Bitcoin Mining Beginner Guide: What Is Bitcoin Mining and How to Mine Bitcoin?

Bitcoin mining has come a long way since the early days when anyone with a laptop could join the party. In late 2025, with the network hashrate hovering above 1 zettahash per second, difficulty sitting around 148 trillion, and post-halving block rewards locked at 3.125 BTC, the game has turned industrial.

Hashprice is scraping lows near $37–$38 per PH/s per day—meaning only the most efficient rigs (think 16–17 J/TH efficiency) running on dirt-cheap power (under $0.05/kWh) are staying profitable. Bitcoin itself trades around $88,000–$90,000 as the year closes, but for retail miners, the math is brutal: power bills often outpace rewards, and solo mining is basically a lottery ticket you pay to lose.

This guide breaks down what Bitcoin mining really looks like—how it works, the real costs, who can still make it pay, and why most people are better off trading or holding BTC instead of firing up rigs in the garage. No hype, just the straight facts so you can decide if it's worth your time and money.

What is Bitcoin Mining? How Bitcoin mining works

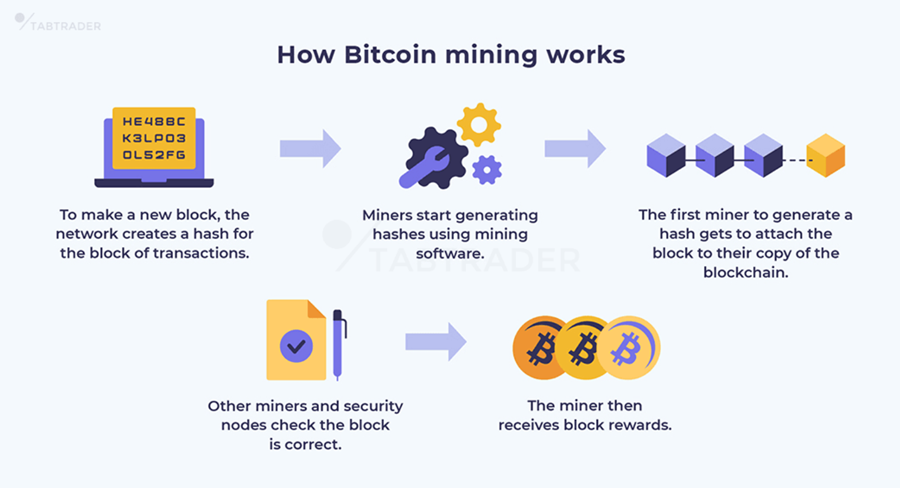

'Bitcoin mining' refers to miners working for the Bitcoin network, and in return, they receive Bitcoin (BTC) rewards. 'Miners' refer to people who own mining rigs and work for the Bitcoin network. 'Mining rigs' refer to the tools used to work for the Bitcoin network, such as computers.

Source: tabtrader.com

It works through proof-of-work (PoW): miners gather unconfirmed transactions from the mempool, pack them into a candidate block, then hammer the SHA-256 hash function over and over—trying billions or trillions of nonce values—until the resulting hash meets the network's current difficulty target (around 148.26 trillion as of late December 2025).

The difficulty recalibrates every 2016 blocks (roughly two weeks) to maintain an average 10-minute block time, regardless of how much hashrate joins or drops off. The entire network now cranks through over 1 zettahash per second (recent estimates put the 7-day SMA at ~1,057–1,150 EH/s), meaning roughly a sextillion guesses per second worldwide.

The first miner or pool to hit a valid hash broadcasts the block. Once the network accepts it via the longest valid chain, the block is added, transactions confirm, and the winner collects the fixed block reward—currently 3.125 BTC (post-2024 halving)—plus whatever transaction fees are included (fees stay relatively low in late 2025, usually adding only a small fraction unless the mempool clogs).

Solo mining is a non-starter for almost everyone—the odds against solving a block alone are astronomical against the global hashrate—so miners join pools, combine firepower, and share rewards proportionally.

What Changes Have Occurred in Bitcoin Mining?

