Where to invest money in 2024? Best companies to invest in the Philippines

Investment has experienced a surge in Asian countries, particularly in the Philippines, in recent years. This growth can be attributed to increasing incomes, improved financial literacy, and a tech-savvy population.

According to a 2023 Manulife report, there has been a significant rise in investment interest among young Filipinos. The report indicates that 67% of millennials are already engaged in investing, with 77% actively practicing investment and 79% seeking to expand their financial portfolios.

"How to choose from different types of investments ? Where can I invest my money and which are the best companies to invest in the Philippines?" These questions are of particular interest to the younger generation in the Philippines today. This article aims to provide readers with answers that will help them make informed decisions in managing their finances.

1. Why should you learn how to invest money at an early age?

Investing money is a fundamental aspect of personal finance that offers numerous benefits and opportunities for financial growth. Here are some compelling reasons why one should learn to invest money:

+ To earn passive income: Investing in various asset types, such as stocks or rental properties, can provide consistent returns in the form of dividends or rental payments. Investors can choose to reinvest these earnings or integrate them into enriching their current lifestyles or financial plans.

+ To get benefit from compound returns: By reinvesting earnings, investments can generate further earnings. Over time, this compounding effect can significantly boost wealth accumulation as both the initial investment and its returns grow exponentially.

+ To mitigate the impact of inflation: Investing offers the potential for returns that outpace the rate of inflation. Assets like stocks, bonds, or real estate have the potential to increase in value over time. If the rate of return on investments exceeds the rate of inflation, purchasing power grows, helping to offset the erosion of the value of money caused by inflation.

+ To achieve financial independence: Investing allows money to grow over time, generating additional income streams or accumulating wealth. This reduces reliance on traditional sources of income, such as a salary, and provides flexibility and security. It empowers individuals to pursue their goals and maintain their desired lifestyle without being solely dependent on a job or external financial support.

Based on the analysis above, it is evident that investing money, especially at an early age, offers significant benefits. Now, the question arises: What is the best way for a newbie to invest money in the Philippines?

2. Best ways to invest money in the Philippines for a newbie

In the Philippines, there are various ways available for individuals, especially newbies looking to grow their wealth and achieve their financial goals. From traditional savings accounts to more complex investment vehicles like stocks and bonds, each option offers its own set of benefits and risks. Understanding the basics of these investment options is crucial for making informed decisions.

In this overview, we'll explore some common investment methods in the Philippines, discussing who they are suitable for, the risks involved, the minimum amount required to invest, and the potential return on investment (ROI). Whether you're just starting your investment journey or looking to diversify your portfolio, this guide will provide valuable insights to help you make sound investment decisions.

You can directly grasp the key points from the following comparison table or obtain more detailed content from the remaining section.

Savings | Paper Gold | Bonds | ETFs | Insurance | |

Low Risk | Medium-to-High Risk | Medium-to-High Risk | Low Risk | Medium Risk | Low Risk |

ROI: Low | ROI: High | ROI: High and volatile | ROI: Lower returns compared to stocks but less volatility | ROI: Medium | ROI: Low |

In the trading world, there is a saying that high return on investment (ROI) often comes with high risks. Therefore, it is important to strike a balance between the two in order to find a suitable trading formula that allows for earning passive income and combating inflation.

According to the data from The Philippine Statistics Authority, the full-year average inflation rate in 2023 was 6%. That means an ROI exceeding 6% can help preserve the value of your money.

Some traders opt for leverage trading to amplify their profits. However, leverage also carries the potential for losses. If you are a newcomer and wish to explore high-return assets, it is crucial to always utilize take-profit and stop-loss mechanisms to minimize potential losses.

Additionally, selecting a platform that offers flexible leverage options, like Mitrade, where leverage ranges from 1:1 to 1:200, enables you to customize your chosen products, such as stocks, gold, and ETFs, based on your risk appetite.

| #Authorized by the leading financial institutes including ASIC, CySEC, CIMA, and FSC #Flexible leverages cater to different risk appetites: US stocks 1:1 to 1:20, Gold 1:1 to 1:100, ETFs 1:1 to 1:10 #Easy, fast, and safe deposit and withdrawal options available, including Visa, Mastercard, Skrill, Neteller, Worldpay, etc. |

2.1) Savings: This method typically involves depositing money into a bank account to earn interest.

