Semiconductors, dubbed the "new oil" of the global economy, play a crucial role in digitizing the electronics industry and contribute significantly to the development of the global information technology sector. In recent years, driven by trends such as digitalization, cloud integration, 5G technology, renewable energy, and electric vehicles, this industry has experienced robust growth.

If 2021 was a year of disappointment for semiconductor investors, how can one invest in semiconductor stocks in 2024? This article will introduce 10 semiconductor stocks worth considering.

1. What does the semiconductor industry include?

The semiconductor industry encompasses various components and processes. It originated in the United States in the previous century and later spread to Japan, South Korea, Taiwan, and China.

During the transformation of semiconductor manufacturing regions, the division of labor within the industry became increasingly specialized. It evolved from the initial vertically integrated model (IDM) to later developments in the Fabless (chip design), Foundry (chip fabrication), and OSAT (packaging and testing) models. Under these sub-models, different companies are assigned specific tasks.

Work division model | Representatives of companies | Investment characteristics |

IDM model (vertical integration) | Samsung , Texas Instruments(TXN), Intel | Requires large company size; high management costs |

Chip design (Fabless) | Qualcomm (QCOM), Broadcom (AVGO), NVIDIA (NVDA) | Light capital structure, small scale; low operating costs; bear the risk of fluctuations |

Chip Foundry (Foundry) | TSMC (TSM) , GlobalFoundries (GFS) | Large investment scale; continue to invest to maintain technology; market monopoly |

Semiconductor materials and devices | Applied Materials (AMAT), ASML, Lam Research (LAM) | Large capital investment; continue to invest; high volatility risk |

Investors can pay attention to the fields of chip design, chip fabrication, and semiconductor equipment as they offer long-term prospects and investment opportunities.

Moreover, considering trading semiconductor stocks using Contracts for Difference (CFDs) can be beneficial. Trading stocks with CFDs allows you to trade with only 5%-10% of the stock's face value, significantly increasing the utilization of funds.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

Furthermore, engaging in simulated trading exercises using the user-friendly trading interface enables you to enhance your familiarity with risk management tools like stop-loss and trailing stop orders.

2. Characteristics of the semiconductor industry

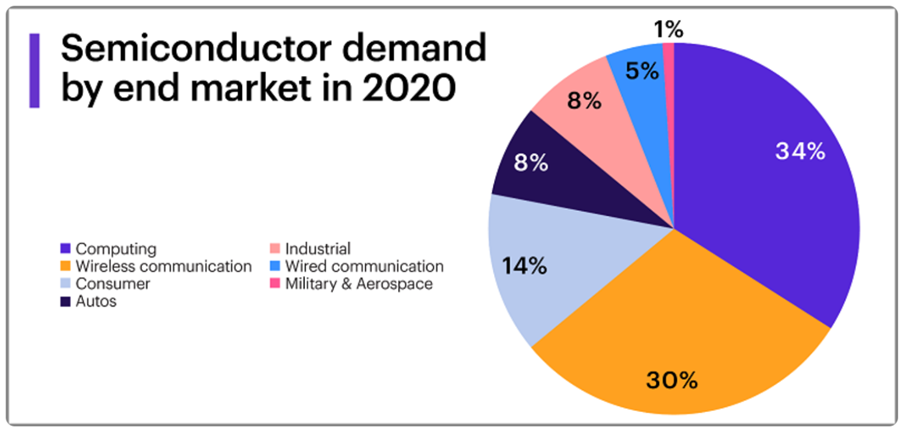

The ultimate applications of semiconductors are associated with various industries, and the global semiconductor demand is divided into different sectors such as computers, telecommunications, automotive electronics, consumer electronics, etc. (see the image).

(Image source: Report by the Semiconductor Industry Association - SIA)

(Image source: Report by the Semiconductor Industry Association - SIA)

Along with the changing demands over time, the factors driving the development of the semiconductor industry also vary. Each phase of technological innovation will also drive market changes, supply-demand transformations in different stages, creating cyclical fluctuations in the semiconductor industry.

