Mexican Peso breaks higher after Banxico keeps key rate unchanged

- The Mexican Peso rallies following Thursday’s Bank of Mexico policy meeting.

- Banxico decided to keep interest rates unchanged but upwardly revised its inflation forecasts.

- USD/MXN broke below the floor of a short-term range following the news and is tipped to decline further.

The Mexican Peso (MXN) breaks higher in its most heavily traded pairs in the aftermath of the Bank of Mexico (Banxico) policy meeting on Thursday, at which the board unanimously voted to keep interest rates unchanged and substantially revised up its inflation forecasts in the light of stubbornly high price pressures.

The Banxico is now not seen cutting interest rates in the near future – a positive for its currency since higher rates attract more foreign capital inflows.

USD/MXN is exchanging hands at 16.80, EUR/MXN at 18.12 and GBP/MXN at 21.08, at the time of publication.

Mexican Peso appreciates after Banxico meeting, inflation revision

The Mexican Peso strengthened by between roughly a quarter and three quarters of a percent in its most heavily traded pairs on Thursday, after the Bank of Mexico held its May policy meeting and decided unanimously to keep the policy rate unchanged at 11.00%. This strength broadly holds up into Friday’s European trading session, with the MXN retreating only marginally from Thursday’s significant appreciation.

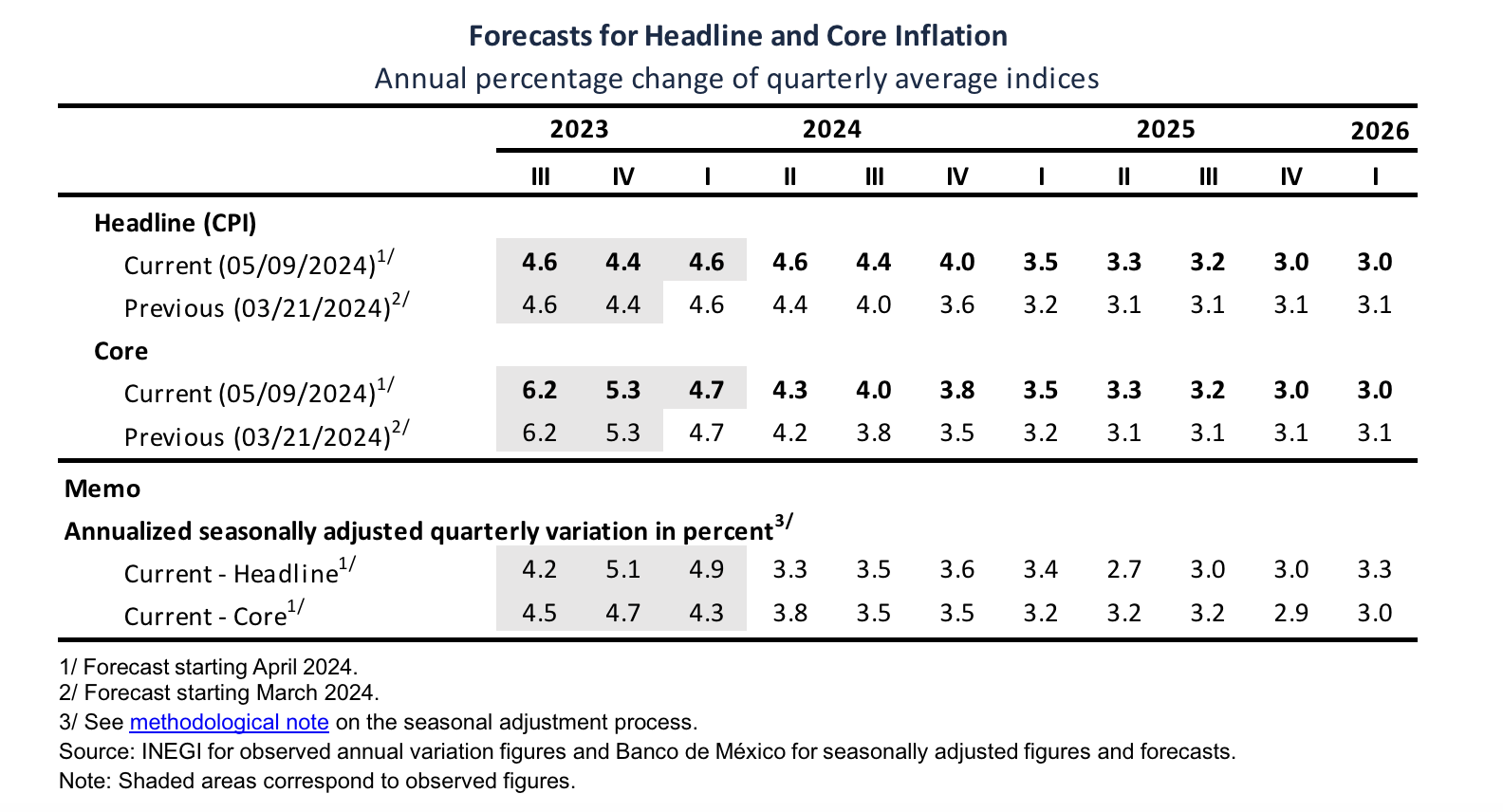

The Banxico revised up its inflation forecasts over the next year and a half, indicating it expected inflation to be stickier than previously anticipated. It forecast inflation to now fall more slowly to its 3.0% target, which it did not foresee reaching until Q4 of 2025.

Previously Banxico had expected inflation to fall more swiftly, reaching 3.1% in Q2 of 2025, and remaining at that level for the rest of the year (see table below). Banxico made similar revisions for core inflation.

In its accompanying statement, Banxico said, “..considering that inflationary shocks are

foreseen to take longer to dissipate, the forecasts for headline and core inflation have been revised upwards for the next six quarters. In particular, services inflation is foreseen to show more persistence, as compared to what had been previously anticipated.”

Technical Analysis: USD/MXN breaks below floor of short-term range

USD/MXN – the cost of one US Dollar in Mexican Pesos – has decisively broken below the bottom of a short-term range at 16.86 and is now expected to continue falling towards the target for the breakout.

USD/MXN 4-hour Chart

The break below the range floor generates an initial, conservative target at 16.54. This is the 0.681 Fibonacci ratio of the height of the range extrapolated lower, and it is followed by 16.34, the full height of the range extrapolated lower.

The short-term trend is now probably bearish following the breakdown from the range, which given the old adage that the “trend is your friend”, suggests the odds favor more downside.

The Moving Average Convergence Divergence (MACD) momentum indicator has crossed below its signal line, further indicating bearishness. However, the momentum accompanying the breakdown move itself was not particularly strong.

Given the medium and long-term trends are bearish, the odds further favor more downside for the pair in line with those trends.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.