With the rise in Bitcoin prices and the influx of more people, the mining industry has also undergone many changes, mainly reflected in three dimensions: mining rigs, mining methods, and mining rewards. It can be seen that Bitcoin has undergone significant changes.

Mining machine | CPU | From 2009 to 2012, mining could be done using the CPU of an ordinary computer . |

GPU | In the first quarter of 2013, GPU and graphics card mining became popular. | |

ASIC | In the second quarter of 2013, the use of application-specific integrated circuits (ASICs) as a specialized mining hardware device gradually dominated the entire mining market. Commonly used ASIC mining machines include Avalon and Antminer. | |

Mining form | Solo Mining | Independent mining refers to independent mining by individuals or institutions, which mainly occurred between 2009 and 2013. |

Pool Mining | As the computing power of the entire network increases, the effective mining probability of independent mining decreases significantly, and it gradually becomes difficult to recover costs. In order to solve this problem, many miners choose to combine mining machines to form mining farms and mine BTC together. | |

Cloud Mining | Cloud mining is another form of Heli Mining, which just builds the mine in the cloud. This kind of website that combines computing power to operate together is commonly known as a "Mining Pool". Currently, the more well-known mining pools include F2Pool, Poolin, BTC.com, and AntPool. | |

Mining rewards | unique | In the early days of independent mining, the rewards and transaction fees contained in a single block were given to a certain person or institution. |

shared | During the current joint effort period, the team/mining pool owners will be divided according to the proportion of computing power. |

Changes in mining machines, mining forms, and mining rewards - compiled by Mitrade

From the perspective of mining rigs, they have evolved from ordinary computers to specialized mining rigs, with equipment costs ranging from hundreds of dollars to thousands or even tens of thousands of dollars. The mining method has also changed from individual to collaborative, with a very high degree of clustering. Correspondingly, the distribution of rewards has changed from individual to shared.

Mining has become an extremely capital-intensive, industrial-scale business. Mining only makes sense for those with industrial advantages (cheap power, scale, or renewables). For everyone else, the simpler, lower-risk path is to acquire BTC directly on an exchange and hold or trade strategically.

How to start Bitcoin mining?

Here is the basic process to get started with Bitcoin mining that you can refer to:

Get educated and run the numbers first

Before spending a cent, use a mining calculator (e.g., WhatToMine, CoinWarz, or Hashrate Index) to input your local electricity cost, hardware hashrate/power draw, and current BTC price. Factor in network difficulty (~148T) and hashprice (~$37–$38/PH/s/day). If your break-even looks years away or negative, stop here—buy/hold/trade BTC instead.

Choose your mining method

Pool mining (recommended for 99% of beginners): Join a pool to combine hashrate with thousands of others for steady, small payouts.

Cloud mining: Rent hashrate from a data centre (e.g., via platforms like AutoHash or similar)—hands-off but watch for high fees/scams.

Solo mining: Lottery odds against the global ~1 ZH/s hashrate—avoid unless for fun.

Skip CPU/GPU; it's pointless for BTC.

Buy the right hardware

Get an ASIC miner optimised for SHA-256 (Bitcoin). In 2025, look for efficient models like Bitmain Antminer S21 series or MicroBT Whatsminer M60/M66 (aim for 16–20 J/TH efficiency). Expect to pay $2,000–$10,000+ per unit depending on hashrate (e.g., 200–400 TH/s). Buy from reputable sellers. Factor in cooling, noise, and ventilation—rigs run hot 24/7.

Set up a secure Bitcoin wallet

Create a non-custodial wallet to receive payouts (e.g., hardware like Ledger/Trezor for security, or software like Electrum for ease). Never use exchange wallets for mining rewards.

Install mining software

Download pool-compatible software: CGMiner, BFGMiner, or user-friendly options like Awesome Miner/EasyMiner. Configure it with:

Your pool's URL (e.g., from F2Pool, AntPool, Foundry USA, or Slush Pool).

Worker name/ID (unique per rig).

Your BTC wallet address for payouts.

Pool username/password if required.