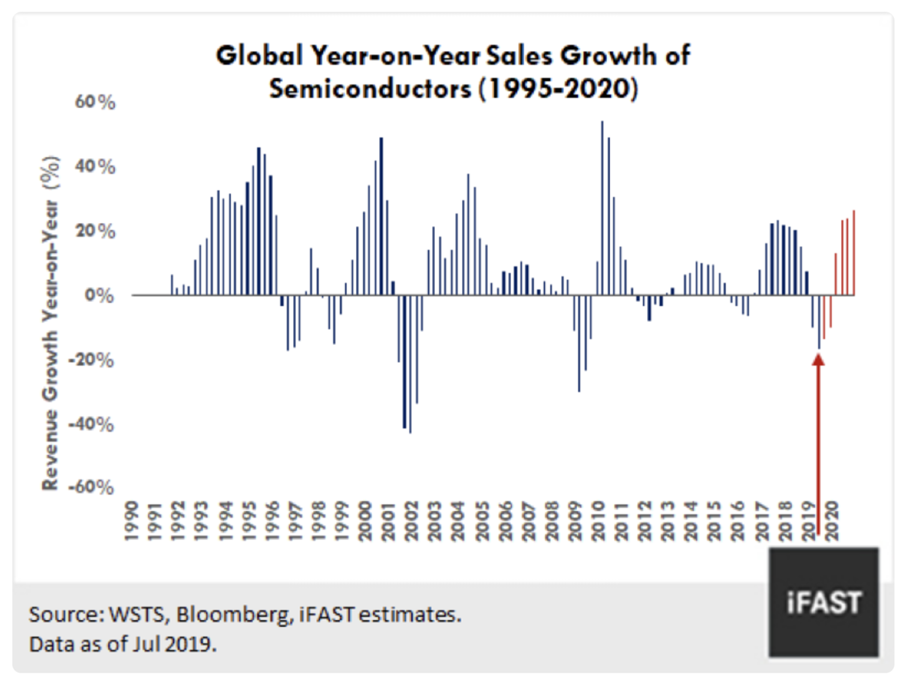

Since 1990, the global semiconductor industry has experienced eight major cycles and is currently in its ninth cycle, expected to commence in 2024.

This year, due to the factors of recovery expectations and the low base effect, upstream raw materials have shown signs of bottoming out. Although the consumer electronics market may continue to weaken, the demand in new fields such as 5G, artificial intelligence (AI) will continue to grow.

(Note: Describing the semiconductor cycle based on the global semiconductor industry's annual growth rate.The current cycle started in mid-2019, Image source: FSM)

(Note: Describing the semiconductor cycle based on the global semiconductor industry's annual growth rate.The current cycle started in mid-2019, Image source: FSM)

3. What are popular semiconductor companies and stocks?

Based on the market capitalization rankings of companies in the semiconductor industry and the potential development of companies in specific sectors, we have selected 11 popular companies currently that you may find more interesting and explore suitable opportunities.

Company name | US stock code | Field | Nation | Market capitalization (Trillion USD) | Dividend rate (%) | P/E (K/LLCT ratio) |

Nvidia Corporation | NVDA | Semiconductor | America | 2.2 | 0.02 | 75.6 |

Taiwan Semiconductor Manufacturing | TSM | Semiconductor | Taiwan | 0.642 | 1.13 | 26.86 |

Broadcom Limited | AVGO | Semiconductor | America | 0.607 | 1.58 | 48.3 |

ASML Holding | ASML | Semiconductor Equipment & Materials | Netherlands | 0.357 | 0.61 | 46.43 |

Texas Instruments | TXN | Semiconductor | America | 0.1682 | 2,83 | 28.47 |

Advanced Micro Devices | AMD | Semiconductor | America | 0.2465 | - | 225.58 |

Qualcomm | QCOM | Semiconductor | America | 0.2022 | 1.88 | 24.21 |

Intel Corporation | INTC | Semiconductor | America | 0.1281 | 1.67 | 31.25 |

Applied Materials | AMAT | Semiconductor Equipment & Materials | America | 0.172 | 0.77 | 24.38 |

Lam Research Corporation | LRCX | Semiconductor Equipment & Materials | America | 0.1187 | 0.88 | 33.58 |

Micron Technology | MU | Semiconductor | America | 0.131 | 0.39 | - |

(Note: Data is updated as of May 10 , 2024)

4. 10 Most Notable Semiconductor Companies in 2024

From the 11 popular companies, we continue to select the top 10 notable semiconductor companies, each of which is a leader in its respective industry segment, with core competitive advantages and remarkable growth in recent years.

