Forex Today: Investors await comments from Fed officials

- Fed Chair Candidate: What Would a Hassett Nomination Mean for U.S. Stocks?

- After the Crypto Crash, Is an Altcoin Season Looming Post-Liquidation?

- The 2026 Fed Consensus Debate: Not Hassett, It’s About Whether Powell Stays or Goes

- AUD/USD holds steady below 0.6550 as traders await Australian GDP release

- AUD/USD sticks to gains above 0.6600, highest since late October after Aussie trade data

- AUD/USD holds steady above 0.6600; remains close to two-month high ahead of US PCE data

Here is what you need to know on Wednesday, August 6:

The trading action in financial markets remains subdued on Wednesday as investors' search for the next catalyst continues. Eurostat will release Retail Sales data for June in the European session. Later in the day, the US Treasury will hold a 10-year note auction. More importantly, several Federal Reserve (Fed) policymakers will be delivering speeches.

The US Dollar (USD) failed to gather recovery momentum on Tuesday and the USD Index closed the day virtually unchanged. The data published by the Institute for Supply Management (ISM) showed that the Services Purchasing Managers Index (PMI) declined to 50.1 in July from 50.8 in June. The Employment Index of the PMI survey dropped to 46.4 from 47.2 in the same period, while the Prices Paid Index, the inflation component, rose to 69.9 from 67.5. Early Wednesday, the USD Index extends its sideways grind below 99.00 and US stock index futures gain between 0.3% and 0.4%.

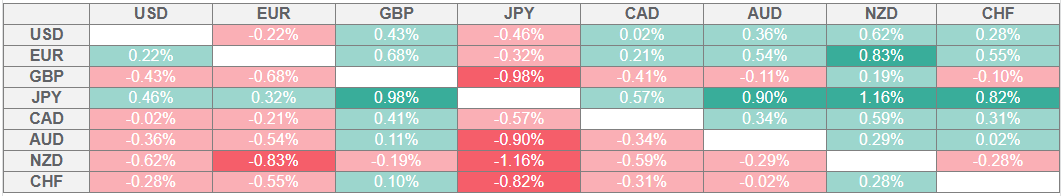

US Dollar PRICE Last 7 days

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

In an interview with CBNC on Tuesday, US President Donald Trump said they were getting very close to making a deal with China. Trump also noted that US Treasury Secretary Scott Bessent will not be considered as Fed Chair Jerome Powell's replacement because he wants to remain in his current position.

The data from Germany showed on Wednesday that Factory Orders declined by 1% on a monthly basis in June. This reading followed the 1.4% contraction recorded in May and came in weaker than the market expectation for an increase of 1%. EUR/USD continues to move up and down in a very tight channel below 1.1600 after this data.

The Unemployment Rate in New Zealand edged higher to 5.2% in the second quarter from 5.1% in the first quarter, Statistics New Zealand reported. This print came in better than the market expectation of 5.3%. After closing marginally lower on Tuesday, NZD/USD holds its ground early Wednesday and trades in positive territory above 0.5900.

GBP/USD continues to tread water slightly below 1.3300 for the third consecutive day on Wednesday. The Bank of England (BoE) will announce monetary policy decisions on Thursday.

USD/JPY stays relatively quiet in the European session on Wednesday and fluctuates above 147.50 after posting small gains on Tuesday.

Gold struggles to preserve its bullish momentum and trades in the red below $3,370 midweek.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.