US Election 2024: Exit polls awaited as voting about to end

American voters have little time left to cast their votes as polls will start closing at 19:00 EST or 00:00 GMT. United States (US) citizens have to decide whether Vice President Kamala Harris or former President Donald Trump will become the 47th President of the United States.

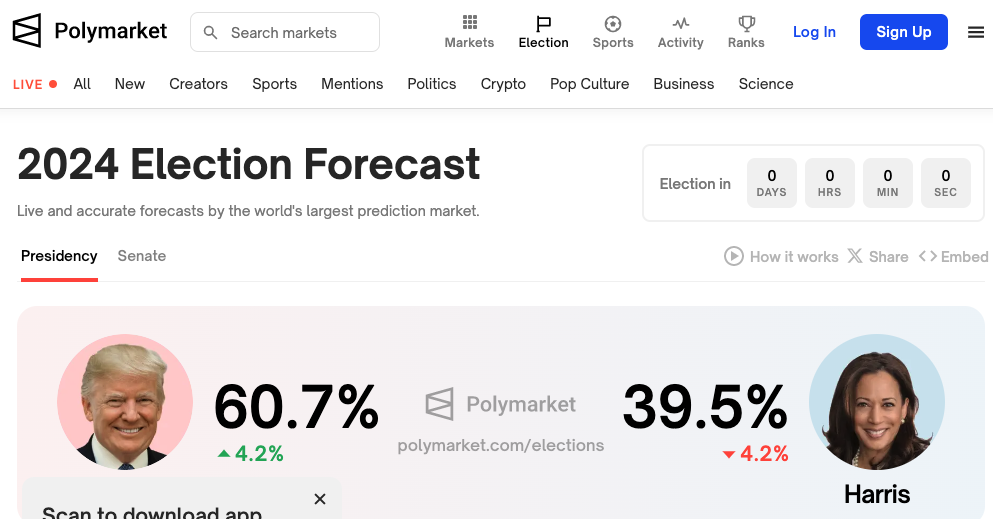

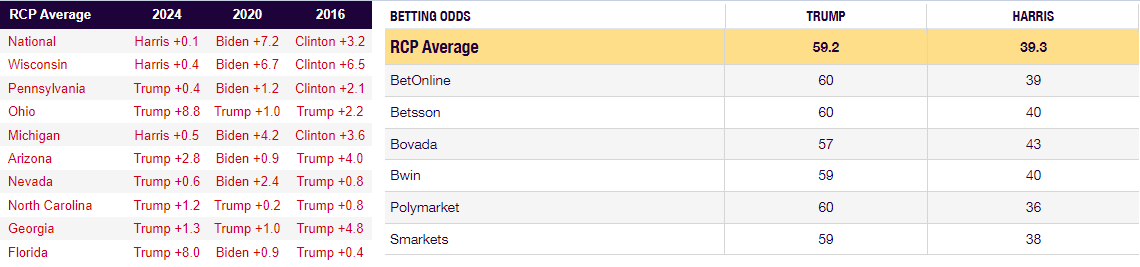

As the time approaches, election polls increasingly show Donald Trump has an advantage over his rival. Kalshi shows an overwhelming 57% to 43% Trump's advantage over Harris, while Polymarket puts the figures at 60.7% and 39.5%, respectively.

In the meantime, Trump stays on top in some swing states such as Arizona and North Carolina, while Harris seems to have taken a small lead in Wisconsin and Michigan. Four swing states – Arizona, Nevada, Pennsylvania, and Wisconsin – have absentee ballot procedures that could delay the calling of a winner. Swing states are likely to define who will take office and exit polls from such states could shake financial boards.

"Early vote returns in US battleground states may not be a good indicator of whether Democratic candidate Kamala Harris or Republican rival Donald Trump will win, experts say, thanks to vote counting rules and quirks in several key states," explains Reuters.

Follow our live coverage of the market reaction to the US presidential election as counting results start hitting the wires.