Crypto Liquidations Cross $300 Million As Bitcoin Reclaims $102,000

Data shows the cryptocurrency derivatives sector has seen a large amount of liquidations in the past day as Bitcoin and others have enjoyed a rally.

Both Crypto Long & Short Liquidations Have Been High Today

According to data from CoinGlass, a significant amount of liquidations have piled up on the derivatives side of the cryptocurrency sector following the market volatility.

“Liquidation” here refers to the forceful closure that any open contract undergoes after it has amassed losses of a certain degree (the exact percentage of which may differ between platforms).

Below is a table that shows the data for the liquidations that have occurred in the cryptocurrency sector during the last 24 hours.

As is visible, liquidations have totaled at almost $306 million in this window. Out of these, $154 million of the contracts involved were long positions, while $151 million were short ones.

This remarkably even split suggests no side of the market was affected more than the other, which is interesting considering the context that Bitcoin and others coins have seen their prices rise during the past day.

It would appear that the traders have been eager to place bullish positions with a high amount of leverage attached in this recovery rally, which is leading to any pullbacks on the way up catching them out and adding to the long liquidations counter.

In terms of the contribution to the derivatives flush by the individual symbols, Bitcoin has once again come out on top with just under $98 million in liquidations.

Ethereum (ETH) and XRP (XRP) have rounded out the top three with $37 million and $25 million in liquidations, respectively. This top three also happens to be the top three coins in the market cap list.

Number four in liquidations doesn’t match up against the market cap ranking, however, as it’s in fact Dogecoin (DOGE) that has followed XRP with almost $16 million in contracts. The high contribution to the squeeze by the memecoin could be down to the fact that its popularity means speculators get driven to it more than larger altcoins like Solana (SOL).

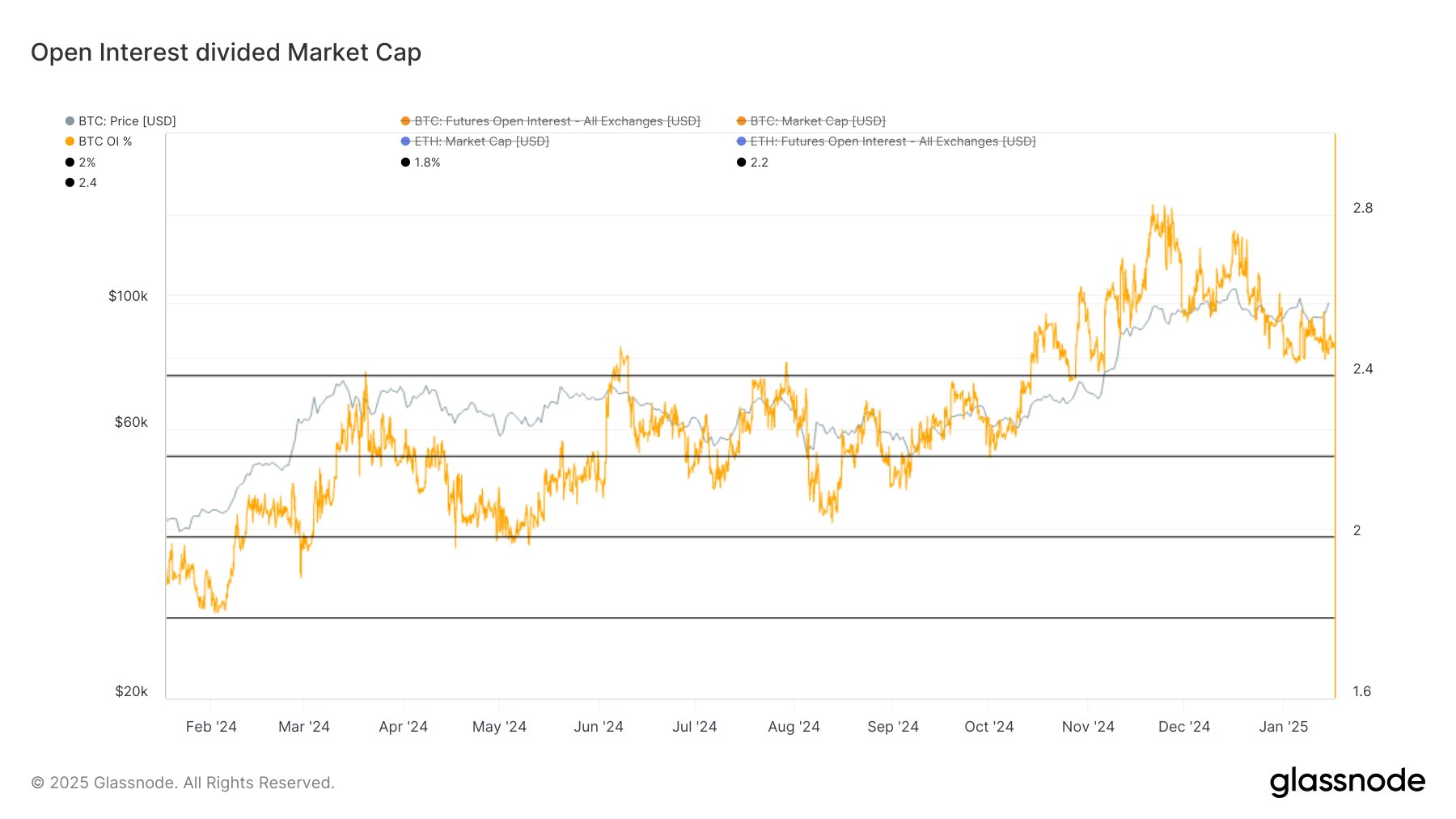

In some other news, the Bitcoin Open Interest has gone down relative to the market cap recently, as analyst James Van Straten has pointed out in an X post.

The “Open Interest” refers to a measure of the total amount of Bitcoin-related derivatives positions that are currently open on all centralized exchanges. A high amount of speculative activity generally leads to volatility for the asset, so this metric’s ratio with the market cap should ideally stay low.

From the graph, it’s apparent that the ratio shot up to a high of 2.8% in November, but its value as since cooled off to about 2.4%, a healthier level.

Bitcoin Price

Bitcoin’s latest recovery push has seen a continuation during the past day as its price has reached the $104,000 mark.