Japanese Yen Analysis & Forecast In 2024/2025/2026: Should I Buy USD/JPY Or Other JPY Currency Pairs?

In the global currency markets, few currencies carry the weight and influence of the Japanese Yen (JPY). Renowned for its stability and significance in international trade, the Japanese Yen stands as a backbone in the forex market, shaping trends and dictating investor sentiments.

As we step into the years 2024, 2025, and 2026, the spotlight intensifies on the trajectory of the Japanese Yen. Amidst evolving economic landscapes, geopolitical tensions, and central bank policies, discerning investors are left pondering: Should I buy USD/JPY or explore other JPY currency pairs?

This article delves into a comprehensive analysis and forecast of the Japanese Yen, navigating through the intricate factors that may sway its valuation in the coming years. From dissecting macroeconomic indicators to scrutinizing geopolitical developments, we aim to equip investors with the insights needed to handle the unpredictable changes in JPY currency pairs.

1. The performance of the Japanese Yen over the years

In the past 15 years, the Japanese Yen (against the US Dollar) has experienced significant fluctuations in performance due to various economic factors and monetary policies of both countries.

The Japanese Yen Currency Index over the years (Source: Tradingview.com)

Before 2012, the Japanese Yen appreciated significantly, which posed challenges for domestic exporters and raised concerns about the competitiveness of their goods in international markets. This trend also put downward pressure on Japan's economic growth. To address this, the Bank of Japan (BOJ) implemented expansionary monetary policies to mitigate the Yen's appreciation and support the country's export-oriented industries.

In 2012, the inauguration of Prime Minister Shinzo Abe marked a turning point in Japan's economic policy. Under his leadership, the government adopted an aggressive strategy known as "Abenomics" to revitalise economic growth. This strategy included three main components: monetary easing, fiscal stimulus, and structural reforms. The BOJ implemented unprecedented levels of quantitative easing as part of the monetary easing component, with the aim of depreciating the Yen to boost exports and combat deflationary pressures.

As a result of these policy interventions, the Japanese Yen experienced a sharp depreciation against major currencies, falling below the psychological threshold of 100 by early 2013. It then exhibited relative stability, fluctuating within a narrow range of approximately 96 to 100 until mid-2014. However, this period of stability was short-lived, as the Yen embarked on a pronounced downtrend, reaching a multi-year low of 80 Yen per Dollar in July 2015.

The primary driver behind this significant depreciation was the divergence in monetary policy between Japan and the United States. While the Federal Reserve signaled a tightening monetary stance by gradually raising interest rates, the BOJ continued its accommodative policy stance, maintaining ultra-low interest rates and expanding its balance sheet through asset purchases. This policy divergence created a yield spread that favored the U.S. Dollar, prompting investors to unwind Yen-denominated assets and seek higher returns elsewhere. Consequently, the Yen depreciated sharply, with adverse implications for Japan's import-dependent industries.

However, the Yen's fortunes began to reverse course in early 2016 as global economic uncertainties and risk aversion triggered a flight to safety, bolstering demand for the Yen as a safe-haven currency. Additionally, concerns over the sustainability of global growth and uncertainties surrounding geopolitical developments contributed to a resurgence in demand for the Japanese currency, driving its appreciation against major currencies.

From 2018 to mid-2021, the Japanese Yen exhibited a relatively stable trading range, fluctuating between 88 and 96. This period of stability was supported by a convergence in monetary policy outlooks between the U.S. and Japan. Both central banks maintained accommodative policy stances in the face of subdued inflationary pressures and modest economic growth.

However, from the latter part of 2021 until now, the Yen started to weaken once again, reaching a new low of 64 points in April 2024. This depreciation reflects changing market dynamics and shifting investor sentiment. Several factors have contributed to this renewed depreciation, including concerns over Japan's fiscal sustainability, heightened inflation expectations, the monetary policies of the United States, Japan, and other countries, as well as geopolitical tensions and uncertainties surrounding the global economic recovery.

