TRON Price Forecast: TRX shows strength amid $1.4 billion selloff

- TRON recorded a large wave of realized profits on Tuesday, reaching $1.4 billion.

- The increased profit-taking spearheaded by long-term holders failed to spark a downtrend, with TRX’s open interest rising gradually.

- TRX held steady at $0.33 despite the selling activity.

TRON (TRX) saw a surge in realized profits on Tuesday after investors booked gains of over $1.4 billion. Despite the strong profit realization, the altcoin held steady as it seeks to flip the $0.33 resistance.

TRX holds steady despite strong selling activity

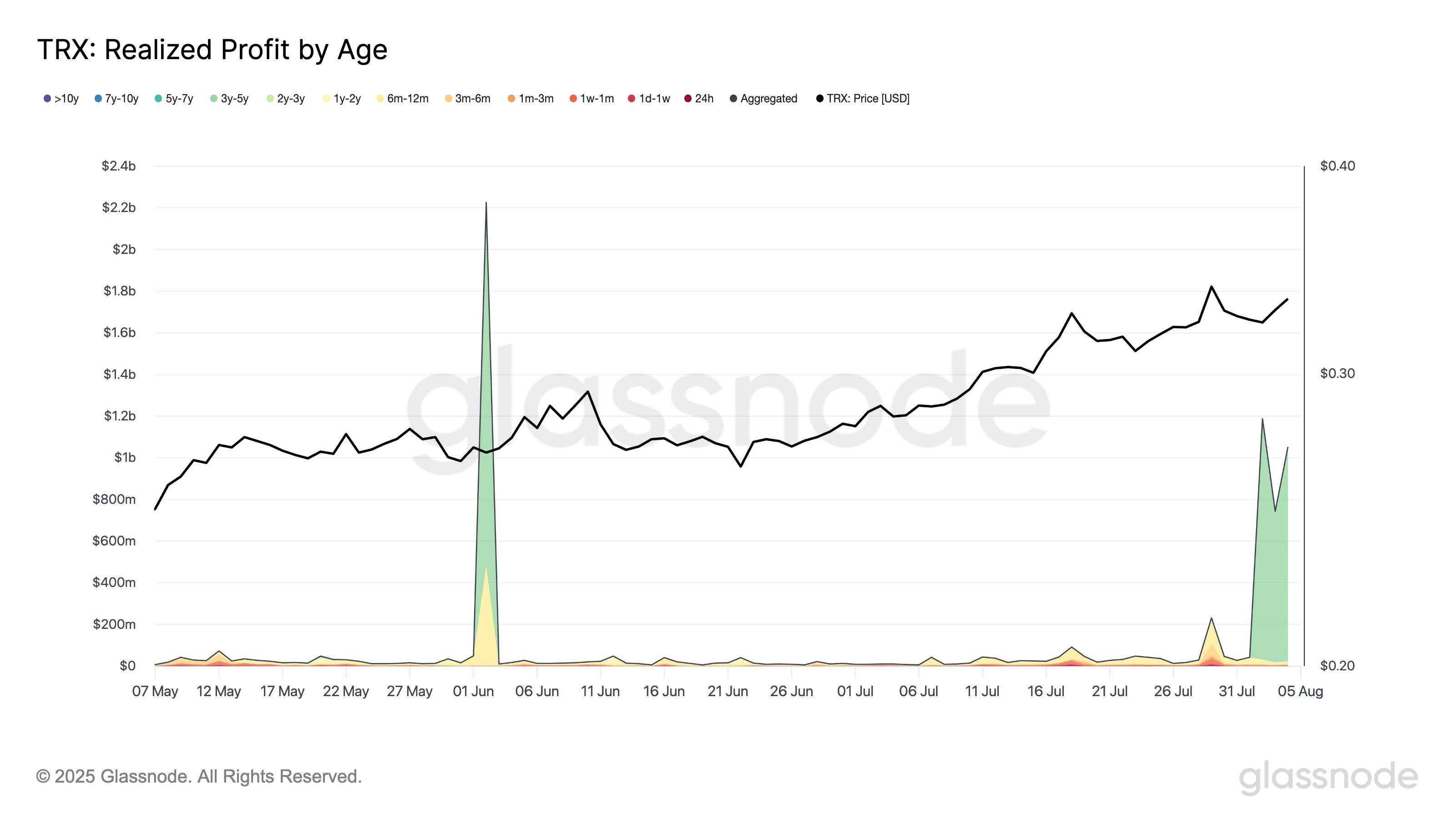

TRX saw the largest profit-taking among large-cap cryptocurrencies on Tuesday, with investors booking profits of over $1.4 billion, according to Glassnode data. This marks its second-highest profit event in 2025.

Notably, TRX investors have maintained a high profit-taking bar above $1 billion per day since Saturday. "This marks the most sustained wave of realized profit for TRON in months," wrote Glassnode analysts in an X post on Tuesday.

