Top 10 crypto market movers as Bitcoin and Ethereum hold steady ahead of $1.8 billion options expiry

- Bitcoin and Ethereum hold steady above $64,000 and $3,400 as $1.8 billion in options expire on Friday.

- WazirX hack of $230 million potentially linked to Lazarus Group ushers correction in Shiba Inu, among other assets.

- Fantom gains nearly 3% in response to a new collaboration announcement, MANTA and BONK kick off meme coin rally.

- Solana meme coins and Layer 2 tokens begin a recovery rally in the last 24 hours, per CoinGecko data.

Bitcoin and Ethereum options worth approximately $1.79 billion are expiring on Friday, per Deribit data. Market-moving events from the week include a $230 million hack on the Indian exchange WazirX, Fantom Foundation’s collaboration with Alchemy, Manta Network and BONK’s reward opportunities for traders, among other updates.

Bitcoin and Ethereum hover around $64,000 and $3,400 respectively, while gains in BONK kick-off recovery in meme coins, per CoinGecko data.

Top 10 market movers this week

- Shiba Inu, one of the largest meme coin in the crypto ecosystem, suffered an 8% decline in its price on Thursday before bouncing back above $0.00001722 on Friday. The correction was likely catalyzed by a $230 million hack associated with the Lazarus Group on the WazirX exchange. Data from on-chain trackers shows over $102 million in Shiba Inu was sold at centralized crypto exchanges. Shiba Inu crushed by 5 trillion SHIB transfer, $230 million WazirX hack

- Manta Network announced a partnership with BONK, and announced rewards for users. The collaboration is labeled “Meme-ta szn”, a celebration of the meme culture, and offered users unique ways to earn rewards. BONK extend gains by 2.31% at the time of writing on Friday.

️ We’re making some exciting updates to the Dual Citizenship Rewards with @bonk_inu, and it’s coming in 2 phrases.

— Manta Network (,) Meme-ta Szn (@MantaNetwork) July 16, 2024

Read more below pic.twitter.com/VkiDlUNBHx

- Italy’s state-owned bank Cassa Depositi e Prestiti SpA completed a $27.2 million digital bond issuance on Polygon, an Ethereum’s Layer 2 scaling solution. The transaction was part of a trial conducted by the European Central Bank (ECB) to identify means of central bank settlement.

Intesa Sanpaolo tweet

- Vitalik Buterin urged the crypto community to evaluate the values of political candidates rather than their stance on crypto. Buterin highlighted that the current trend of supporting political candidates can turn out to be short-sighted as politicians may change their views on crypto in the future.

Vitalik Buterin blog

- Ether.Fi protocol announced the launch of season two of its airdrops.

Season 2 ETHFI claims are live: https://t.co/Zhqhe9VvoO

— ether.fi Foundation (@ether_fi_Fdn) July 18, 2024

Please only click official links

- Sandbox (SAND) extended gains by over 8% in the past seven days. Analyst behind the @DCLBlogger handle on X notes that while the “metaverse on blockchain” hype has died out, SAND remains a relevant project.

7/ SAND.

— MattyVerse (@DCLBlogger) February 8, 2024

They hit $7 at peak!

Although the 'Metaverse on blockchain' hype as died out.

I DO think they've had ample momentum with partners.

I think they'll still be relevant during bull as 'Metaverse' sees a resurgance in AR, etc. pic.twitter.com/PwCSDCNhc6

