This guide will introduce everything you need to know about forex market trading hours, with a particular focus on the Australian region.

Unlike the stock market, which typically operates for 4–7 hours during official business hours, the forex market is effectively a 24-hour market. It runs across four major regions of the world, with each region trading during the standard business hours of their respective time zones.

There are sixteen independent forex (FX) exchanges operating across these four major regions. Johannesburg, South Africa, is the newest global FX exchange. Each exchange operates five days a week during its unique trading hours (Monday through Friday, excluding weekends and local holidays).

Although these global exchanges operate independently, they all trade the same currencies. This effectively divides the forex market into sequential (and sometimes overlapping) sessions, enabling currency trading to occur in any part of the world, 24 hours a day.

Global Forex Trading Exchanges

Region (session) | Fx trading center | Home Currency | Business Hours (local time) | Time Zone |

Oceania session | Wellington, New Zealand | NZD | 08:00-17:00 | UTC+12 (+13) |

Sydney, Australia | AUD | 08:00-17:00 | UTC+10 (+11) | |

Asia Session | Tokyo, Japan | JPY | 08:00-17:00 | UTC+9 |

Hong Kong, China | HKD | 09:00-17:00 | UTC+8 | |

Shanghai, China | CNY | 09:00-17:00 | UTC+8 | |

Singapore, Singapore | SGD | 09:00-17:00 | UTC+8 | |

India | INR | 09:00-17:00 | UTC+5:30 | |

Moscow, Russia | RUB | 09:30-19:00 | UTC+3 | |

Europe Session | Frankfurt, Germany | EUR | 07:00-15:00 | UTC+1 (+2) |

Zurich, Switzerland | EUR | 09:00-17:30 | UTC+1 (+2) | |

London, United Kingdom | GBP | 08:00-16:00 | UTC (+1) | |

New York, United States | USD | 08:00-17:00 | UTC-5 (-4) | |

Americas Session | Toronto, Canada | CAD | 08:00-17:00 | UTC-5 (-4) |

Chicago, United States | USD | 08:00-16:00 | UTC-6 (-5) | |

| Johannesburg, South Africa | ZAR | 09:00-17:00 | UTC +2 |

The conclusion of the weekend marks the beginning of a new forex trading week.

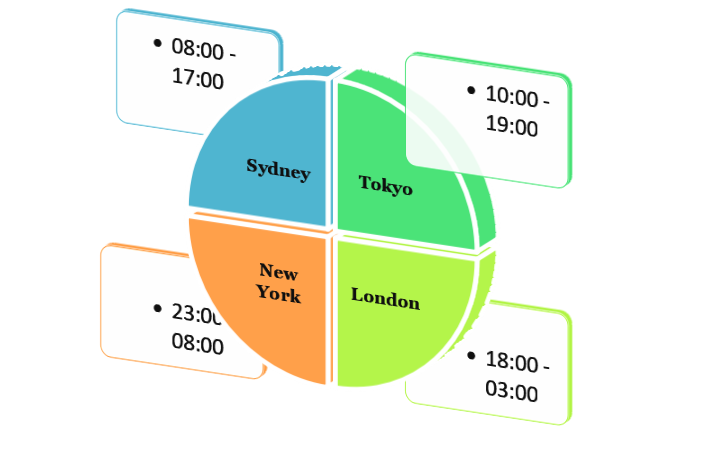

The Oceania market is the first to open, with the Wellington, New Zealand trading center kicking off on Monday at 7:00 AEST (Australian Eastern Standard Time), an hour ahead of the Sydney, Australia FX center (8:00 AEST). Wellington concludes at 16:00 AEST, while Sydney closes later at 17:00.

Throughout the following days, up to the next weekend break, Sydney begins its session right as the New York dealing center closes for the day at 5:00 PM EST. This handoff occurs because when it’s Monday at 5:00 PM local time in New York, it’s actually Tuesday at 8:00 AM local time in Sydney. Generally, at this time, traders based in the Americas have closed their FX order books and plan to take some time off from the screen. Some traders will continue monitoring the market at least until the Asian session comes online.