Suitable for: Individuals who prioritize safety and liquidity over higher returns.

Risks: Low, as savings are typically held in bank accounts insured by the Philippine Deposit Insurance Corporation (PDIC).

Minimum amount to invest: Varies depending on the bank, often with low or no minimum balance requirements.

Return on investment (ROI): The ROI is relatively low due to interest rates that vary depending on the bank and the amount of your deposit. However, it provides easy access to funds. For example, the Overseas Filipino Bank offers 1% per annum for accounts with savings ranging from

₱0.01 to ₱20,000.00, and 4% per annum for accounts with savings of ₱500,000.01 and above.

2.2) Stocks: Investing in stocks involves purchasing shares of ownership in a company with the expectation of earning a return on that investment.

Suitable for: Investors seeking potentially higher returns and willing to accept higher volatility.

Risks: Medium to High. Investing in stocks carries risks such as market volatility, company-specific risks, and the possibility of experiencing losses if the stock price decreases.

Minimum amount to invest: Varies depending on the brokerage platform, but some allow for small investments through fractional shares.

ROI: Potentially high returns over the long term, but can also result in losses.

2.3) Paper Gold: This term refers to financial instruments such as gold CFDs or gold futures contracts, which allow investors to profit from changes in gold prices without physically owning gold.

Suitable for: Investors who are interested in using gold as a hedge against inflation or economic uncertainty without the need to physically own gold.

Risks: Medium to High. This investment option carries risks associated with price fluctuations of gold and counterparty risks related to the chosen financial instrument.

Minimum amount to invest: Varies depending on the chosen investment platform or financial product.

ROI: Returns depend on the performance of the underlying gold price, which can be volatile.

2.4) Bonds: These are debt securities issued by governments or corporations, offering fixed interest payments and a return of principal at maturity.

Suitable for: Investors seeking fixed income with lower risk compared to stocks.

Risks: Generally low, especially for government bonds. The risks associated with interest rate risk, credit risk (which is low to medium, especially for corporate bonds), and inflation risk.

Minimum amount to invest: The minimum investment amount varies depending on the bond issuer and the type of bond, but it is typically higher than that of savings accounts.

ROI: Bonds generally provide fixed interest payments, resulting in lower returns compared to stocks but with less volatility. For example, the Philippines 10-year government bond currently has a 6.295% yield.

2.5) ETFs (Exchange-Traded Funds): These are funds that hold a diversified portfolio of assets, such as stocks, bonds, commodities, or other securities. Investors can purchase shares of an ETF to profit from capital appreciation, dividends, and interest income.

Suitable for: Investors seeking diversified exposure to various assets, which can help reduce risk and potentially enhance long-term returns.

Risks: Low to Medium. The risks associated with market volatility and the underlying assets held by the ETFs.

Minimum amount to invest: Varies depending on the specific ETF, but it is generally lower compared to directly investing in individual stocks or bonds.

ROI: Returns depend on the performance of the underlying assets, offering the potential for capital appreciation, dividends, or interests.

2.6) Insurance: Refers to purchase insurance policies to protect against financial losses from unexpected events like accidents or illness. Some insurance policies, such as investment-linked insurance, also offer an investment component where premiums are allocated to investment funds for potential returns.

Suitable for: Individuals seeking financial protection against unforeseen events and those interested in accumulating cash value or potential investment returns through insurance policies.

Risks: Low. The risks include policy-specific risks, such as coverage limitations or policy lapses, as well as investment risks for investment-linked insurance products.

Minimum amount to invest: Varies depending on the insurance provider and the type of policy.

ROI: Returns depend on the type of insurance policy and any investment component, with some policies offering cash value accumulation over time.

Each investment option has its own advantages, risks, and suitability depending on an individual's financial goals, risk tolerance, and investment horizon. It's essential for beginners to research and seek professional advice before making investment decisions.

