Ethereum price crash follows wider crypto market dump as long traders see high liquidations

- Ethereum risk reversal sunk by 20% on Tuesday following nervousness surrounding the recent crypto market crash.

- ETH liquidated long positions reached $67.37 million in the past 24 hours as short traders prevailed.

- Glassnode shared insights into the recent Ethereum issuance reduction proposal that has sparked criticism from the crypto community.

Ethereum's (ETH) price briefly dipped below $3,000 on Tuesday after tensions surrounding a potential Iran-Israel conflict suppressed the effect of Hong Kong's spot ETH approval. Regardless of the price dump, the recent ETH issuance reduction proposal has made the rounds again following research firm Glassnode's report.

Read more: Ethereum recovers from dip as Hong Kong ETH ETF approval sparks whale buying spree

Daily digest market movers: risk reversal dips, liquidated long positions, ETH issuance

Ethereum headlines the crypto market again with increased attention surrounding it. Here are your key market movers:

- Ethereum investors are showing increased nervousness as ETH risk reversals have sunk 20% on Tuesday, according to QCP Broadcast. Generally, crypto bulls are exercising caution as Bitcoin and other altcoins have also posted losses following the prevalence of the Iran-Israel conflict. QCP further highlights that the market is shorting ETH gamma, indicating a sharp move either upward or downward could be amplified.

- Following the Hong Kong spot ETH ETF approval, the second largest digital asset saw increasing discussions, making it the most trending token among traders, according to data from Santiment. Despite the increased attention, ETH shorts have risen by 54% as bearish sentiment around the digital asset continues increasing.

- The crypto market liquidation heat map validates this as Ethereum has seen over $81.9 million in liquidations in the past 24 hours, according to data from Santiment. Liquidated long positions account for $67.4 million of the total ETH liquidations, with the largest coming from an ETH-USD swap valued at $6 million.

Also read: Ethereum price stagnates as EIP-3074 brings smart contract functionalities to wallets

- The Ethereum Foundation's proposal to reduce ETH issuance still faces criticism despite clarifications that the aim is to maintain Ethereum's status as money and a balance in the network's governance power, according to Glassnode.

The rise of restaking and liquid restaking tokens increases ETH's inflation rate and impacts several ETH holders. "In other words, there is a wealth transfer taking place from a shrinking pool of non-staked ETH holders, towards a growing pool of staked ETH holders," says Glassnode.

As a result, the "real yield" could shift the "role of money" within the Ethereum ecosystem from ETH to liquid staking tokens or restaking tokens because of their significantly high yields. "A side-effect of such a development would be the projects which issue these derivative tokens gaining an outsized influence over the governance and stability of Ethereum's execution and consensus layers," stated Glassnode.

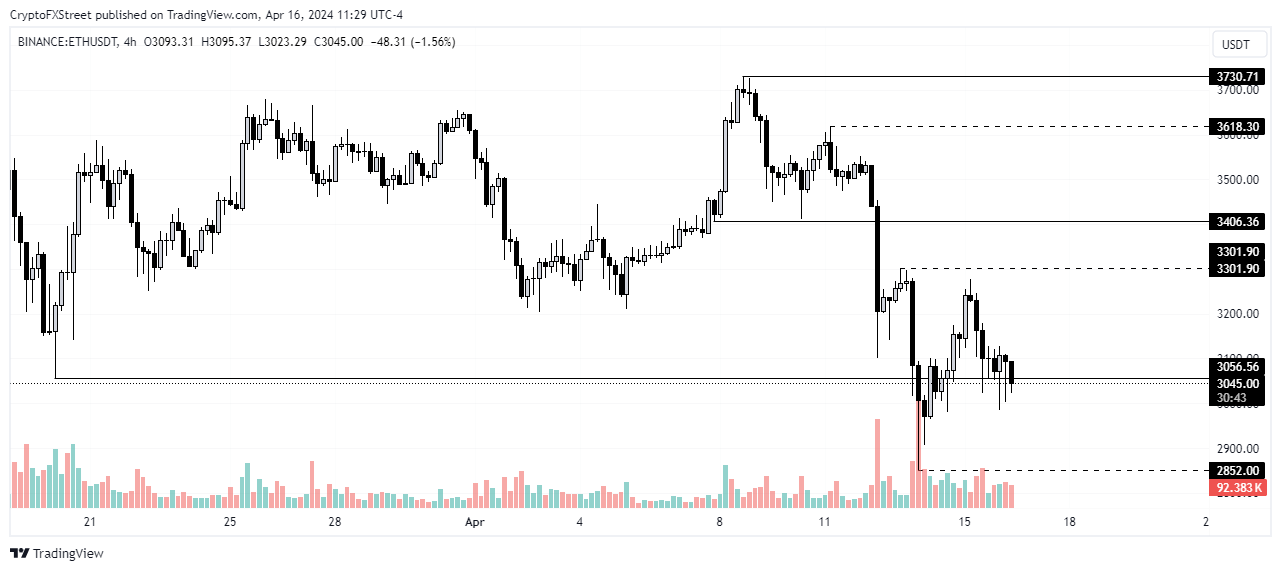

Technical analysis: ETH to trade below $3,301

Ethereum bears prevailed in the past 24 hours as its price has found it difficult to recover from the weekend slump. After a brief move toward $3,300 on Monday, expectations were that it would maintain a sideways movement in the $3,210 to $3,406 range. However, ETH declined further, settling around the $3,000 support.

ETH/USDT 1-hour chart

Read more: Ethereum price recovers slightly as whales begin accumulation spree

Considering current volatility, ETH may trade inside the range of $2,852 and $3,301, both formed on Saturday. A move above the range may see it breaking past the $3,406 resistance of April 7 and testing the 3,618 key level of April 11. A further upward move will see ETH sustain bullish momentum. However, a move below the range will see ETH entering a bearish trend.

Three factors will affect this thesis: the upcoming Bitcoin halving, a potential Iran-Israeli conflict, and the Securities & Exchange Commission’s (SEC) decision on a spot Ethereum ETF.

Ethereum is trading around the $3,000 support at the time of writing.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.