Register and trade Forex CFDs with 0 commission and low spreads! Trade Demo with 50,000USD RISK-FREE virtual money!

In the next part of the article, we will delve deeper into the USD/JPY exchange rate from 2022 to late 2024 to assess investment opportunities with JPY currency pairs in the coming years.

2. Historical USD/JPY analysis in 2022/2023/2024

From early 2022 until now, the general trend of USD/JPY has been upward, reflecting the depreciation of the Japanese Yen against the US Dollar.

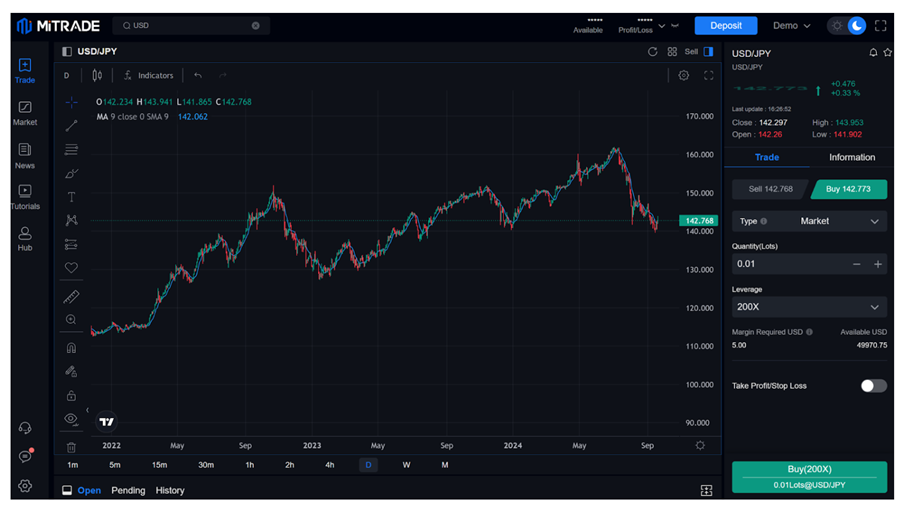

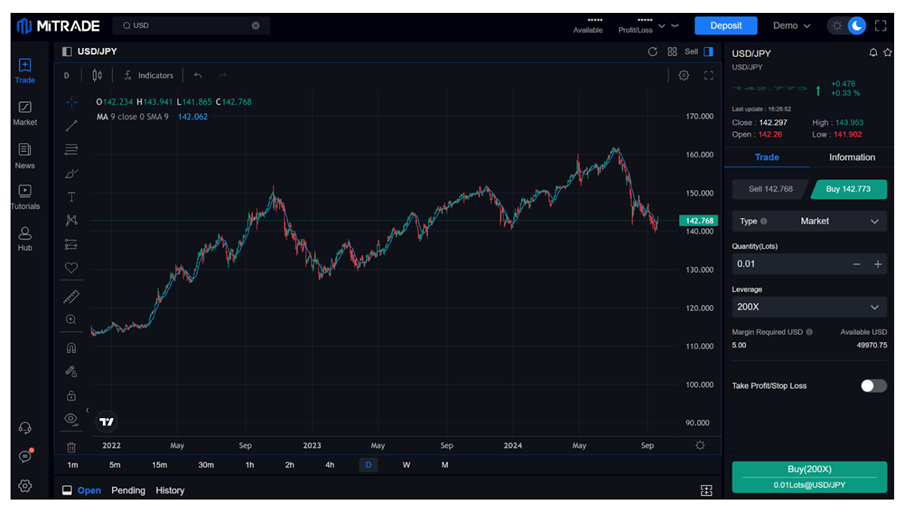

The price chart of USD/JPY from 2022 to late 2024 (Source: Mitrade)

At the beginning of March 2022, the USD/JPY exchange rate sharply increased due to the Federal Reserve's interest rate hike policy aimed at curbing inflation, while the Bank of Japan continued to maintain negative interest rate policies to support the economy after the COVID-19 pandemic. By mid-October 2022, the USD/JPY exchange rate reached 151.94, the highest level since April 1990.

