Best 15 ASX Lithium Stocks To Watch in 2024-2025 | Industry Overview & Stock List

In an era marked by the relentless pursuit of sustainable energy solutions, lithium emerges as a pivotal element driving innovation and progress. As the world shifts towards electrification and renewable energy adoption, the demand for lithium-ion batteries has skyrocketed, underpinning the transition towards a cleaner, greener future.

In this article, we delve into the realm of lithium investments on the Australian Securities Exchange (ASX) in 2024-2025. We explore the critical role of lithium in revolutionizing industries such as transportation and energy storage and spotlight companies at the forefront of this transformative journey, which may be worthy additions to our investment portfolio.

1. Lithium industry overview from 2022 to 2024

The lithium industry has experienced remarkable growth in recent years, primarily fueled by the burgeoning demand for lithium-ion batteries, particularly in electric vehicles and renewable energy storage systems. As the world transitions towards a cleaner and more sustainable energy future, the demand for lithium is expected to soar, driving significant growth in the industry.

Lithium, predominantly sourced from mineral ores like spodumene and lithium-rich brines, is extracted through conventional mining techniques or solar evaporation processes. Major lithium-producing countries include Australia, Chile, China, and Argentina, which boast significant reserves and contribute significantly to the global lithium market. In 2020, the European Union classified lithium as a "critical raw material," along with cobalt and nickel, due to their essential roles in battery production.

The global lithium market is categorized into segments based on its application, which include:

+ Batteries

+ Glass & ceramics

+ Lubricants

+ Polymers

+ Metallurgy

+ Medical applications

+ Air treatment, and other uses.

Among these, batteries hold the largest market share, accounting for approximately 75% in 2023.

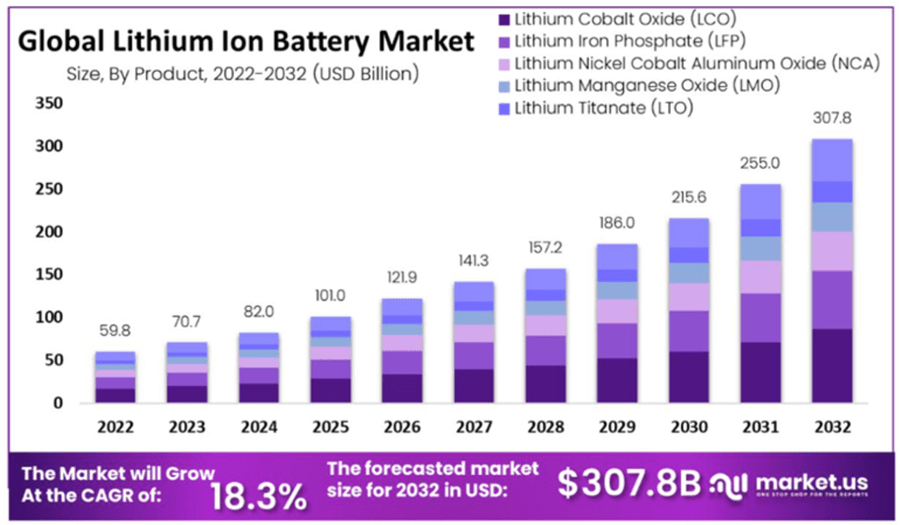

Global Lithium Ion Battery Market (Source: market.us)

According to a report by Market.us in 2023, the global lithium-ion battery market was valued at $59.8 billion in 2022, which increased to $70.7 billion in 2023. It is projected to reach $82.0 billion in 2024, with a compound annual growth rate (CAGR) of 18.3% per year.

2. The performance of ASX lithium stocks in 2023 and 2024

The Australian Securities Exchange (ASX) hosts several companies actively involved in the lithium sector, ranging from explorers and miners to battery manufacturers and technology innovators.

At the beginning of 2023, the Australian stock market, represented by the ASX index, approached its historical peak of around 7561 points reached in 2022. However, it later experienced a decline, reaching its lowest point in late October 2023 with a loss of about 10%. The market then recovered and surpassed the previous peak in February 2024.

Although the Australian stock market had a relatively modest performance in 2023, ASX-listed lithium stocks significantly underperform the market, with many companies within the industry losing up to 80% of their value.

In 2024, there are only a couple of companies showing positive performance which coincide with the Australian stock market reaching new historical highs.

List of Companies in Lithium industry in ASX (Source: Marketindex.com.au; update: 20/09/2024.)

In 2024, many investors and financial analysts are anticipating a revival in lithium stocks as the global economy shows signs of recovery. This optimism stems from the belief that the increased economic activity will drive greater demand for lithium-based products, particularly in sectors such as electric vehicles and renewable energy storage. Furthermore, advancements in technology and growing awareness of sustainability are likely to further boost the demand for lithium, contributing to the positive sentiment surrounding lithium stocks.