3. Where to invest money in the Philippines - Best companies list

With the continuous advancement of financial technology and the increasing interest of Filipinos in investment opportunities, the Philippine market has witnessed a surge in the number of financial companies. However, for newcomers, identifying the optimal investment companies in the Philippines can be challenging. In response, we have compiled a selection of top-performing companies to serve as a valuable reference for those who are looking to enter the market:

1) Mitrade

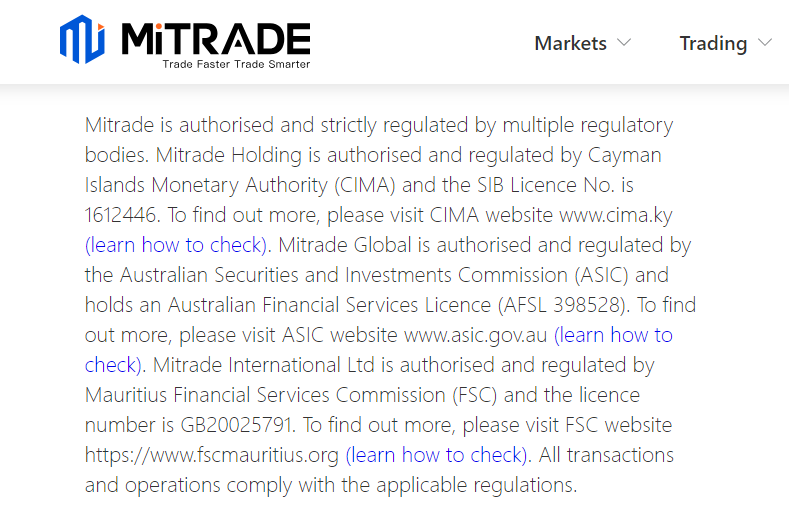

Introduction: Mitrade is an online CFD trading platform that provides access to a wide range of financial instruments. It boasts 2,400,000 worldwide users and has established multiple official locations, including Australia, Singapore, and the UK. With its user-friendly trading app and advanced tools, Mitrade caters to both beginner and experienced traders.

Types of Investment: Stocks, indexes, forex, ETFs, commodities(Including Paper gold and crude oil), and cryptocurrencies, with leverage options ranging from 1:1 to 1:200.

Trading Fees:

- Trading commission: No.

- Deposit and Withdrawal: No.

- Buy-Sell Spread: Flexible and competitive.

- Overnight Funding Cost: Varies depending on products.

- Other Fees: No.

Minimum Amount to Invest: The minimum investment amount on Mitrade varies depending on the products but is generally low, making it accessible to traders with different budget levels. For example, the minimum deposit is 20 USD (≈1200 pesos).

Pros | Cons |

|

|

2) BDO Personal Banking

Introduction: BDO is a leading universal bank in the Philippines, offering a comprehensive range of financial products and services. With a vast network of branches and ATMs nationwide, as well as international offices, BDO provides convenient access to its offerings. It prioritizes digital banking solutions for enhanced client convenience and security. As of September 30, 2023, it maintains its status as the Philippines' largest bank, leading in terms of total resources, customer loans, deposits, assets under management, capital, and the extent of its branch and ATM network.

Types of Investment: Savings accounts, time deposits, insurance, and investment funds.

Trading Fees: BDO Personal Banking generally charges fees or commissions on certain investment products, such as investment funds. However, it may not charge transaction fees for basic banking services like savings accounts.

BDO Personal Banking generally charges fees or commissions on certain investment products, such as investment funds. However, it may not charge transaction fees for basic banking services like savings accounts.

Minimum Amount to Invest: The minimum investment amount varies depending on the specific investment product chosen but is generally affordable, making it accessible to a wide range of investors. For example, a time deposit account can start from 1,000 pesos or a savings account can start from 100 pesos.

Pros | Cons |

|

|

3) COL Financial

Introduction: As the leading online stockbroker, COL Financial Group, Inc. (COL) is committed to democratizing stock market investing by providing access to its user-friendly online trading platform. Through this platform, investors can tap into expert opinions, comprehensive research, and educational seminars to capitalize on market opportunities.

