Gold Price Forecast: XAU/USD attracts some sellers below $2,350, eyes on Eurozone political concerns

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

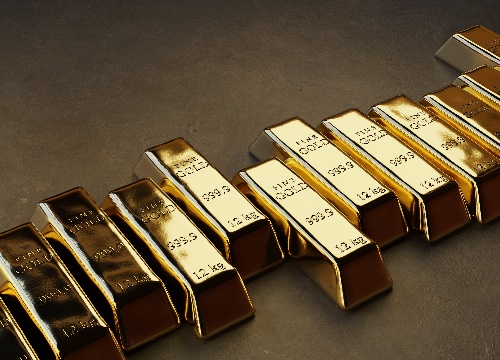

■ Gold price edges lower to $2,325 in Monday’s early Asian session.

■ The hawkish Fed continues to underpin the Greenback and drag USD-denominated Gold lower.

■ The Eurozone political concerns might boost the safe-haven flows and cap the downside for yellow metal.

Gold price (XAU/USD) trades on a softer note near $2,325 during the early Asian trading hours on Monday. The speculation that US interest rates will stay higher for longer, with the median projection from Federal Reserve (Fed) officials calling for one interest rate cut this year, has lifted the Greenback broadly. However, the risk aversion fueled by political uncertainty in Europe might boost the safe-haven flows and cap the downside for yellow metal.

On Friday, Cleveland Fed President Loretta Mester said that she would like to see good-looking inflation data, adding that the path towards the Fed's 2.0% inflation goal may take longer than expected. Meanwhile, Minneapolis Fed President Neel Kashkari stated on Sunday that it is a “reasonable prediction” that the central bank will wait until December to cut interest rates. Kashkari added that the Fed is in a very good position to get more data before making any decisions. The hawkish comments from the Fed officials weigh on the non-yielding assets like Gold as it makes the white precious metal more expensive for overseas buyers.

Consumer sentiment fell to a seven-month low in June, according to the preliminary report for the Michigan Consumer Sentiment Index on Friday. The Consumer Sentiment Index dropped 3.5 points to 65.6 in June from May's final reading of 69.1. The figure came in weaker than the estimation of 72.0. Additionally, the one-year inflation expectation held steady at 3.3%, and the five-year inflation outlook rose to 3.1% from 3%.

On the other hand, the downside for yellow metal might be limited amid the Eurozone political concerns. France's President Emmanuel Macron called for early parliamentary elections after losing to the right-wing National Rally in the European vote. On Sunday, Macron said that Economic programs by two extremist blocks in the parliament election are not realistic, and France is at a very serious moment with major economic issues at stake. Any negative development surrounding the Eurozone or France's political concerns could provide some support to the safe-haven assets like Gold.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.