Over the past three years, the demand for on-chain interaction activities has surged, and many people have also learned to use hot wallets. However, using a hot wallet has a rather troublesome issue: managing private keys and mnemonic phrases. . Due to poor management, many people have forgotten or had these stolen, resulting in the loss of their cryptocurrency assets.

As a result, the demand for cold wallets has increased dramatically, as people want to use cold wallets to securely store their cryptocurrency assets. However, there are many different cold wallets on the market, what are the differences between them? How should one choose? How do you use them? We will address these questions one by one.

1. What is a cold wallet?

Cryptocurrency wallets, commonly referred to as wallets, are a type of digital wallet used to store, manage, and use virtual currencies. There are two main types: hot wallets and cold wallets. You can use them to receive, store, and transfer cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Litecoin (LTC), and others..

Cold wallets refer to cryptocurrency wallets stored on offline devices. Cold wallets generally refer specifically to hardware wallets, but also include paper wallets and USB wallets.

Hot wallets, also called software wallets, refer to cryptocurrency wallets stored on online devices such as computers and mobile phones. These can be further divided into app wallets and desktop wallets.

Classification of Cryptocurrency Wallets:

| Evaluation criteria | Hot wallet | Cold wallet |

| Definition | These are types of wallets that are regularly connected to the Internet (Online Wallets). This frequent connection makes this type of wallet, in addition to storing electronic currencies, also effective in sending/receiving money during transactions. For this reason, it is used more in Online transactions and payments. | This is a type of wallet that is completely disconnected from the Internet environment (Offline Wallet). |

| Types | There are numerous variations, yet they all share the common characteristic of being software programs.. Specifically:

| This discrepancy necessitates its special design for cryptocurrency storage. It consists of only one form, the physical form (can be held). Specifically:

|

| Advantages | Free: Currently, all hot wallets on the market are free. Creating your own wallet to conduct cryptocurrency transactions won't require much effort. Convenience: Because it is always connected to the Internet, you can easily trade anytime. Easy to use: With a hot wallet, you only need to remember your wallet address and the recipient's wallet to be able to make transactions simply and easily. | Safety: With the feature of not requiring an Internet connection, compared to hot wallets, cold wallets have a much higher level of safety. Being offline prevents anyone from attacking your wallet. |

[Classification of Cryptocurrency Wallets - Summarized by Mitrade]

Cold wallets typically have a form similar to a USB drive or a small mobile phone, which helps make it convenient for storage and use when traveling. It is considered one of the most secure storage devices, as in addition to being offline by nature, it is also equipped with various other security measures.

Typically, this type of cold wallet will require the user to provide a PIN code or password to access the device. This PIN code or password ensures that even if the device falls into the hands of a stranger, they cannot access your cryptocurrency.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

2. How does code wallet work?

When a user creates a cryptocurrency wallet, they will be provided with a Seed Phrase, Private Key, and Public Key. If someone else knows the Private Key or Seed Phrase of the user, they can steal all the cryptocurrency associated with that account. By storing the Private Key and Seed Phrase offline, it becomes much more difficult for hackers to steal the cryptocurrency.

Essentially, a cold wallet stores the private key offline on a device or medium. The specific working principle involves two steps:

(1) Generating a public-private key pair:

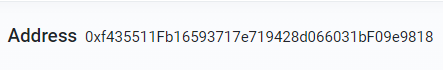

When you set up a cold wallet, it uses an encryption algorithm to generate a public key and a private key. The public key (also called an address) can be understood as an account number and is used to receive cryptocurrency assets. It can be shared publicly.

The address of the Public Key. Source:MetaMask

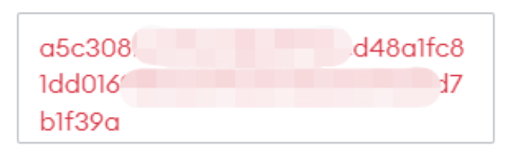

The private key is akin to an account password and gives you the right to access all the assets in the wallet. People may also be familiar with the seed phrase (also a variant of the private key) which is used for easier memorization, typically consistsof 12 or 24 English words.

The address of the private Key. Source:MetaMask

(2) Offline storage of the private key:

Generally not connected to the internet, cold wallets store the private key in a physically isolated manner, effectively preventing hacker and malware attacks. . Note that a cold wallet can store not just the private key it generated, but also private keys generated on other devices or hot wallets. However, a single cold wallet can typically only store one private key, so there is a limit on the number of keys it can hold.

3. Analysis of the cold wallet market trend

According to data from Blockchain.com, the number of cryptocurrency wallet users is around 68 million, and this has seen exponential growth in 2022, already exceeding 80 million in just the first half of the year compared to the full year of 2021. Furthermore, a report from Research And Markets indicates that the hardware wallet market reached $400 million in 2021, and is projected to reach $3.6 billion by 2032.

Over the past years, cold wallets have been continuously improved by manufacturers to become more superior, and the future trend of these wallets also seems quite promising.

More advanced security features: The core value of cold wallets is security, so it would not be surprising if current cold wallet manufacturers continue to develop even more superior security features. Modern cold wallets are gradually being equipped with various security features such as biometric identification, two-factor authentication, PIN codes, etc. These new features will create more difficulties for hackers and better protect the security of your cryptocurrency.

Ability to interact with multiple blockchains and support more cryptocurrencies: In the past, cold wallets were designed to only support a few major blockchains. However, with the emergence of an increasing number of blockchains and new cryptocurrencies, cold wallet manufacturers have made efforts to make their devices more compatible with these new technological changes. This development helps users easily manage their assets everywhere, making cold wallets much more widely adopted.