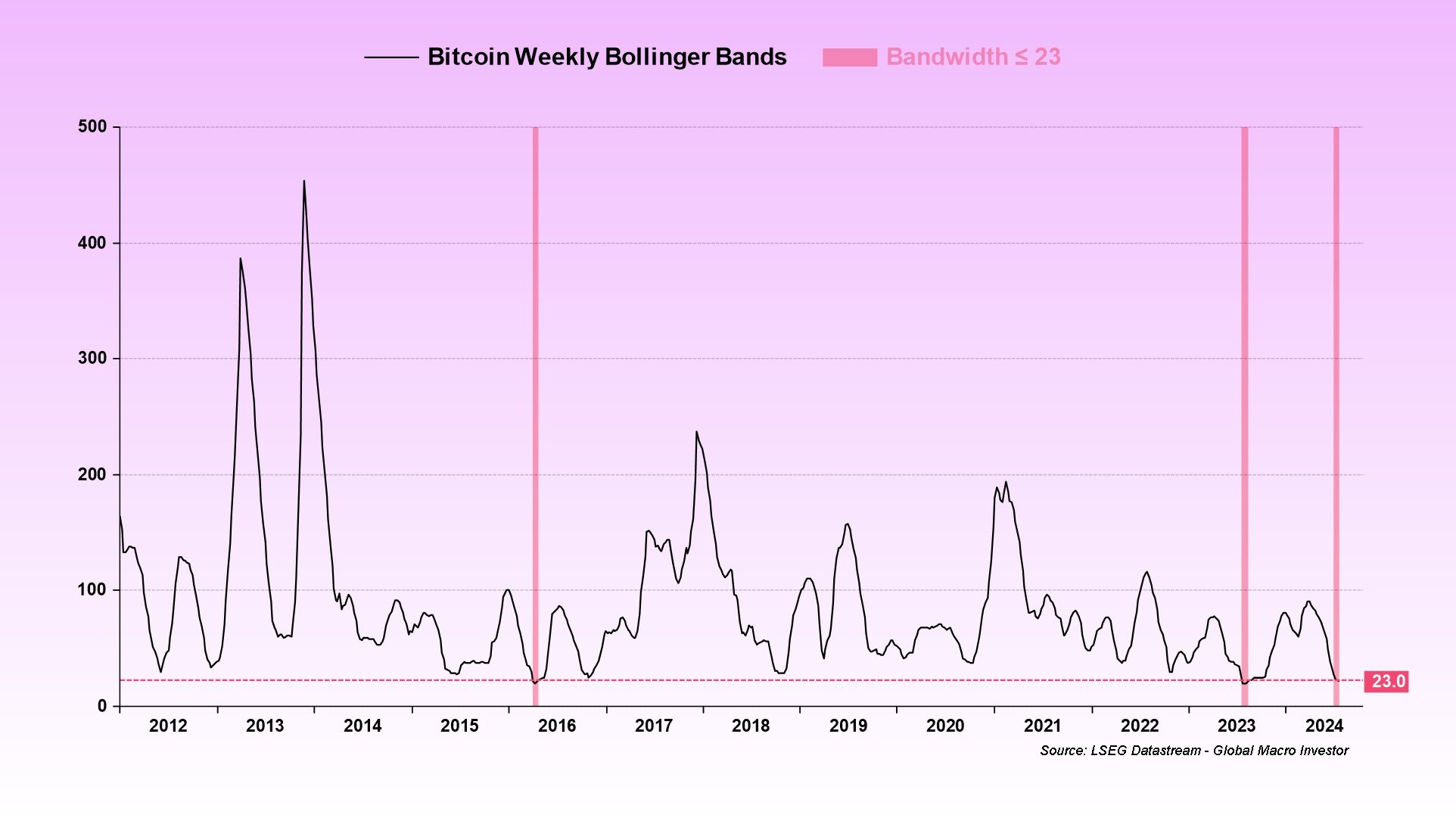

- LSEG data shows that Bitcoin Bollinger Bands are the tightest since April 2016. The momentum indicator is used to identify overbought and oversold market conditions.

Bitcoin weekly Bollinger Bands

- The Artificial Intelligence (AI) sector gained 34% this week, as asset management giant Grayscale launched an AI-focused crypto fund with tokens Near (NEAR), Render (RNDR), Bittensor (TAO), Filecoin (FIL) and Livepeer (LPT).

- Sources informed Cointelegraph that the US Securities & Exchange Commission (SEC) has reportedly given permission to BlackRock, Franklin Templeton, and VanEck for their Spot Ether ETFs, and trade could begin as early as July 23.

- Data from a Circle.com report shows USD Coin (USDC) circulation increased by nearly $100 million in the past week, and the total circulation reached $33.9 billion.

