In the world of big tech, Alphabet (Google's parent) keeps things simple for most punters: two main tickers—GOOGL (Class A) and GOOG (Class C). They look almost identical on the chart, move in lockstep, and give you the same economic slice of the pie. But there's a catch with voting rights—and in practice, it's tiny noise.

As of late December 2025, with Alphabet's market cap hovering around $3.8 trillion, AI momentum still strong (despite some Gemini ad rollout chatter), and regulatory noise in the background, the question remains: does the letter at the end matter? Spoiler: for 99% of investors, not really.

GOOG vs GOOGL: Overview

Alphabet class A vs class C

Alphabet Inc., the parent company of Google, offers two types of stock: Class A (GOOGL) and Class C (GOOG). The primary difference between the two lies in voting rights. Class A shares confer voting rights to shareholders, allowing them to have a say in corporate decisions. On the other hand, Class C shares do not provide any voting rights. This distinction is crucial for investors who wish to have an influence in the company's governance.

From a financial perspective, both share classes typically trade at similar prices, although Class A shares sometimes trade at a slight premium due to their voting privilege. When deciding which one to buy, investors should consider their desire for voting power versus their investment strategy and goals.

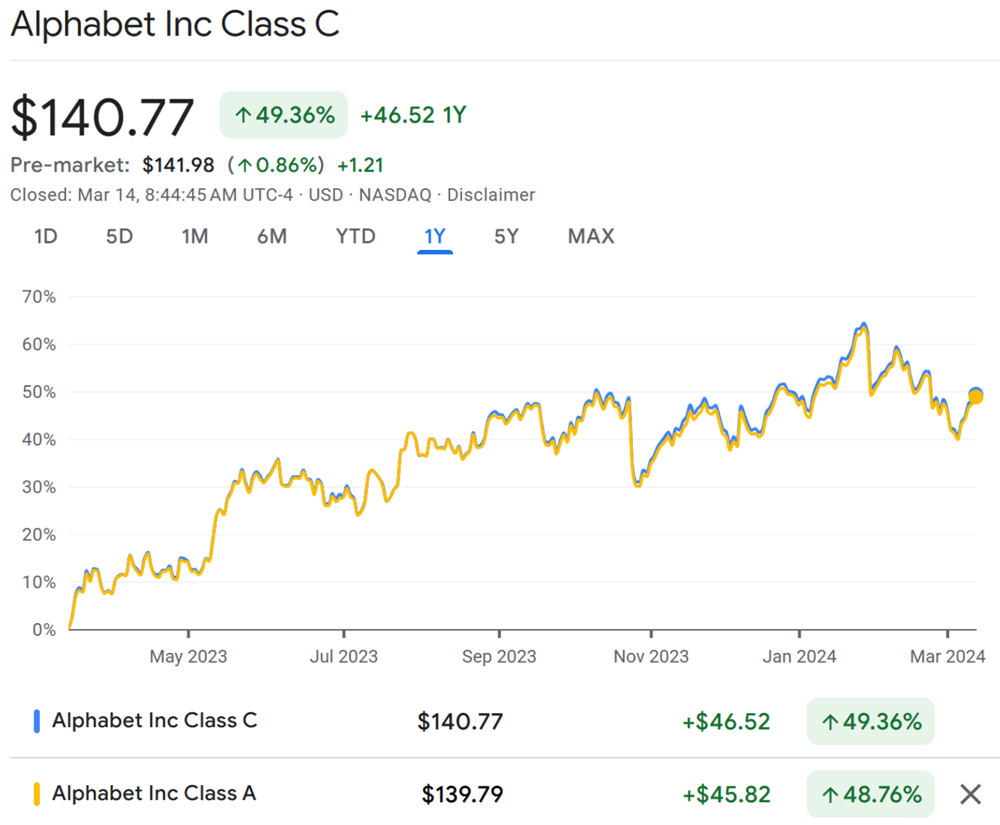

GOOG stock price chart

The only differences between GOOG and GOOGL are price and voting rights.

| Item | GOOGL (Class A) | GOOG (Class C) |

|---|---|---|

| Voting Rights | 1 vote per share | No voting rights |

| Latest Close | ~$313.51–$313.56 | ~$313.65–$314.39 |

| Price Difference | Usually trades at tiny discount | Often small premium (~0.2–0.5%) |

| 2025 YTD Return | ~66.3% | ~66.0% |

| 5-Year Total Return | ~256% (post-2022 split) | ~257% |

| P/E (TTM) | ~30.9–31.0 | ~31.1 |

| Dividend | None | None |

| Liquidity/Volume | Slightly higher (better for options) | High, but GOOGL edges it |

| Best For | Buy-and-hold, slight voting "feel" | Often cheaper entry, buybacks favour |

