Forget 2025: 2 High-Yield Materials Stocks to Power Your Passive Income in 2026

Key Points

Dow and LyondellBasell are at multiyear lows.

Both stocks have high yields, providing an incentive to hold them through this challenging period.

Lower interest rates will make borrowing capital less expensive, potentially boosting demand from key end markets.

- 10 stocks we like better than Dow ›

2025 was a year to forget for chemical giants Dow (NYSE: DOW) and LyondellBasell Industries (NYSE: LYB). Both stocks plummeted to multiyear lows. Coincidentally, they both fell by exactly 41.7%.

2026 is already looking a lot better for materials sector investors. Materials and energy are the best-performing stock market sectors in 2026. And Dow and LyondellBasell are both up over 15% year to date at the time of this writing.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

On top of that, Dow yields 5%, and LyondellBasell yields a staggering 10.9%. Here's why both chemical giants are excellent turnaround stocks to buy for passive income in 2026.

Image source: Getty Images.

The downturn drags on with more pain ahead

Dow and LyondellBasell produce commodity chemicals used in packaging, industrial applications, consumer goods, additives, sealants, fluids, and lubricants. Key products such as polyethylene, polypropylene, and polyurethane are the building blocks of global manufacturing.

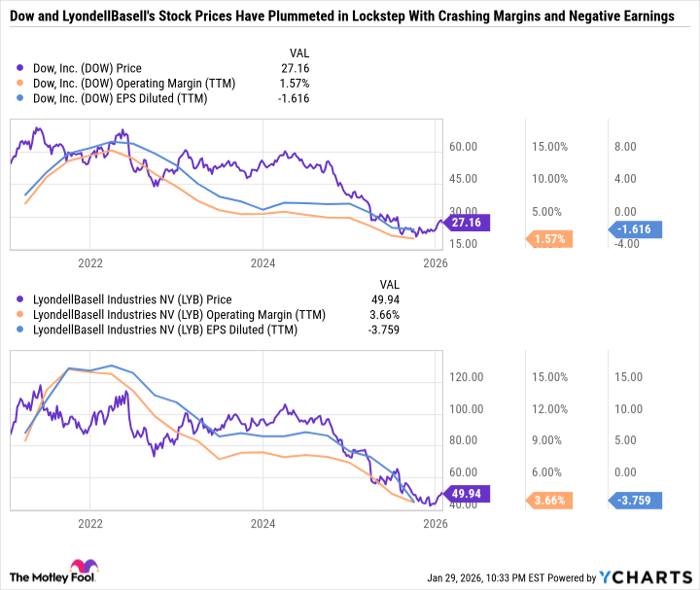

The challenge is that supply has been outpacing demand due to intense competition from countries like China, as well as overcapacity and slowdowns in key end markets like consumer goods, automotive, and construction. As you can see in the following chart, these headwinds have taken a toll on Dow and LyondellBasell's earnings and margins, which are at multiyear lows.

DOW data by YCharts. EPS = earnings per share. TTM = trailing 12 months.

On its fourth-quarter 2025 earnings call from Jan. 29, Dow provided some useful insights into what to expect in the year ahead. Although the downturn is likely to drag on, Dow did cite a variety of positive factors, such as lower interest rates improving the housing market and higher margins in packaging and specialty plastics, but a weak year for U.S. auto sales.

For what it can control, Dow is slashing costs -- expecting to deliver the remaining $500 million in cost savings by the end of the year, which is the second half of its $1 billion program. On its January earnings call, Dow also announced the reduction of 4,500 roles globally (roughly one-eighth of its workforce), which will lead to $600 million to $800 million in one-time severance costs. In addition to cutting costs, Dow has improved its balance sheet through asset sales and pullbacks in capital-intensive projects, and it cut its dividend in half last July.

LyondellBasell is in a similar boat, with $600 million in expected cash improvements in 2025 and $1.1 billion in total by the end of this year. But unlike Dow, LyondellBasell has not cut its dividend -- hence the higher yield. However, like Dow, it has sold assets, shut down plants, and paused or canceled projects to shore up cash.

I could see LyondellBasell following in Dow's footsteps and slashing its dividend in half this year. Even if it did, it would still yield north of 5% and remain in high-yield territory while preserving some much-needed cash in the process.

Two value stocks for risk-tolerant income investors

When cyclical stocks are in downturns, especially of this magnitude, it's impossible to value them using traditional valuation metrics like price-to-sales, price-to-earnings, or price-to-free-cash-flow ratios. However, analyst consensus estimates have Dow's earnings remaining negative in 2026 and turning slightly positive in 2027, with LyondellBasell building on a positive year in 2025, with even better profitability in 2027.

The glass-half-full outlook for both companies is that their cost cuts, efficiency improvements, and restructuring will coincide with an eventual industrywide recovery. In the meantime, both stocks have high yields to boost passive income. As earnings improve, both stocks could look dirt cheap given how beaten down they are. However, some investors may still want to pass on Dow and LyondellBasell because they aren't supporting their dividends with free cash flow, instead leaning on their already strained balance sheets or relying on asset sales.

All told, Dow and LyondellBasell are so out of favor and beaten down that some deep-value investors may want to take a closer look at them, but risk-averse investors may prefer to power their portfolios with more straightforward blue chip stocks like Procter & Gamble and Coca-Cola.

Should you buy stock in Dow right now?

Before you buy stock in Dow, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dow wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $450,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,171,666!*

Now, it’s worth noting Stock Advisor’s total average return is 942% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 2, 2026.

Daniel Foelber has positions in Procter & Gamble and has the following options: short February 2026 $150 calls on Procter & Gamble. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.