Helium Price Prediction 2025-2031: Is HNT a Good Investment?

Key Takeaways:

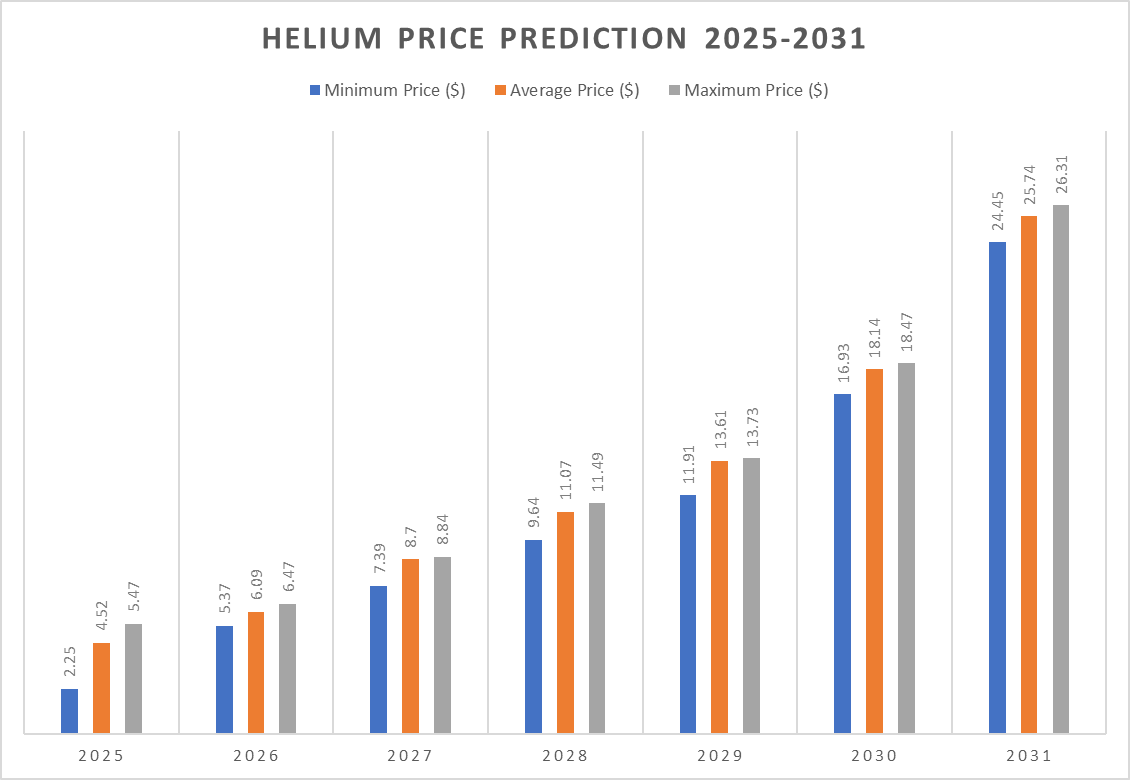

- Helium’s price can reach a maximum of $5.47 and an average trading value of $4.52 in 2025.

- By 2028, HNT is expected to reach a new high of $11.49, driven by increased adoption of its decentralized network and IoT (Internet of Things) applications.

- Helium’s price could surpass the $26 mark, potentially reaching $26.31 or higher by 2031, as the ecosystem continues to expand and gain mainstream traction.

Helium (HNT) stands out in the cryptocurrency space for its innovative approach to decentralized wireless networks, enabling a global, community-driven infrastructure for IoT devices. This makes it a popular choice for tech enthusiasts and businesses seeking cost-effective, scalable connectivity solutions. The Helium ecosystem continues to evolve, marked by significant milestones such as the expansion of its 5G network, partnerships with major telecom providers, and growing adoption across industries, which underscore its real-world utility.

