Investing in stocks can be an effective way to build wealth over time, but it's crucial to understand that not all stocks are created equal. Some companies choose to reward their shareholders by distributing a portion of their profits in the form of dividends. These dividend payments provide investors with an additional source of returns, beyond just the potential for the stock's value to appreciate.

When evaluating investment opportunities, it's important to consider not just a stock's growth potential, but also whether it offers dividend payouts and the sustainability of those dividends.

So what is a stock dividend? How is a stock dividend calculated? Which Stocks Pay The Highest Dividend? This article will answer these questions one by one.

1. What is a stock dividend?

There are two ways for the company to distribute dividends to shareholders - one is to give stocks, and the other is to give cash.

Giving stocks means that the listed company distributes free shares to the shareholders, and the shares will be deposited into the investor's original shareholding account. In this case, the number of shares held by the investor will increase, which is also called a stock dividend or bonus shares.

Giving cash means distributing cash directly into the investor's fund account, also known as a cash dividend, dividend payout, or dividend distribution.

As for which method the company chooses, it depends on the company's actual situation. Generally speaking, the requirements for distributing cash dividends are higher. The company must have remaining profits after repaying debts and making up for past losses, and there must be sufficient cash on hand for the distribution without affecting the company's normal liquidity. The threshold for distributing stock dividends is relatively lower. As long as the dividend distribution conditions are met, the company can adopt this method regardless of whether the cash on hand is sufficient.

2. How to Invest in Dividend Stocks

2.1 Understand Dividends:

Dividends are cash payments made by a company to its shareholders.

Dividend-paying stocks can provide a steady stream of income in addition to potential capital appreciation.

2.2 Choose Dividend Stocks:

Look for companies with a history of consistent, growing dividends.

Consider the dividend yield (annual dividends per share divided by the stock price).

Evaluate the company's financial health and growth potential.

2.3 Build a Diversified Dividend Portfolio:

Invest in a mix of sectors and industries to reduce risk.

Consider low-cost index funds that track dividend-focused indexes.

2.4 Reinvest Dividends:

Enroll in a dividend reinvestment plan (DRIP) to automatically reinvest dividends and buy more shares.

Compounding the reinvested dividends can significantly grow your investment over time.

2.5 Monitor and manage:

Review your portfolio periodically and make adjustments as needed.

Be aware of changes in a company's dividend policy or financial condition.

If you're not particularly concerned about stock dividends and don't want to devote extensive time to analyzing the underlying investment value of high-dividend stocks, trading stocks through CFDs (contracts for difference) may be a suitable alternative strategy for you.

CFD trading allows you to capitalize on the price differences between the buying and selling prices of stocks, enabling you to pursue opportunities based on market movements rather than focusing primarily on dividend payouts. This approach can be attractive for investors who want to take a more active, trading-oriented approach to the markets.

3. Top 20 High-Dividend Stocks List For 2024

We'll look at the top 20 dividend stocks on either the New York Stock Exchange (NYSE) or the Nasdaq, based on their forward dividend yield. We'll leave out companies with payout ratios that are negative or over 100%. These facts are correct as of April 30, 2024.