4.1 Texas Instruments: Reputation in the Simulation Field

Company Name: Texas Instruments

US Stock Code: TXN

Established: 1930

Main Revenue Source: Selling simulation devices

Website: https://www.ti.com/

Texas Instruments is the world's largest semiconductor simulation company. Its main customers include companies in the industrial, automotive, communications, and consumer electronics sectors. Due to the influence of simulation characteristics, Texas Instruments' products and technologies are highly independent, difficult to replicate, and surpass others.

Texas Instruments' stock price increased by 9.75% ($185.32) by 5/2024, with a P/E ratio of 28.67. Despite some fluctuations in stock price, the company's profits have remained stable. The company has built a strong protective barrier based on a rich product portfolio, a robust sales model, industry mergers and restructuring, and continuous investment in research and development over decades. This has helped Texas Instruments secure a leading position in the industry.

Real-time quote chart for TXN stock price chart ▼ Mitrade

Register and trade stocks CFDs with 0 commission and low spreads! Trade Demo with 50,000USD RISK-FREE virtual money!

4.2 NVIDIA: Dominant Player in the Chip Industry

Company Name: Nvidia Corporation

US Stock Code: NVDA

Established: 1993

Main Revenue Source: Data center and gaming business

Website: https://www.nvidia.com

Nvidia, originating from the graphics card market, has become a widely recognized company. ChatGPT has become a global phenomenon, targeting end users for the first time, and major companies have competed to enter the market, with Nvidia emerging as the winner. TrendForce predicts that GPU demand will reach 30,000 units, and Nvidia holds a significant advantage in this field.

Despite the general semiconductor industry downturn last year, Nvidia has demonstrated strong business performance. Their two core sectors, data centers and automotive, have experienced explosive growth. Their autonomous driving solutions have been well-received, and they have signed partnerships with Foxconn and expanded their market scale.

Furthermore, with the emergence of artificial intelligence in the new era, Nvidia remains a company that investors should pay attention to. Nvidia's stock price has increased by 205.97% in 1 year (by 5/2024) , but it also carries notable risks for investors.

Real-time quote chart for NVDA stock price chart ▼ Mitrade

4.3 Broadcom: Crown in the Communications Chip Industry

Company Name: Broadcom Limited

US Stock Code: AVGO

Established: 1991

Main Revenue Source: Semiconductor solutions

Website: https://www.broadcom.com/

Broadcom operates mainly in the fields of networking and data storage, enterprise applications, computer and software monitoring and security, smartphone components, telecommunications, and factory automation.

Broadcom has achieved a leading position in its field by providing high-performance solutions and continuously acquiring other companies to expand its product line and market share.

Broadcom's stock price has increased by 109.89% in 1 year, reaching $1305.67 (as of 10/5/2024). The company has consistently improved its profitability and will continue to leverage its technological advantage and market position to provide more efficient solutions. Broadcom will also benefit from investments in emerging areas such as artificial intelligence to deliver smarter and more natural business services.

Real-time quote chart for AVGO stock price chart ▼ Mitrade

4.4 Qualcomm: King of Mobile Processors

Company Name: Qualcomm

US Stock Code: QCOM

Established: 1985

Main Revenue Source: Mobile processor business and patent licensing

Website: https://www.qualcomm.com/

Qualcomm is a leading global technology company specializing in wireless technology innovation. Its main operations include mobile chips (QCT), patent licensing (QTL), and the Internet of Things (IoT), automotive, computing, etc. Qualcomm generates revenue and profits by providing wireless solutions and patent licensing to customers.

Qualcomm's stock price has increased by 68.73% in 1-year, reaching $180.51 (as of 10/5/2024). Despite being affected by the downward trend in 2022, the stock price has started to recover gradually. As the largest provider of 5G processors, Qualcomm has a market share of up to 53% and collaborates with numerous mobile phone manufacturers, service providers, and infrastructure manufacturers globally.

Not only achieving success in the current trillion-dollar market, the company also expects to benefit from emerging areas such as augmented/virtual reality, connected cars, and the Internet of Things, reaching a $7 trillion market value by 2030.