As Helium continues to progress, many wonder about its future price trajectory. Will its unique features and expanding use cases drive substantial value growth? Can it sustain its competitive edge in the ever-evolving crypto market? Will HNT recapture its all-time high (ATH) at $54.32?

Overview

| Cryptocurrency | Helium |

| Token | HNT |

| Price | $2.31 |

| Market Cap | $437 M |

| Trading Volume 24-h | $13 M |

| Circulating Supply | 186,010,358.23 HNT |

| All-time High | $517.62 Nov 13, 2021 |

| All-time Low | $0.213, Jun 10, 2020 |

| 24-h High | $2.46 |

| 24-h Low | $2.29 |

Helium price prediction: Technical analysis

| Sentiment | Bearish |

| 50-Day SMA | $2.92 |

| 200-Day SMA | $3.13 |

| Price Prediction | $4.92 (112.34%) |

| F & G Index | 27.57 (fear) |

| Green Days | 11/30 (37%) |

| 14-Day RSI | 30.08 |

Helium price analysis: HNT falls to $2.30

TL;DR Breakdown:

- Helium price analysis shows fall towards 2.30

- Resistance for HNT is at $2.40

- Support for HNT/USD is at $2.30

The price analysis of Helium for September 6 shows that HNT has fallen to the $2.30 mark as bearish pressure continues to rise for the price.

Helium price analysis 1-day chart: HNT falls to $2.30

Helium faced selling pressure as buyers failed to climb past $4.00, and started a bearish trend downhill. The bearish trend has observed the price falling to $2.30 where it trades at press time.

The Relative Strength Index (RSI) stands at 35.08, which reflects the recent trend, showing that the asset is observing bearish pressure recently. The Moving Average Convergence Divergence (MACD) line moves horizontally, suggesting rising bearish market sentiment in a period of consolidation as HNT observes low volatility. Additionally, the MACD candles show increasing bearish momentum in the market.

HNT/USD 4-hour price chart: Bulls face resistance above $2.40

The 4-hour chart for Helium revealed a steady decline as the bears aimed to move below the $2.30 price level, but the bulls fought to defend the level. The recent recovery surged the HNT price toward $2.40 resistance line before falling back below $2.35 where it trades at the moment.

From a technical perspective, the MACD shows falling bearish momentum at -0.005, with the indicator showing rising buying pressure with recent candles. The RSI (Relative Strength Index) fell to 40.18, indicating that Helium faces strong resistance at the $2.40 mark and HNT needs to defend the $2.30 level to prevent a breakdown below $2.22.

Helium technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

|---|---|---|

| SMA 3 | $ 2.47 | SELL |

| SMA 5 | $ 2.52 | SELL |

| SMA 10 | $ 2.56 | SELL |

| SMA 21 | $ 2.63 | SELL |

| SMA 50 | $ 2.94 | SELL |

| SMA 100 | $ 2.82 | SELL |

| SMA 200 | $ 3.15 | SELL |

Daily exponential moving average (EMA)

| Period | Value | Action |

|---|---|---|

| EMA 3 | $ 2.53 | SELL |

| EMA 5 | $ 2.55 | SELL |

| EMA 10 | $ 2.59 | SELL |

| EMA 21 | $ 2.67 | SELL |

| EMA 50 | $ 2.80 | SELL |

| EMA 100 | $ 2.97 | SELL |

| EMA 200 | $ 3.40 | SELL |

What to expect from Helium price analysis?

The Helium price analysis across the daily and 1-hour chart indicates support around $2.30.

As the price oscillates at the $2.30 – $2.40 level, HNT can be expected to continue consolidating at the current level for next week. However, if the price fails to defend the $2.30 support the price can be expected to fall towards the $2.00 mark.

Is Helium a good investment?

Helium distinguishes itself in the cryptocurrency market by focusing on decentralized wireless networks, enabling a global infrastructure for IoT (Internet of Things) devices. It aims to revolutionize connectivity by providing cost-effective, scalable solutions for businesses and individuals. Helium’s innovative technology and real-world utility make it an attractive option for those interested in the future of decentralized networks and IoT applications.

