Australian Dollar Forecast In 2024/2025/2026: Should I Buy AUD/USD Or Other AUD Currency Pairs?

Renowned for its liquidity and widespread use in global forex markets, the Australian Dollar (AUD) holds a prominent position among traders worldwide. Notably, the AUD/USD pair stands out as one of the most actively traded currency pairs, commanding a substantial 6% share of the total trading volume in the forex market.

As we look ahead to the years 2024, 2025, and 2026, investors and traders alike are eager to discern the trajectory of the AUD against the US Dollar and other AUD-denominated currency pairs. In this article, we delve into the forecast for the Australian Dollar, exploring whether now is the opportune time to consider positions in AUD/USD or other AUD currency pairs.

1. Australian dollar (AUD) overview over the years

Over the last 20 years, the Australian Dollar has undergone notable fluctuations, driven by a complex interplay of economic variables and monetary policies both within Australia and abroad.

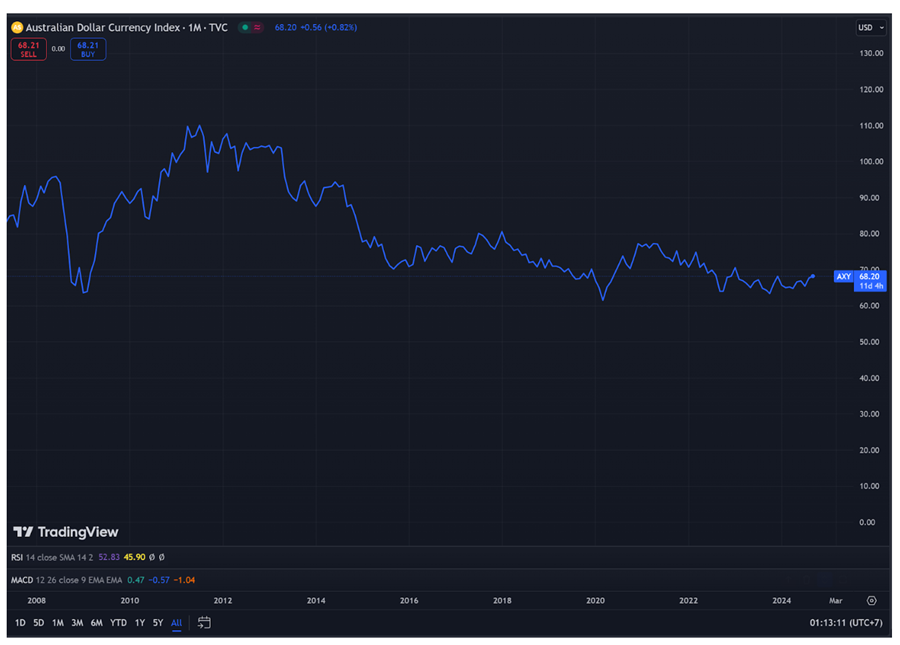

Australian Dollar Currency Index (Source: Tradingview)

From early 2004 until the onset of the Global Financial Crisis (2007-2009), the AUD experienced a robust upward trend, reaching its highest value of 97 points since 1983. However, during the crisis, it depreciated by approximately 35% from its peak in June 2008 to its lowest point of 62 in October 2008.

Following the Global Financial Crisis, the AUD staged a rapid recovery and reached a historic peak of 110 points in July 2011, marking a remarkable rebound of approximately 77.6% from its lowest point in October 2008. This significant appreciation of the AUD was primarily attributed to the mining boom in Australia, fueled by the increasing demand from China and other Asian countries.

Since mid-2013, the AUD has experienced rapid depreciation following the end of the mining boom. Additionally, the economic slowdown in China in 2015 further weakened the strength of the AUD, reaching a low point of 68 in January 2016.

This depreciation of the AUD can be attributed to the decline in Australia’s terms of trade and the decrease in interest rate differentials, as monetary policy in Australia has been eased while interest rates in other advanced economies remained low. Consequently, the difference between interest rates in Australia and those in major advanced economies narrowed.

During 2016 and 2017, the AUD experienced a slight recovery, hovering around 70 to 80 points, driven by expectations of increased iron ore exports amidst rising commodity prices. However, since January 2018, the AUD has resumed its downward trend, reaching its lowest point of 58 in March 2020 due to the onset of the Covid-19 pandemic. Subsequently, the AUD staged a recovery, reaching 78 by February 2021.

