In the world of finance, many times there is a disconnect between the minds of the masses and the minds of what many consider to be the elite. Institutions and accredited investors look at things like the macro picture, price to earnings ratio, discounted cash-flow, and yield. The masses, especially those on Reddit and other forums, sometimes look for a totally different set of metrics, with many revolving around narrative and hype.

In this article below, we look at the top 10 stock picks for 2026, what Reddit is buying, and what you should consider going into the new year.

Wall Street’s Top 10 Stocks for 2026

Acadia Pharmaceuticals (ACAD)

UBS, about as blue-chip as they come for financial instituions has put this atop its 2026 list, and why? Because there is a new Alzhemiers drug readout due in the middle of the year. Although shares have gotten a bump in 2025 due to interim data, you could still consider this stock a deal if the trial succeeds based on revenue forecasts. Analysts peg an upside to earnings growth that has not yet been priced in.

PepsiCo (PEP)

PepsiCo trades for a forward P/E around 17.6x, even though it generates stable revenue and strong cash flow, which is roughly a $150 billion+ market cap and a ~3.8% dividend yield/$5.69 annual payout. Its forward dividend yield is solid, making it a great "income + growth" play, although the stock on the surface might not seem obviously cheap.

General Motors (GM)

GM’s current P/E sits around 15–16x, well below many global auto peers whose average is above 25x, but GM still produces strong cash flows and has a market cap near $76 billion. That gap suggests the market is still discounting earnings power that could strengthen by 2026. Analysts see room for margins to improve, supporting the valuation bump.

Autohome (ATHM)

This Chinese auto information platform trades at a P/E of ~13.3x–13.4x with a market cap of around $2.7–2.8 billion. It’s trading below some fair value estimates by ~20%, and its forward P/E is roughly 12x, which looks cheap relative to its history and peer averages in digital media. Strong liquidity (high current and quick ratios) gives it some downside protection if growth rebounds. Some investors are cautious with the Chinese market and tech companies after the earlier crackdown and disappearance of Jack Ma. However, the CCP has been adamant about presenting a "friendly face" to the tech sector and private business going forward.

EOG Resources (EOG)

Energy stocks often get thrown out with macro volatility, but EOG’s cash flow yield and debt discipline stand out. Free cash flow outpaces many peers, and its EV/EBITDA is compelling compared with sector standards. With oil and gas prices still supportive, earnings resilience isn’t fully priced in, leaving a valuation gap.

Citigroup (C)

Even after a strong 2025 performance (~+68%), Citi trades at around 11.2x expected earnings, below rivals like JPMorgan and Bank of America. Analysts see its valuation lagging despite profitability improvements, suggesting multiple expansion if the turnaround continues.

Lam Research (LRCX)

Lam’s chip equipment business sees robust AI-driven capital spending, yet it still sits at more moderate forward multiples compared with pure AI playmakers. Its backlog and earnings consensus growth imply valuation hasn’t caught up to demand trajectory.

Spotify (SPOT)

Spotify’s streaming franchise runs at a lower multiple than many tech peers due to margin pressure, but subscriber growth and monetization improvements aren’t fully reflected in current estimates. Adjusted earnings potential could create a re-rating.

YouTube

Oracle (ORCL)

Oracle’s cloud transition hasn’t lifted its multiple to the same level as pure cloud peers. Its strong free cash flow and consistent margins make it a better value pick if institutional investors refocus on earnings durability.

Broadcom (AVGO)

Broadcom trades at healthy but not elevated multiples given its exposure to AI connectivity and data center demand, and its free cash flow remains robust. If AI hardware buildouts continue strongly, earnings growth could outpace valuation expectations.

What is Reddit Buying?

Reddit doens't seem to concern itself with data points that we all look at stocks; macro picture, micro picture, company revenue, P/E valuation, etc., are not as important as a story with Reddit. Below are the top stocks that Reddit is buying for 2026.

How do Reddit users value stocks?

Retail traders on Reddit behave quite differently from analysts on Wall Street. Although narratives and stories pertaining to a stock are common and are indeed important for analysts, Reddit users almost exclusively focus on the story/narrative, even if the stock's economic fundamentals might not be sound. Case in point is NVIDIA. NVIDIA is front and center of any AI conversation, and as AI continues to dominate the headlines, traders feel greatly influenced by NVIDIA's narrative, for the mere fact that it's name is being shoved down the throats of the general populace on a regular basis.

Some of these choices stick around because of legacy and hype, and are sought after for easy vehicles for wealth accumulation, should sentiment flip. It's also important to note that a lot of Reddit stock plays are driven by rumours that are not based on fact. This isn't to say that this doesn't happen on Wall Street quite often. Shortsellers will spin stories about a failing company, and rumours about a new secret pharmaceutical drug will always swirl around the health sector.

