Pinduoduo Earnings Incoming: Morgan Stanley Sees Long-Term Profit Potential

- 270,000 People Instantly Liquidated. Crypto Earthquake, Just Because This Person Might Take Over the Fed?

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Dollar Slumps to Four-Year Low, Trump Still Says ‘Dollar Is Doing Great’?

- Bitcoin No Longer Digital Gold? Gold and Silver Token Market Cap Hits Record $6 Billion

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP deepen sell-off as bears take control of momentum

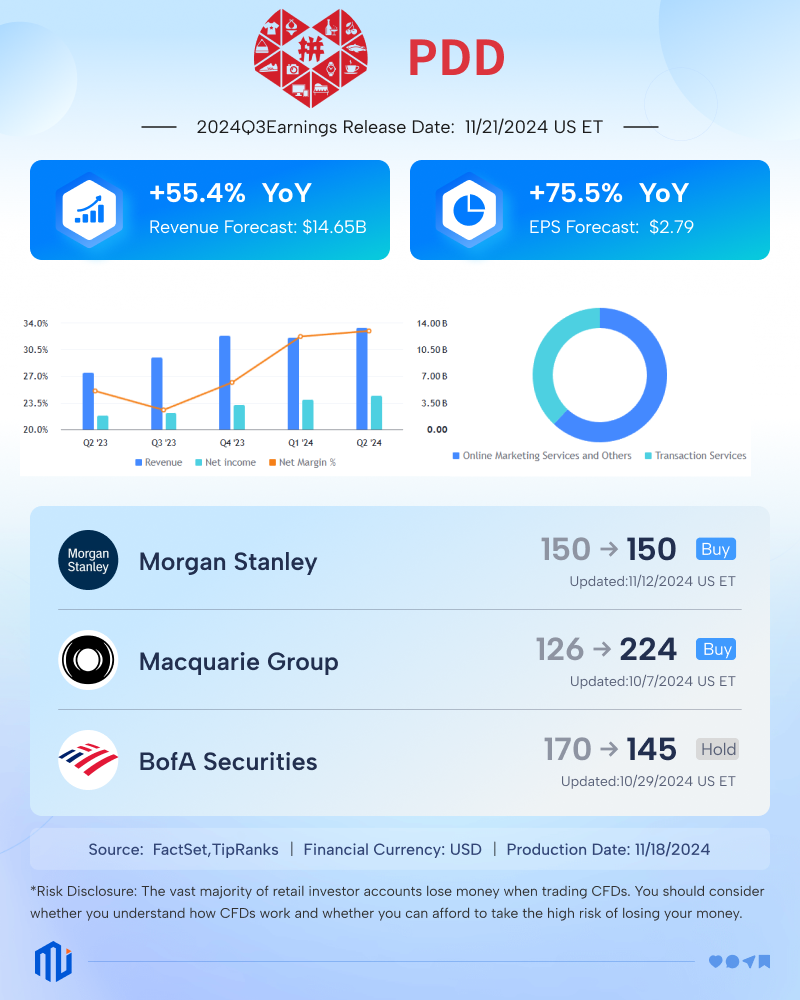

Insights – On November 21, Chinese e-commerce giant Pinduoduo (PDD) will release its Q3 2024 earnings.

The market widely expects Q3 revenue to reach $14.65 billion, representing a 55.4% year-over-year increase. Earnings per share (EPS) are forecasted at $2.79, up 75.5% year-over-year.

Last quarter, Pinduoduo reported revenue of ¥97.06 billion (approximately $11.34 billion), falling short of market expectations. Management warned that due to intense competition, revenue growth may slow, and profits could fluctuate in the coming quarters, with rebounds possible, but the long-term trend of declining profitability is inevitable.

Management also indicated that they are prepared to sacrifice short-term profits, with no plans for dividends or share buybacks in the coming years.

Following the disappointing earnings report, Pinduoduo’s stock plunged nearly 30%.

Source: TradingView; Pinduoduo (PDD) Stock Performance

Mixed Institutional Opinions

The latest 13F filings reveal growing divergence in institutional views on Pinduoduo.

Hillhouse Capital reduced its Pinduoduo holdings by 46% in Q3, almost halving its position and dropping Pinduoduo from its top holding to the third-largest. Similarly, Greenwoods Asset Management trimmed its stake by 13%, although Pinduoduo remains its largest holding.

In contrast, hedge fund titan David Tepper’s Appaloosa fund more than doubled its Pinduoduo position. Duan Yongping’s H&H fund also significantly increased its stake, adding 3.8 million shares, making Pinduoduo its fifth-largest holding.

Morgan Stanley’s latest report maintains an "Overweight" rating for Pinduoduo, with a price target of $150. Morgan Stanley believes Pinduoduo remains the fastest-growing e-commerce company in China and expects this growth to continue driving operational leverage and long-term profitability. The firm estimates Pinduoduo’s 2025 price-to-earnings (P/E) ratio at 13x, higher than Alibaba’s 9x and JD.com’s 7x.

How Will Pinduoduo’s Stock Perform?

According to TipRanks data, Pinduoduo’s stock has a 67% chance of rising on earnings day, with an average price movement of ±14% over the past 12 quarters.

Source: TipRanks; Pinduoduo Stock Performance Post-Earnings

Wall Street analysts have an average price target of $169 for Pinduoduo over the next year, suggesting the stock has 44% upside potential.

Analysts highlight that, beyond revenue and GMV growth, investors should closely watch the performance of Pinduoduo’s cross-border e-commerce platform, Temu, and management’s forward guidance. Trump’s tariff policies could impact Temu’s revenue. Meanwhile, If management issues weaker-than-expected guidance again, Pinduoduo’s stock could face significant volatility.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.