The foreign exchange market—Forex for short—is the world's biggest financial playground, churning through around $7.5 trillion a day in late 2025. Liquidity is insane, spreads are razor-tight on majors, and there's always a trade somewhere if you know where to look. But here's the thing, mate: not every pair is worth your time. With over 100 options out there, picking the right ones separates consistent traders from those who get chopped up.

In my decade analyzing the currency markets, I’ve learned one immutable truth: The market doesn't break traders; volatility-mismatch does. As we head into 2026, the global macro landscape is shifting. Here is how to find the best forex pair that actually fits your DNA.

Best currency pairs to trade for 2026

In the forex market of late 2025 and 2026, the "best" pair to trade depends entirely on your risk tolerance and trading window. The market is currently defined by a weakening US Dollar (due to Fed rate cuts) and a volatile Japanese Yen (due to policy shifts in Japan).

Here is the strategic breakdown of the best currency pairs to trade for 2026.

| Pair | Best For... | 2026 Outlook |

| EUR/USD | Beginners & Stability | Bullish. Expected to climb towards 1.20 as the ECB outlasts the Fed on rates. |

| USD/JPY | Macro Swing Traders | Bearish. The "Trade of the Year" candidate if Japan finally raises rates. |

| GBP/JPY | Day Traders / Scalpers | Highly Volatile. Offers massive daily ranges (150+ pips); high risk/reward. |

| AUD/USD | Trend Followers | Bullish. A proxy for global growth and commodity recovery in 2026. |

What is the best currency pairs?

The "Safety First" Pairs

If you have a day job and don't want to check your phone every 15 minutes, you need low-velocity environments.

EUR/GBP: Trading this pair is like watching a slow-motion chess match. Because the UK and EU economies are so deeply integrated, the movements are incremental. It’s the ultimate "mean-reverting" pair.

AUD/NZD: For us in Australia, this is our backyard. Because the RBA and RBNZ often move in semi-synchronization, this pair rarely trends forever. It loves to bounce between established ranges. It’s predictable, boring, and for the right trader, profitable.

USD/CAD: This is an "Oil Proxy." If you follow energy markets, this is your pair. When oil prices rise, CAD strengthens (USD/CAD falls).

The most volatile Forex pairs

Some traders crave the "Alpha" that only comes from chaos. If you are a scalper or a high-intensity Day Trader, you need movement.

GBP/JPY: This pair is notorious. It can move 150–200 pips in a single session without breaking a sweat. It’s highly sensitive to global "Risk-On/Risk-Off" sentiment. If you trade the Dragon, your stop losses must be wider, and your ego must be non-existent. It will hunt you if you’re careless.

GBP/AUD: A hidden gem for volatility. It combines the "risk-on" nature of the Aussie with the volatility of the Pound. It often trends hard for days without looking back.

The "Macro" Forex Pairs

USD/JPY (The "Policy Divergence" Trade): For years, traders sold Yen to buy Dollars (the "Carry Trade"). In 2026, this is unwinding. With the Bank of Japan (BoJ) signaling normalization and the Fed cutting, the gap is closing.

Strategy: Watch for BoJ announcements. A single rate hike from Japan could send this pair crashing down 300-400 pips in minutes.

The Commodity Currencies

AUD/USD: For years, the Aussie was dragged down by China’s property woes and a widening interest rate gap with the US. In 2026, the tide is turning. As the RBA signals potential rate hikes to combat stubborn domestic inflation while the Fed targets a "neutral" rate near 3%, the yield advantage is shifting back to Australia.

Risk-Free Demo Account

Trade forex at Mitrade. 0 commission, low spreads. Enjoy limit and stop loss for every trade! Get Started

How to choose the right currency pairs?

In order to choose the right currency pairs to trade, traders should consider several factors such as investment knowledge and experience, capital amount, risk tolerance, or market conditions. You may consider making use of this 7-step approach to assist in your trading decisions and analysis.

Step 1: Create a watchlist

Creating a watchlist involves compiling a list of currency pairs that you are interested in trading or have potential for based on your analysis. This allows you to focus your attention on specific pairs and monitor their movements more effectively.

You can also create a watchlist by taking suggestions from your trading app. Some trading apps generate popular forex trading pairs according to market activity.

For example:

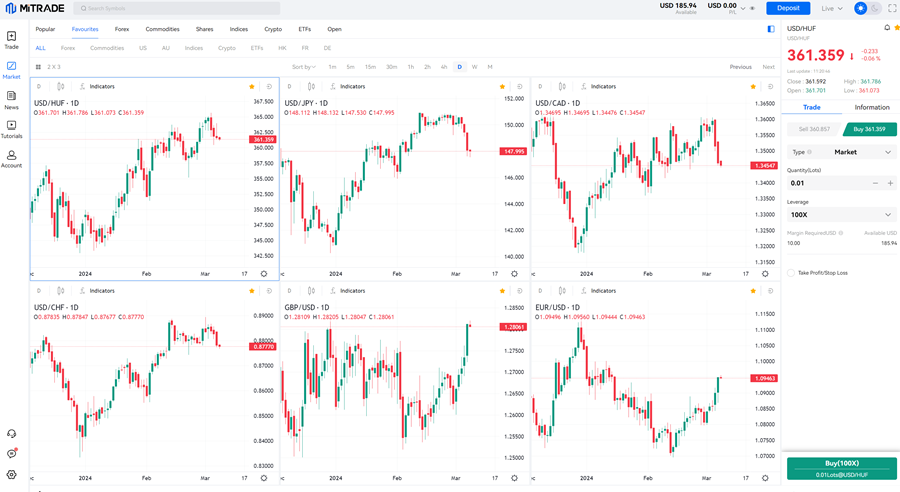

Some popular forex pairs (Source: Mitrade.com)

Step 2: Analyze economic factors and market conditions

- Analyze the fundamental factors driving currency movements, such as interest rates, economic indicators (e.g., GDP, inflation, employment), central bank policies, or geopolitical events. These indicators provide insights into the health and direction of an economy, influencing currency values in the forex market. In particular, central bank policies, such as monetary policy decisions and intervention measures, play a pivotal role in shaping currency movements.

