On-chain data shows the veterans of the Bitcoin market are taking 89% less profits compared to the May peak, despite prices being similar now.

Bitcoin Realized Profit For 1Y+ Hands Is Relatively Low Right Now

In a new post on X, the on-chain analytics firm Glassnode has talked about the latest trend in the Realized Profit of the seasoned hands on the Bitcoin network. The “Realized Profit” refers to an indicator that measures, as its name implies, the amount of profit that the BTC investors are realizing through their selling.

The metric works by going through the transfer history of each coin being transacted or ‘sold’ on the chain to see what price it was moved at prior to this. If the previous selling value is less than the current price for any token, then that particular token’s sale is contributing to profit realization.

The amount of profit realized in the sale is naturally equal to the difference between the two prices. The Realized Profit sums up this value for all tokens being transferred to find the total for the network as a whole.

In the context of the current topic, the Realized Profit of the entire userbase isn’t of interest, but just that of a specific part of it: the 1+ year holders. These are the investors who have been holding onto their coins since more than a year, without having involved them in a transaction even once.

Statistically, the longer an investor holds onto their tokens, the less likely they become to sell them in the future. As such, this part of the userbase with its significant holding time would include the resolute diamond hands of the market.

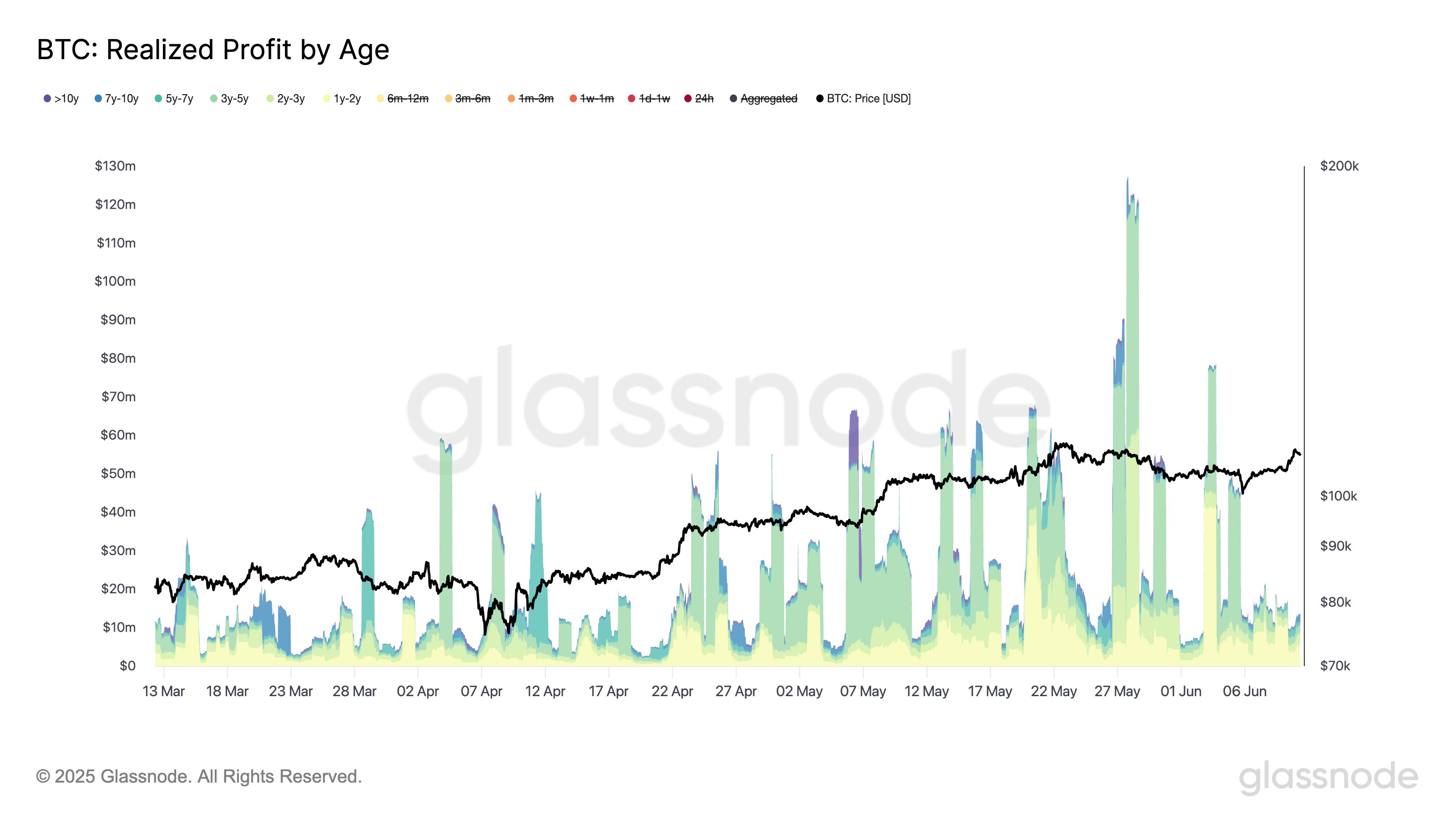

Now, here is the chart shared by Glassnode that shows the trend in the Bitcoin Realized Profit for these HODLers over the last few months:

As displayed in the above graph, the Bitcoin Realized Profit of the 1+ year investors observed a huge spike in late May. This sharp profit-taking spree from these seasoned hands came as BTC surged to $110,000 following its post all-time high (ATH) pullback.

Shortly after the selloff from this cohort, BTC started on a decline. During the past day, though, the asset has appeared to have finally shoved off this bearish momentum, as it has once more returned above the $109,000 mark.

This time, however, there hasn’t been any significant reaction from the diamond hands. Currently, the 24-hour simple moving average (SMA) of the group’s Realized Profit sits at $13.6 million, which is 89% down compared to the $126 million peak from last month.

It’s possible that the veterans of the market think there is more to come in the latest Bitcoin rally, so they are choosing to HODL strong.

BTC Price

At the time of writing, Bitcoin is floating around $109,100, up more than 2% in the last seven days.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.