Join a mining pool

Sign up with a reputable pool (F2Pool, AntPool, ViaBTC, Foundry—check fees ~1–2%, payout schemes like PPS+ or FPPS). Enter the pool details into your software. The pool coordinates work and distributes rewards proportionally to your contributed hashrate.

Start mining and monitor

Power on the rig, connect to the internet, launch the software, and let it run 24/7. Monitor via the pool dashboard or software interface: hashrate, temperature (~60–80°C ideal), rejects, and earnings. Keep rigs cool and dust-free. Payouts (small fractions of BTC) arrive daily/weekly once you hit the minimum threshold.

BTC Mining Cost and Reward

The real costs of Bitcoin mining

Bitcoin mining today is far from the "plug in and profit" days—it's an industrial operation where costs can quickly exceed rewards for most setups. Here's the straight breakdown as of December 31, 2025, with BTC hovering around $87,000–$90,000, network difficulty at 148.26 T, global hashrate above 1 ZH/s (recent estimates ~1,057 EH/s on a 7-day average), and hashprice scraping $35–$38 per PH/s per day.

Electricity — The single biggest killer. A modern efficient rig (e.g., Antminer S21 series or Whatsminer M60/M66 at 16–20 J/TH) draws 3,000–5,000 W. At average commercial rates (~$0.10–$0.15/kWh in many places), that's $7–$18+ per day per machine just to run it. Break-even electricity price for top-tier hardware is often $0.06–$0.077/kWh or lower—anything above $0.08–$0.10/kWh usually means losses.

Hardware — Upfront $2,000–$10,000+ per ASIC, depending on hashrate, e.g., 200–400 TH/s models. Depreciation hits fast—economic lifespan is often 2–3 years as newer, more efficient machines flood in.

Cooling, maintenance & facility — Fans, air-con, dust filters, repairs (fans/PSUs fail), noise mitigation, and space. Add 10–20% to power costs in home setups; pro farms use industrial cooling to keep temps 60–80°C.

Pool fees & misc — 1–2% cut from rewards, internet, minor downtime. Cloud mining adds high management fees, often making it unprofitable.

Opportunity & hidden — Capital tied up (could buy BTC directly), noise/heat disruption, potential hardware obsolescence, and taxes on rewards.

Rewards

Block Rewards: Miners receive newly minted Bitcoins as block rewards for successfully adding a new block to the blockchain. This reward decreases over time due to halving events (approximately every four years).

Transaction Fees: Miners also earn transaction fees for including transactions in the blocks they mine. As the network processes more transactions, fees become an increasingly important part of mining rewards.

Long-Term Appreciation: Some miners hold onto their mined Bitcoins, hoping for long-term price appreciation. If Bitcoin's value increases significantly, the rewards gained earlier become more valuable.

In summary, mining in 2026 is profitable only for the leanest, lowest-cost players—everyone else is subsidising the network or burning cash. If your electricity isn't dirt-cheap and your setup isn't cutting-edge, you're almost always better buying/holding/trading BTC spot or CFDs: simpler, no noise, no surprise bills, and you capture the upside without the operational headache.

Reputable Cloud / Hashrate Rental Platforms and Hardwares

Currently, there are mainly two ways to mine Bitcoin - solo-mining or cloud mining. However, regardless of the choice, some preparatory work needs to be done to avoid illegal activities or getting scammed.

First, understand if mining is legal in the local area.

Mining is a power-intensive industry, especially the Proof of Work (PoW) mechanism, which consumes a large amount of electricity. Given the current global shortage of power resources, mining has been severely cracked down on or even banned in many countries or regions. Therefore, do not blindly engage in mining, otherwise the mining equipment may be confiscated, fines imposed, or even detention. In Taiwan, China, mining is legal, so this is not a concern at the moment.

Secondly, consider whether to buy mining rigs or rent computing power, self-mining or outsourcing.

