Arbitrum shows resilience as bulls emerge amid $32 million token unlock

- Arbitrum moves toward a potential breakout from a falling wedge pattern.

- Arbitrum’s $32 million token unlock increases circulating supply by 37%, risking extreme volatility.

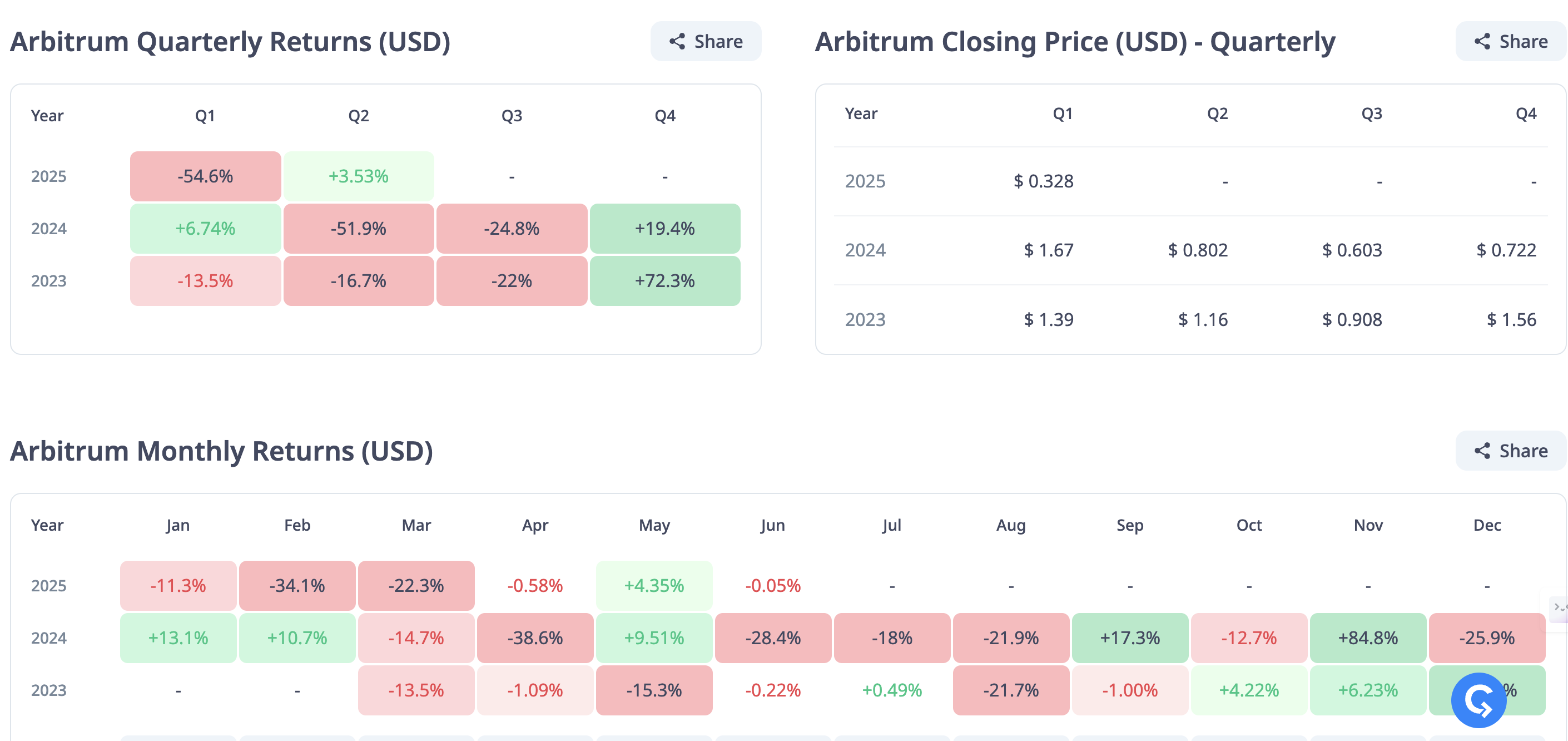

- Arbitrum is on track to post positive Q2 returns, following a steep 54% decline in Q1.

Arbitrum (ARB), a roll-up Layer-2 chain designed to enhance the scalability of the Ethereum (ETH) network, continues to experience price fluctuations like many other altcoins in the market. Meanwhile, ARB, the ecosystem's native token, shows resilience, rising over 3% on the day to exchange hands at around $0.33 at the time of writing despite the potential impact of a massive token unlock on Monday.

Arbitrum eyes steady uptrend despite $32 million token unlock

Arbitrum extends its gains alongside the recovery in the broader cryptocurrency market, led by Bitcoin’s (BTC) price return above $107,000 on Monday. This widespread uptick in crypto prices, which has bolstered the market capitalization to $3.5 trillion, comes amid tensions in the Middle East.

“More broadly, markets appear remarkably composed in the face of rising geopolitical risk,” QCP Capital's market update states.

In addition to the broader volatility due to the conflict between Israel and Iran, Arbitrum faces fundamental challenges, particularly with the scheduled token unlock.