3. Best 15 ASX lithium stocks to watch in 2024

Investing in ASX lithium stocks offers exposure to the thriving industry driven by the growing adoption of electric vehicles, renewable energy, and energy storage solutions worldwide.

Here is a list of the top 15 ASX-listed lithium stocks that have garnered prominence in the sector for your reference:

No. | Company | Code |

1 | Rio Tinto Limited | RIO |

2 | Pilbara Minerals Limited | PLS |

3 | Mineral Resources | MIN |

4 | Arcadium Lithium | LTM |

5 | IGO | IGO |

6 | Liontown Resources | LTR |

7 | Vulcan Energy Resources Ltd | VUL |

8 | De Grey Mining | DEG |

9 | Core Lithium | CXO |

10 | Latin Resources | LRS |

11 | Argosy Minerals | AGY |

12 | Wildcat Resources | WC8 |

13 | Piedmont Lithium Inc | PLL |

14 | Future Battery Minerals | FBM |

15 | Lithium Power International | LPI |

#1 Rio Tinto Limited (ASX: RIO)

Rio Tinto Limited, founded in 1959, is a globally renowned mining corporation known for its diversified portfolio of high-quality mineral assets, listed on the ASX as RIO. Headquartered in Melbourne, Australia, Rio Tinto is a leading producer of lithium, iron ore, aluminum, copper, diamonds, and other essential metals and minerals. With operations spanning across six continents, Rio Tinto is recognized for its commitment to sustainable mining practices, innovation, and community engagement.

Stock price: 113.61 AUD

Market cap: 157.15 billion AUD

Performance (YTD): -15.91%

P/E: 11.03

Beta (1Y): 0.61

Revenue (2023): 81.42 billion AUD

#2 Pilbara Minerals Limited (ASX: PLS)

Pilbara Minerals Limited, founded in 2005, is an Australian lithium and tantalum producer listed on the ASX as PLS. The company focuses on the exploration, development, and operation of lithium and tantalum projects, with its flagship operation being the Pilgangoora Lithium-Tantalum Project in Western Australia. Pilbara Minerals aims to capitalize on the growing demand for lithium, particularly in the electric vehicle and renewable energy sectors.

Stock price: 2.88 AUD

Market cap: 8.49 billion AUD

Performance (YTD): -26.34%

P/E: 34.08

Beta (1Y): 1.6

Revenue (2023): 4.06 billion AUD

#3 Mineral Resources (ASX: MIN)

Mineral Resources Limited, founded in 2006 by Christopher J. Ellison and listed on the ASX as MIN, is a leading mining and processing services provider and iron ore producer in Australia. The company operates across the entire mining lifecycle, from exploration and mine development to production and logistics. Mineral Resources is also involved in commodity trading and owns significant infrastructure assets, positioning itself as a diversified player in the mining industry.

Stock price: 37.8 AUD

Market cap: 7.23 billion AUD

Performance (YTD): -45.92%

P/E: 63.4

Beta (1Y): 1.92

Revenue (2023): 4.78 billion AUD

#4 Arcadium Lithium (ASX: LTM)

Arcadium Lithium Plc, founded in 2023 in Ireland and listed on the ASX as LTM, is a lithium exploration and development company with a focus on advancing lithium projects in Australia. The company is committed to leveraging its expertise in lithium exploration and development to meet the increasing global demand for lithium-ion batteries, particularly in the electric vehicle and energy storage sectors.

Stock price: 3.72 AUD

Market cap: 3.93 billion AUD

Performance (YTD): -66.76%

P/E: N/A

Beta (1Y): 2.65

Revenue (2023): 1.33 billion AUD

#5 IGO (ASX: IGO)

IGO Limited, founded in 2000 and listed on the ASX as IGO, is an Australian diversified mining company with a focus on lithium, cobalt, nickel, copper, and other base metals. The company operates several mining projects in Western Australia and is actively involved in exploration and development activities to expand its resource base. IGO is committed to sustainable mining practices, clean energy, and value creation for its shareholders.

Stock price: 5.20 AUD

Market cap: 3.85 billion AUD

Performance (YTD): -41.90%

P/E: 2291

Beta (1Y): 1.93

Revenue (2023): 1.05 billion AUD

#6 Liontown Resources (ASX: LTR)

Liontown Resources Limited, founded in 2006 and listed on the ASX as LTR, is an Australian mineral exploration company focused on the discovery and development of high-grade lithium and gold deposits. The company's flagship project is the Kathleen Valley Lithium-Tantalum Project in Western Australia, which has demonstrated significant exploration potential. Liontown Resources aims to create long-term value through the advancement of its exploration projects.

Stock price: 0.665 AUD

Market cap: 1.58 billion AUD

Performance (YTD): -59.70%

P/E: N/A

Beta (1Y): 2.51

Revenue (2023): N/A

#7 Vulcan Energy Resources Ltd. (ASX: VUL)

Vulcan Energy Resources Ltd. operates as a lithium producer with net zero greenhouse gas emissions. Its Zero Carbon Lithium project intends to produce a battery-quality lithium hydroxide chemical product from its combined geothermal energy and lithium resource. The company was founded by Francis Wedin and Horst Kreuter on February 5, 2018 and is headquartered in Perth, Australia.