Register and trade Forex CFDs with 0 commission and low spreads! Trade Demo with 50,000USD RISK-FREE virtual money!

However, influenced by inflationary pressures and central bank monetary policies, the AUD has since depreciated and is currently valued at 68 points as of Sep 2024.

2. Should I buy Australian Currency pairs? How to buy Australian dollars?

Whether to buy Australian currency pairs depends on your investment goals, risk tolerance, and market outlook. Before making any trading decisions, traders should consider pros and cons, conducting thorough research and analysis to assess the current economic conditions, geopolitical factors, and technical indicators affecting the Australian Dollar (AUD) and its related currency pairs.

Pros:

- High liquidity: The AUD is one of the most actively traded currencies globally, offering high liquidity and narrow spreads, which can result in lower transaction costs for traders.

- Resource-rich economy: Australia is abundant in natural resources such as iron ore, coal, and gold. Fluctuations in commodity prices can influence the AUD's value, providing trading opportunities for those who can accurately forecast commodity trends.

- Strong economic fundamentals: Australia boasts a stable economy with sound fiscal policies, a well-regulated financial system, and relatively low levels of public debt. Positive economic data releases, such as GDP growth, employment figures, and inflation data, can support the AUD.

- Interest rate differentials: The Reserve Bank of Australia (RBA) sets interest rates, which can impact the AUD's value relative to other currencies. Interest rate differentials between Australia and other countries can create opportunities for carry trades, where traders borrow funds in currencies with low interest rates to invest in higher-yielding assets denominated in AUD.

- Correlation with Asian markets: Australia has strong trade ties with Asia, particularly China. Positive economic developments in China and other Asian economies can often lead to increased demand for Australian exports, benefiting the AUD.

Cons:

- Dependency on commodity prices: Australia's economy is heavily reliant on commodity exports, making the AUD sensitive to fluctuations in commodity prices. Declines in commodity prices, especially for key exports like iron ore, can weaken the AUD.

- Vulnerability to global economic events: The AUD is susceptible to global economic events and market sentiment. Factors such as geopolitical tensions, trade disputes, and shifts in risk appetite can lead to volatility in the AUD.

- Interest rate risk: Changes in interest rates set by the Reserve Bank of Australia (RBA) can impact the AUD's value. Unforeseen shifts in monetary policy or divergent monetary policies between Australia and other major economies can lead to currency fluctuations and trading uncertainties.

- Exposure to external shocks: As an export-oriented economy, Australia is vulnerable to external shocks, such as natural disasters, global health crises, and geopolitical events. These events can disrupt trade flows, investment patterns, and economic growth, impacting the AUD's value.

How to buy Australian dollars?

After considering the pros and cons, as well as your personal trading strategies, you can begin trading the Australian dollar. The most popular method is to trade AUD pairs, such as AUD/USD, AUD/JPY, or EUR/AUD, online through reputable CFD brokers. This way, traders can utilize opportunities from either direction of price movement, buying when predicting price increases or selling when expecting price decreases

Here are some steps to consider if you decide to buy Australian dollars or trade AUD currency pairs:

Remember that trading forex involves inherent risks, and it's essential to only trade with capital you can afford to lose. Consider seeking advice from a financial advisor or trading mentor if you're new to forex trading or unsure about your investment decisions.

3. Historical analysis of AUD/USD, AUD/JPY, and EUR/AUD in 2022/2023/2024

Here's a brief historical analysis of the AUD/USD, AUD/JPY, and EUR/AUD currency pairs for the years 2022, 2023, and 2024:

AUD/USD

AUD/USD price chart (Source: Mitrade)

2022: In 2022, the AUD/USD pair commenced the year trading at approximately 0.72 levels. Throughout the year, the pair exhibited volatility, driven by various factors including shifts in monetary policies of both the US and Australia, respective economic conditions, global economic dynamics, and geopolitical tensions. March 2022 marked the onset of interest rate hikes by the Federal Reserve (Fed) aimed at combating inflation.

Despite the Reserve Bank of Australia (RBA) also implementing rate increases, they remained below those of the Fed. This primarily contributed to the downward trajectory of the AUD/USD exchange rate over the course of the year. The pair bottomed out at 0.61 in mid-October before staging a modest recovery, concluding the year at around 0.68.