Ticker Symbol | Company Name | Industry | Dividend Yield % |

DEC | Diversified Energy Company | Energy | 24.36% |

EC | Ecopetrol S.A. | Energy | 23.25% |

TRMD | TORM plc | Shipping | 19.89% |

ECC | Eagle Point Credit Company | Finance | 16.73% |

RC | Ready Capital Corporation | Finance | 15.44% |

CLCO | Cool Company Ltd | Technology | 14.54% |

GECC | Great Elm Capital Corp | Finance | 13.50% |

IIF | Morgan Stanley India Investment Fund | Finance | 13.35% |

XFLT | XAI Octagon Floating Rate & Alternative Income Trust | Finance | 13.31% |

ABR | Arbor Realty Trust | Real Estate | 13.13% |

FBRT | Franklin BSP Realty Trust Inc | Real Estate | 10.97% |

AOMR | Angel Oak Mortgage REIT Inc | Real Estate | 10.64% |

INSW | International Seaways Inc | Shipping | 10.58% |

CIVI | Civitas Resources Inc | Energy | 9.37% |

CVI | CVR Energy Inc | Energy | 8.97% |

EGBN | Eagle Bancorp Inc | Finance | 8.85% |

EPM | Evolution Petroleum Corporation | Energy | 8.82% |

MO | Altria Group Inc | Consumer Goods | 8.71% |

ALX | Alexander's Inc. | Finance | 8.63% |

WASH | Washington Trust Bancorp, Inc. | Finance | 8.26% |

A high dividend yield doesn't necessarily mean a stock is a good investment. As you noted, yields can increase due to a falling stock price, which could indicate underlying financial issues with the company. Additionally, some firms may be overspending on dividends and could be forced to cut them in the future if the payouts become unsustainable.

The ideal dividend portfolio really comes down to an individual's specific investment goals, risk tolerance, and time horizon. For some investors, a more conservative approach focused on the "dividend aristocrats" - S&P 500 companies with at least 25 consecutive years of dividend increases - may be more appropriate than chasing the highest yields.

Many financial advisors also recommend that most investors are better off gaining exposure to dividend-paying stocks through low-cost index funds, rather than trying to pick individual high-dividend stocks. Index funds provide built-in diversification and tend to outperform most actively managed portfolios over the long term.

The key is to carefully evaluate any high-dividend stocks, considering the company's financial strength, dividend history, and sustainability of the payouts. Investors should also make sure any individual stock picks fit with their overall investment strategy and risk profile. A well-diversified, index-based approach is often the safest way to generate consistent dividend income.

4. When are stock dividends distributed? How are they distributed?

When a listed company decides to distribute dividends, it is usually an annual cash dividend payment. U.S. listed companies tend to use quarterly dividend distributions. So the dividend distribution is generally done after the annual or quarterly financial reports are released.

The dividend plan needs to be approved by the shareholders' meeting and disclosed in the financial reports.

The specific dates when companies release their financial reports vary. If a company discloses its annual report in February, then shareholders may receive the dividend in April. If the company discloses the annual report in April, then shareholders may have to wait until June to receive the dividend.

Not all companies that achieve profitability will distribute dividends to investors every year. There are very few companies that are able to maintain stable annual dividends. If a company has many ongoing projects or needs a large amount of capital for business expansion, they may not distribute dividends, even if they have remaining profits.

The process of distributing stock dividends:

Announcement day | Company announces dividend payment |

Equity registration date | To count and confirm the information of shareholders participating in the current dividend distribution, as long as they hold the company's stocks before this date (including the current day), they can participate. |

ex-dividend ex-rights date | In order to count and confirm the information of shareholders participating in the current dividend distribution, they must hold the company's stocks before this date (including the current day). |

Distribution day | The day when dividends are officially distributed to shareholders. You can trade on ex-rights and ex-dividend dates. Even if you sell the stock, it will not affect your enjoyment of current dividends. |

Furthermore, the distribution of dividends is one way to reward shareholders, but it is not the only way. If a company's stock is in a good upward trend, this can also be a return for shareholders, even without dividends, as shareholders can still enjoy the gains from the stock price increase.

For companies that do not pay dividends, there are other ways to reward shareholders, such as stock splits and stock buybacks.

Stock Splits:

A stock split refers to dividing one share into two or more shares. The total equity of the company and the shareholders' proportional holdings remain unchanged, but the number of shares held by shareholders and the company's total outstanding shares increase, while the share price decreases.

A stock split does not directly increase the wealth of investors, but the lower share price may attract more investors to buy in, driving the price higher and thereby increasing shareholder wealth.