Types of Investment: Stocks.

Trading Fees:

- Trading commission: 0.25% of the gross trade amount.

- Value Added Tax (VAT): 12% of commissions.

- Philippine Stock Exchange Transaction Fee: 0.005% of the gross trade amount.

- Securities Clearing Corporation of The Philippines Fee (SCCP): 0.01% of the gross trade amount.

- Sales Tax: No. of Shares X Price x 0.006.

- Deposit: Depending on the bank account of the customer. For example, a deposit over the counter with BPI is charged 110 pesos, however, it is free of charge with AUB.

- Withdraw: Free of charge in most cases. However, a fee of 100 pesos for canceling a check withdrawal and a processing charge for unsuccessful attempts to deposit a check into a closed, cash-deposit-only (CDO), or invalid bank account.

Minimum Amount to Invest: The minimum deposit is 1,000 pesos.

Pros | Cons |

|

|

4) BPI Trade

Introduction: Established in 1851, the Bank of the Philippine Islands (BPI) holds the distinction of being the first bank in the Philippines. As a universal bank, BPI, provides an extensive array of financial products and solutions catering to both retail and corporate clients, supported by its two international subsidiaries and 139 global partnerships.

Types of Investment: Savings, insurance, stocks, bonds, trust funds, mutual funds.

Trading Fees:

Philippine Peso Denominated Fixed Income Securities for individuals:

Broker’s Fee

- Securities with the remaining tenor of 1 year or more: 0.25% of face value

- Securities with remaining tenor of less than 1 year: Face value x 0.25% x remaining tenor / 365.

- Admin fee per annum: 100 pesos for face amount below 1 million pesos. Up to 5,000 pesos for face amounts exceeding 20 million pesos.

Adhoc Fees:

- SEC Earmarking of Government Securities: 10,000 pesos.

- Hold-out of Securities: 2,000 pesos per security.

- Non-trade Transfer of Securities: 500 pesos per security.

- Request for Certification: 100 pesos per security.

- IC Mandatory Reserve Earmarking: 1,000 pesos

- QB Certification: 10,000 pesos.

Minimum Amount to Invest:

- From 0 pesos for saving accounts.

- Minimum trading amount of 100,000 pesos for Fixed Income Securities (Secondary Market).

- Minimum 1,000 pesos for investment trust funds.

- Minimum 5,000 pesos for accessing portfolios of stocks, bonds, and other financial assets.

Pros | Cons |

|

|

5) Philstocks

Introduction: Philstocks Financial Inc., established in 2001 in the Philippines, is dedicated to advancing the technology-driven stock market industry and constantly enhancing its offerings to improve accessibility for investors.

Types of Investment: Stocks.

Trading Fees:

- Trading commission: 0.25% of the gross trade amount

- Value Added Tax (VAT): 12% of commissions

- Philippine Stock Exchange Transaction Fee: 0.005% of the gross trade amount

- Securities Clearing Corporation of The Philippines Fee (SCCP): 0.01% of the gross trade amount.

- Sales Tax: 0.6%

- Deposit and withdrawal: Depending on the customer's bank account. The average fee ranges from 12 to 25 pesos.

Minimum Amount to Invest: Initial fund of 5,000 pesos.

Pros | Cons |

|

|

Each of the companies mentioned above has its own pros and cons, catering to the investment strategies of individual investors. In the subsequent sections of the article, we will introduce additional investment methods/products that readers may consider, as well as provide tips for selecting suitable investment approaches.