Two hours into Sydney’s day, another primary market opens: the Tokyo, Japan center (from 10:00 AEST to 19:00 AEST). This marks the beginning of the Asian session. The Hong Kong and Shanghai, China markets, as well as Singapore, open soon after, almost simultaneously. India follows, and the Moscow, Russia center becomes the last of the Asian session to open at 10:30 AEST.

Just as the Oceania sessions close, but before the Asian session concludes, the European session kicks off at 17:00 AEST with Frankfurt, Germany coming online. Zurich, Switzerland; Paris, France; and Johannesburg, South Africa start dealing soon after. London, United Kingdom follows at 18:00 AEST and closes at 3:00 AM the following day.

Halfway into the European session, the Americas come online. The East Coast North American market opens in New York at 23:00 AEST and closes at 8:00 AM the next day. Toronto, Canada starts trading almost at the same time, while Chicago, United States follows an hour behind.

The last deal for the week is done on Saturday at 8:00 AEST when the New York market closes. Forex participants are allowed the weekend break. The trading cycle resumes on Monday at 8:00 AEST when the Sydney center comes online.

This global FX trading session handoff allows the currency market to operate 24 hours a day, 5 days a week. However, as you will learn later in this article, trading volumes for different currency pairs are not equal across all sessions. Some periods will experience high volatility, while others will remain thin.

With knowledge of the market hours, you don’t have to stay up all night to catch profitable trades. You can set workable schedules around trading prime times, giving you a better chance of realizing profits.

The Four Major Forex Exchanges

Sydney, Australia

This is the first of the primary markets to open and where the trading day officially begins. It is smaller than other mega-markets, but it’s the busiest after the weekend break. Fluctuations around the first hours are attributed to the regrouping of individual traders and financial institutions when the markets reopen after a long break.

Tokyo, Japan

Tokyo is the first of Asian trading center to start dealing. It experiences a lot of initial action in the Asian sessions, ahead of Hong Kong, Shanghai, and Singapore. Even though trading can be thin, Tokyo is estimated to reach $210 Bn Average Trading Volume.

USD/JPY, AUD/USD, and NZD/USD typically receive a fair amount of action. GBP-based currency pairs GBP/CHF and GBP/JPY are also excellent opportunities. The USD/JPY receives the most activity concentration, especially when the Tokyo center is the only open trading center open, probably due to the influence it receives from the Bank of Japan.

EUR-based currency pairs do not perform well around this time. EUR/CHF, EUR/GBP, EUR/USD, and their crosses are typically avoided until London comes online.

London, United Kingdom

With an Average Trading Volume of $580 Bn, the London market is the largest and most-watched FX center in the world. According to IFS London, the UK dealing center accounts for a market share of 34% of the global forex market.

The Bank of England greatly influences the fluctuation of currency pair prices. It is the primary organ that sets interest rates and the monetary policy affecting the GBP. Technical traders regularly watch London because most trades in the UK and most of the European session originate from the city.

GBP and EUR-based currency pairs receive a lot of attention from traders. These currency pairs are excellent opportunities because of the high transaction volumes from an extremely volatile market.

JPY currency pairs are least favored because volumes begin to wane when the overlap period ends.

New York, USA

With an Average Trading Volume of $330 Bn, the New York dealing center is the 2nd largest dealing center and controls about 16% of the global forex market trading volumes.

This forex platform is watched heavily by local and international investors because the U.S. dollar is involved in more than 2/3rd of the fx market.

Trading during this session is greatly influenced by movements in the New York Stock Exchange (NYSE). Changes in the US equity, bond market, and fundamental news like mergers & acquisitions instantly affect the dollar value.

US-based pairs offer the best opportunities. USD/CHF, GBP/USD, USD/CAD, and EUR/USD are the most traded pairs. Momentum for GBP-based pairs spills over from the previous European session. GBP/CHF and GBP/JPY received a fair amount of attention in the New York session. Euro-based currencies, EUR/GBP and EUR/CHF are generally avoided towards the end of the overlap because liquidity is expected to decline.