The difference is that the rumors on Reddit many times have absolutely no basis in fact, and can at times appear counterintuitive. Other names like Micron or Broadcom show how Reddit interest can shift into more traditional companies when there is a clear cycle or demand story. Even Reddit itself shows up because familiarity matters; people are more comfortable trading what they already use and understand.

How Wall Street vs. Reddit performed in 2025?

Don't take our word, Wall Street's word, and definitely not the word of random Reddit users. Investing should be about data first and foremost, and data from 2025 paints a pretty solid picture.

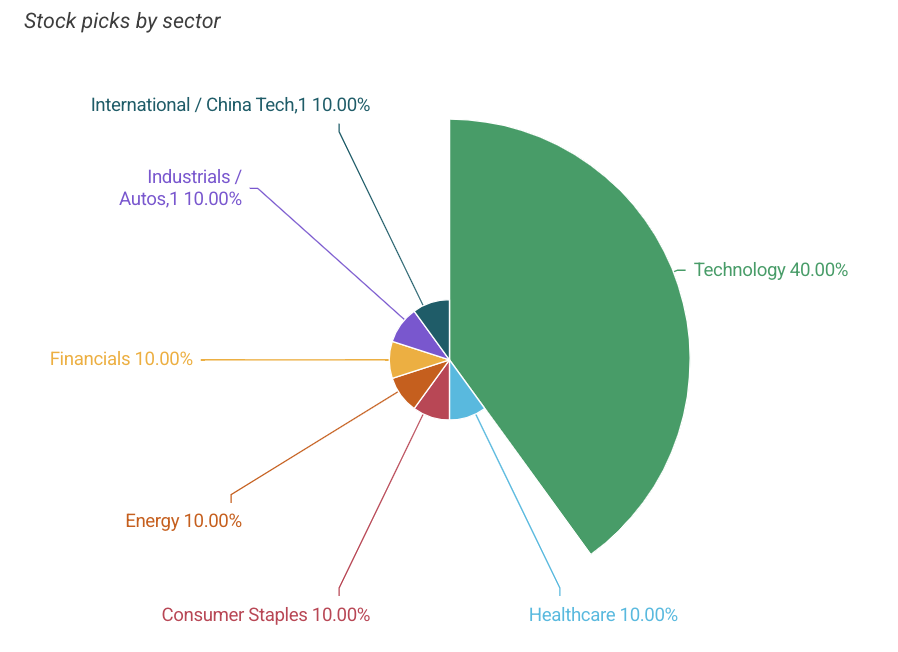

Reddit vs. Wall Street average returns (5 stocks)

Reddit pics are skewed towards visibility and big stories, as mentioned above, as well as name recognition. Names that are well-known brands will move much faster than those that are not. It must be noted, however, that just as fast as people can pile into a stock, they can flip out of the stock in mass once sentiment flips. This is why you see huge drops by BYND, GME, and AMC; when things turned south, they turned South fast.

Wall Street leaned more into earnings, cash flow, the capital stack, and businesses rather than the perfect headlines or the never-ending hype. And therein lies the fundamental difference between Reddit and Wall Street; one is solid data + hype, and the other is just hype, which can ebb and flow at a moment's notice.

Bottom Line: Use all the data you can, but be wary of sentiment

In the world of investing, knowledge is power. And the more data and information you have access to, the more power you can wield. Investor sentiment is a real thing, and although Reddit is the loudest and most unfiltered version of pure sentiment, it can't be ignored. That being said, it's important ot pair sentiment with real data, and that's what Wall Street excels at. If a company has a great story, but its debt load is 3x assets, then it will probably have some issues. If a company is kind of boring, but its numbers speak for themselves, it might be worth giving it a look. Remember, sentiment moves the market, but the real data will usually always win in the end

FAQ

Why do Reddit stock picks tend to be more volatile?

Reddit traders often focus on visibility, momentum, and stories that can move a stock quickly. That can lead to sharp gains when sentiment is strong. It can also result in fast losses once attention fades or the narrative breaks.

Does Wall Street usually outperform Reddit picks?

Not every year, but over longer periods it often does. Institutional investors tend to focus on earnings, cash flow, and valuation, which helps returns hold up when markets cool. That steadier approach shows up more clearly over full market cycles.

Can retail investors still use ideas from Reddit effectively?

Yes, but they work best with guardrails. Narrative-driven trades benefit from clear entry points, exit plans, and position sizing. Pairing sentiment with basic fundamentals can reduce downside when momentum turns.

Risk-Free Demo Account Trade Stock CFDs at Mitrade. 0 commission, low spreads. Enjoy limit and stop loss for every trade!

Risk-Free Demo Account Trade Stock CFDs at Mitrade. 0 commission, low spreads. Enjoy limit and stop loss for every trade!* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.