GOOG vs GOOGL: Price change trend

Since the 2022 20-for-1 split, GOOGL and GOOG have moved in near-perfect tandem, delivering monster total returns of approximately 256–257% over five years (as of late December 2025). That means a $10,000 investment back then would be worth around $35,600–$35,700 today, post-split adjusted. In 2025 alone, both classes posted strong YTD gains of roughly 66% (GOOGL ~66.3%, GOOG ~66.0%), fuelled by AI tailwinds in Search/Cloud, Gemini momentum, and robust ad recovery—despite occasional regulatory jitters and antitrust headlines.

Any tiny price divergences (usually under 0.5%, with GOOG often holding a slight premium from buybacks and RSUs) get arbitraged away fast by pros. These twins don't drift far—the business drives the ride, not the ticker letter. If you're holding long-term, the chart tells the same story either way.

Historical price comparison: goog vs googl over one year. Source: Google Finance

How to buy GOOG or GOOGL shares?

To buy these shares, one can follow these steps:

Open a brokerage account: Choose a reputable brokerage that aligns with your investment goals and offers access to the NASDAQ where both GOOG and GOOGL are traded.

Fund your account: Transfer funds into your brokerage account to make your purchase.

Research current market conditions: Analyze the current price, performance history, and market conditions of GOOG and GOOGL.

Place an order: Decide on the number of shares you wish to purchase and whether to place a market order (buying at current market price) or a limit order (setting a maximum purchase price).

Monitor your investment: Keep track of your investment's performance and the ongoing developments within Alphabet Inc., the parent company of Google.

In Section One, we mentioned the voting rights of Google stocks, which only apply when you purchase the underlying assets of the stocks. When buying some derivatives such as CFDs, you only gain or lose money based on the difference between the buying and selling prices, without any voting rights or stock dividends.

GOOG vs GOOGL: Which one should you buy?

They're basically identical twins on the chart. Both give you the same economic exposure to Alphabet—ads, Cloud, AI bets, the lot. The only difference is voting: GOOGL (Class A) has one vote per share; GOOG (Class C) has none. For retail traders like us, that vote is meaningless—founders control everything with their super-votes anyway.

Prices stay glued together. Right now (late Dec 2025), GOOG’s around $314, GOOGL $313.50, gap usually under 0.5%. Arbitrage pros squash any drift fast. GOOG sometimes trades a tiny premium from buybacks and RSUs, but it’s noise.

Long-term holder? Grab whichever’s cheaper that day—don’t overthink it. Active trader? GOOGL edges it for option liquidity and spreads. Tax play? Use small gaps for harvesting if you’re clever. Don’t chase the letter. Bet on the business, not the ticker. Size smart, stay patient, and let Alphabet do the work. The chart’s the same story either way.

FAQs

5.1 What about class B stock?

Google’s lesser-known Class B shares deserve attention. Unlike publicly traded shares, these special shares cannot be bought or sold on the stock market. However, they wield significant influence: each Class B share carries ten votes, granting it ten times the voting power of regular GOOGL shares.

The creation of Class B shares in April 2014 was strategic. Google’s founders, Larry Page and Sergey Brin, along with former CEO and chairman Eric Schmidt, designed these distinct share classes to maintain control of the company. Even if their individual ownership fell below 50%, the Class B shares ensured their continued influence over Google’s direction.These Class B shares serve as a powerful tool for insiders, safeguarding their say in critical decisions while preserving the company’s stability.

5.2 Does having a say in company decisions through voting really matter?

When you invest in GOOGL shares, you're granted the right to vote at shareholder meetings. But for an individual investor, the small number of shares you hold means your voice is hardly heard. This is especially true considering the company's founders and executives hold all class B shares, wielding over 60% of the voting strength. Thus, while it might feel good to have voting privileges, in reality, they don't offer much actual influence.

5.3 Google Stock Split: Why?

Google stock was originally GOOGL, class A shares. This stock has traded on Wall Street since the company's 2004 IPO. Since then, private Class B stock has had more voting power. GOOGL stock grows steadily. However, in 2012, Larry Page and Sergey Brin recognized that GOOGL's pricing may be deterring new investors. One of Wall Street's most expensive equities, GOOGL traded over $650.

Page and Brin intended to lower stock prices without losing voting power. The corporation chose a smart split over a stock issuance. The corporation introduced class C GOOG stock after this split.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.