With a focus on expanding its 5G network and forming partnerships with major telecom providers, Helium is well-positioned to drive significant growth in the decentralized connectivity ecosystem. Its potential to disrupt traditional telecom industries and capture market share in the IoT space makes it an intriguing investment opportunity for those interested in cutting-edge technological solutions.

Why is HNT down?

Helium observed a steady decline as the bears aimed to move below the $2.30 price level, but the bulls fought to defend the level. The recent recovery surged the HNT price toward $2.40 resistance line before falling back below $2.35 where it trades at the moment.

Will HNT reach $10?

Based on current forecasts, Helium is expected to experience steady growth, potentially reaching the $10 mark before the end of 2028. This projection depends on continued adoption of its decentralized network and advancements in IoT and 5G technologies.

Will HNT reach $20?

Helium is expected to cross the $20 threshold by 2031 as the industry continues to see increasing adoption of decentralized wireless solutions. The bullish rally will be supported by Helium’s vision of a scalable, decentralized future and its user-friendly architecture, which sets it apart from other blockchain projects.

Does HNT have a good long-term future?

Yes, Helium (HNT) has a strong long-term future, with a unique market position and promising potential ROI due to its innovative decentralized wireless network model. Helium’s ability to provide low-cost, efficient connectivity for IoT devices, combined with its expanding ecosystem and global adoption, strengthens its outlook. The project’s growing community, technological advancements, and strategic partnerships further support Helium’s potential for sustained growth in the coming years.

Will HNT reach $50?

The chance of Helium reaching the $50 mark depends on various factors, including future network development, regulatory changes, and broader cryptocurrency market trends. If Helium continues its current trajectory of innovation and adoption, it could potentially reach $50 within the next decade. However, this outcome remains speculative and contingent on sustained growth and technological advancements.

Recent News

Dane County Regional Airport (MSN) was able to enhance the airport’s connectivity by using Helium’s Mobile Hotspots providing seamless coverage to travelers across the airport. It also enhances the business capabilities of the airport as data offloaded to the Helium network brings real rewards and potential to earn revenue.

Helium Price Prediction September 2025

The Helium price prediction for September 2025 is a maximum price of $4.22. The coin’s lowest price will be $2.15, and the average trading price of the coin is $2.51.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| September | $2.15 | $2.51 | $4.22 |

Helium Price Prediction 2025

The Helium price forecast for 2025 predicts a maximum price of $5.47. The coin’s lowest price will be $2.25, and the average trading price is expected to be $4.52.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2025 | 2.25 | 4.52 | 5.47 |

Helium Price Prediction 2026 – 2031

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2026 | 7.14 | 8.09 | 8.60 |

| 2027 | 9.82 | 11.56 | 11.74 |

| 2028 | 12.81 | 14.71 | 15.26 |

| 2029 | 12.81 | 14.71 | 15.26 |

| 2030 | 15.83 | 18.09 | 18.24 |

| 2031 | 22.49 | 24.11 | 24.55 |

Helium Price Prediction 2026

The HNT price prediction for 2026 forecasts a maximum price of $6.47. The minimum price by the end of 2026 will be $5.37, while its average trading price is expected to be $6.09.

Helium Price Prediction 2027

The HNT token price prediction for 2027 indicates a maximum price of $8.84, with a minimum price of $7.39. The average trading price is projected to be $8.70.

Helium Price Prediction 2028

The HNT coin price prediction for 2028 suggests a maximum price of $11.49. The minimum price by 2028 will be $9.64, and the average trading price is forecasted to be $11.07.

Helium Price Prediction 2029

The HNT price prediction for 2029 shows a maximum price of $13.73, with an average trading price of $13.61. The coin’s lowest price is expected to be $11.91.