- Assess the current market environment, including volatility, liquidity, trends, and sentiments. For example, major pairs typically offer higher liquidity due to the larger market size arising from its demand and hence have a deeper order book. Unlike major pairs, exotic pairs have smaller market size which results in a more volatile trading environment making them even riskier.

Step 3: Technical Analysis

Some Forex traders utilize technical analysis tools such as price charts, indicators and drawing tools to identify trends or understand the price behavior through trading platform software that provide such features. Traders usually look for patterns such as flag and pennant, double top, head and shoulders etc. in addition to the commonly understood support and resistance level.

Step 4: Consider the trading strategy

There are many different trading strategies used by different traders. Similar to clothing, there will never be a “one size fit all” strategy as different individuals have different trading mentalities and risk appetites. Here are some considerations when trying to determine which trading strategy suits yourself better:

Trend-following strategies may be better suited to pairs with clear and consistent trends.

Range-bound strategies may work well in pairs with low volatility and well-defined support and resistance levels.

Scalping strategies may require pairs with high liquidity and tight spreads for quick execution of trades.

Step 5: Testing

Testing currency pairs using a demo account or small trades is crucial for traders, especially newbies. It offers the chance to familiarize oneself with trading platforms and evaluate the performance of chosen pairs under various market conditions. This process also validates the effectiveness of trading strategies, helping traders refine their approach before risking real capital.

Step 6: Keep Tracking and Adapt

Continuously monitor your selected forex pairs and adapt to changing market conditions. Stay informed about economic developments, news events, and technical signals that may affect currency movements. Be prepared to adjust your trading approach as needed based on new information and market dynamics.

Strategy for Trading forex pairs

Don't trade highly positively correlated currency pairs simultaneously

In professional FX portfolio management, doubling up on highly correlated pairs is the cardinal sin of unintended concentration. When you go long on both $EUR/USD$ and $AUD/USD$, you aren't diversifying; you are simply executing a massive, leveraged bet against the US Dollar under different labels. If a surprise US CPI print sent the Greenback surging, both positions would collapse in lockstep, effectively doubling your downside risk and bypassing your predefined stop-loss logic.

True mastery lies in understanding that risk is not the number of trades you open, but the net exposure to a single macro driver.

Determining the best currency pairs to trade based on market sessions

In the world of FX, liquidity is the lifeblood of profit, and for us in Australia, the clock is often our greatest adversary. Trading isn’t a 24-hour sprint; it’s about tactical strikes during "The Overlap."

If you are trading EUR/USD or GBP/USD, the London/New York overlap (roughly 11:00 PM to 2:00 AM AEDT) is the undisputed heavyweight champion of volatility. This is when the world’s two largest financial hubs are shouting at each other, spreads tighten to their absolute minimum, and the "real" trends for the day are established. However, if you prefer the AUD/JPY or AUD/NZD, your "Golden Hour" starts much earlier, during the Tokyo/Sydney session (10:00 AM to 2:00 PM AEDT), when local RBA headlines and Asian demand drive the price action.

The analytical secret? Never trade "The Dead Zone." The period between the New York close and the Sydney open is a graveyard of "fake-outs" and wide spreads. If you aren't trading when the big banks are awake, you aren't trading—you're just paying the broker's spread for the privilege of being stuck in sideways traffic.

The Australian Trader’s Peak Performance Matrix

| Session / Overlap | Time (AEDT - Summer) | Key Pairs to Watch | Market Personality |

| Sydney/Tokyo Overlap | 10:00 AM – 2:00 PM | AUD/USD, AUD/JPY, NZD/USD | The Home Ground. Best for reacting to RBA news, China data, and regional trends. |

| Tokyo/London Overlap | 6:00 PM – 7:00 PM | EUR/JPY, GBP/JPY, AUD/JPY | The Catalyst. Brief but explosive; often sets the "bias" for the European evening. |

| London/NY Overlap | 11:00 PM – 3:00 AM | EUR/USD, GBP/USD, XAU/USD | The Heavyweight. Maximum liquidity. Trends are most reliable here. Spreads are tightest. |

| The "Dead Zone" | 7:00 AM – 9:00 AM | Avoid Majors | High Risk. Liquidity dries up; spreads widen as New York closes and Sydney prepares to open. |

Conclusion

There is no such thing as the "best" currency pair—only the one that's best for you.

Every trader chases the hottest pair at some point: EUR/USD for its liquidity, USD/JPY for carry, GBP/USD for volatility. But what looks perfect on paper often feels like torture in real life. The "best" pair is the one that matches your risk tolerance, daily schedule, edge, and stomach for drawdowns. A scalper thriving on GBP/JPY chaos will hate the slow grind of EUR/CHF. A swing trader who sleeps through Asian sessions will get wrecked forcing USD/JPY trades.

Ask yourself: How much volatility can I handle? When can I actually watch the charts? What markets do I genuinely understand? The answer points you to your real edge—not some universal ranking. Find that fit, and suddenly trading stops feeling like a battle. The market doesn't care about "best"—it rewards the trader who knows themselves best.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.