Real-time quote chart for QCOM stock price chart ▼ Mitrade

4.5 Advanced Micro Devices (AMD): CPU Growth Phenomenon

Company Name: Advanced Micro Devices

US Stock Code: AMD

Established: 1969

Main Revenue Source: Gaming Industry

Website: https://www.amd.com

AMD is primarily involved in the development and sale of processors, graphics cards, chips, and various other products. It competes with rivals such as Intel and NVIDIA in high-end gaming, data center, and artificial intelligence sectors to gain market share.

Recently, AMD has established long-term strategic relationships with Microsoft, Sony, Apple, and other partners, providing customized solutions to enhance stability and generate sustainable income. AMD also attracts more developers to join their ecosystem through open platforms and systems.

The stock price of AMD has increased by 58.05% in 1-year, reaching $152.39(as of 10/5/2024), showing outstanding stock price growth compared to profit fluctuations. In the future, AMD plans to continue expanding its global market share based on advanced 7nm technology products and more advanced technologies.

Real-time quote chart for AMD stock price chart ▼ Mitrade

4.6 ASML Holding: Leading in the Field of Light Projection

Company Name: ASML Holding

US Stock Code: ASML

Established: 1984

Main Revenue Source: Semiconductor Equipment Sales

Website: https://www.asml.com

ASML is primarily engaged in the research and manufacturing of light projection machines, maintaining a leading position in this field and being the sole provider of Extreme Ultraviolet (EUV) light projection machines. The company collaborates with Samsung, TSMC, Intel, and other semiconductor manufacturers to supply products and services.

The stock price of ASML has increased by 40% in 1-year , reaching $913.54 (á of 10/5/2024),. In the future, ASML plans to expand its EUV light projection manufacturing capabilities and strengthen collaboration with global customers and suppliers. Investors may continue to monitor the company's stock price.

4.7 Applied Materials: Leading Equipment Supplier in the Semiconductor Industry

Company Name: Applied Materials

US Stock Code: AMAT

Established: 1967

Primary Revenue Source: Sale of semiconductor equipment

Website: http://www.appliedmaterials.com

Applied Materials is one of the largest suppliers and service providers in the semiconductor manufacturing industry. It is also a leader in materials engineering for flat panel displays and solar energy technology. Its main activities include semiconductor systems, global services, and the display and related markets.

Applied Materials focuses on providing high-quality, efficient, and value-driven products and services. It also offers various system platforms to improve efficiency and reduce investment costs. The stock price of Applied Materials has increased by 78.61% in 1-year, reaching $206.33 USD (as of 10/5/2024).

The price-to-earnings ratio (P/E ratio) was 22.02 in 2020, 13.09 in 2022, and currently stands at 24.39, indicating a gradual recovery in the P/E ratio. In the future, the company will continue to benefit from the rapid development of the flat panel display and solar energy industries, as well as the growing demand in 5G, Internet of Things (IoT), and artificial intelligence (AI) sectors.

Real-time quote chart for AMAT stock price chart ▼ Mitrade

4.8 Intel: Leader in PC Processing

Company Name: Intel Corporation

US Stock Code: INTC

Established: 1968

Primary Revenue Source: Computing solutions for customers

Website: https://www.intel.com

Intel primarily operates in the fields of computing solutions for customers, data centers, IoT, non-volatile memory solutions, and programmable solutions. It provides semiconductor products and services along with chip design services. The company holds a major market share in CPUs for personal computers.

Although Intel is currently facing strong competition, it remains a dominant player in the market due to its strong presence in desktop and mobile computing.

The stock price of Intel is $30.09 USD (as of 10/5/2024). The P/E ratio was 10.08 in 2020, 5.44 in 2022, and currently stands at 31.25, indicating that Intel has been significantly impacted by this price decline, and its stock price has been seriously affected. However, it has started to recover gradually this year. In the future, Intel will benefit from the development of smart automobiles and the recovery of the personal computer market.

Real-time quote chart for INTC stock price chart ▼ Mitrade

4.9 Lam Research: Leadership in Semiconductor Equipment

Company Name: Lam Research Corporation

Stock Ticker: LRCX

Established: 1980

Main Revenue Source: Sale of manufacturing equipment

Website: http://www.lamresearch.com

Lam Research is a semiconductor equipment manufacturer, primarily providing equipment such as deposition, etch, clean, and metrology. The company holds a 50% market share in the etch segment. With technical prowess, customer base, and market share, Lam Research delivers efficient, high-quality, and value-driven solutions for semiconductor manufacturers.