2023: Continuing the upward trend from late 2022, the AUD/USD continued to rise to 0.71 by the end of January 2023, also marking the highest level of the year. In 2023, the Fed maintained high interest rates at 5.25% - 5.5%, while the RBA kept rates at 4.35%. Additionally, the positive growth of China, Australia's largest trading partner, following the pandemic, and slipped into deflation in July 2023, negatively impacted the strength of the AUD. The AUD/USD entered a downward trend until October 2023, trading at 0.61, then repeated the scenario of 2022 by recovering until the end of the year, and closing the year at 0.68.

2024: In January 2024, the AUD/USD experienced a slight decrease from 0.68 to 0.65 and has since fluctuated within a narrow range of 0.64 to 0.68 from February 2024 to the present (Sep, 2024).

AUD/JPY

AUD/JPY price chart (Source: Mitrade)

2022: In the first four months of 2022, AUD/JPY saw a strong increase of approximately 14.4%, reaching 95 by the end of April 2022. However, it then underwent a downward adjustment to 88 in May, followed by maintaining a narrow trading range between 91 and 95 until mid-December.

In the latter half of December 2023, AUD/JPY continued to decline slightly, ending the year at 88. These changes can be attributed to the interest rate policies of the two countries, with Australia consistently raising interest rates in line with the trend of most major economies to curb inflation, while Japan has remained steadfast in its negative interest rate policy to support the economy.

2023: The general trend of AUD/JPY in 2023 was a slight increase, starting the year at 88 and rising to 97 in June 2023, with minimal changes until the end of the year, closing at 96. The interest rate policies and economies of the two countries saw little change in 2023. Meanwhile, Japan also intervened in the forex market to maintain the strength of the Yen.

2024: From the beginning of 2024 to May 2024, AUD/JPY has experienced a positive increase of approximately 6.72%, rising from 96 to 108 , but then a decrease from 108 to 97 in Sep 2024. This can be attributed to the significant depreciation of the Japanese Yen when Japan experienced a technical recession at the end of 2023 and lost its position as the world's third-largest economy to Germany, according to economic data released in February 2024.

Despite Japan ending its negative interest rate policy in March 2024, raising it to 0 - 0.1%, and intervening in the forex market, there have been minimal changes in the strength of the Japanese Yen.

EUR/AUD

EUR/AUD price chart (Source: Mitrade)

2022: The EUR/AUD pair began 2022 trading around 1.5588. The EUR/AUD experienced a sharp decline from February to early April 2022, losing approximately 7% and reaching 1.437, triggered by the conflict between Ukraine and Russia in February 2022, which negatively affected the European region, particularly the energy crisis. Afterwards, the EUR/AUD exchange rate made a short-term recovery until the end of June 2022, reaching 1.52, before continuing its decline to 1.42 by late August 2022.

Changes in the interest rate policies of Europe were also implemented to minimize the negative impact of the energy crisis, which helped strengthen the EUR from September to December. By the end of 2022, the EUR/AUD was trading at 1.57.

2023: The general trend of the EUR/AUD in 2023 was upward, with short-term downward adjustments within a narrow range. At the beginning of 2023, the EUR/AUD was trading at 1.56, then rose to 1.67 by the end of April 2023. Subsequently, it gradually declined to 1.59 by mid-June 2023 before resuming its upward trend to 1.69 by the end of September 2023. However, it experienced a slight decline in the last three months of the year, closing the year at 1.62.

2024: From the beginning of 2024 until now (Sep 2024), the EUR/AUD exchange rate has remained relatively stable, trading sideways within the range of 1.62 to 1.63. This stability can be attributed to minimal changes in monetary policies and the general economic situation in both the European zone and Australia.

This historical analysis provides insight into the performance and fluctuations of the AUD/USD, AUD/JPY, and EUR/AUD currency pairs over the years 2022, 2023, and 2024, highlighting the various factors that influenced their movements.

4. AUD/USD, AUD/JPY, EUR/AUD Forecast in 2024/2025/2026

Analyzing the detailed historical exchange rates of currency pairs involving the AUD from 2022 to the present in part 3 can provide traders with a broad overview of exchange rate fluctuations and the main factors impacting them. This also serves as a basis for traders to make forecasts about the future price trends of these currency pairs.