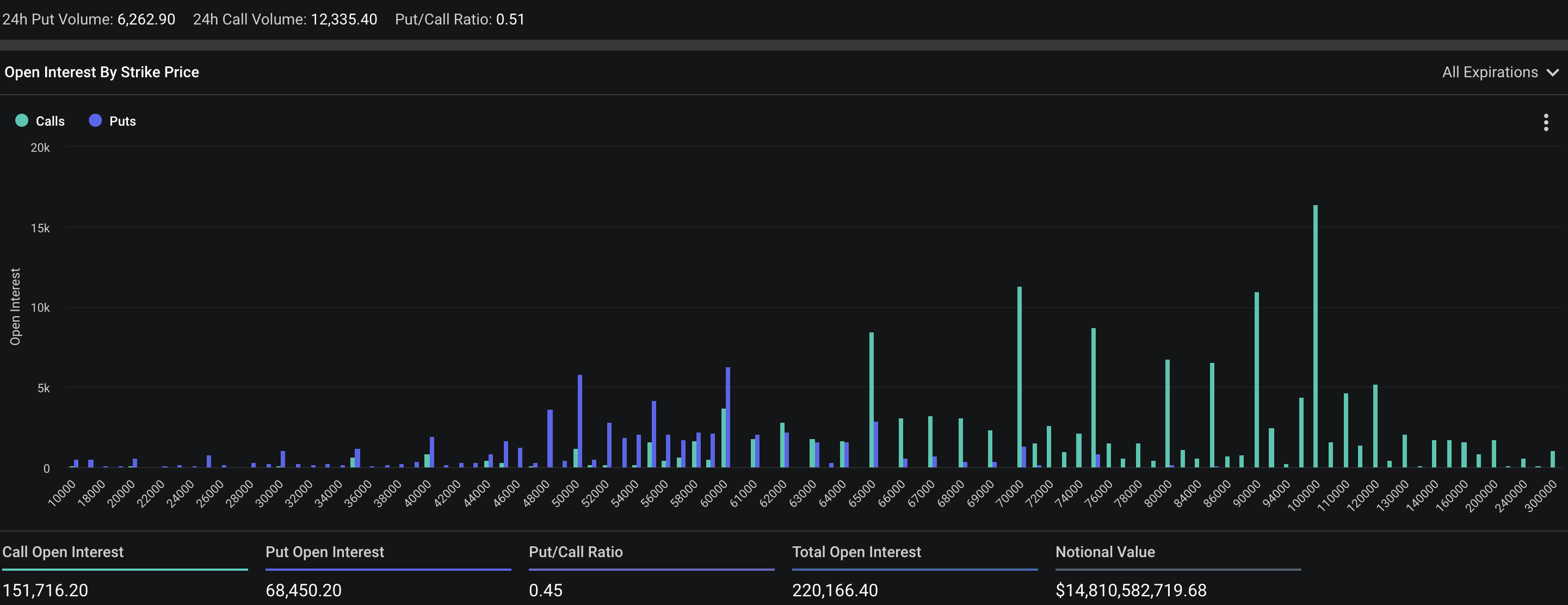

Bitcoin and Ethereum’s $1.79 billion options expiry

Deribit data shows that approximately $1.79 billion in Bitcoin and Ethereum options are set to expire on Friday, and market participants brace for volatility. Traders are expected to keep their eyes peeled for the upcoming launch of the Spot Ethereum ETF and the final green flag from the US financial regulator.

Bitcoin options expiration

Bitcoin and Ethereum sustained above key support levels on Friday, while a decline is likely over the weekend unless news of ETF approval makes headlines on Friday.