Subsequently, the USD/JPY exchange rate began to decline following reports suggesting that the Federal Reserve would ease off on interest rate hikes starting from December 2022. By mid-January 2023, the exchange rate touched 127.5.

However, the USD/JPY exchange rate has since rebounded and resumed its upward trajectory. This upward movement has persisted despite the Bank of Japan ceasing its negative interest rate policy on March 19, 2024, and Japan's efforts to intervene in the forex market. Currently, the USD/JPY is trading at 155.5, approaching its peak level observed in January 1990.

By late July, the rate had declined to around 154.00, with forecasts suggesting it could end the year between 138 and 177, depending on further developments in monetary policies and economic conditions in both countries

If you just want to chase opportunities from the changes in buying and selling prices, regardless of whether the JPY is decreasing or increasing in value, trading CFDs (Contract for Difference) may be an optimal choice for traders who prioritize daily trading or are confident in leveraged trading, due to its low trading fees and flexible leverage options.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

3. Should I buy JPY currency pairs? Where to trade online?

The Japanese Yen has historically been considered a safe haven by many investors, leading to its significant appreciation against the US Dollar in recent years despite economic uncertainties. However, the current context shows a different picture as the JPY continues to depreciate.

Japan's economic indicators for the fourth quarter of 2023 reveal that the nation entered a technical recession after experiencing consecutive quarters of negative growth. In Q4 2023, Japan's GDP contracted by 0.1% compared to the previous quarter and decreased by 0.4% year-on-year. Moreover, the GDP growth rate for Q3 2023 was revised downward to -0.8%. As a result of these economic trends, Japan has been surpassed by Germany as the world's third-largest economy. Japan's current GDP stands at $4.2 trillion, trailing behind Germany's $4.5 trillion.

Given the pronounced weakness of the Japanese Yen, which is the most notable in the past 34 years, buying JPY currency pairs at this time may entail heightened risks for investors. However, diligent market tracking and careful monitoring of financial and economic indicators can help identify suitable trading points. This content will be continued in the next section of the article.

In today's trading landscape, traders have numerous options for trading currencies against the Japanese Yen. Instead of solely buying when predicting an upward price trend or short-selling during downward trends, traders can explore various online CFD brokers such as Mitrade, Etoro, and Fxpro. These brokers offer access to diverse trading platforms and instruments.

These platforms often provide advanced tools and features, allowing traders to implement different strategies like sentiment analysis, market data analysis, technical analysis tools, and educational resources. Additionally, traders can benefit from competitive pricing, leverage options, and comprehensive market analysis resources offered by these reputable brokers.

The List of some JPY currency pairs on Mitrade

You can 'BUY' the EURJPY currency pair when you believe the EUR will be stronger than the JPY. Conversely, you can place a 'SELL' order when you think the JPY will strengthen in the near future.

4. How to analyze the Japanese Yen- How to find a buying/ selling signal?

When analyzing the Japanese Yen and looking for buying/selling signals, it's important to consider both fundamental and technical analysis. Here are some key aspects to consider:

Fundamental Analysis:

- Economic Indicators: Analyze key economic indicators from Japan, such as GDP growth, inflation rate, employment data, and trade balance, etc. Strong economic data could indicate a strengthening yen, while weak data could lead to yen depreciation.

Factors | Result | Impact |

BOJ’s interest rate | Increasing interest rate | Positive |

Inflation | Range from 0% to 2 % | Positive |

GDP | Stable growth | Positive |

The balance of trade | Trade surplus | Positive |

Unemployment rate | Low | Positive |

PMI | High | Positive |

Public debt | Low | Positive |

FDI | High | Positive |

- Monetary Policy: Keep an eye on the monetary policy decisions of the Bank of Japan (BOJ). Changes in interest rates, quantitative easing measures, and forward guidance can have a significant impact on the value of the Yen. It's also important to consider the monetary policies of other central banks, especially those of countries with close trade relations with Japan, as they can influence currency trends between the two countries.