4. Other types of investments to consider - complete list

In addition to the products discussed in part 2 of the article, here is a selection of items available for consideration in building your investment portfolio

Tables comparing 6 other types of investments

Investment | Overview | Pros | Cons |

Crypto- currencies | Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of a central bank. They offer decentralization, anonymity, and the potential for high returns. | - Potential for high returns. - Decentralization and anonymity.

| - High volatility and risk - Lack of regulation and security - Limited acceptance as a mainstream currency |

Real Estate | Real estate involves the ownership, purchase, sale, and development of land, buildings, and other physical properties. It offers the potential for long-term appreciation and passive income through rental yields. | - Potential for long-term appreciation - Passive income through rental yields - Tangible asset with intrinsic value | - High initial investment and transaction costs - Low liquidity - Market fluctuations and economic downturns |

Business | Investing in business involves developing a business plan or contributing capital to develop a venture to generate profits. | - Potential for significant returns - Control over investment decisions - Opportunity for active involvement and impact | - High risk of failure - Lack of liquidity - Time and effort required for due diligence and management |

Gcash | Gcash is a mobile wallet and financial services platform in the Philippines that allows users to perform various transactions such as money transfers, bill payments, and online purchases. | - Convenience and accessibility - Cashless transactions - Integration with various services and merchants | - Limited investment options - Reliance on technology and network connectivity - Security and privacy concerns |

Mutual Funds | Mutual funds refer to pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. | - Diversification of investment portfolio - Professional management by fund managers - Accessibility for individual investors | - Management fees and expenses - Lack of control over investment decisions - Market risk and potential for losses |

Commodities (physical) | Commodities are physical goods such as gold, silver, oil, and agricultural products that are traded on exchanges. | - Diversification of investment portfolio - Inflation protection - Potential for profit during market fluctuations | - Price volatility - Storage and transportation costs - Dependency on global economic factors |

5. Tips for choosing the right way to invest money

5.1 Choose trusted companies to invest money

Investing in reputable and well-established companies can provide a sense of security and confidence in your investment. These companies often have a proven track record of success, stable performance, and strong management teams. Key factors to consider when choosing trusted companies include:

Business license issued by the authorized agency.

Website with clear information about headquarters, privacy policy, products and services, legal documents and disclosures, fees and charges, etc.

Operating for a specific period, ideally for at least two years.

Positive ratings from the investor community or mainstream media.

5.2 Open a savings account and explore other ways to grow your money

Savings accounts provide a secure and convenient method for depositing money while accruing interest, offering liquidity, and serving as a cornerstone for financial growth. However, considering alternative investment avenues may yield greater returns compared to conventional savings accounts.

5.3 Invest only what you can afford to lose

This approach helps mitigate financial risk and protects investors from potential losses that could negatively impact their financial and mental well-being. It encourages responsible investing and avoids overexposure to high-risk investments.

5.4 Start with a small amount of money and learn from experience

Beginning with a small investment allows investors to gain hands-on experience in the market without risking significant capital. It provides an opportunity to learn about investing principles, market dynamics, and personal risk tolerance.

5.5 Diversify your investment portfolio

Diversification helps spread risk across different asset classes, industries, and geographic regions, reducing the impact of a single investment's poor performance on the overall portfolio. It can enhance long-term returns while minimizing volatility. However, careful planning and monitoring are necessary to ensure a balanced and effective diversification strategy.

6. FAQ

#6.1 Where can I invest my 1,000 pesos?

You can use 1,000 pesos to start a savings account. Many financial or brokerage companies have a minimum requirement of 1,000 pesos to open an account. Additionally, you can select products with small values, such as stocks, to learn how to invest and understand how the market works.

Alternatively, you can choose to leverage your investment by using a low or medium leverage. For example, if you choose a leverage of 1:2, you can use 1,000 pesos to purchase an amount of 2,000 pesos worth of stocks. Another option is to use 500 pesos to buy 1,000 pesos worth of stocks and allocate the remaining 500 pesos to buy 1,000 pesos worth of paper gold.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

#6.2 Should you put your money in a stock or in a bond?

Investing in bonds typically carries low risk and offers fixed returns. On the other hand, investing in stocks entails higher risk but also the potential for higher returns. The choice of investment type depends on an individual's risk tolerance and investment knowledge to select the most suitable investment approach for themselves.

#6.3 How can resident Filipinos buy foreign stocks?

Resident Filipinos can open an account with international brokerage companies like Mitrade that offer foreign stocks for trading.

#6.4 Is trading cryptocurrencies legal in the Philippines?

Yes, trading cryptocurrencies has been legal in the Philippines since 2017, according to the BSP issued Circular No. 944 in 2017.

References:

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.