Stock price: 3.77 AUD

Market cap: 705.71 billion AUD

Performance (YTD): +30.00%

P/E: N/A

Beta (1Y): 2.89

Revenue (2023): 11.05 million AUD

#8 De Grey Mining (ASX: DEG)

De Grey Mining Limited, founded in 2000 and listed on the ASX as DEG, is a vibrant exploration and development company specializing in gold and lithium exploration. Based in Western Australia, De Grey Mining is renowned for its strategic approach to unlocking the potential of its vast landholdings in the Pilbara region, a renowned gold-producing area.

Stock price: 1.30 AUD

Market cap: 3.01 billion AUD

Performance (YTD): 5.96%

P/E: N/A

Beta (1Y): 1.66

Revenue (2023): 0.026 million AUD

The above information provides fundamental insights into promising ASX lithium stocks. Nonetheless, it is crucial for traders to continue tracking market dynamics and monitor the performances of these companies to anticipate price trends and exercise effective risk management throughout their trading endeavors.

4. Which factors will affect the price of ASX Lithium Stocks?

The valuation of ASX lithium stocks is influenced by various factors, ranging from global market trends to technological innovations and regulatory shifts. These factors collectively shape the landscape of the lithium industry and impact the performance of companies listed on the Australian Securities Exchange (ASX). Traders should carefully consider the following factors to make informed decisions and better navigate the volatility inherent in the lithium market, ensuring a more strategic approach to trading ASX lithium stocks:

Lithium Market Supply and Demand: Supply and demand dynamics play a crucial role in determining the price of lithium stocks. Factors such as changes in production levels, new lithium discoveries, and shifts in global demand for lithium-ion batteries (used in electric vehicles, energy storage systems, etc.) can impact market conditions and consequently stock prices.

Electric Vehicle (EV) Demand: The demand for electric vehicles, which heavily rely on lithium-ion batteries, directly affects the demand for lithium. Government incentives, regulations promoting EV adoption, and advancements in battery technology can all influence EV demand and subsequently impact lithium stock prices.

Renewable Energy Trends: Lithium batteries are also essential for storing renewable energy generated from sources like solar and wind power. Growth in renewable energy installations and grid-scale energy storage projects can drive demand for lithium and impact stock prices.

Geopolitical factors: Geopolitical tensions, trade disputes, or disruptions in the global supply chain can create uncertainty in commodity markets, including lithium. Political instability or trade policies affecting major lithium-producing regions (such as Australia, Chile, or Argentina) can impact supply availability and prices, consequently affecting lithium stock prices.

Technological advancements: Innovations in battery technology, energy storage systems, and renewable energy solutions can drive demand for lithium and influence investor sentiment towards lithium stocks. Breakthroughs in battery efficiency, energy density, and cost reduction can have a significant impact on the long-term prospects of lithium companies.

Economic conditions: Economic indicators, such as GDP growth, industrial output, and consumer spending, can impact the overall demand for commodities, including lithium. Positive economic conditions typically lead to increased industrial activity and higher demand for lithium, which can support higher stock prices for lithium companies.

Government policies and regulations: Government policies related to environmental regulations, renewable energy targets, and incentives for electric vehicles can shape the demand for lithium and impact the profitability of lithium companies. Changes in policies regarding mining regulations, environmental standards, or subsidies for clean energy technologies can affect the operating costs and revenues of lithium producers.

Traders should also factor in competitive dynamics and investor sentiment, as they play significant roles in shaping the performance of ASX lithium stocks. By considering these additional elements, traders can gain a more comprehensive understanding of the market landscape and make more effective trading decisions.

5. FAQs about ASX Lithium Stocks/Shares

5.1 What are the key drivers behind the growth of ASX lithium stocks in 2025?

The growth of ASX lithium stocks in 2025 is primarily driven by the increasing demand for lithium-ion batteries, particularly in electric vehicles and renewable energy storage systems. As the world moves towards sustainable energy solutions, the demand for lithium is expected to soar, bolstering the prospects of lithium stocks.

5.2 How can investors stay informed about developments in the ASX lithium industry?

Investors can stay informed by regularly monitoring industry news, financial reports of lithium companies, market research reports, and by attending industry conferences and events.

5.3 What are the potential risks associated with investing in ASX lithium stocks?

Risks associated with investing in ASX lithium stocks include volatility in lithium prices, regulatory changes impacting lithium mining and processing operations, competition within the industry, and geopolitical tensions affecting global supply chains.

5.4 What should investors consider before investing in ASX lithium stocks in 2024?

Before investing in ASX lithium stocks in 2025, investors should conduct thorough research, assess their risk tolerance, and consider consulting with financial advisors to make informed investment decisions aligned with their investment goals.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.