- Market Sentiment: Monitor market sentiment towards the Japanese yen. Geopolitical tensions, global economic uncertainties, and risk-on or risk-off sentiment can influence investor perception of the yen as a safe-haven currency.

- Currency Correlations: Assess correlations between the Japanese yen and other major currencies, such as the US dollar (USD), euro (EUR), and Australian dollar (AUD). Understanding these relationships can help predict yen movements relative to other currencies.

- Central Bank Interventions: Be aware of potential interventions by the Bank of Japan in the foreign exchange market to influence the value of the yen. Such interventions can create short-term volatility and affect trading decisions.

- Global Events: Stay informed about global events, economic releases, central bank announcements, and geopolitical developments that could affect currency markets and investor sentiment towards the Yen.

Technical Analysis:

Utilize technical analysis techniques to identify potential entry and exit points for JPY currency pairs. Analyze price charts, support and resistance levels, trend indicators, and momentum oscillators to gauge market trends and potential price movements.

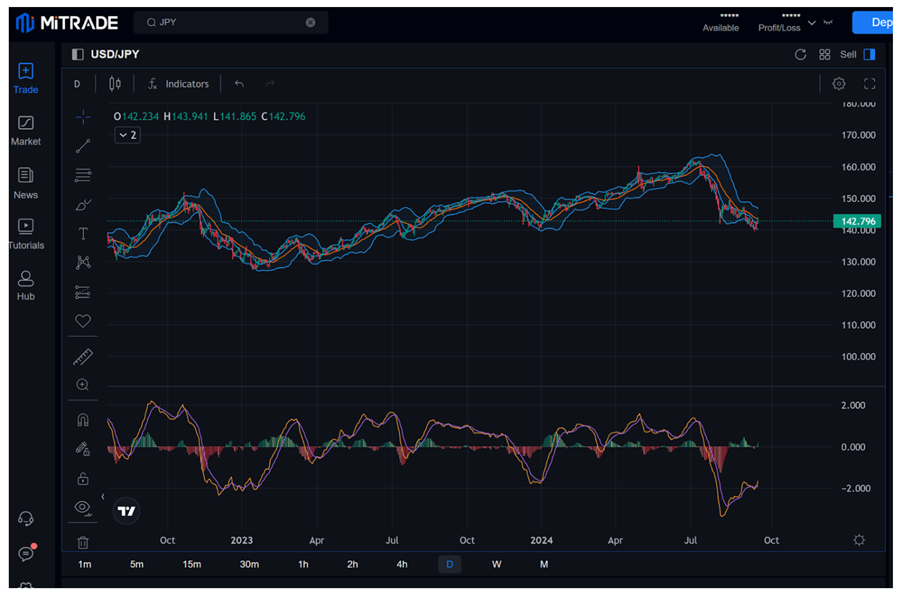

Price chart of USD/JPY (Source: Mitrade)

For example:

The USD/JPY is in an ascending channel on the weekly chart, indicating a continued upward trend.

The MACD indicator is in the positive zone with its lines directed upward, confirming strong upward momentum and the current bullish trend.

The 50-day moving average (MA-50) is above the 100-day moving average (MA-100), a bullish signal that the faster SMA is above the slower SMA and the trend is upward

The USD/JPY reached a high of 161.90 in July 2024 before declining to around 154.00 as of late July. These levels could act as resistance and support, respectively.

The Relative Strength Index (RSI) measures the speed and change of price movements, with readings above 70 indicating overbought levels and below 30 determining oversold areas.