What to expect from meme coins and Layer 2 tokens

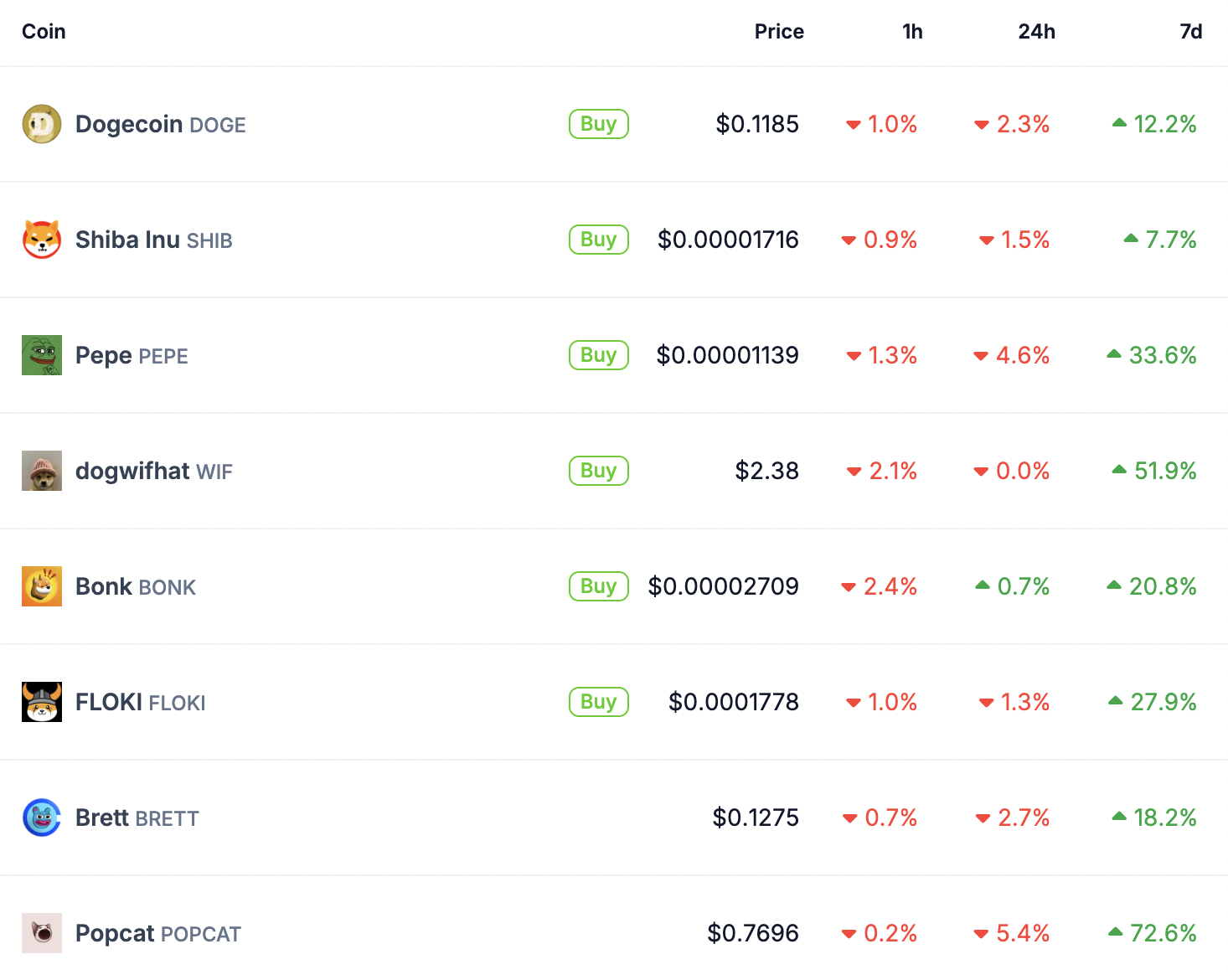

Solana meme coins added 5% to their market capitalization in the last 24 hours, per CoinGecko data. The total market capitalization of the category is $8.22 billion. Meme coins like Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), Dogwifhat (WIF) erased between 1% and 4% of their value in the last 24 hours, while BONK started its recovery.

Coingecko data shows that BONK sustains its seven-day gains of 20%. The dog-themed meme coin could lead recovery in the asset category.

Meme coin prices as seen on Coingecko

Ethereum Layer 2 tokens started their recovery as ETH traders anticipate approval of the Spot Ethereum ETF by July 23.