Below are forecasts for the AUD/USD, AUD/JPY, and EUR/AUD currency pairs for the years 2024, 2025, and 2026 from financial institutions worldwide for traders to reference:

Forecast | 2024 | 2025 | 2026 |

AUD/USD | |||

Westpac Institutional Bank | 0.66 - 0.67 | 0.68 - 0.71 | - |

NAB | 0.69 - 0.72 | 0.75 - 0.78 | 0.76 - 0.78 |

Exchange rates | 0.62 - 0.72 | 0.62 - 0.76 | - |

Long forecast | 0.64 - 0.70 | 0.66 - 0.69 | 0.62 - 0.65 |

Coincodex | 0.64 - 0.71 | 0.59 -0.71 | 0.50 - 0.60 |

AUD/JPY | |||

NAB | 98 - 97 | 95 - 92 | 90 - 87 |

Long forecast | 98.19 - 116.26 | 112.78 - 116.15 | 114.42 - 126.60 |

Coincodex | 102.23 - 120.39 | 102.23 - 134.40 | 107.87 - 128.58 |

EUR/AUD | |||

NAB | 1.639 - 1.612 | 1.612 - 1.562 | 1.587 - 1.612 |

Long forecast | 1.577 - 1.603 | 1.579 -1.728 | 1.693 - 1.748 |

Coincodex | 1.546 - 1.656 | 1.457 - 1.659 | 1.444 - 1.706 |

Fluctuations in the forex market are significantly driven by the monetary policies of nations and prevailing domestic and global economic conditions. Consequently, traders must meticulously monitor market dynamics and economic indicators to adeptly comprehend these shifts, facilitating more informed forecasts and trading strategies.

5. Summary

In summary, the Australian Dollar (AUD) is expected to experience significant fluctuations in the coming years, influenced by various economic factors such as global commodity prices, interest rate differentials, and geopolitical events. While the AUD/USD pair may offer attractive opportunities for traders, it is crucial to stay informed about the broader economic landscape and potential risks.

Diversifying investments across different AUD currency pairs can also help mitigate risks and capitalize on various market conditions. Ultimately, whether to buy AUD/USD or other AUD currency pairs depends on individual risk tolerance, investment goals, and market outlook. Staying updated with the latest economic trends and forecasts will be key to making informed decisions in this dynamic market environment.

6. FAQs about Australian Dollar and AUD Currency Pairs

#What are the key factors influencing the forecast for the Australian Dollar in the years 2024, 2025, and 2026?

The forecast for the Australian Dollar (AUD) in the coming years is influenced by a variety of factors, including Australia's economic performance, global economic trends, monetary policy decisions by the Reserve Bank of Australia (RBA), commodity prices, geopolitical developments, and trade relations with key trading partners.

#How might global economic trends, such as shifts in trade dynamics and geopolitical tensions, impact the Australian Dollar's performance in the forecasted years?

Global economic trends play a significant role in shaping the AUD's performance. Developments such as changes in trade policies, geopolitical tensions, and shifts in global economic growth trajectories can impact investor sentiment and capital flows, influencing the demand for the Australian Dollar.

#How might Australia's trade relationships with key trading partners, particularly China, impact the Australian Dollar's performance?

Australia's trade relationships, particularly with China, have a significant impact on the AUD's performance. Developments in trade relations, such as changes in tariffs or trade agreements, can affect Australia's export volumes and commodity prices, thereby influencing the demand for the Australian Dollar.

#What risk management strategies should traders employ when trading AUD currency pairs?

Risk management is essential when trading AUD currency pairs or any financial instrument. Traders should consider implementing strategies such as setting stop-loss orders to limit potential losses, diversifying their portfolios to spread risk, sizing their positions appropriately based on their risk tolerance, and staying disciplined with their trading plan. Additionally, staying informed about market developments and adjusting positions as needed can help mitigate risks associated with trading AUD currency pairs.

#How can traders incorporate technical analysis and fundamental analysis into their trading strategy when considering AUD currency pairs?

Traders can utilize a combination of technical analysis and fundamental analysis to inform their trading decisions. Technical analysis involves studying price charts, identifying patterns, and using indicators to analyze market trends and potential entry and exit points. Fundamental analysis, on the other hand, focuses on economic indicators, central bank policies, geopolitical events, and other macroeconomic factors that can impact currency values. By integrating both approaches, traders can gain a more comprehensive understanding of market dynamics and make informed trading decisions.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.