Here is what you need to know on Friday, June 13:

Safe-haven flows dominate the action in financial markets on Friday as investors closely follow the deepening conflict in the Middle East after Israel launched an attack against Iran, targeting sites used in nuclear enrichment program. In the second half of the day, the US economic calendar will feature the University of Michigan's Consumer Sentiment Index for June.

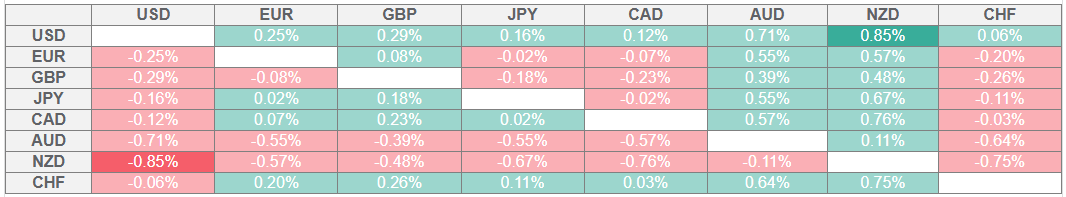

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Israel's Prime Minister Benjamin Netanyahu announced early Friday that they have launched "Operation Rising Lion" to damage Iran's nuclear infrastructure, ballistic missile factories and its military capabilities. Netanyahu also noted that the operation will continue for as many days as it takes. Iran's Armed Forces General staff responded on Friday, warning that Israel and the US will "pay a very heavy price." The latest news surrounding the conflict suggests that Israel has intercepted drones launched by Iran in Jordanian and Syrian airspaces.

United States (US) President Donald Trump will convene a meeting of the National Security Council later in the day to discuss the Israel-Iran conflict. White House Secretary of State Marco Rubio released a statement following the initial attack, warning that Iran should not target US interest or personnel in retaliation.

Gold benefits from the risk-averse market atmosphere and trades above $3,400 early Friday, rising about 1% on the day.

Crude oil prices also shot higher with the immediate reaction to this development. After rising to its highest level since January above $74, the barrel of West Texas Intermediate (WTI) corrected lower and was last seen trading near $70, still rising about 4% on the day.

The US Dollar (USD) Index gains traction and trades in positive territory above 98.00 after losing nearly 0.8% on Thursday.

EUR/USD advanced to its highest level since November 2021 above 1.1600 on Thursday. The pair stays on the back foot early Friday and trades near 1.1550. The European economic calendar will offer Industrial Production and Trade Balance data for April later in the session. Several policymakers from the European Central Bank are scheduled to deliver speeches as well.

GBP/USD turns south in the European morning on Friday and declines toward 1.3550. Still, the pair remains on track to end the week modestly higher.

USD/JPY stages a rebound and trades marginally higher on the day near 143.70 after slumping below 143.00 in the early Asian session on Friday.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.