The stock price of Lam Research has increased by 73.16% in 1-year, reaching $907.54 USD (as of 10/5/2024). The P/E ratio was 31.28 in 2020, 12.83 in 2022, and currently stands at 33.58, indicating that Lam Research's stock price still has potential for further growth, and investors may consider opportune moments to buy. In recent years, Lam Research has benefited mainly from growth in storage, 5G, artificial intelligence, and other fields. In the future, revenue is expected to continue benefiting from the recovery in the storage sector.

Real-time quote chart for LRCX stock price chart ▼ Mitrade

4.10 Micron Technology: Leading in Memory Storage

Company Name: Micron Technology, Inc.

Stock Ticker: MU

Established: 1984

Main Revenue Source: Revenue from computing and networking

Website: http://www.micron.com/

Micron Technology primarily sells various types of memory storage, including DRAM, NAND flash memory, NOR flash memory, and 3D Xpoint. The company holds a 22.52% market share in the DRAM segment (ranked third), 11.6% in the NAND flash memory segment (ranked fourth), and 5.4% in the NOR flash memory segment (ranked fifth).

The stock price of Micron Technology has increased by 90.26% in 1-year, reaching $117.81 (as of 10/5/2024). Although the stock price and profit declined in the previous year due to the impact of the recession, this year the market has rebounded, and the company's stock price still has further development potential.

Real-time quote chart for MU stock price chart ▼ Mitrade

5. Factors influencing the stock price of semiconductor companies in the future

Market demand changes

The semiconductor industry has undergone significant changes primarily due to the development of mobile products such as personal computers, mobile phones, and later areas such as the Internet of Things (IoT), 5G, artificial intelligence (AI), automotive electronics, and more.

In the future, the global number of connected 5G devices is expected to reach 1.48 billion units by 2024, an increase of 31.7% compared to the same period, the number of IoT devices is expected to increase by 38.5% compared to the same period, and the number of automotive electronics is expected to increase by 35.1% compared to the same period. Market demand changes will continue to drive changes in the stock price of semiconductor companies.

Inventory level changes

The global semiconductor inventory reflects supply and demand conditions and expectations in the future. High inventory levels indicate weak market demand or supply exceeding demand, negatively impacting stock prices; low inventory levels indicate strong demand or insufficient supply, positively impacting stock prices.

Technological innovation

Technological innovation brings new market demands, competitive advantages, and new profit opportunities, significantly impacting the stock price of global semiconductor companies. When a semiconductor company has the ability to innovate technologically, their stock price will be favored in the market.

For example, the current diversification and specialization of AI chips, the ability to increase the output and performance of EUV lithography machines, and many other highlights are pushing the stock prices of related companies to new heights.

It is advisable to focus on monitoring the situation of semiconductor companies such as ASML (ASML.US) and Applied Materials (AMAT.US) as demand recovers, as well as the growth of Nvidia (NVDA.US) and AMD (AMD.US) in the AI field recently. It is important to note the timing of buying stocks for each company, as there has been a significant increase in February and March, with the risk of a downward correction.

Meanwhile, Broadcom (AVGO.US) and Texas Instruments (TXN.US) are stable "bull" stocks, which conservative investors may consider particularly in these two stocks.

In addition to the factors influenced by changes in market demand, inventory fluctuations, and technological innovation, attention should also be paid to overall market fluctuations and the general economic situation.

6. Risks of investing in semiconductor stocks

General economic instability

The uncertainty of the overall economic situation and the impact of interest rate hikes can have unpredictable effects on semiconductor-related companies. Recent fluctuations in the banking sector in Silicon Valley have caused market panic, and the Federal Reserve's attitude towards interest rate hikes still needs to be closely monitored.

Technological competition

The semiconductor industry requires continuous innovation and investment in research and development to maintain an advantage in design, advanced manufacturing processes, packaging, and other areas. Advances and delays in technology can lead to market share shifts and changes in stock prices of companies.