Best Times to Trade the Foreign Exchange Market

You may have noticed several instances when there is more than one market open at the same time. These are the overlap periods. Generally, the trading volumes during overlapping sessions dramatically increases due to the increase in fx trading participants. During this time, the bid and ask changes in one market automatically adjusts the bid and ask in another market until an average is arrived at.

Increased market participants increase liquidity and volatility. In FX, higher liquidity and volatility means that there are better trade opportunities available. Also, during this time, the spread is significantly reduced.

The best time to trade Forex in Australia has to be when more than one session overlap. You get better pip range movement and the highest level of liquidity, making it the best time to trade.

However, you should beware not to trade dormant currency pairs since not all currencies will experience higher trading volumes at any given overlap period. There are certain times when trading is more substantial for particular currency pairs and other times when opportunities from these currencies fall thin.

As a trader, you should know when to trade what currency pair so you can have the edge needed to set up profitable trades. This especially applies to day traders who look to trade breakouts between when one trading session starts and when it overlaps with another session. Short-term strategies like scalping also give you an edge if you know what currency pairs to target.

The Overlaps

Global Fx session showing overlaps (24Hrs, AEST)

8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

Sydney | |||||||||||||||||||||||

Tokyo | |||||||||||||||||||||||

London | |||||||||||||||||||||||

New York | |||||||||||||||||||||||

The Australian - Asian Overlap (10:00 to 17:00 AEST)

Two hours after the Sydney session is online, Japan starts dealing, creating an overlap. Singapore, China, and Moscow also overlap with the rest of the active centers.

This overlap creates volatility with AUD, NZD and their crosses experiencing increased liquidity at this time. Trading the JPY and other Asian currencies provides the potential for breakouts since these pairs will be within their active business times until London takes over.

Trading breakouts for EUR-based currencies at this time will prove difficult. European currencies tend to move slowly (if at all) during the Australia-Asia overlap. This is generally an OFF HOUR for EUR-based currencies.

Generally, this overlapping time frame is considered the slowest of the three. At the time, European traders have scheduled trading for the London session, and U.S-based traders have just closed their books, with most taking a rest until the London session comes online.

Active currencies you might hope to bag significant pips include; AUD/USD, EUR/AUD, AUD/JPY, NZD/USD, AUD/NZD and NZD/JPY currency pairs.

The Asian - European Overlap (18:00 to 19:00 AEST)

This overlapping time frame will have Tokyo, Hong Kong, Singapore, and Moscow trading simultaneously with Frankfurt, Paris and London. It offers a chance to trade in higher pip movements – sometimes up to 150 pips depending on the prevailing market conditions.

EUR and JPY and their crosses are the most targeted currencies. They are the main currencies influenced because the Bank of Japan (BOJ), Bank of England (BoE) and European Central Bank (ECB) are active. This creates significant liquidity for the Japanese Yen, the British Pound, the Euro and their crosses.

At this time, AUD and NZD have declined but are still experiencing some reasonable movement since some traders based in Australia are still looking to ride the Japan-London overlap before they can retire and come back just in time for the London – New York overlap.

The most active currency pairs most traders would hope to bag serious pips from include EUR/JPY, GBP/JPY, and CHF/JPY currency pairs.

The European- American Overlap: (23:00 to 3:00 AEST)

This is the most active, most volatile, and most liquid of the three overlap periods. It is considered prime time in forex marketing since most (if not all) major currencies and their crosses are traded. Fx activity during this time is influenced by The U.S. Federal Reserve, European Central Bank – ECB, and Bank of England – BoE businesses.

FX activity is at its peak when the New York and London markets are online because the US Dollar and the Euro are the most traded currencies. When the two markets overlap is considered prime time. This is the optimal time to trade in all Euro, Pound sterling, Swiss Franc, and USD currency pairs and their crosses. Volatility is at its highest – sometimes up to 350 pips.

Day traders based in Europe and the US mainly trade breakouts during this period, until Europe moves offline at 3:00 AEST.

The most active currency pairs most trader would hope to bag serious pips from include: EUR/USD, GBP/USD and USD/CHF currency pairs.