Stock Buybacks:

A stock buyback is when a company buys back its own shares. The repurchased shares are held as treasury stock or canceled, reducing the total number of outstanding shares. This increases the net asset value per share and causes the stock price to rise, resulting in increased returns for investors.

Additionally, a stock buyback sends a signal to investors that the stock is undervalued, which boosts investor confidence and subsequently drives up the stock price.

5. How to calculate Stock Dividends (Examples)?

To calculate stock dividends, we can use the Dividends Per Share formula:

Dividends per Share = Annual Dividend / Number of Shares Outstanding

Here are a few examples:

Example 1: Apple Inc.

Let's say Apple announced a total dividend of $750,000 to shareholders in the previous financial year, and they have 200,000 shares outstanding.

Dividends per Share = $750,000 / 200,000 shares

Dividends per Share = $3.75 per share

Example 2: Alphabet Inc. (Google)

Alphabet paid a total of $250,000 in dividends over the last year, and they also provided a special one-time dividend of $47,500 to existing shareholders. Alphabet has 200,000 shares outstanding.

Annual Dividend = Total Dividend - Special Dividend

Annual Dividend = $250,000 - $47,500 = $202,500

Dividends per Share = $202,500 / 200,000 shares

Dividends per Share = $1.01 per share

Example 3: Microsoft Corporation (MSFT)

Annual Dividend in 2022: $2.48 per share

Shares Outstanding in 2022: 7.46 billion

Dividends per Share = $2.48 / 7.46 billion = $0.33 per share

The key points are:

Use the Dividends per Share formula: Dividends per Share = Annual Dividend / Number of Shares Outstanding

Calculate the Annual Dividend by subtracting any special dividends from the total dividends paid

Use the average number of outstanding shares if the number changes during the year

6. How Do Dividends Impact Stock Prices?

Here are the key points on how dividends impact stock prices, based on the information provided in the article:

Dividend Declaration:

When a company announces it will pay dividends, the stock price often rises as investors want to buy the shares to receive the dividends.

This increase in stock price continues until the ex-dividend date, which is 3 business days before the record date.

Ex-Dividend Date:

On the ex-dividend date, the stock price tends to drop by approximately the amount of the dividend per share.

This is because investors who buy the stock on or after the ex-dividend date will not receive the upcoming dividend payment.

Long-Term Effects:

Companies that pay consistent, substantial dividends often have higher stock prices in the long run as they are seen as reliable investments.

Smaller companies that retain earnings for growth tend to have lower stock prices, as investors view them as less profitable in the short-term.

Stock Dividends:

The issuance of stock dividends also impacts stock prices, causing a temporary increase around the declaration date.

However, the stock price adjusts downward around the ex-dividend date for stock dividends as well.

Overall:

Dividend announcements and payments cause systematic fluctuations in stock prices in the short-term.

In the long-run, a company's dividend policy is an important factor in determining its stock price and perceived value.

7. How to Check for Stock Dividends Paid by a Company?

Here are the steps to check for stock dividends paid by a company:

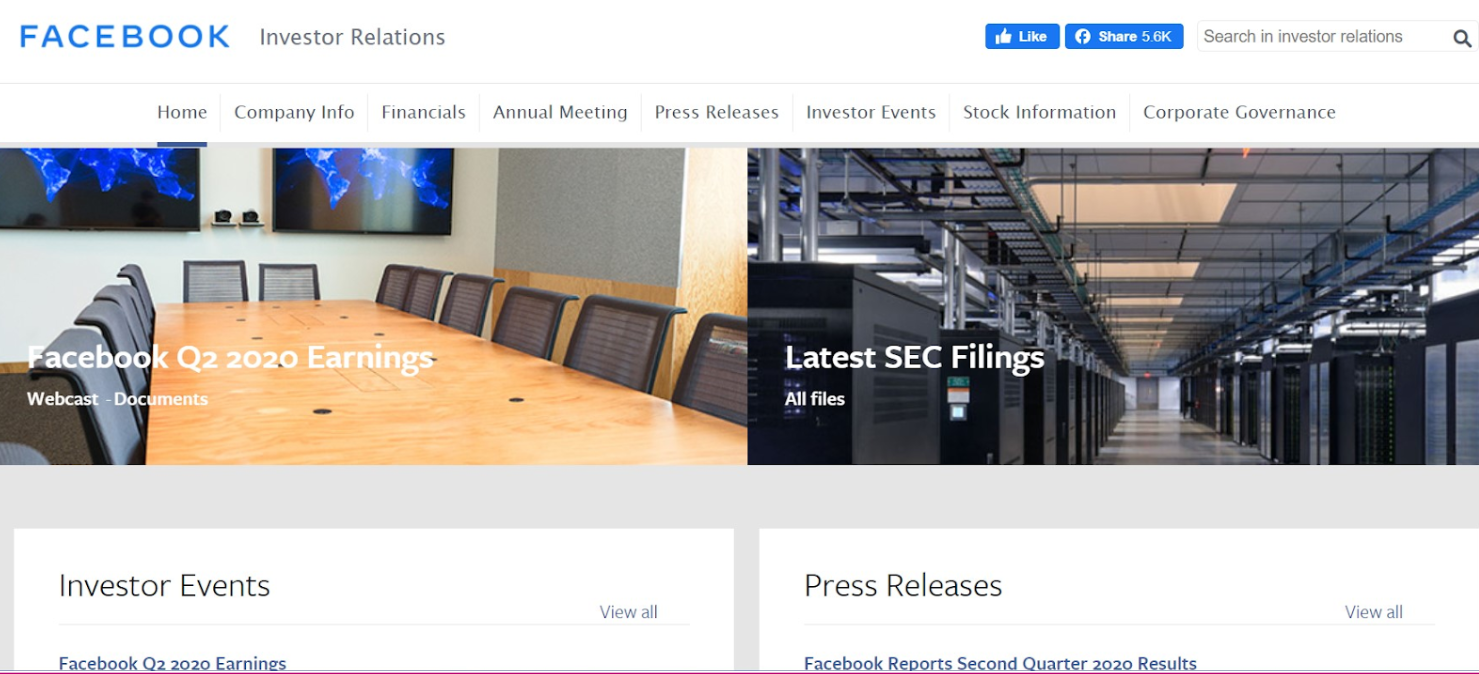

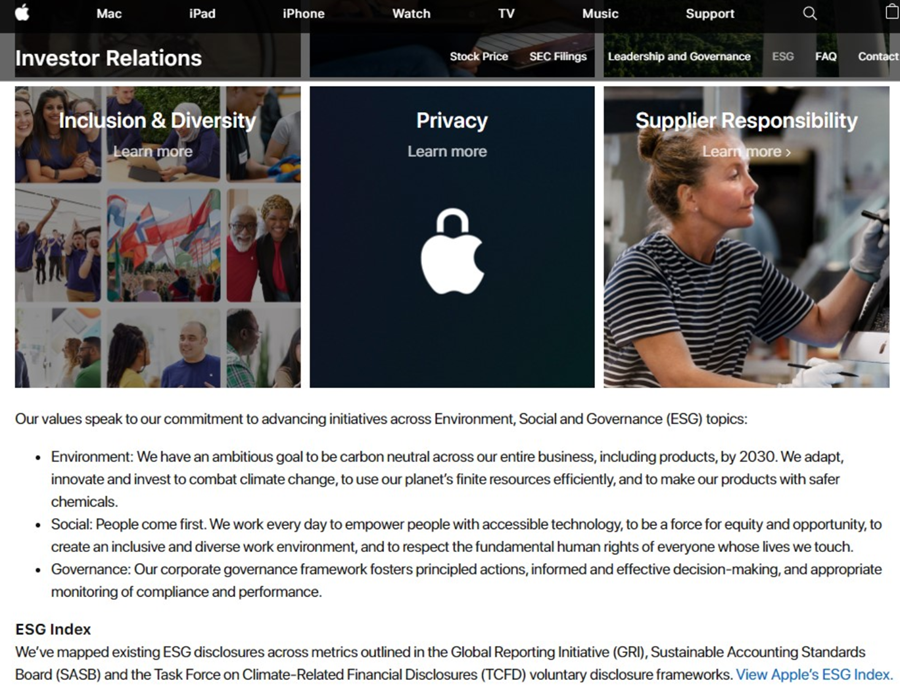

Step 1: Check the Company's Investor Relations Website

Companies typically announce their dividend payments and policies on their investor relations website. Look for sections like "Dividends" or "Investor News" to find information on past and upcoming dividend payments.

source: q4blog.com

Source: q4blog.com

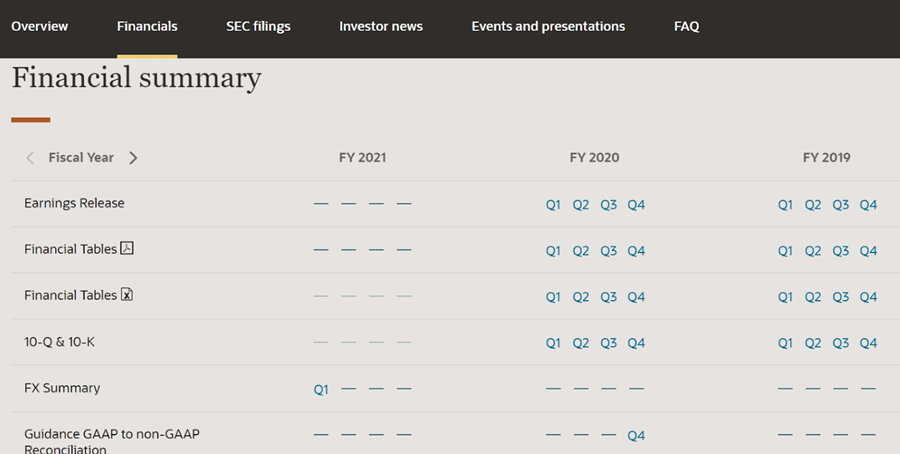

Step 2: Review the Company's Earnings Reports

Dividend information is usually included in a company's quarterly and annual earnings reports, which are publicly available. Look for the "Dividends" section or line item in the financial statements.

source: cdn.corporatefinanceinstitute.com

Step 3: Search Financial News and Databases

Financial news sites and databases like Yahoo Finance, Google Finance, and S&P Capital IQ often have historical dividend data for publicly traded companies.

Source: q4blog.com

Step 4 Refer to Stock Exchange Announcements

For companies listed on stock exchanges, you can check the exchange's website for announcements about upcoming or past dividend payments.

source: pbs.twimg.com

Step 5: Contact the Company's Investor Relations Department

If you can't find the dividend information you need online, you can directly contact the company's investor relations team and request the details.

The key is to look for the dividend per share amount, the payment date, and any special dividends or distributions the company has made. This information can help you understand a company's dividend history and policies.

8. Conclusion

While high-dividend stocks can be appealing, investors should approach them with caution. A lofty yield does not automatically make a stock a good investment. Careful analysis of the company's financial strength and dividend sustainability is crucial.

For most investors, a diversified approach focused on dividend-oriented index funds or "dividend aristocrats" may be a safer bet than trying to hand-pick the highest-yielding individual stocks. This allows you to benefit from dividend income while limiting company-specific risk.

Ultimately, successful dividend investing requires aligning your portfolio with your individual financial goals and risk tolerance. By doing so, you can leverage the power of dividend income to help achieve your investment objectives.

Why do companies pay dividends?

What is a good dividend yield to look for?

How do I build a diversified dividend portfolio?

What are dividend aristocrats and why are they important?

Should I reinvest my dividends?

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.