Bitcoin declines following $1 trillion exodus from stock market

- The US stock market lost over $1 trillion of market value following weak performance across Magnificent 7.

- Bitcoin showed a positive correlation to the stock market, trading at a daily loss alongside several other cryptocurrencies.

- New stablecoin inflows have yet to be allocated, says CryptoQuant analyst.

Bitcoin (BTC) plunged more than 2% on Tuesday after the US stock market posted significant losses. The decline saw the general crypto market recording a 3.6% loss amid negative sentiment surrounding historically weak BTC September returns.

Bitcoin and crypto market decline as US stock market post loss

The US stock market extended its losses on Tuesday after wiping out $1.05 trillion from its market value. Notably, the Magnificent 7 stocks, which include Apple, Nvidia, Amazon, Meta, Microsoft, Alphabet and Tesla, lost more than $550 billion of their market capitalization in the past 24 hours, per The Kobeissi Letters.

This is not the #crypto market,

— Evan Luthra (@EvanLuthra) September 3, 2024

It's the US stock market.

More than $1.05 trillion has been wiped out from the US stock market today. pic.twitter.com/FnUlkyh3L0

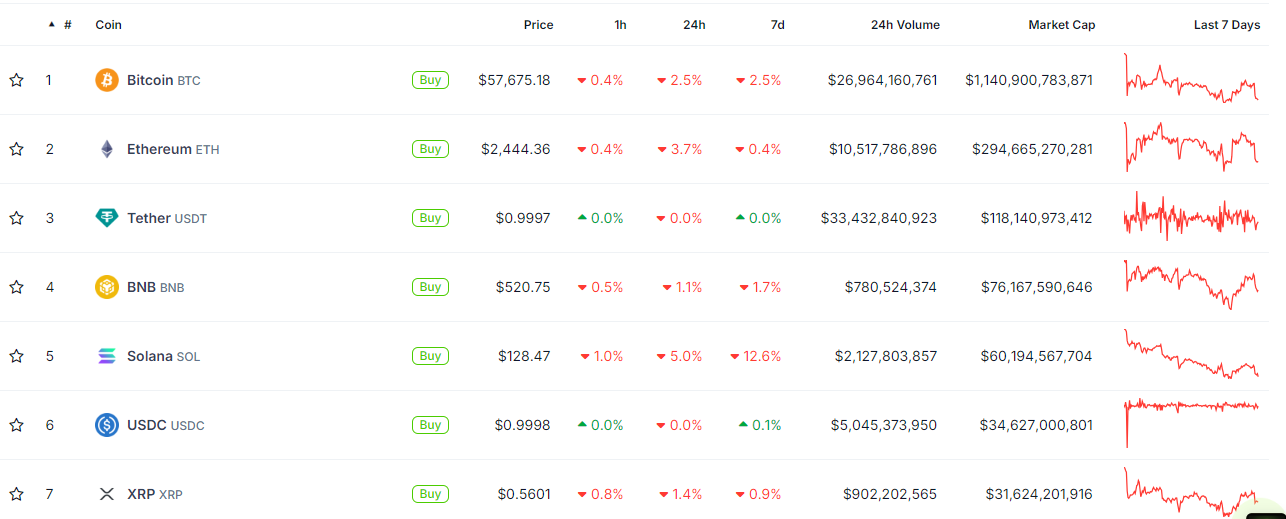

A similar trend is visible in the crypto market, where Bitcoin and several other cryptocurrencies in the top 20 are trading at a daily loss. The move underscores Bitcoin's rising correlation with the traditional stock market. Unlike in previous times, when investors often switched to Bitcoin for uncorrelated exposure, the influx of traditional investors into the crypto market — especially with the launch of Bitcoin ETFs — has changed the narrative.

