After the Crash and Scandal: Why Hyperliquid Looks Unstoppable

Crypto Black Friday’s record liquidations erased $19 billion in positions, exposing transparency gaps between centralized and decentralized venues. As Binance stumbled, Hyperliquid held firm, making the 10.10 crash crypto’s biggest stress test since FTX.

The crash and Binance’s recent listing controversy underscored one growing theme: the cost of centralization and the appeal of open systems.

The Crash That Shook Trust

Latest UpdateBloomberg reported that Hyperliquid processed over $10 billion of the $19 billion in liquidations while Binance suffered outages and refunded users. The DEX maintained 100% uptime, proving its resilience during extreme volatility.

Background ContextBitwise CIO Matt Hougan noted that blockchains “passed the stress test,” highlighting that DeFi venues like Hyperliquid, Uniswap, and Aave stayed operational while Binance had to compensate the traders. His conclusion: decentralization preserved market integrity as leveraged traders collapsed.

Spot Volume: Binance vs Hyperliquid | Dune

Spot Volume: Binance vs Hyperliquid | Dune

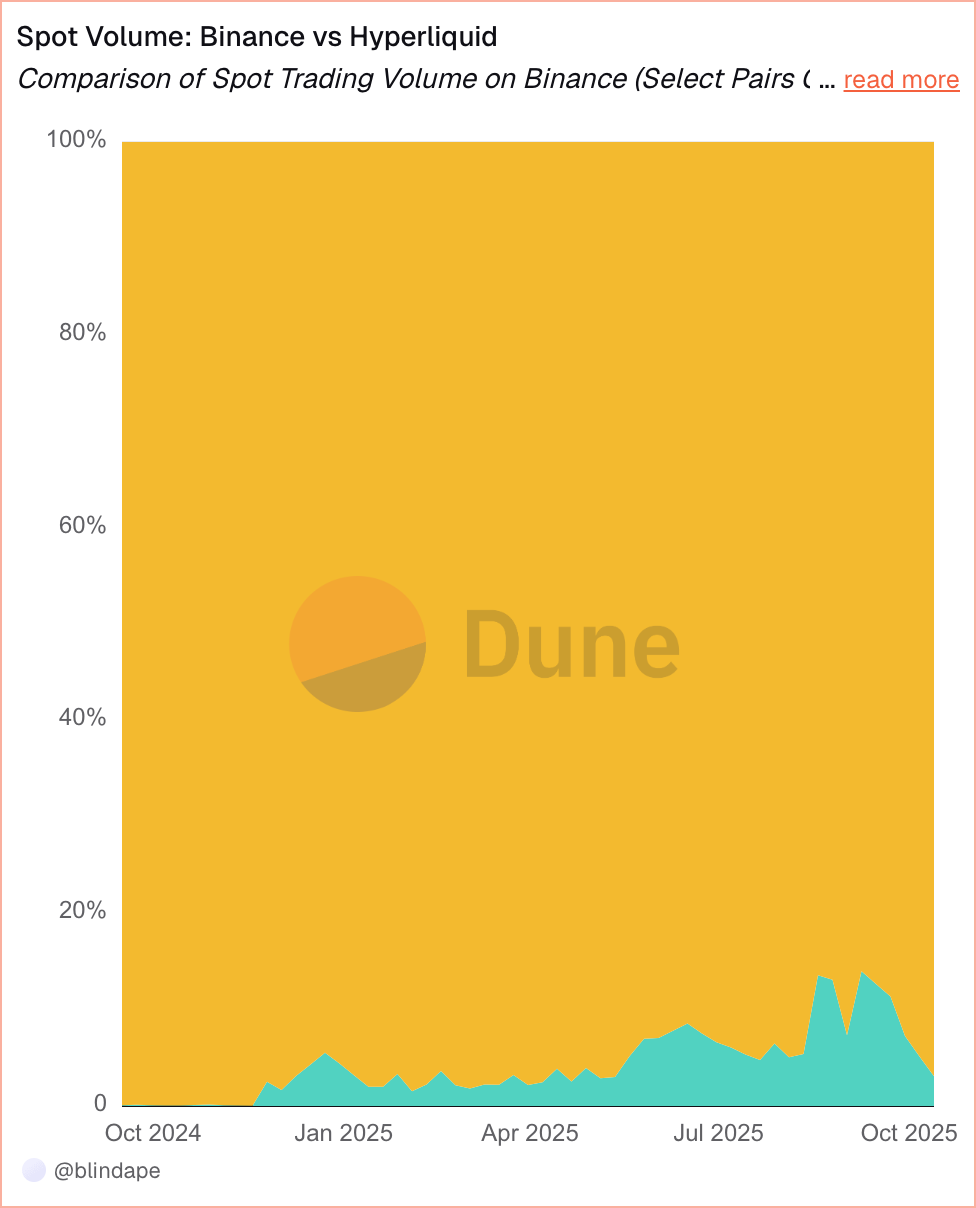

Dune data shows Binance dominates spot volume, while Hyperliquid’s share remains under 10% despite steady growth through mid-2025. The same trust gap that surfaced during the crash soon reappeared in a different form — the listing fee debate.

Binance Faces the Listing Backlash

Deeper AnalysisLimitless Labs’ CEO alleged that Binance demanded 9% of the token supply and multimillion-dollar deposits for listings. Binance denied it, citing refundable deposits, and defended its Alpha program. The fairness debate erupted as CEX trust hit new lows.

Behind the ScenesCZ argued exchanges follow different models and said, “If you dislike fees, build your own zero-fee platform.” Hyperliquid replied that on its network, “there is no listing fee, department, or gatekeepers.” Spot deployment is permissionless: any project can launch a token by paying gas in HYPE and earn up to half of trading fees on their pairs.

Uniswap founder Hayden Adams argued that DEXs and AMMs already offer free listing and liquidity—if projects still pay CEX fees, it’s purely for marketing.

Hyperliquid Emerges as the On-Chain Contender

Essential Facts