If you have relatively professional mining capabilities, you can purchase mining rigs and operate and maintain them yourself, but you need to be aware of the noise generated by the operation of the machines that may affect others. If you are not very knowledgeable about mining, you can purchase mining rigs and entrust them to a third party, or directly rent computing power (with self-hosting). Beware of fraud, never buy mining rigs or computing power from unknown platforms, and consider more common products in the market, such as:

Mining machine model | Advantage | Shortcoming | Suitable for the crowd |

Antminer S19 Pro | High energy consumption, high computing power, low power consumption | Expensive, noisy, requires cooling system | Professional miners, miners who require high efficiency |

WhatsMiner M30S++ | High computing power and low power consumption. No external cooling system required | Large size and noisy | Professional miners, miners who require high efficiency |

AvalonMiner 1246 | High computing power and good cost performance | Short warranty period and loud noise | Beginner/intermediate miners looking for affordable miners |

Innosilicon T3+ | High computing power, low energy consumption | Expensive and noisy | Professional miners, miners who require high efficiency |

Bitmain Antminer S9 | Low cost and high popularity | Low computing power and high energy consumption | Beginner/intermediate miners looking for affordable miners |

Current mainstream Bitcoin mining machines - compiled by Mitrade

Platforms | Computing power | Price (per TH/s per day) | Suitable for the crowd |

NiceHash | 10 GH/s - hundreds of PH/s | Approximately US$0.05 - US$1.5 | Small miners or people who need short-term computing power |

Genesis Mining | 1 TH/s - 35 TH/s | $28-$979 | Miners with some experience in Bitcoin mining |

HashFlare | 100GH/s-10TH/s | $1.20 - $220 | Beginners or people looking for low risk investments |

Bitdeer | 1 TH/s - 50 TH/s | $20-$940 | People who want to mine multiple cryptocurrencies |

BTC computing power rental platform - organized by Mitrade

After choosing the mining rigs or computing power platform and completing other preparatory work, you can now start mining officially. Once the mining pool successfully mines a block, the contributor's shares will be rewarded with a certain proportion of BTC. The recipient can then choose to sell or hold the BTC based on their own preferences.

If collecting the rewards through a wallet, it is crucial to properly safeguard the private key or recovery phrase. If these are lost, the associated assets will be irrecoverable. If there is a suspected leak of the private key or recovery phrase, the wallet should be immediately replaced.

Can We Still Mine Bitcoin for Free?

No, individuals cannot mine Bitcoin for free in any practical way today, and certainly not in the manner of the early years.

In 2009–2011, low difficulty and CPU/GPU mining meant near-zero marginal cost for hobbyists, with rewards in newly valuable BTC.

Today, even a basic ASIC setup requires upfront hardware costs ($2,000–$10,000+ per unit), ongoing electricity (the dominant expense), and operational overhead.

Free mining is only possible in very rare situations, such as using excess solar power that would otherwise go unused, capturing flare gas from oil fields, or accessing heavily subsidized electricity. These scenarios are uncommon for ordinary people. Even when they occur, the amount of Bitcoin earned is usually too small to matter.

For the vast majority, mining costs exceed rewards, turning it into a subsidized contribution to network security rather than income.

What will happen when all Bitcoins are mined?

When all 21 million Bitcoins are mined (estimated around 2140), no new coins will ever be created. Miners will stop receiving block rewards and will rely solely on transaction fees to secure the network and validate transactions. This shift is designed to keep the blockchain running securely through economic incentives rather than new issuance.

The transition is expected to work because higher adoption should increase transaction volume and fees, compensating miners. Bitcoin's scarcity will be absolute, potentially boosting its value as "digital gold." The network continues indefinitely as long as fees remain sufficient to attract miners.

#1. What is the best Bitcoin mining rig to mine Bitcoin?

If we compare the hash rate, the current top mining rigs are the Antminer S19, Antminer S19 Pro, and WhatsMiner M30S+. However, profitability depends far more on your electricity price, cooling setup, hosting/hosting fees, and local regulations than on raw specs.

#2. Can you mine Bitcoin on any regular computer?

No, you cannot realistically mine Bitcoin on a regular computer (laptop, desktop CPU, or even a gaming PC with a GPU) in any profitable way. Instead, you can download Bitcoin mining software and join online mining pools.

#3. How long does it take to mine 1 BTC?

#4. Can Bitcoin mining never result in losses?

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.