Helium Price Prediction 2030

The Helium cryptocurrency prediction for 2030 forecasts a maximum price of $18.47. The coin’s lowest price will be $16.93, and the average trading price is expected to be $18.14.

Helium Price Prediction 2031

The Helium price prediction for 2031 anticipates a maximum trading price of $26.31, with an average trading price of $25.74. The minimum price of the coin is projected to be $24.45.

HNT market price prediction: Analysts’ HNT price forecast

| Firm | 2025 | 2026 |

| Coingecko | $6.01 | $8.09 |

| Digitalcoinprice | $7.27 | $8.60 |

Cryptopolitan’s Helium price prediction

According to Cryptopolitan’s Helium price forecast, HNT could reach a maximum price of $5.47 by the end of 2025. By 2026, the price of the HNT token is predicted to reach a minimum value of $5.37. Helium’s rise in price could take it to a maximum price level of $26.31 with an expected average trading price of $25.74 by 2031.

Helium Historic Price Sentiment

- In 2021, the Helium Network secured $111 million through a token sale prominently led by the venture capital firm Andreessen Horowitz. Following this achievement, Helium Network further advanced its financial standing in February by raising $200 million in a Series D funding round. This substantial investment valued the project at $1.2 billion and featured prominent backers such as Tiger Global and FTX Ventures.

- Helium Network transitioned from its proprietary blockchain to the Solana blockchain in September 2022 to enhance its technological infrastructure. In the 2021 bull run, HNT rose from $1.4 to its all-time high of $55.22 on November 12, 2021. HNT corrected to $26.03 in December before rising to $41 in January 2022.

- In the 2022 crypto winter, HNT started losing value and has not significantly recovered. By December 2022, HNT had dropped to as low as $1.18. At press time, HNT was down 92.66% from its all-time high. In 2023, the coin was bullish in the first and last quarter of the year. In December alone, it managed over 2X gains from the previous month.

- Across 2023, Helium’s price experienced significant fluctuations. The highest price recorded was $9.74 (on February 17, 2024), while the lowest dipped to $3.16 (on July 16, 2024).

- In January 2024, Helium remained relatively stable, trading around the $6.92–$8.96 range as market momentum stayed subdued. However, this stability was short-lived, as February saw a sharp decline to $8.90 (on February 22, 2024), marking one of the lowest points of the month. Despite this, Helium demonstrated resilience, recovering quickly to stabilize near the $9.00 mark by the end of the month.

- In March and April 2024, HNT experienced a steady decline from $9.07 (on March 1, 2024) to $5.64 (on April 1, 2024), where it found key support. This period was characterized by cautious trading and low volatility.

- In May 2024, Helium observed steady bullish pressure as the price rose from $5.04 (on May 1, 2024), gradually approaching resistance at $5.54 (on May 5, 2024). This upward trend was driven by renewed investor interest and broader market optimism.

- In June 2024, Helium traded within the $5.64–$6.11 range, with neither bulls nor bears managing to secure a decisive breakout. In July, the cryptocurrency hovered around the $7.59 mark, with price volatility remaining relatively low. HNT opened trading in August at $7.65 and ended the month at $8.70 , making notable gains.

- September turned bearish for Helium, as the price declined below the $7.80 mark by the end of the month. In October, Helium faced a steep crash but began a swift recovery shortly thereafter.

- In December, Helium made remarkable strides as the asset’s price briefly broke past the $9.00 mark, albeit closing the month just below that level.

- In January 2025, Helium saw a bullish start to the year, with the price rising from below the $4.21 mark to $4.27 by the end of the month.

- In February, however, the price trended downward toward the $3.19 mark as bears began to dominate the markets. A trend that continued through June as the price fell to $2.19. In July, the trend reversed as the price rose as high as $4.00 but could not maintain the heights as bears struck again.

- The market still faces the pressure of that bearish market as by early September the price has dwindled to $2.36.