| Platform | Sept 2025 Volume | Market Cap |

|---|---|---|

| Hyperliquid | ≈ $200 B | ≈ $13.2 B |

| Aster | ≈ $20 B | ≈ $2.5 B |

| dYdX | ≈ $7 B monthly | $1.5 T cumulative |

Looking ForwardVanEck confirmed Hyperliquid captured 35% of blockchain fee revenue in July. Circle added native USDC to the chain, and Eyenovia launched a validator and HYPE treasury. HIP-3 enabled permissionless perps, letting builders create futures markets for any asset.

Grayscale reported that DEXs have become price-competitive with CEXs, citing Hyperliquid as 2025’s breakout. It projects that DEXs could dominate the long tail of assets where transparency and community governance matter most.

Hyperliquid’s edge lies in efficiency. A ten-engineer team runs a venue rivaling Binance’s 7,000 staff and $500M marketing spend. The DEX turns savings into token value and liquidity rewards by cutting listing bureaucracy and ads. VanEck calls this “profit without marketing spend”—a moat no centralized player can copy.

The data shows Hyperliquid’s share of Binance’s volume hit ~15% in August before easing slightly—signaling rising trader interest in on-chain derivatives.

The Road Ahead for Exchanges

Risks & ChallengesBitwise analyst Max Shannon told BeInCrypto that decentralized perps could hit $20–30 trillion in annual volume within five years if regulation aligns. He warned that DEXs processing $67B daily may face oversight and need standardized oracles, audited insurance funds, and risk controls.

Expert Opinions

“Perp DEXs can fail, but their risks are transparent and on-chain,” said Max Shannon, Bitwise.

“Hyperliquid has everything it takes to become the House of Finance,” stated OAK Research.

“Centralized exchanges will stay relevant by embracing hybrid models—combining non-custodial trading, deep liquidity, and regulatory trust,” Gracy Chen, Bitget CEO told BeInCrypto

Bottom LineParadigm urged the CFTC to recognize DeFi transparency, arguing decentralized trading already meets key regulatory goals like impartial access and auditability. With regulators warming to DeFi and institutions adopting on-chain models, Hyperliquid’s permissionless ecosystem stands as crypto’s most credible alternative to centralized power—where transparency replaces trust as the foundation of finance.