Crypto market performance

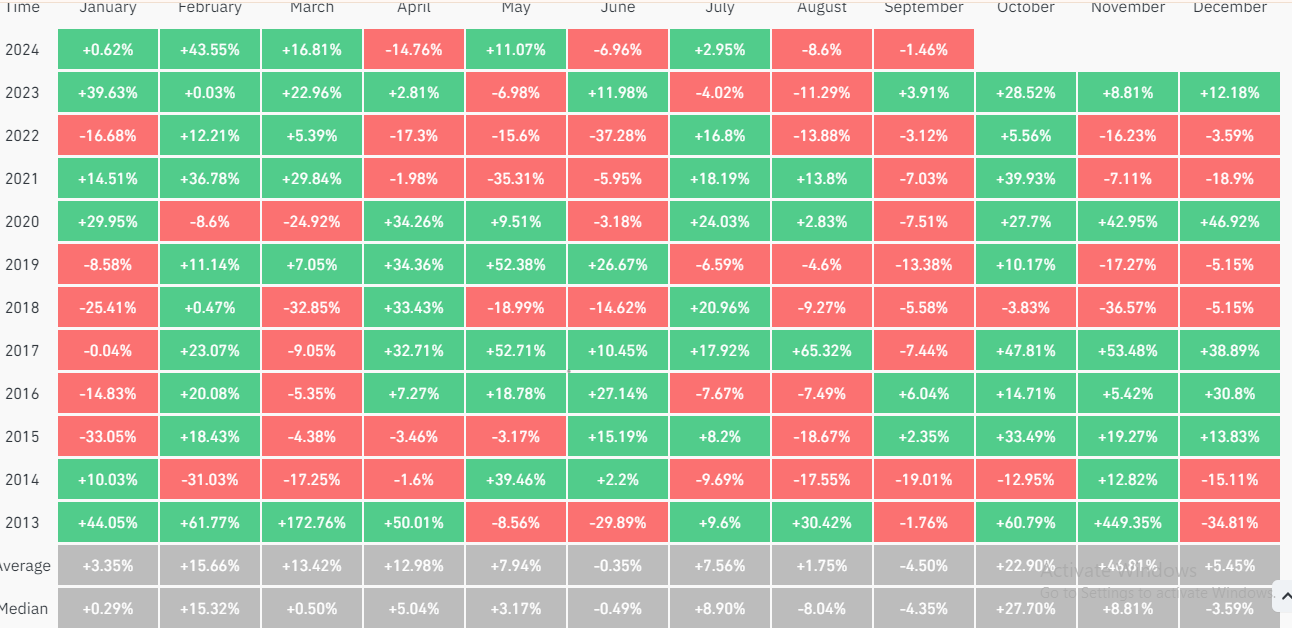

Bitcoin's decline also aligns with its historically weak September performance, which shows it has been the worst month for Bitcoin with an average and median loss of -4.5 and -4.35, respectively — no other month has recorded a lower average return.

BTC Monthly Performance

The same trend is noticeable in the S&P 500, which records Septembers as its worst month in the past 30 years.

#September has historically been the WORST month for the S&P500 over the last 30 years

— Susan Li (@SusanLiTV) September 3, 2024

Also around the rest of the world

1st day of trading already indicating a tough month ahead #StockMarket $spy pic.twitter.com/g3GdSfbFlO

The recent price decline comes despite an increase in stablecoin supply in the crypto market, which is a bullish trend. As a result, a CryptoQuant analyst believes most of the new capital hasn't been allocated yet.

"Much of the capital that is being allocated to stablecoins remains without providing buying pressure on the order books, but this 'firepower' could reach the market at any time," stated the analyst. "It is possible that institutional investors are buying digital assets via TWAP orders or with algorithms to reduce the impact on the short-term price," he added.

Meanwhile, Bitcoin's recent weak price action has seen Meta stock and Gold rising to challenge its outperformance as the second-best asset on risk-adjusted returns.

Bitcoin’s outperformance on risk adjusted returns is being challenged.

— ecoinometrics (@ecoinometrics) September 2, 2024

Over the last twelve months Meta and even Gold are catching up to it.

Bitcoin is still lacking a sense of direction after the launch of the ETFs at the start of the year. pic.twitter.com/PUi449z6WA

The BTC MVRV Z-Score has also flipped to a red bar, indicating a prevailing bearish sentiment. An extended period of this metric staying red could signal the beginning of a bear market.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.