TRUMP meme coin declines as World Liberty Financial releases updates for USD1

- TRUMP meme coin remains near the critical $10.00 support level as recovery remains elusive.

- The Trump family project, World Liberty Financial, releases key updates for USD1, including bridge and swap features.

- The massive decline in the derivatives market Open Interest, along with low trading volumes, signals waning investor interest.

Trump Official's (TRUMP) bulls are losing grip as the meme coin approaches support at $10.00 at the time of writing on Thursday. The token's recovery has remained largely subdued over the last few weeks, reflecting declining sentiment, falling derivatives market Open Interest (OI) and trading volumes.

World Liberty Financial debuts key updates for USD1 stablecoin

United States (US) President Donald Trump's family's World Liberty Financial (WLFI) has released several updates, highlighted on the official website, adding bridge and swap modules for the USD1 stablecoin.

Other updates include separate lending and WLFI application modules. However, apart from the bridge module, which is currently active, the rest of the updates, as shown on the website, are still in development and pending official launch.

USD1 is a stablecoin that is redeemable 1:1 with the US Dollar (USD). The token is fully backed by the fiat currency (USD) and US government treasuries. It boasts multi-chain support for ease of adoption, interoperability and integration.

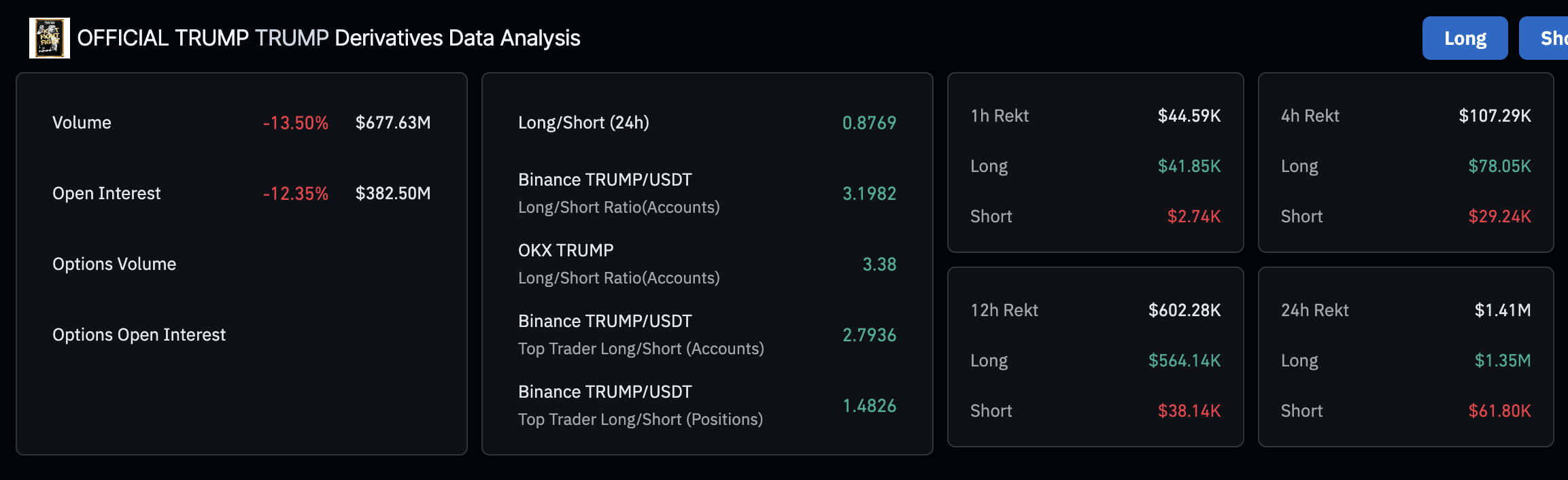

Meanwhile, interest in the TRUMP meme coin has been waning, underpinned by a massive drop in the trading volume by nearly 14% to $678 million over the past 24 hours. The derivatives market's open interest is in sharp decline, down to $383 million, marking a 12.4% drop in the same period.

OI refers to the number of outstanding futures and options contracts that have yet to be settled or closed. The persistent decline in OI, alongside the trading volume, suggests a lack of interest in the TRUMP token, which negatively impacts market participation and hinders potential price increases.

Official Trump OI | Source: CoinGlass

Technical outlook: Can TRUMP meme coin stage a rebound?

The Official Trump meme coin's price hovers broadly sideways within a range with support around $10.00 and resistance at approximately $16.00. Over the past few weeks, the token has maintained a bearish bias, with its upside limited by potential profit-taking and a lack of conviction among traders.

The downward-sloping Relative Strength Index (RSI) indicator, currently holding at 40, suggests that bears have the upper hand. Should the RSI continue to move below the descending trendline toward the oversold region, the path of least resistance will remain downward, increasing the probability of TRUMP sliding below $10.00.

TRUMP/USDT daily chart

Still, with the support at $10.00 intact, a recovery could ensue depending on sentiment in the broader cryptocurrency market. The liquidity-rich region could encourage traders to buy the dip, potentially intensifying the tailwind on the meme coin. Key areas of interest on the upside include the seller congestion at $13.00 and the range limit at $16.00, representing a 55% move from the current price level.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.