TORN price rallies 170% as Ethereum's Vitalik Buterin urges Trump to pardon Tornado Cash founders

- TORN, the native token of Tornado Cash, crossed the $20 mark on Friday, posting 170% gains since Trump’s inauguration.

- Ethereum co-founder Vitalik Buterin has called for the release of Tornado Cash co-founders after Trump’s recent pardon of Ross Ulbricht.

- Recent events have boosted demand for privacy-focused coins with Monero, TRON and DASH attracting significant search interest on Coingecko.

TornadoCash (TORN) price hit $20 on Friday, having increased by nearly 170% since Trump’s inauguration. TORN price appears poised for more near-term gains as Ethereum’s Vitalik Buterin issued statements calling for the release of the mixer protocol’s co-founders.

Tornadocash posts 170% gains in first week of Trump’s presidency

TornadoCash (TORN) has emerged as one of the biggest beneficiaries of Trump’s presidency as multiple bullish catalysts propelled its price to new heights this week.

Two key US regulatory moves have significantly influenced TORN's remarkable upward trajectory.

First, in a landmark decision, a US court reversed sanctions placed on TornadoCash, initially imposed under the Biden administration due to allegations that North Korean hackers used the cryptocurrency mixer for money laundering. This legal victory has revitalized market confidence in the protocol.

Adding further momentum, President Trump issued an executive order pardoning Ross Ulbricht, founder of the notorious Silk Road dark web marketplace. This unprecedented move has reignited enthusiasm among privacy-focused crypto advocates, boosting TornadoCash’s appeal.

TornadoCash (TORN) Price Action

TornadoCash (TORN) Price Action

These developments have driven TORN’s price action significantly. Since Trump's inauguration, TORN has surged 167%, rallying from $7.50 on Monday to $20 by Friday’s close.

This incredible rally outpaces other major gainers like Solana, Chainlink and Tron (TRX), which posted solid but comparatively modest double-digit gains over the same period.

Ethereum co-founder calls for release of TornadoCash founders

TornadoCash’s co-founders, Roman Storm and Alexey Pertsev, were detained in 2022 under accusations of enabling money laundering through their decentralized protocol.

US authorities charged them with facilitating the laundering of over $7 billion in cryptocurrency, including funds allegedly tied to North Korean hackers.

The arrests sparked heated debates across the crypto community with enthusiasts and privacy advocates criticizing the detentions as an overreach that could stifle innovation.

Vitalik Buterin calls for TornadoCash Co-Founder’s release, January 23, 2025, Source: X.com/VitalikButerin

Vitalik Buterin calls for TornadoCash Co-Founder’s release, January 23, 2025, Source: X.com/VitalikButerin

Vitalik Buterin, Ethereum’s co-founder, recently reignited the conversation, calling for the release of Storm and Pertsev.

In a widely shared social media post, Buterin declared, "No man left behind," while emphasizing the need to free these developers, who he believes were unfairly targeted.

His call to action has intensified global scrutiny of the legal treatment of TornadoCash’s creators and energized privacy coin markets.

