Arbitrum DAO approves M&A pilot as on-chain metrics suggest ARB may rally soon

- Arbitrum DAO approved an eight-week pilot M&A program after 99% support for the proposal.

- Key on-chain metric hints that Arbitrum is still in buy zone despite 7.5% rise.

- Arbitrum could see a rally soon following an increase in its MVRV.

Arbitrum's (ARB) on-chain metrics showed signs of a rally on Friday following news that the Arbitrum DAO approved an eight-week M&A pilot proposal on Wednesday.

Also read: Arbitrum price sets the stage for 30% recovery rally

Arbitrum approves M&A proposal

The Arbitrum DAO showed massive support for the eight-week M&A pilot phase proposal, with over 99% of DAO members voting for it.

According to the proposal, the eight-week M&A pilot would focus on in-depth data-driven research and discussion to provide Arbitrum's DAO with robust information on whether to approve or deny "further operationalization of the M&A unit and its funding requirements."

"The overarching aim is to utilize M&A as a key growth driver for the Arbitrum ecosystem and to help the DAO expand non-organically through acquisition opportunities that are not accessible to competing ecosystems, thereby critically enhancing Arbitrum DAO's capital allocation methods," stated the proposal.

The M&A move from Arbitrum DAO follows the recent approval from the individual communities of AI tokens FET, OCEAN, and AGIX to merge as one with a new token, ASI.

Read more: Injective to launch Layer 3 chain on Arbitrum, INJ falls 4%

ARB's on-chain metrics show signs of potential rally

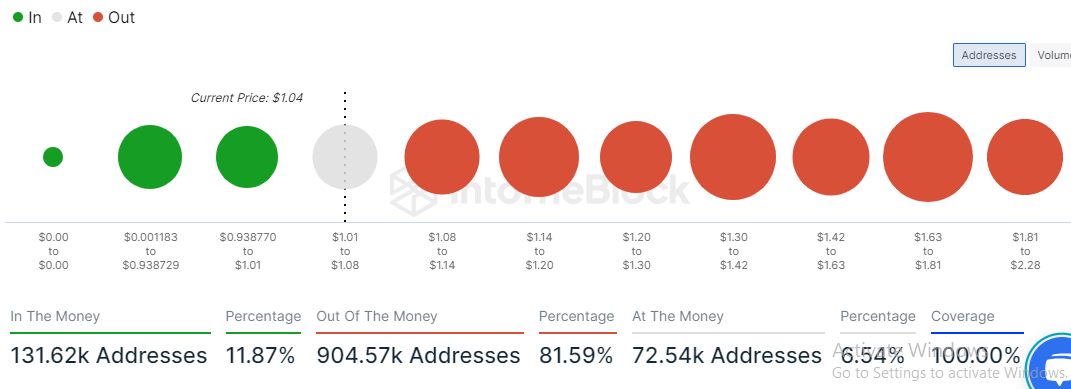

ARB posted an impressive 7.5% gain on Friday, following a generally positive outlook across the crypto market. However, despite the recent gain, data from IntoTheBlock shows that 79.6% of ARB addresses are still out-of-the-money, with only 20.11% -in-the-money and 0.29% at-the-money.

A high percentage of in-the-money addresses signifies potential profit-taking from investors, and vice versa for out-of-the-money addresses.

Global In/Out of the Money

As a result, ARB investors are likely to hold onto their assets in anticipation of a tangible price appreciation that would see them being in the money.

A further look into other metrics shows addresses holding 55% of ARB's circulating supply are out of the money. This may be because of the 1.1 billion ARB — 41% of its current circulating supply — token unlock on March 16. The unlock largely affected ARB's price growth, correlating with a steep decline that saw ARB drop 103% within two months from $1.83 to $0.93 on May 15.

Also read: Arbitrum price dips post massive token unlock, mass sell-off drives ARB decline

While prices have slightly recovered to $1.03, these metrics show ARB is still in the buy zone for investors looking to open a position in the Ethereum Layer 2 altcoin. However, investors should exercise caution, considering whales hold about 45% of the token's total supply.

There has also been equal activity from bulls and bears in the past seven days, with 146 bulls and 146 bears indicating uncertainty. However, recent price movement tilts toward the direction of bulls, indicating signs of a potential rally.

ARB's market value to realize value (MVRV) ratio also confirms the rally signs with a 6.54% growth in the past 24 hours. A bearish change in the general crypto market sentiment would invalidate this thesis.