Declining market demand

Demand for consumer electronics products may decrease, and the prospects of recovering demand for mobile phones and personal computers in the second half of the year remain unclear. The recovery of demand for data centers and cloud computing, as well as the growth in computing power from artificial intelligence, still need further evidence to be demonstrated.

7. How to find the best timing for trading semiconductor stocks?

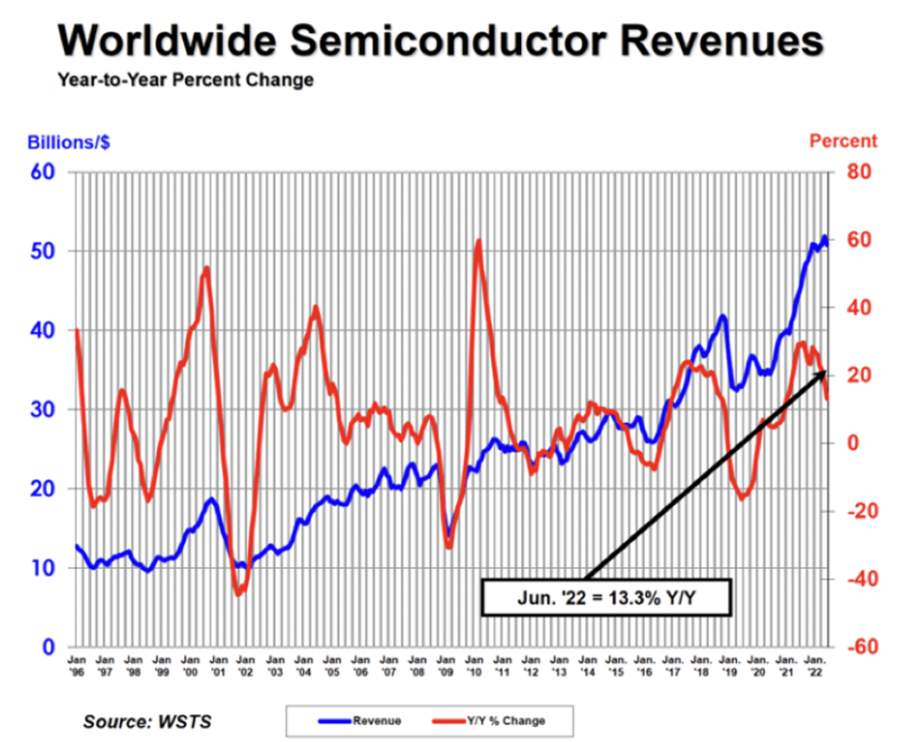

(Suorce: WSTS)

The semiconductor industry typically operates in cycles that last around 4-5 years. From the peak of a cycle to the most recent trough, the latest cycle lasted from December 2015 to June 2019 (3 years and 6 months). The Philadelphia Semiconductor Index (SOX.US) reached its bottom in August 2015 and December 2018, with stock prices reacting about 3-6 months ahead of the basic cycle.

Currently, the cycle began in the second half of 2019, continued to face global chip shortages and price increases in the latter half of 2020, and witnessed a turning point in October 2021. Based on this, it is expected that the bottom of this cycle will occur in Q1-Q2 2024, with currencies reacting about 6 months earlier. Currently, you can gradually shape your investment in the semiconductor industry, preparing to embrace the recovery cycle.

8. Conclusion

In general, the semiconductor industry is one of the potential industries with strong development prospects in 2024, as the demand for electronic devices, computers, smartphones, and smart cars continues to increase. In this article, we have introduced the top 10 semiconductor stocks worth investing in 2024, based on criteria such as revenue, profit, growth, strategies, and prospects of the companies.

These stocks all have the potential to generate high profits for investors by seizing the recovery opportunity of the chip industry after the Covid-19 pandemic. They can provide safety and stability to your investment portfolio in a volatile and challenging market. However, please note that these are personal perspectives and not investment recommendations. You should consult multiple sources and combine them with your own investment strategy and selection criteria to make informed decisions for your portfolio.

What criteria are used to select the best semiconductor stocks?

What role do semiconductor stocks play in the artificial intelligence industry?

How do interest rates affect semiconductor stocks?

How do geopolitical tensions impact semiconductor stocks?

What impact does the global chip shortage have on semiconductor stocks?

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.