270,000 People Instantly Liquidated. Crypto Earthquake, Just Because This Person Might Take Over the Fed?

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

TradingKey - Cryptocurrencies plunge again as Warsh emerges as a possible candidate for Fed Chair and the U.S. SEC delays the release of crypto innovation waiver measures.

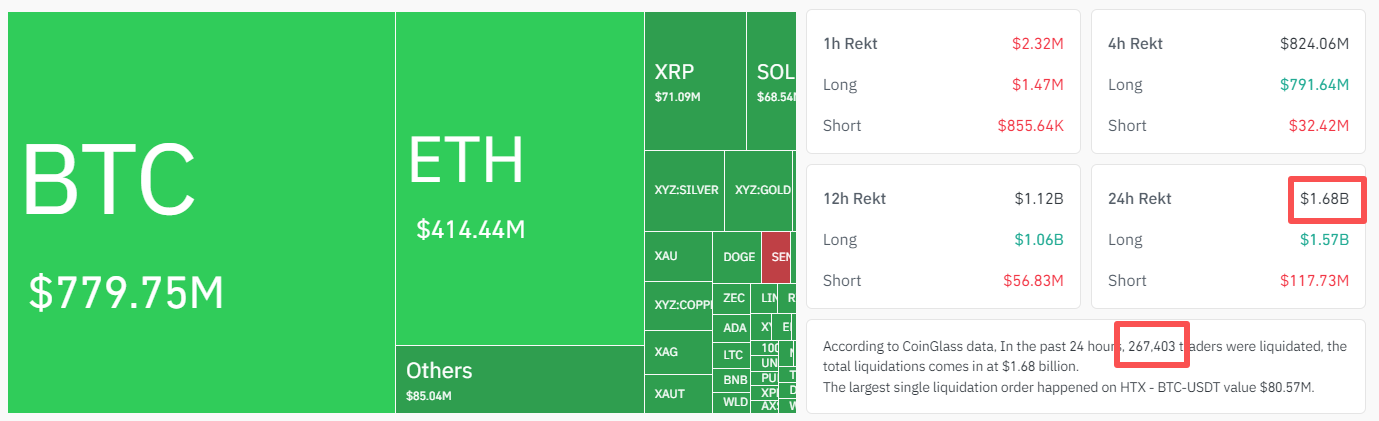

On Friday (January 30), the cryptocurrency market experienced a major upheaval, triggering another wave of liquidations. Over the past 24 hours, more than 270,000 users saw their positions liquidated, with the total value reaching nearly $1.7 billion. Long liquidations accounted for nearly $1.6 billion, or 93% of the total, with all metrics surpassing records set on January 19.

Crypto market liquidation data; Source: CoinGlass

Crypto market liquidation data; Source: CoinGlass

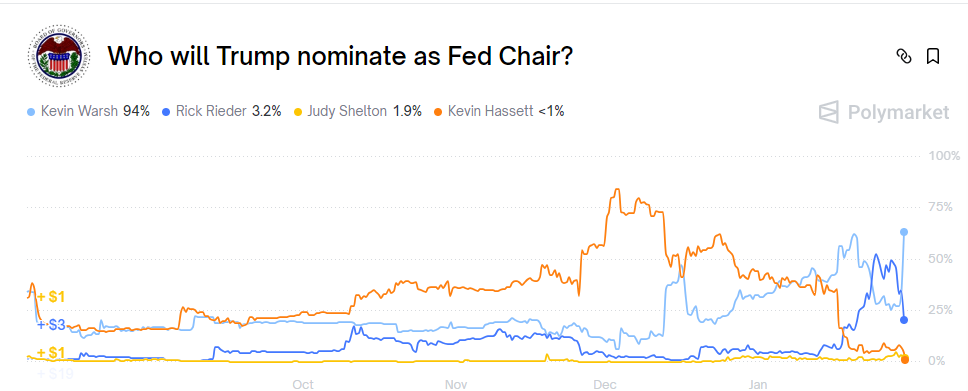

According to people familiar with the matter, U.S. President Donald Trump called former Federal Reserve Governor Kevin Warsh on Thursday to ask if he would be willing to accept the position, and Warsh indicated his acceptance. As of press time, prediction market Polymarket shows that the probability of Warsh being nominated as the new Fed Chair has surged to 94%, while the previous frontrunner, BlackRock ( BLK) Chief Investment Officer of Global Fixed Income Rick Rieder now has a probability of only 3.2%.

Market predictions for the Fed Chair candidate; Source: Polymarket

Market predictions for the Fed Chair candidate; Source: Polymarket

It is reported that Warsh is not considered particularly hawkish. Analysts at Maybank noted, "Warsh has long been a critic of extremely loose monetary policy, so the market may be pricing in the potential impact of his appointment on the future policy path." Additionally, Shoki Omori, chief strategist at Mizuho Securities, stated, "If Warsh is elected as the new Fed Chair, the market will feel sustained pressure to cut rates."

Following news that Warsh is likely to be named the new Fed Chair and U.S. SEC Chairman Paul Atkins announced a delay in the release of crypto innovation waiver measures, the double blow caused the cryptocurrency market to plunge by more than 2% over the past 24 hours, with total market capitalization falling back below $3 trillion. In this market movement, major coins generally fell by 6%, with Bitcoin ( BTC) falling to around $81,000, Ethereum ( ETH) falling to $2,700, and Binance Coin ( BNB) falling to $840.

Price changes of the top 10 cryptocurrencies by market cap; Source: CoinGecko

Price changes of the top 10 cryptocurrencies by market cap; Source: CoinGecko

It should be noted that Trump has not yet officially announced his choice for Fed Chair, meaning there could still be a change. Yesterday, Trump stated he would announce the nominee on Friday morning. If Warsh indeed becomes the candidate, the cryptocurrency market could move further lower. Conversely, cryptocurrencies could reverse their losses and rebound.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.