Most of the realized profits flowed from holders who bought TRX within the past three to five years. TRON's Spent Output Profit Ratio (SOPR) staying above 1 shows that this cohort is selling after experiencing substantial gains. SOPR is a metric that reflects market sentiment by determining whether investors are selling their coins at a profit or a loss.

TRX Realized Profit by Age. Source: Glassnode

Despite the surge in profit-taking, TRX futures open interest (OI) is recovering, rising from 1.49 billion TRX on August 1 to 1.56 billion TRX on Tuesday. This indicates that futures traders are still showing conviction and are keeping their positions open.

Open interest is the total worth of outstanding contracts in a derivatives market.

However, these traders could begin downsizing their holdings with US President Donald Trump's reciprocal tariffs set to go into effect on Thursday. The new tariffs will impose levies on roughly 68 countries, including Brazil, India, and the EU. The tariff rates will range from 10% for nations with trade surpluses to as high as 50% for others like Brazil.

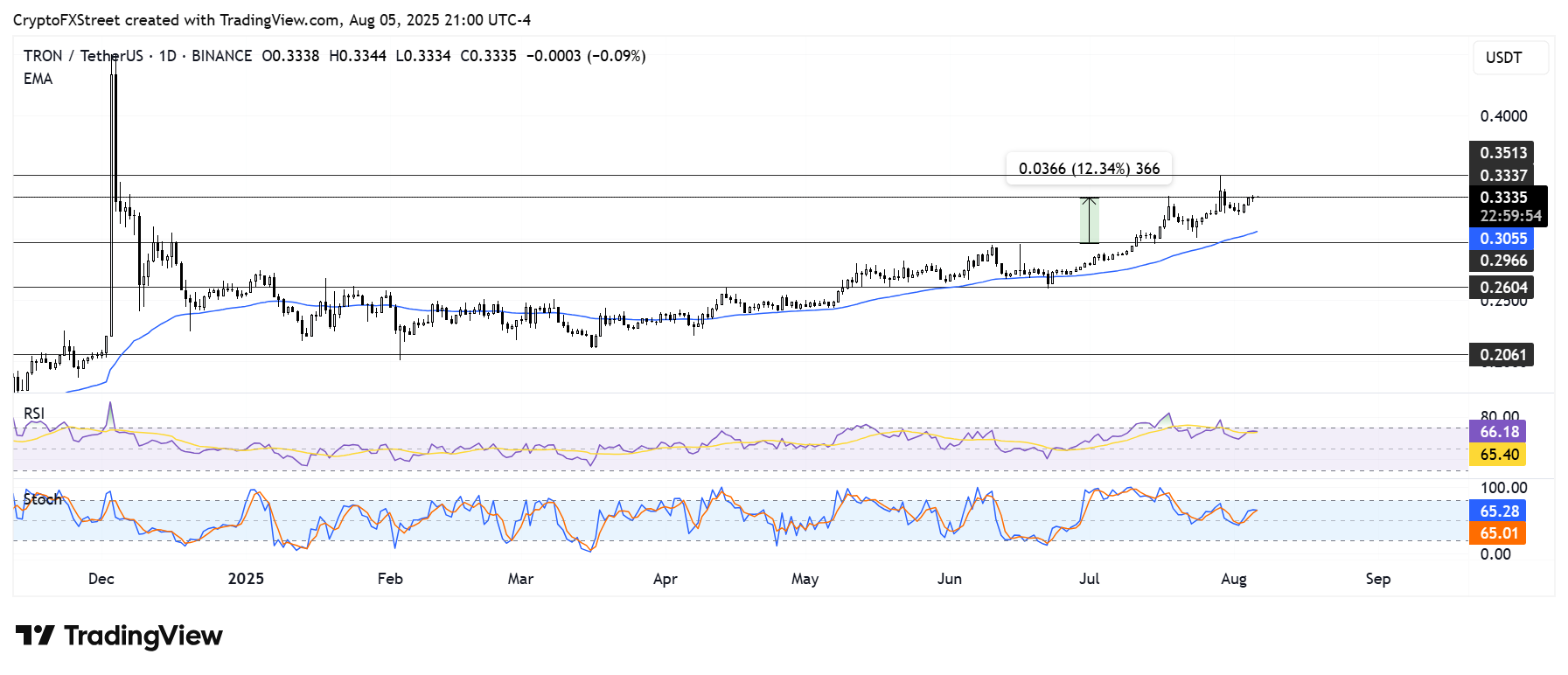

After declining from a year-to-date high of $0.35 over the past week, TRX is showing recovery signs, tackling the resistance at $0.33 despite the surge in profit-taking.

TRX/USDT daily chart

A recovery above this level could see the native token of the TRON blockchain retest the $0.35 resistance. On the downside, TRX could find support near the 50-day Exponential Moving Average (EMA), with the $0.30 support level just below it.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels, indicating dominant bullish momentum.