Novo Nordisk Q3 Earnings Preview: Investors to Focus on Wegovy Sales

- Crypto Meltdown. 240,000 Liquidated, $100 Billion Wiped Off Crypto Market Cap.

- When is the US President Trump’s speech at WEF in Davos and how could it affect EUR/USD

- Gold nears $4,700 record as US–EU trade war fears ignite haven rush

- Gold Price Forecast: XAU/USD surges to all-time high above $4,650 amid Greenland tariff threats

- US-Europe Trade War Reignites, Bitcoin’s $90,000 Level at Risk

- Silver Price Forecast: XAG/USD corrects to near $86.50 as Iran stops killing protesters

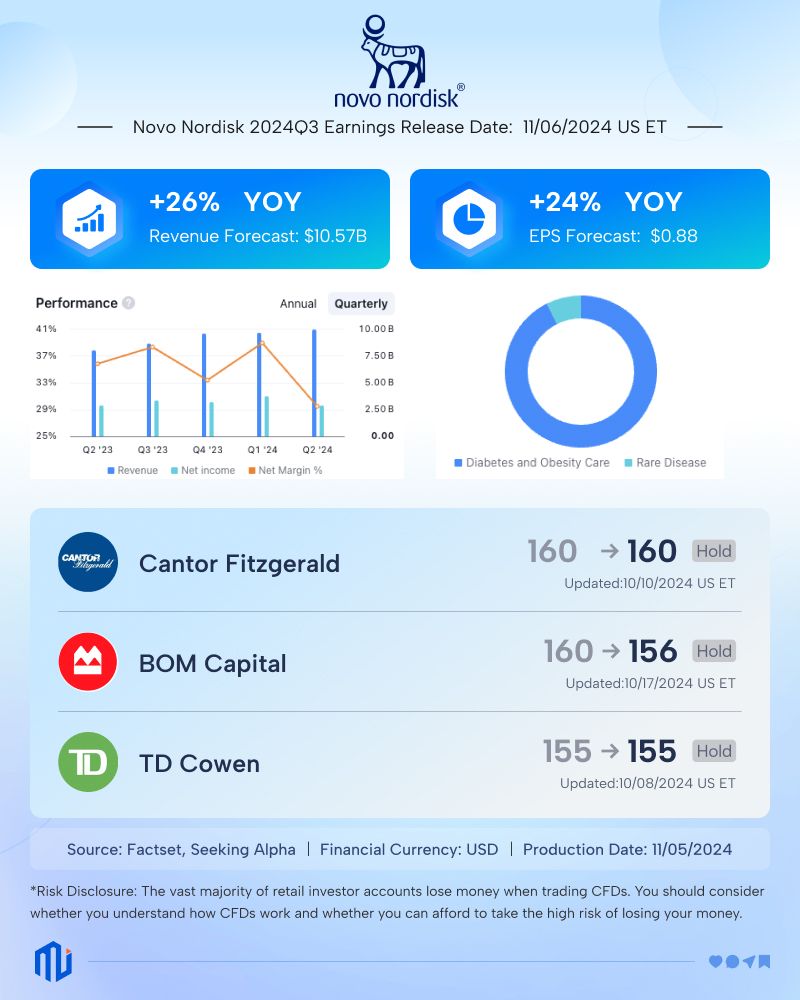

Insights – Novo Nordisk (NVO.US) is set to release its Q3 earnings before the market opens on Wednesday, November 6. Investors will focus on the latest supply-demand dynamics and market share of its best-selling weight-loss drugs.

According to FactSet, analysts expect Novo Nordisk’s Q3 net sales to grow 26% year-over-year to $10.57 billion, with earnings per share increasing by 24% to $0.88.

In Q2, net sales rose 25% year-over-year to DKK 68.06 billion (approximately $9.97 billion), slightly falling short of the market's expectation.

However, due to strong demand, Novo Nordisk raised its full-year sales forecast to 22%-28% from 19%-27%. However, it lowered its operating profit growth outlook to 20%-28% from 22%-30% as it expands production capacity.

Growth Potential of the Blockbuster Weight-Loss Drug

The market is closely watching the growth potential of Wegovy (semaglutide), Novo Nordisk's blockbuster weight-loss drug, which has driven the company’s stock price to soar since its launch in June 2021, making Novo Nordisk the largest publicly traded company in Europe by market capitalization.

Analysts expect combined Q3 sales of Wegovy and its sister drug Ozempic to reach approximately $6.8 billion, up from $5.4 billion in Q2. Novo Nordisk CFO Karsten Munk Knudsen stated before that by 2024, weekly Wegovy prescriptions in the U.S. have doubled, rising from 100,000 to 200,000. However, JPMorgan analysts had predicted that Q3 sales of Wegovy would fall short of expectations Previously.

Despite the success of Wegovy and Ozempic, investors are keeping a close eye on competitors in the weight-loss market, as they launch their own drugs. For instance, pharmaceutical giant Eli Lilly & Co (NYSE: LLY) has introduced Zepbound.

As Novo Nordisk releases its latest earnings on Wednesday, a key focus for investors will be how much market share these GLP-1 competitors can capture from Wegovy and Ozempic.

Stock to Rise 25% Over the Next Year?

In September, Novo Nordisk’s stock declined, primarily due to disappointing interim trial data for its "next-generation" weight-loss drug, monlunabant, and a U.S. Senate hearing on Wegovy’s pricing.

Nevertheless, analysts remain optimistic about Novo Nordisk’s future earnings, expecting the stock to rise by 25% over the next year. Wall Street analysts believe the company is taking steps to meet the strong demand for Wegovy and will conduct important clinical trials for its next-generation weight-loss drug this year, which could further boost the stock.

Cantor Fitzgerald reiterated its overweight rating on Novo Nordisk, maintaining a price target of $160. BMO Capital Markets kept its buy rating but lowered the price target from $160 to $156. TD Cowen also maintained its buy rating with a price target of $155.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.