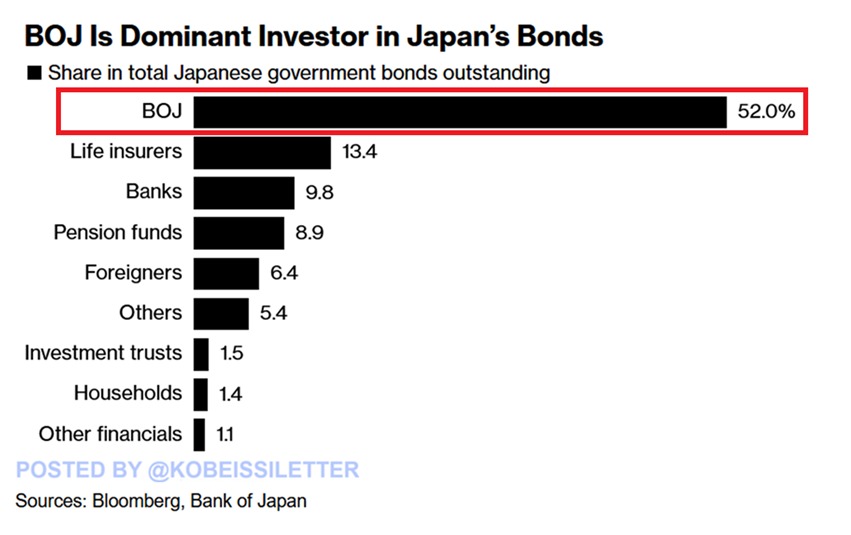

Bank of Japan owns 52% of all domestic government bonds

The Bank of Japan has officially taken control of 52.0% of all Japanese government bonds, according to data from Bloomberg. That means over half of the country’s entire debt market is now held by the central bank.

Life insurers only hold 13.4%, banks hold 9.8%, and pension funds carry just 8.9%. In raw numbers, Japan’s total government debt sits at $7.8 trillion, with the BOJ alone holding $4.1 trillion of that. The only governments with bigger debt loads are the United States and China.

This level of ownership didn’t just happen overnight. Japan has been relying on its central bank to support the market for years. But now, it’s hitting a wall.

The government is boxed in by rising costs, falling demand, and an economy too fragile to carry the weight of this much debt. Every new bond it issues just deepens the hole.

Long-term yields jump as market liquidity breaks down

Since April, the spread between Japan’s 10-year and 30-year bond yields has grown by about 50 basis points, a sharp move that’s bigger than what’s been seen in the US, the UK, or Germany. The jump is tied to rising global uncertainty, especially with Donald Trump back in the White House.

Germany’s new spending program has also pushed up global long-end yields. But Japan’s curve is moving faster and more violently than the rest.

Some investors aren’t waiting around to find out where this goes. Takashi Fujiwara, chief fund manager at Resona Asset Management Co., said, “The rise in volatility worsened dealer sentiment and caused liquidity to dry up. Super-long yields have peaked and are likely to stabilize.” That’s one view, but not everyone agrees.

Others are still buying. Vanguard and RBC BlueBay Asset Management have both been picking up 30-year Japanese government bonds. Ales Koutny, head of international rates at Vanguard, said, “We think the curve will flatten. Two-year to 10-year maturities will sell off and the long end has found its new clearing level of 2.5% to 3%.” He sees recent trade calm as a reason the BOJ could finally start tightening.

But demand is shaky. Shinichiro Kadota, head of FX and rates strategy at Barclays Securities Japan Ltd., pointed out, “Life insurer demand is the key to the eventual stabilization of 30-year bonds, and we haven’t really heard of any intention to buy.”

If insurers stay on the sidelines, there may not be anyone left to catch the falling knife.

Foreign investors step in but fall short of filling the gap

Foreign demand is growing, but it’s still not enough. Overseas investors reportedly added a record amount of Japanese bonds in the first quarter, but they still make up a small part of the market. Tomoaki Shishido, senior yen rates strategist at Nomura Securities Co., said:

“It is unlikely that overseas investors and pension funds will become stable buyers of super-long JGBs as a substitute for life insurers, and it will be difficult to completely offset the shortfall in demand.”

The government isn’t making things easier. Net supply—that’s new bond sales minus redemptions—is being funneled into the long end. There’s more supply of 30-year debt than anyone wants. The result is higher yields, weaker prices, and growing pressure on the BOJ to either buy more or back off.

Omori from Mizuho warned, “For the BOJ, the question is how far and how fast they can let these long-term rates run before it puts too much strain on the rest of the economy.” The central bank is walking a tightrope, trying to balance rising inflation, fiscal needs, and global interest rate pressures, all without letting the financial system unravel.

Meanwhile, the government is facing insane debt servicing costs. With Prime Minister Shigeru Ishiba preparing for upper house elections expected in July, he has to spend in the short term to win votes. At the same time, defense spending is on the rise, adding long-term pressure to a budget that’s already strained beyond breaking.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now