of its value on Wednesday. The token could extend losses by 26% and sweep liquidity at the lower boundary of the Fair Value Gap (FVG) between $0.00554 and $0.00750.

The Relative Strength Index (RSI) reads 31.72, close to the oversold zone. Sidelined buyers can enter a position in NOT as the asset dips closer to the oversold zone on the NOT/USDT daily chart.

NOT could begin its recovery once the imbalance is filled and begin a recovery toward the Fair Value Gap (FVG) between $0.01060 and $0.01061.

Market updates

- The FBI made a public service announcement warning market participants of North Korean actors attempting malicious cyber activities against companies associated with cryptocurrency ETFs.

The FBI has put out a statement/warning that "North Korean actors may attempt malicious cyber activities against companies associated with cryptocurrency ETFs." The notice includes what to watch for and what you can do about it. h/t @Cointelegraph Link: https://t.co/aeyrg9ElWh pic.twitter.com/8OR8iOXhnb

— Eric Balchunas (@EricBalchunas) September 4, 2024

- Data from Token Terminal shows that fees on the Ethereum mainnet dropped by over 30 times in the last six months.

Fees on Ethereum mainnet fell over 30x in the last 6 months

— Milk Road (@MilkRoadDaily) September 4, 2024

So is $ETH dead? pic.twitter.com/1Cyj2RywE9

- A cybersecurity firm Gen Digital reported a significant increase in activity by crypto scammers leveraging AI deepfake videos in the second quarter of 2024. Colin Wu reports that the company tracked a scam group called "CryptoCore" that defrauded people by forging videos of influencers in crypto and technology such as Elon Musk, Vitalik Buterin and Larry Fink. Scammers used AI-generated audio or mixed with unauthorized content to spread false investment information.

网络安全公司 Gen Digital 报告称,2024 年第二季度加密诈骗者利用 AI 深度伪造视频的活动显著增加。该公司追踪了名为“CryptoCore”的诈骗组织,该组织通过伪造知名人物如 Elon Musk、Vitalik Buterin 和 Larry Fink 的视频进行诈骗,并利用 AI…

— 吴说区块链 (@wublockchain12) September 4, 2024

Industry updates

- Binance announced plans to launch liquid-staking token BNSOL in September, the token is said to make major changes to staking on centralized exchanges.

BNSOL

— Binance (@binance) August 29, 2024

- Former Mt.Gox CEO is set to launch a new crypto exchange later this month, per a report from the Block.

- Japan’s FSA proposes aligning taxes on crypto with traditional financial assets. Crypto accountants TokenTax state that crypto profits in Japan are currently taxed as miscellaneous income between 15% and 55%. This could change to a flat 20% if crypto reforms are accepted by the regulator.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.