User-friendly: The current design of cold wallets is becoming increasingly visually appealing and convenient. The goal is to make these devices more accessible to users without much technical knowledge, who are only interested in cryptocurrency as an investment. For example, new cold wallets now support large color touchscreens instead of just black and white displays as before.

Reasonable pricing: The first cold wallets released on the market were very expensive and not easily accessible to the majority of customers. However, new products have emerged on the market and are more affordable, such as the Ledger Nano S with a retail price of $79 and the Trezor One at around $69.

4. 03 popular crypto cold wallet for 2024

(1) Ledger Nano S Wallet

Among cold wallets, the Ledger Nano S is considered the best solution currently. This wallet has the size of a USB drive, is evaluated to have a metal body that provides high durability, an easy-to-use interface, and high security. The Ledger Nano S cold wallet also helps store over 1100 different cryptocurrencies.

Advantages:

Stores a diverse range of cryptocurrencies in a single small USB wallet

Has backup and data recovery features for the account in case the Ledger device is damaged, lost, or stolen

Provides multi-layer security with high protection

Disadvantages:

Expensive solution, costing $95 per unit

Low flexibility as it needs to be connected to a computer to conduct transactions

Does not support the Vietnamese language

(Source: i5.walmartimages.com)

(2) Ledger Nano X Wallet

The Ledger Nano X is the latest cold wallet version from Unicorn (after the Nano S version) and is considered an even more optimized solution compared to the Nano S. Similar to the Nano S, the Nano X also has the size of a USB drive, is evaluated to have a metal body that provides high durability, an easy-to-use interface, and high security.

Unlike the Ledger Nano S where users need to manually install/remove apps to use a specific wallet, the Ledger Nano X can install multiple cryptocurrency wallets simultaneously.

Advantages:

Stores a diverse range of cryptocurrencies in a single USB wallet

Has backup and data recovery features for the account in case the Ledger device is damaged, lost, or stolen

Provides multi-layer security with high protection

Disadvantages:

High cost: $166 per unit

Limited flexibility as it needs to be connected to a computer to conduct transactions

Does not support the Vietnamese language

Source: ledger.com

(3) Trezor One Wallet

The Trezor wallet is a pioneer in the era of hardware wallets, and is therefore the first secure cold wallet in the world. The Trezor wallet is created by SatoshiLabs and is like a small computer with an OLED screen.

It is secured by a 9-digit random PIN code and a 24-word recovery seed, ensuring security and recoverability in case the device is lost or damaged.

Advantages:

Stores a diverse range of cryptocurrencies in a single device

Has backup and data recovery features for the account in case the device is damaged, lost, or stolen

Provides multi-layer security with high protection

Disadvantages:

High cost: $99 per unit

Limited flexibility as it needs to be connected to a computer to conduct transactions

Does not support the Vietnamese language

Source: trezor.io

5. How to choose a suitable cold wallet?

How to choose a cold wallet? The individual's needs may vary, but they generally consider four aspects: security, compatibility, cost, and user experience.

Security

Each manufacturer uses different types of technology when designing cold wallets to securely store cryptocurrency ownership offline. . Therefore, you must look for a wallet with strong encryption, multi-factor authentication, and other security features to ensure the safety of your seed phrase and private keys.

Compatibility

Before purchasing a cold wallet, ensure that it supports the cryptocurrencies you own. Most cold wallets are designed to support thousands of different cryptocurrencies, but some cold wallets only support a limited number of mainstream cryptocurrencies.

Cost

Cold wallets come in a range of prices, from simple and affordable to high-end and expensive. Before purchasing a cold wallet, consider whether the money spent is worth it. If you buy an expensive wallet, make sure it meets your requirements in the most effective way.

User Experience

While the operation process of each wallet is similar, the appearance and feel of different wallets can vary greatly, so it's important to find one that you like. A user-friendly interface makes it easier for you to navigate and better manage your assets.

You can generally find the above information on the official website. Of course, you can also understand the product's real performance through other users' reviews.

6. How to use cold wallets correctly?

Even though cold wallets typically remain disconnected from the internet, they still require connection during transactions. Therefore, users still need to be careful when handling the wallet to avoid irreparable mistakes.

◆ Read the user manual carefully: Cold wallets have diverse features, and the usage also varies depending on the manufacturer. So make sure to fully understand the wallet's features by reading the user manual or watching tutorial videos.

◆ Check the receiving wallet address: When using a cold wallet for transactions, make sure the receiving address is correct, as sending to the wrong address can result in permanently losing the funds.

◆ Check the cold wallet regularly: Regularly check the cold wallet to ensure all its features are working as expected. Before transferring a large amount, you can try sending a small amount first to check for any errors. Additionally, monitor the transactions in the wallet to detect any suspicious activity in a timely manner.

◆ Store the cold wallet in a secure location: Cold wallets are electronic devices that can be damaged or lost. Store the cold wallet offline in a secure location where no one can access it, and protect it from physical factors like impact and moisture that can damage the hardware.

7. Conclusion

In summary, when choosing a cold wallet, it's important to prioritize security, compatibility with your cryptocurrencies, cost-effectiveness, and a user-friendly interface. By carefully evaluating these key factors, you can select the cold wallet that best meets your needs and provides secure offline storage for your digital assets. Doing thorough research and reading user reviews can also help you make an informed decision. Choosing the right cold wallet is a crucial step in protecting your cryptocurrency holdings.

What is the main difference between a hot wallet and a cold wallet?

How do I know if a cold wallet is compatible with my cryptocurrencies?

How do I set up and use a cold wallet securely?

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.