Gold nears $4,700 record as US–EU trade war fears ignite haven rush

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

Gold jumps over 1.5% after US–EU trade tensions escalate over Greenland-related tariff threats.

The US Dollar slides while havens rally as markets react during thin liquidity on US holiday.

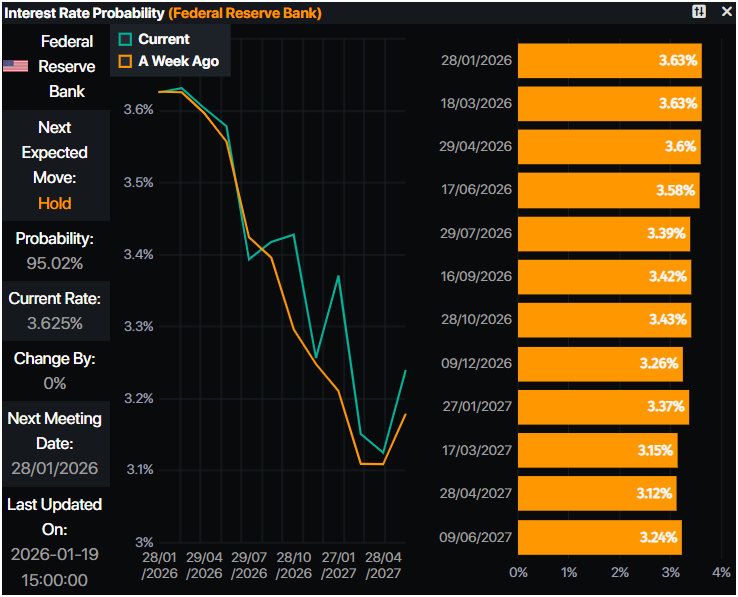

Traders still price 45 bps of Fed easing in 2026 ahead of US GDP and Core PCE data.

Gold (XAU/USD) rallies on Monday after falling to a four-day low on Friday, edging up more than 1.50%, and hovers near the $4,700 figure after reaching a new all-time high courtesy of geopolitical uncertainty amid the US-European Union trade-war escalation over the weekend. XAU/USD trades at $4,672 at the time of writing.

Bullion rebounds sharply as Trump’s tariff threats against Europe hammer the Dollar

Last Saturday, US President Donald Trump announced duties of 10% to eight European countries, effective February 1, in a dispute over Greenland, and said he would increase tariffs even further by June 1.

Consequently, the US Dollar plunged while safe-haven assets like Gold, Silver and currencies like the Japanese Yen and the Swiss Franc, soared amid thin trading due to US markets being closed in observance of Martin Luther King Jr. Day.

Meanwhile, members of the European parliament announced that they would freeze ratification of the trade deal that Trump and the President of the European Commission Ursula von der Leyen, signed last summer.

The Greenback is trimming some of last week’s gains sponsored by solid US economic data, which pushed investors to trim the odds for a rate cut by the Federal Reserve (Fed) at the January 27-28 meeting. Traders had priced in 45 basis points of Fed easing toward the end of 2026, according to Prime Market Terminal data.

In the meantime, the National Economic Council (NEC) Director Kevin Hassett removed his name from the race to become the new Fed Chair. Last week, Trump said that he had someone in mind for the job.

Ahead this week, the US economic docket will feature housing and jobs data, the final reading for Q3 2025 Gross Domestic Product (GDP), followed by the Federal Reserve’s preferred inflation metric, the Core Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Gold rises on geopolitical risks

The US Dollar Index (DXY), which tracks the American currency's performance versus six peers, is down 0.36% to 99.02. US Treasury yields rose nearly six basis points on Friday, with the 10-year T-note yield up at 4.227%.

US President Donald Trump announced the imposition of 10% tariffs on eight countries—Denmark, Norway, Sweden, France, Germany, Finland, the Netherlands and the UK—set to take effect on February 1. He added that the duties would rise to 25% on June 1 unless agreements are reached, linking the move to US ambitions to annex or purchase Greenland.

The European Union (EU) and the United Kingdom appear poised to retaliate. The EU is reportedly preparing up to €93 billion in counter-tariffs on US goods and is also considering restricting access for American companies to the European market.

Federal Reserve officials entered their blackout period ahead of the January 27-28 meeting, yet the Fed Chair Jerome Powell will attend the hearing of Governor Lisa Cook at the Supreme Court of the United States.

Polymarket reported that the favorite to become the next Fed Chair is Kevin Warsh, as his odds moved from around 40% to 62% as of writing.

Technical analysis: Gold price refreshes record high near $4,700

Gold price had set a record high at $4,690 on Monday, shy of the $4,700 mark due to geopolitical uncertainty, retaining its bullish bias.

Nevertheless, momentum began to show that bullish momentum might be fading, with price action reaching a higher high, while the Relative Strength Index (RSI) latest peak remains below the highest high. This suggests that a negative divergence looms, but sellers must push the XAU spot price below the January 16 low of $4,536 so they could materialize a reversal to challenge the 20-day Simple Moving Average (SMA) at $4,484.

Conversely, if Bullion pushes above $4,700, the next key resistance levels would be $4,750 and $4,800 ahead of the $5,000 milestone.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.