Crypto Today: Bitcoin hashrate hits all-time high as BTC, Ether and XRP hover near support

- Bitcoin’s hashrate hit a new all-time high on Sunday.

- Bitcoin and Ethereum hover around support at $56,486 and $2,383 on Monday, respectively.

- XRP trades at $0.5325, up slightly on the day.

Bitcoin, Ethereum and XRP updates

- Bitcoin’s hashrate, or the difficulty of mining BTC, hit an all-time high of 827.68 EH/s on Sunday, according to data fromCoinwarz. . BTC trades at $56,486 at the time of writing.

- Typically, a high hashrate signals investor confidence in the asset.

- Ethereum trades at $2,383. The altcoin struggles with selling pressure as wallets related to founder Vitalik Buterin continue to send Ether to exchanges, on-chain data shows.

According to Spot On Chain, the multi-signature address marked by Arkham as controlled by Vitalik's wallet: 0xfE…03B2 has been selling ETH since receiving 3,800 ETH (about $9.99m) from Vitalik's related wallets on August 9 and 30. Currently, 760 ETH has been sold for 1.835…

— Wu Blockchain (@WuBlockchain) September 9, 2024

- XRP trades at $0.5325, under the key resistance level of $0.5500. The native token of the XRPLedger gains slightly on Monday.

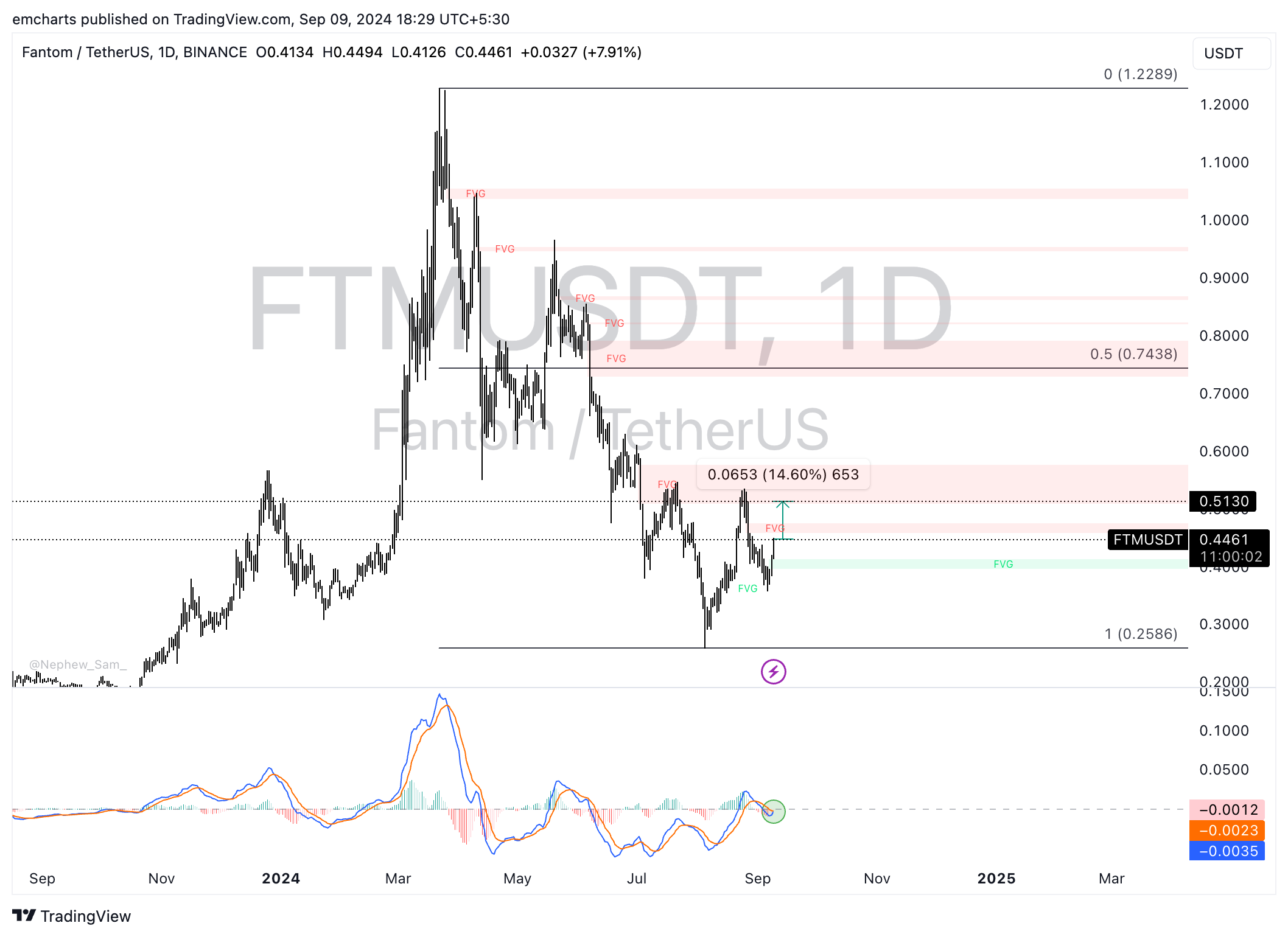

Chart of the day: FANTOM

FTM/USDT daily chart

Fantom’s native token FTM is one of the best-performing tokens on Monday, up more than 7% at $0.4461 at the time of writing. The token has registered three consecutive sessions in the green, and it could extend gains by another 14.60% if it rallies to the lower boundary of the Fair Value Gap (FVG) at $0.5130.

The Moving Average Convergence Divergence (MACD) indicator flashes a key buy signal as the MACD line is set to cross above the signal line. This cross, alongside the emergence of green histogram bars above the neutral line, are a sign of underlying positive momentum.

Market updates

- A subsidiary of Japan’s largest electricity company, Tokyo Electric Power Co (TEPCO), plans to use renewable energy to mine Bitcoin, according to a report from local newspaper The Asahi Shimbun.

- CoinShares’ latest report shows that global crypto investment products recorded outflows of $726 million last week. Bitcoin ETFs have noted consistent outflows, signaling either a decline in institutional investor interest or a shift in sentiment, amidst the macroeconomic developments this week.

- DRiP, an NFT drop platform on Solana, raised $8 million in seed funding from investors, including TikTok executives.

Industry updates

- Binance announced on Sunday that its subsidiary Tokocrupto obtained a physical crypto asset dealer license issued by Indonesia’s Commodity Futures Trading Regulatory Authority. The exchange is now the third largest to obtain such a license in the country.

- None of the 12 Bitcoin Spot ETFs registered net inflows last week, according to data from Farside Investors.

- Friend.Tech, the web3 social network platform that gained massive popularity among crypto market participants in 2023 and early 2024, has renounced control of the smart contracts, per an official announcement on X.

- The team informed the community that no fees from the contracts or the website goes to developers. Meaning the developer team did not take profits from Friend.Tech’s smart contracts or websites and while they shutter the project to move on, no one else can make changes to its function, or fees, essentially ensuring it stays the same for users.

Admin and ownership parameters have been set to 0x000...000 to prevent any changes to their fees or functionality in the future.

— friend.tech (@friendtech) September 8, 2024

This change does not affect the separate web client operated at https://t.co/YOHabcBL3H which will continue to function as is. No fees from either…