Solana Price Forecast: SOL flashes bearish signals, risks double-digit crash

- Tesla Stock Hits Record High as Robotaxi Tests Ignite Market. Why Is Goldman Sachs Pouring Cold Water on Tesla?

- Gold Price Hits New High: Has Bitcoin Fully Declined?

- Gold jumps above $4,440 as geopolitical flare, Fed cut bets mount

- U.S. November CPI: How Will Inflation Fluctuations Transmit to US Stocks? Tariffs Are the Key!

- US Q3 GDP Released, Will US Stocks See a "Santa Claus Rally"?【The week ahead】

- December Santa Claus Rally: New highs in sight for US and European stocks?

Solana price trades red on Monday, nearing the 200-day EMA at $162.42; a decisive close below could trigger further downside.

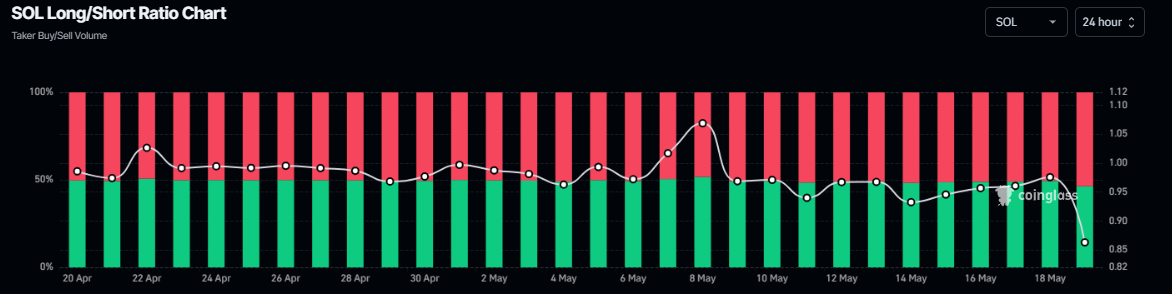

Bearish sentiment spikes, with CoinGlass data showing short positions at their highest level over a month.

Momentum indicators show growing weakness, with a potential downside target near $141.41 if support fails.

Solana (SOL) price shows early signs of a potential breakdown as it trades lower at $165.40 on Monday. SOL is approaching a key support level that could determine its next major move. Technical indicators flash red, and bearish sentiment intensifies, with short positions hitting a monthly high. If SOL closes below its critical support level, the selling pressure could accelerate, potentially driving the token into a double-digit decline toward the $141 mark.

Solana shows a bearish bias in momentum indicators

Solana price faced rejection around the $184.13 daily resistance level on May 14 and declined nearly 10% until Saturday. However, it recovered slightly the next day after finding support around its 200-day EMA at $162.42. This level roughly coincides with the daily support at $160 and the ascending trendline (drawn by joining multiple low levels since April 7), and a breakdown indicates a bearish trend. At the time of writing on Monday, it trades down at around $165.40, approaching its critical support zone.

If SOL continues its correction and closes below $160 on a daily basis, it could extend the decline by 14.6% from its current levels to retest its May 6 low of $141.41.

The Relative Strength Index (RSI) on the daily chart reads 54, pointing toward its neutral level of 50, indicating fading bullish momentum. If the RSI moves below its neutral level of 50, it would give rise to strong bearish momentum and a sharp fall in Solana prices. The Moving Average Convergence Divergence (MACD) indicator is also switching to a bearish crossover on the daily chart. If the crossover occurs, it would confirm another sell signal.

SOL/USDT daily chart

Another sign of a bearish outlook. According to Coinglass’s data, SOL’s long-to-short ratio reads 0.85, the lowest level over a month. This ratio below one reflects bearish sentiment in the markets as more traders are betting on Solana's price to fall.

Solana Long-to-short ratio chart. Source: Coinglass

However, if SOL finds support around the daily level at $160 and recovers, it could extend the recovery toward the next daily resistance at $184.13.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.