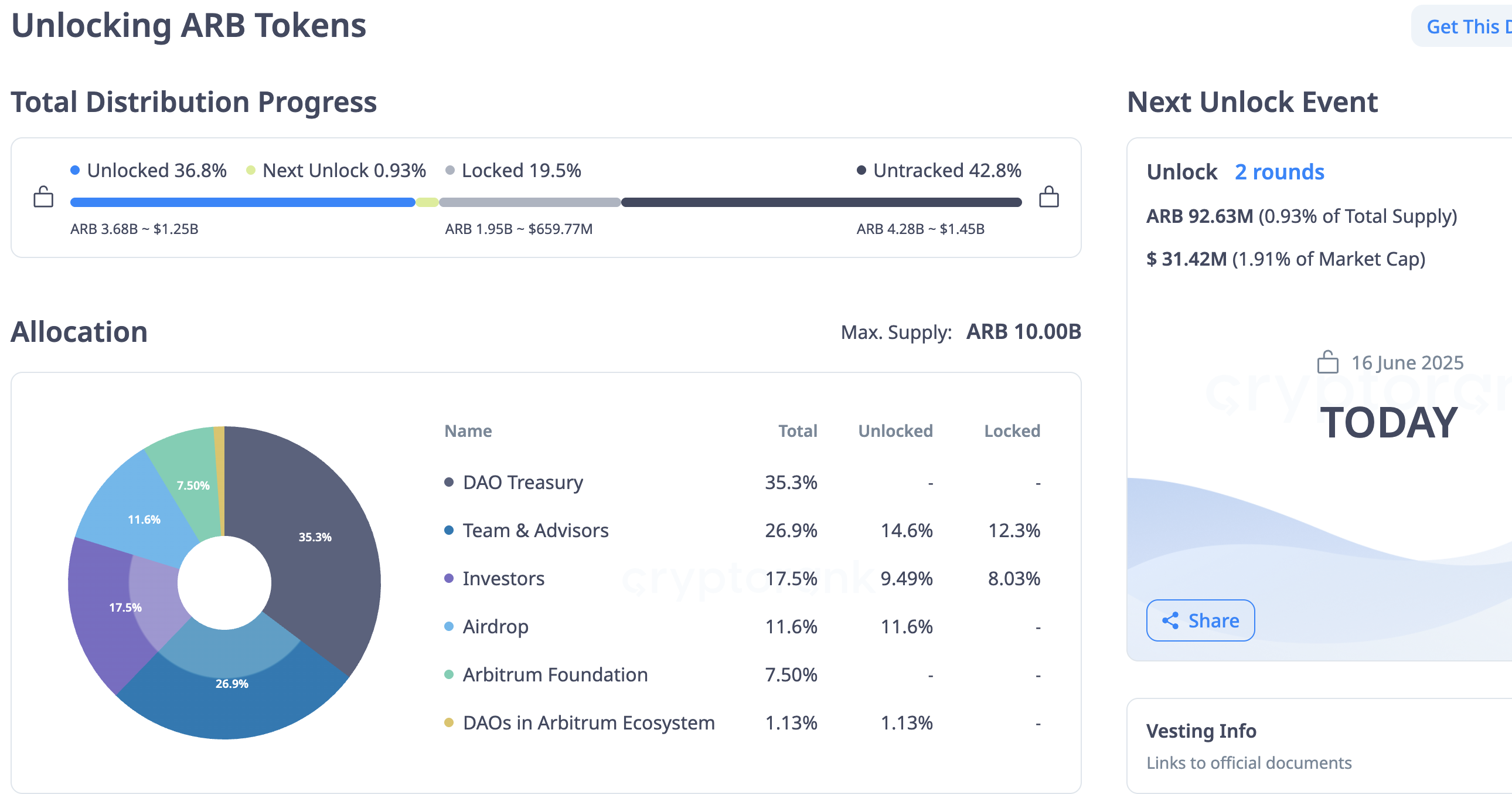

According to CryptoRank, the token unlock event is expected to increase the circulating supply by approximately 93 million ARB, valued at around $32 million, representing 1.90% of the asset’s market capitalization.

Currently, there are about 3.68 billion ARB in circulation, marking 36.8% of the total 10 billion ARB supply. A 0.93% increase would bring this figure to 37.73%, with approximately 1.95 billion ARB or 19.5% in staking contracts.

Arbitrum token unlock event | Source: CryptoRank

Large token unlocks increase the available supply, which can potentially dilute the value of the digital asset. This increase in supply can lead to extreme volatility levels, especially if the beneficiaries of the unlocked tokens sell on the open market.

Token unlocks can also impact market sentiment, with traders reducing their exposure in anticipation of a price decline.

If a project has strong fundamentals through adoption and utility, the impact of the token unlock can be minimized, as demand offsets the increase in supply.

Meanwhile, Arbitrum is on track to post positive returns in the second quarter if the recovery staged from Friday’s low at $0.32 steadies in the next two weeks. CryptoRank shows Q2 returns at 3.53% so far, compared to a 55% loss in Q1. ARB recorded the first positive monthly returns of 4.35% in May. Cumulative gains in June are slightly negative.

Arbitrum quarterly and monthly returns | Source: CryptoRank

Technical outlook: Arbitrum eyes technical breakout

Arbitrum’s price is currently above ascending trendline support, which was tested on Friday at around $0.32. A daily close above $0.33 is expected to provide short-term support if bulls weather the potential pressure from the token unlock event.

Similarly, as the price of ARB consolidates, a falling wedge continues to form. A breakout above the broken upper trendline could boost the price by 39% to $0.50, accompanied by an increase in trading volume.

ARB/USDT daily chart

The breakout target is determined by measuring the distance between the pattern’s widest points and extrapolating above the breakout point.

Key monitoring indicators include the Relative Strength Index (RSI), which is currently approaching the 50 midline, and a potential buy signal from the Moving Average Convergence Divergence (MACD). This signal occurs when the blue MACD line crosses above the red signal line, which often encourages traders to seek exposure to ARB.

Depending on the level of volatility resulting from the token unlock event and sentiment in the broader cryptocurrency market in light of geopolitical tensions in the Middle East, traders may pay attention to tentative support levels, including the regions at $0.30 and $0.25.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.