5. USD/JPY Forecast in 2024/2025/2026

The forecast for the Japanese Yen's exchange rate in the upcoming years has sparked divergent perspectives among analysts and leading financial entities:

Longforecast, a reputable financial technology firm renowned for its expertise in providing comprehensive price forecasting data, particularly through technical analysis, has projected that the USD/JPY exchange rate will range between 151 and 175 in 2024. This is expected to climb to 176 to 186 in 2025 and further surge to 192 to 211 in 2026. These forecasts signify a pronounced depreciation trend of the JPY against the USD over the forthcoming years.

Meanwhile, banks worldwide have more modest predictions for the USD/JPY forex pair in the coming years. They still anticipate an early recovery in the strength of the JPY. ING, a Dutch bank, forecasted in early April 2024 that the USD/JPY would reach around 138 by the end of 2024 and fluctuate within the range of 140 to 142 in 2025. Bank of America forecasted that USD/JPY would reach 160 in 2024 but decrease to 136 - 147 in 2025.

However, a reduction of 50 basis points in the interest rate might enable the retest of the September 17 low of 140.32 and thereafter facilitate the challenge of the year-to-date (YTD) low of 139.58.

As the USD/JPY exchange rate continues to scale new peaks throughout April 2024, unabated by Japanese market interventions or monetary policy adjustments, financial institutions worldwide are incessantly recalibrating their forecasts for this currency pair. This underscores the capricious nature of the foreign exchange market, particularly amid heightened economic and political turbulence globally.

In the short-run, the USD/JPY trajectory will be influenced by the US job market statistics and the interest rate decision made by the Bank of Japan on Friday. An increase in unemployment claims and a cautious position by the Bank of Japan on interest rates might depress the USD/JPY exchange rate below 139.5. The present monetary policy positions of the Bank of Japan (BoJ) and the Federal Reserve (Fed) indicate a decreasing difference in interest rates, which implies a downward force on the USD/JPY exchange rate.

Market participants should maintain vigilance, as the Bank of Japan's interest rate decision is essential for the USD/JPY currency pair. Utilise real-time data, central bank perspectives, and expert analysis to adapt your trading methods for optimal results. Maintain a competitive edge in the industry with our specialized knowledge.

Hence, long-term prognostications for the USD/JPY exchange rate ought to be regarded with caution, serving primarily as reference points. Traders are advised to meticulously monitor market dynamics and the myriad factors influencing the Japanese Yen, as analyzed in section 4 of the article, to make better price predictions for each period and trading decisions.

6. FAQs about Japanese Yen

#6.1 What are the key factors influencing the Japanese Yen's performance in 2024?

Several factors, including Japan's economic growth prospects, monetary policy decisions by the Bank of Japan, global market sentiment, and geopolitical developments, are likely to impact the Japanese Yen's performance in 2024.

#6.2 How might the Bank of Japan's monetary policy decisions affect the USD/JPY and other JPY currency pairs?

The Bank of Japan's monetary policy decisions, such as changes in interest rates and asset purchase programs, can influence the value of the Japanese Yen relative to other currencies. Accommodative monetary policies may weaken the yen, while hawkish policies could strengthen it.

#6.3 What are the potential risks associated with trading USD/JPY or other JPY currency pairs in 2024?

Risks associated with trading USD/JPY or other JPY currency pairs in 2024 include volatility stemming from economic data releases, geopolitical tensions, unexpected policy changes, and fluctuations in global financial markets.

#6.4 How might economic trends in Japan and the United States impact the USD/JPY exchange rate?

Economic trends in Japan, such as GDP growth, inflation, and trade balances, along with corresponding trends in the United States, can influence the USD/JPY exchange rate. Stronger economic performance in one country relative to the other may lead to shifts in the exchange rate.

#6.5 What are the technical indicators or patterns to consider when analyzing USD/JPY or other JPY currency pairs?

Technical indicators such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and key chart patterns like support and resistance levels, trendlines, and candlestick formations can provide insights into potential buying or selling opportunities in USD/JPY or other JPY currency pairs.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.