Israeli Airstrikes on Iran Escalate Middle East Conflict, Spiking Oil Prices and Lifting Oil Stocks

TradingKey - On June 12, local time, the Israeli Air Force launched airstrikes on Iran, prompting Iran to vow retaliation and launch a significant number of drones towards Israeli territory, impacting financial markets.

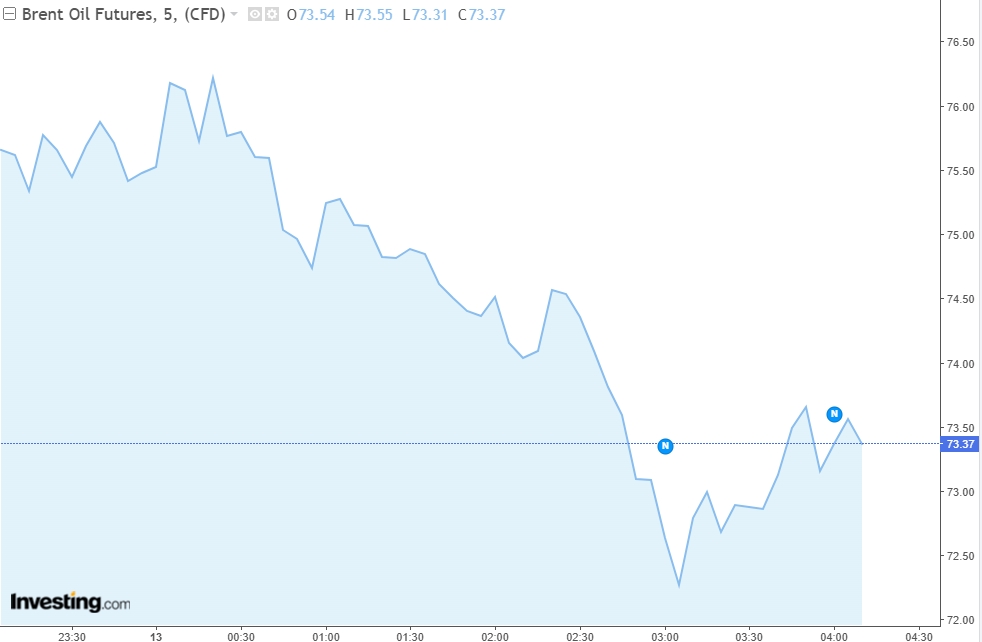

As of June 13, Brent crude oil has surged over 5%, trading at approximately $72.9 per barrel, after intraday highs of $78.50—a peak not seen since January 27. Similarly, WTI crude rose more than 5%, approximately $71.5 per barrel, with intraday peaks reaching $77.62, the highest since January 21.

Brent crude oil trend chart, source: Investing.com

WTI chart, source: TradingKey

This news has caused oil stocks to climb broadly.

In the Hong Kong market, oil and gas equipment stocks continued to rise in the afternoon. As of reporting time, Shandong Molong Petroleum Machinery (00568.HK) had surged over 126.522%, Sinopec Oilfield Service Corporation (01033.HK) rose about 50%, while Dalipal Holdings Limited (01921.HK) saw its stock price spike before slightly retreating, currently up more than 8%. China Oilfield Services Limited (02883.HK) increased by over 5%.

On the A-shares front, China Oilfield Services Limited (601808) rose by 4.2%; Zhongman Petroleum (603619) increased by 10%; and Shandong Taishan Pectroleum (000554) gained approximately 10%.

In the U.S. pre-market session, ExxonMobil (XOM) increased by 3.12%, Chevron (CVX) rose 2.89%, and ConocoPhillips (COP) climbed 3.84%.

Future Oil Price Trends

Saul Kavonic, a senior energy analyst at MST Marquee, commented that Israel's attack has increased the risk premium, but the oil supply will only be genuinely affected if the conflict escalates to the point where Iran retaliates against regional oil infrastructure.

He noted that in extreme scenarios, Iran might target infrastructure or restrict passage through the Strait of Hormuz, potentially disrupting up to 20 million barrels of oil supply daily.

Several seasoned energy analysts pointed out that if Iran retaliates or Israel initiates more extensive strikes, Brent crude and WTI could temporarily test levels of $80 or higher. Oil stocks might be affected under such circumstances.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.