Bank Holidays & Public Holidays

Individual currency markets close during selected national holidays in their respective regions. These bank holidays and national holidays limit the overall trading hours of the forex market. Currencies for a particular parent market may experience weaker fluctuations when they are closed for the holiday. Globally, all currency markets remain closed during Easter and Christmas.

What else causes currency pair fluctuations?

While understanding the market hours and how overlapping sessions create volatility can help traders plan suitable trading schedules, other factors influencing currency pair fluctuations should not be forgotten.

1. When rate decisions are made

Rate announcements and monetary policy reports are made by the Central Banks of a country. These announcements are released on a fixed day and time of the month. These announcements directly influence the currency trading of the relevant pairs.

As a trader, you should know the critical central bank announcement dates and times.

Major central banks you should watch

The U.S. Federal Reserve

European Central Bank - ECB

Bank of England - BoE

Bank of Japan - BoJ

Bank of Canada - BoC

Reserve Bank of Australia - RBA

Reserve Bank of New Zealand – RBNZ

2. Economic data announcements

Significant news regarding economic data can shake up an otherwise slow trading period. When such data is released, traders will react based on their expectations, thus creating volatility in the market. Depending on what the general market expectation was (whether expectations were met or not), currencies will lose value or gain value within a matter of seconds.

A critical factor here would be to investigation when potentially market-shaking news are scheduled for release, and what the general mood of the market might be. Currency prices will start reacting to a major announcement before, during, and after it has been released.

Significant news releases you should follow

Interest rate decisions

GDP data

CPI data

Trade deficits

Consumer consumption

Consumer confidence

Retail trade

Employment/Unemployment rates

Central bank meetings

Best Fx Hours: Is Profitability Guaranteed?

Up to this point, you know that the best forex hours are the most active hours. These are hours that have any two of the four major markets open simultaneously. During these overlapping times, a heightened trading environment is created where the market experiences more significant fluctuations with a higher price range in the currency pairs, creating better trade opportunities. Overlaps can easily experience a 70 to 100 pip range, especially when there is a major announcement coming up.

The opportunity created here doesn’t eliminate the potential for loss. Active times only mean increased volatility and better profits (if a trade goes your direction). Trading currencies using leveraged margins (in both slow and prime hours) carries high levels of risk and can quickly deplete your account.

Before putting even, a little skin in the game, FX traders must be certain they understand how to use the different features, tools, and strategies required to execute orders that carry higher potential to win. The best way to achieve this is to use demo accounts to practice with real trading tools, instruments, and charting. As such, demo trading is indispensable and very crucial for forex trade beginners.

Most forex brokers will offer a FREE DEMO ACCOUNT with all the features of a real trading account. Even so, if you wish to make trading on demos practical enough and achieve a seamless transition to the actual trading, you’ll have to execute each trade as if you were staking real money. If you plan to load $10,000 into your trading account, don’t go for a $100,000 demo.

Direct market access | Deal on rising and falling market | 24-hour trading | Limit and stop-loss for every trade

Do I need multiple FX brokers to trade all hours?

No. Forex brokers can access all currency markets to allow you to trade multiple currencies throughout the trading day. Mitrade provides forex trading across all trading sessions as long as anyone market is open

Just because only one market is online at a particular point (say, the Asian market) doesn’t mean you wouldn’t access EUR/USD, USD/CAD, or GBP/USD to trade. Interestingly, most currency pairs are traded the most when their home markets are closed.

This goes to show the abundance of opportunities across time and region. However, the trader has to consider the possibility of slow markets for some currency pairs when their home fx trading centers are closed.

The Take-Away

Knowing what currency pairs to trade is vital in the forex market. Knowing when to trade is equally essential. An understanding of the forex market hours and the different trading sessions available fundamentally increases your potential to succeed.

Having knowledge of the market hours enables you to identify specific trading windows when your currency pair choice experiences heightened volatility and trading volumes. You are able to strategize and set up trading schedules for the most favorable trading hours. Being in such an enlightened position, you can afford to catch a wink or two, knowing that opportunities aren't slipping away.

Direct market access | Deal on rising and falling market | 24-hour trading | Limit and stop-loss for every trade

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.