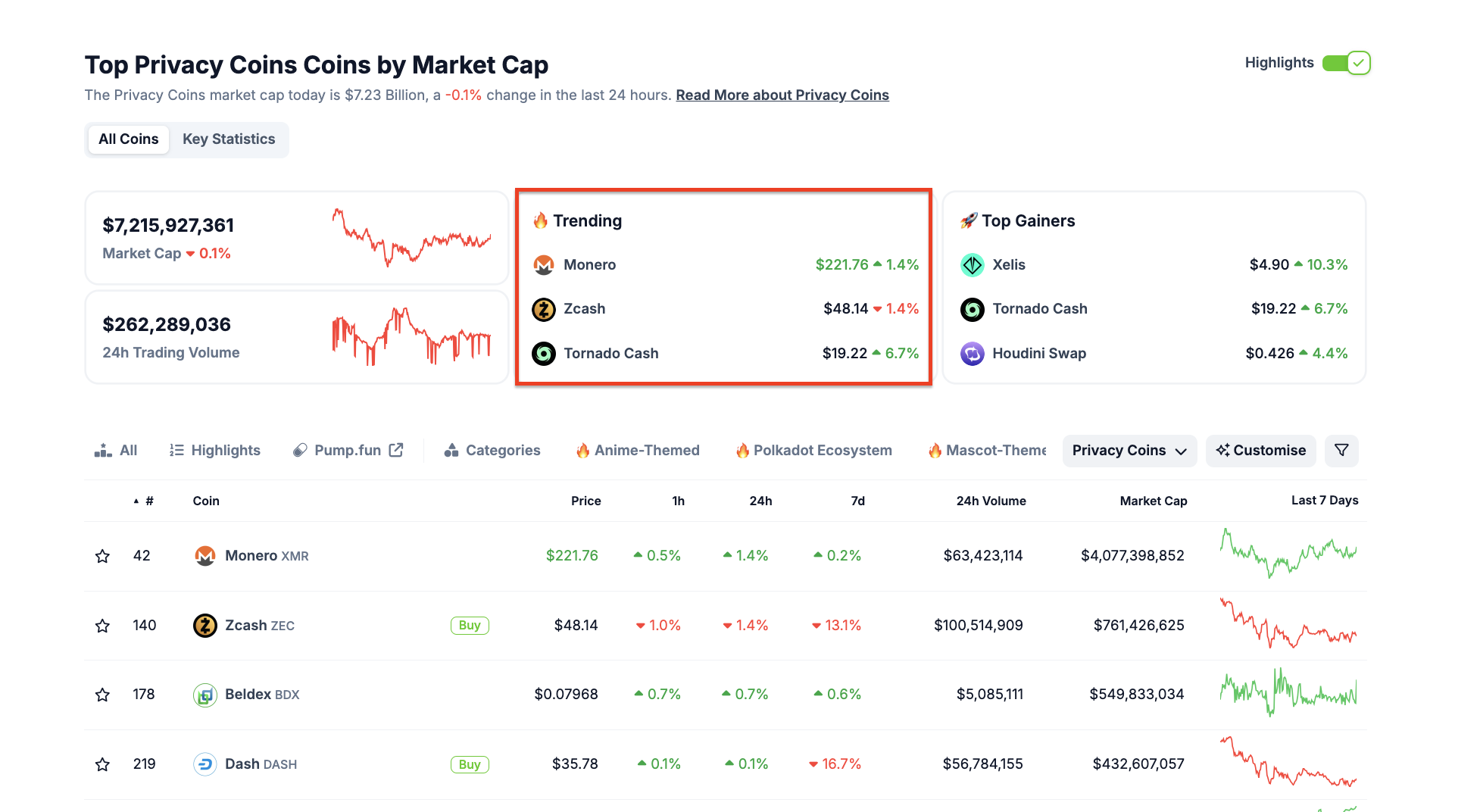

Privacy Coins Sector Performance, January 24 2025 | Source: Coingecko

Privacy Coins Sector Performance, January 24 2025 | Source: Coingecko

Recent events, including Buterin’s statements, have boosted demand for privacy-focused cryptocurrencies like Monero (XMR), TRON and ZCASH.

Coingecko data shows a sharp rise in search interest for these assets within the last 24 hours, underscoring growing investor enthusiasm for privacy solutions.

The increasing attention on TornadoCash suggests that TORN is gaining traction among new market entrants.

Should its co-founders be released, the expanding customer base could stabilize TORN’s price, insulating it from sharp downturns when market euphoria subsides.

TORN Price Forecast: Multi-day closes above $20 to confirm next leg-up?

TornadoCash (TORN) continues to show remarkable momentum, rising 169.69% over five days to trade near $20.13. Despite the rally, the chart highlights $21 as a critical resistance level for the next bullish confirmation. A multi-day close above this threshold could ignite a further rally toward $26.

The technical chart shows a decisive breakout above the 50-day (red) and 200-day (blue) moving averages, signaling bullish strength. Volume surged to 626,770, reflecting heightened market interest. The Parabolic SAR (blue dots) remains below the candles, reinforcing the uptrend.

TornadoCash (TORN) Price Forecast

TornadoCash (TORN) Price Forecast

Sustained buying at current levels could push TORN above $21, paving the way for price targets at $26 and $30 that align with Fibonacci extensions.

However, failure to break and hold above $21 may trigger profit-taking as overbought conditions loom after a 169% surge. Volume is tapering off, hinting at a possible demand slowdown. If prices dip below the $18 support zone, TORN could retrace to $14, near the 200-day Simple Moving Average (SMA), undermining recent bullish sentiment.

The rising interest in privacy coins supports the bullish narrative, but strategic traders hold out for a confirmation breakout of $21 before entering fresh positions.